A candidate for long term investment

By IE&M Research

Gufic Biosciences Ltd. is a specialized pharmaceutical company with a mission to achieve leadership position in the specialized medicinal segments and make products available at a cost-effective rate using innovation and technology to enhance the welfare of the population worldwide.

Last month the company informed the bourses that it has received two patent certificates from the Intellectual Property India, The Patent Office. It has been granted patents for two formulations viz. process for the preparation of the parental formulation of Anidulafungin, and a freeze dried parental composition of Tigecycline and process for the preparation of it.

It has presence in different segments

of the pharmaceutical sector, including some presence in Ayurveda. Gufic in 1990s was a strong pharma company with products in the APIs and Formulations. Its strength can be gauged from the fact that its brand Mox (which was sold to Ranbaxy) was very well known in the market. Same was the case with Zole (Miconazole Nitrate). It currently has established its expertise in the specialty injectable area with a specific focus on lyophilisation products.

The history

With its Registered and Corporate office in Mumbai the company was promoted by Late Shri Pannalal Choksi in the 1970s. Gufic Bioscience is one of the largest manufacturers of Lyophilized injections in India and has a fully automated lyophilisation plant. The product includes antibiotic, antifungal, cardiac, infertility, antiviral and proton-pump inhibitor segments. Being historically a pioneer in the lyophilized segment, Gufic has long time partnerships with several large MNCs and Indian pharma companies to manufacture their products in its manufacturing facility. After the sale of such great brands, promoter family was unable to create a focused brand based organization. With unnecessary diversification in OTC products, Ayurveda and other FMCG products, it got relegated to the sidelines.

It kept meandering along till 2005 when Pranav Choksi (son of Jayesh Choksi) took over the mantle of the company. He is educated in oncology and joined Gufic after short stints in the few MNCs in USA where he gained good experience in different areas. It took him a few years to get hold of the organization and in 2012, he decided to expand Gufic group with an aggressive approach and focused on the strength of the organization. With that intent, they broke ground for a new manufacturing facility – Gufic Lifescience, to cater to the advanced economies with the same product profiles as they were operating in Gufic Bioscience. Till the end of March 2016, they ended up putting up their own money to the tune of ` 65 crore (which in the end of Sept, 2016 went up to ` 88 crore). For a company which was generating approximately ` 100 crore revenue till 2014, this was a big commitment and that too from the promoter’s personal funding. Also, promoter putting up their own money not to stretch the balance sheet of listed entity is a big positive in terms of consideration of minority shareholders.

Capacity expansion

Gufic Bioscience has capacity to manufacture 12 lakh vials per month. With the new capacity built in Gufic Lifescience, the total capacity goes up to 32 lakhs in two stages. These two plants are in Navsari. In fact, the second plant built in Gufic Lifescience is a state of the art facility. It has two more plants in Belgaum and Baroda which cater to herbal products and consumer products respectively.

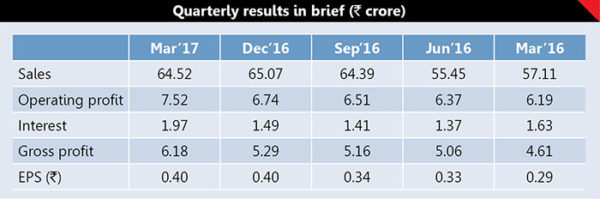

The current capacity is used for MNCs and local market, which at full capacity can clock revenue of around ` 250 to 300 crore. Since these contracts are outsourcing contracts, the EBITDA margin is not that great. Enterprise Value for shareholders will be created when the two plants for injectable operate at full capacity by 2021 when the revenue can touch upwards of ` 750 crore. This is being targeted with direct supply in the European market since Gufic has obtained WHO GMP certification for their injectable plant. With an EBITDA margin of 18 to 20%, which is what is being targeted by Pranav, EBITDA can touch around ` 150 crore and net profit can work out to be around ` 60 to 75 crore.

Also looking at acquisitions

Additionally, Gufic is also looking at acquisitions, which can add value to the company by way of the new brand, IP or allowing Gufic to enter new markets. It is also learnt that Gufic is looking for JV with few of the specialized injectable players in the area of Critical Care Antibiotic Injections, which is a very high margin business since it requires a separate plant (the plant cannot be then used for any other injections). Third avenue for further growth will be with entry into the US market, which is not yet explored by Gufic management. Pranav Choksi literally injects new life into Gufic and is helping create value for both his family as well as the shareholders. He has recently recruited some new members for his marketing team from large pharma companies to continue the momentum. In addition, there is a new vigour in the company.

Concerns

Here are few risk areas which should be closely monitored-

Gufic is planning to enter the US market, which is a tough market and can be a stumbling block for the company if they encounter FDA issues

Future acquisition may divert attention from the focus area

Full capacity may not be achieved by 2021 and may get delayed further

Large dilution of equity while merging with Gufic Lifescience

Our Take

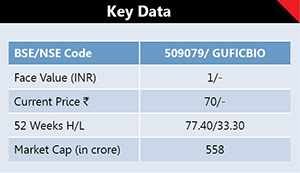

From a valuation perspective, there are different methodologies to value a pharma company, but a simple yardstick is how much sales it generates and based on efficiency it can fetch the enterprise value accordingly. A pharma company is a steal if available at three times its sales and expensive when available at more than 10 times sales. So, for reasonable valuation of Gufic Bioscience, five times sales can be considered which gives a valuation of ` 3500 crore market cap. Once the merger between Gufic Bio and Gufic Life is consummated, the current market cap can touch upwards of ` 750 crore. So, the company has all the elements to be in a good portfolio provided it is untouched for at least the next three years. The promoters holding in the company stood at 69.98%, while Institutions and Non-Institutions held 0.2% and 29.82% respectively.

On a sideline, Choksis are a well known family in the pharma industry and informally they are known to be very close to another big name in the industry. Moreover, they also have a very large presence in real estate sector in their personal capacity and therefore do not have a dearth of funding new projects.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)