By Prof R Mukundan & Prof KS Ranjani

This is the concluding part of the three-part series of our discussion on cashless transactions. In the first part of this series, we discussed the advantages offered by digital transactions and its potential to change the way the world transacts. We also discussed the concept of foundational technologies and why certain technologies require a different approach for widespread absorption. In the second part of the series, we discussed the impact of foundational technologies taking blockchain as an example. In this article, we will examine the requirements to successfully map a sample transaction to a smart contract that incorporates blockchain technology.

Advancement in technologies and encryption methods seeks to address fundamental weaknesses in an existing digital infrastructure. Smart contracts show their potential in large scale networks where data redundancies are inevitable and process capabilities are required in a multiple party set up to track and manage a deal. By ensuring visibility throughout a chain, smart contracts avoid data redundancy and allow participants to view and process data across multiple systems. The visibility throughout the chain leads to certainty in the contract implementation. Are there ways to optimize this large scale setup? Smart contracts have two main advantages – verifiability of what the contract code is and the transparency provided. Smart contracts are but pieces of software code, not a living document that is malleable to the vagaries of the market. Hence, choosing smart contracts requires a strong data driven relationship – a pure black and white and no grey in between! Smart contracts can model business process flow systematically and their distribution using blockchain makes it verifiable down to the last syntax.

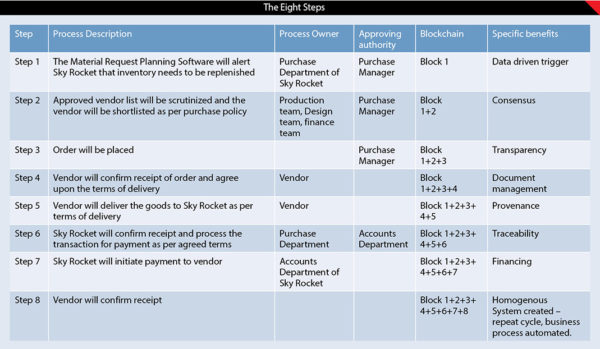

In Part II we had discussed the inventory ordering process of a hypothetical company called Sky Rocket using current systems and technologies. We will now discuss the example of Sky Rocket’s inventory order process in the context of a blockchain. The inventory requirement generated by Sky Rocket will be visible to their registered vendors. This visibility can also be made specific to certain vendors. In the absence of a blockchain, the current method to share inventory requirements would typically lead to data redundancy (each party trying to maintain their own set of records). In a blockchain, the same data can be made visible to registered vendors / selected vendors. The blockchain also provides control on the data modification and is in a ‘track change mode’ for all participants to see. We call this as Block 1.

When vendors can see the user requirement in real time, it helps to reduce the inventory cycle. The vendor(s) confirm availability of stock and supply terms by appending to the previous block of requirements raised. We call this as Block 1+2.

Sky Rocket can then approve or reject the vendor, which also gets appended to status and becomes visible to all the vendors after the order processing. We call this as Block 1+2+3.

The purchase order generated by Sky Rocket becomes visible to the selected vendor. The vendor’s system will create the order track status, which becomes visible to Sky Rocket. We call this as Block 1+2+3+4.

On receipt and inspection of the goods necessary approvals are made visible in real time, enabling the vendor to be informed of the order acceptance status. We call this as Block 1+2+3+4+5.

Sky Rocket will initiate the payment process and payment status again becomes available to the vendor in real time. We call this as Block 1+2+3+4+5+6.

The payment done by the account section of Sky Rocket will be the next block appended. We call this as Block 1+2+3+4+5+6+7.

The vendor upon receipt of the money closes the deal and this completes the entire chain of activities described. We call this as Block 1+2+3+4+5+6+7+8. Our Blockchain is now complete!

The pre-condition for successful implementation of a transaction in a blockchain is that all transactions should be data driven. Except for step 2, all are data driven. Step 2 might have certain decisions which are not data driven. Once we identify such processes, are there ways to automate them? Is automation enough or we need to build some ‘smart’ into it? Building smart is possible through blockchain capabilities whose fundamental architecture is designed to make it impossible to break the stipulations of the contract. An accepted business logic across multiple parties cannot be arbitrarily modified. The focus of smart contract is on the numerous check and balances on a decision taken and not on the product itself.

A blockchain‘s three main characteristics are: security, transparency and process efficiency. Its architecture has four essential components – use of consensus algorithm, data anonymity, security and in turn, trust of the chain participants. Consensus algorithm uses serious mathematics, thus ensuring the blockchain implementation to be perceived as unbiased by all participants. Blockchain lays out the data into the open and attempts to ensure complete information is available. This helps blockchain to convert a heterogenous system into a homogenous system. In a homogenous system, verification and audit are structurally feasible and can provide the correct result, always. A consensus can occur only when trust and transfer of complete information is present. Trust is provided through security algorithms – known as cryptography. The architecture of blockchain is thus to convert (reduce) the indeterminism (variability) in the system. Blockchain deployment, therefore, involves creation of a deterministic system. A deterministic system and its behavior suggest traceability, provenance, document management, all characteristics that have the potential to generate appropriate financing at the right time.

We reproduce the sample transaction taken up for discussion here, along with the blockchain components. The last column helps us to connect the characteristics of blockchain with the actual activity done.

Availability of data in real time helps in the efficient management of several business processes and as discussed earlier makes financing far less complex than it is today. Permissioned blockchain is easier to initiate, deploy and trial as there are limited parties required for consensus and enforcement of the smart contract. It can also have data driven business modules and the limited participation in such a chain reduces transaction ambiguity. Compliance is possible even within the existing regulatory framework. Permissionless approach requires legal approvals which need to be preceded by creation of suitable legal and regulatory infrastructure. Permissionless block chain involving multiple participants, possibly across countries, continents and cultures may be far more complex and challenging. In a data driven setup, the challenge of automated contractual obligations means enforcement is fundamental. Hence this is not a disruptive but a foundational technology shift.

Let us now understand if any blockchain variants are available and if so, what they are. Steps 1 – 8 can be a permissioned blockchain if there are only limited and closed-door participation of Sky Rocket and its identified vendors. The participation is limited to the vendor, buyer and the banking system that enables the financial processes. The quality inspection can also be part of the signed vendor. Steps 1 – 8 can also be a permissionless blockchain if there are numerous suppliers or the multiple suppliers need to speak to each other before the final product is manufactured. In a permissionless blockchain, any participant can edit the block. This is an example of peer to peer network, and there is no single source control over the block being shared. We must remember that whether permission or permissionless, the crux of blockchain lies in making visible its ‘track change mode’ to all its participants.

Applications of blockchain in the business environment are many. The example discussed in the article is hypothetical. However, several real life examples abound that illustrate the application of blockchain to business situations. Bajaj Electricals, for example, uses blockchain for its vendor financing system. When a vendor supplies goods to Bajaj Electricals, the invoice is raised in Bajaj’s Accounting System. These invoices are transferred to their bank’s ledger and a blockchain is created with Bajaj Electricals, the Bank and the vendor. The vendor is settled in real time by the Bank. While the possibilities of blockchain driven solutions involving financial transactions are aplenty, what is even more exciting is the prospect of blockchain solutions in public governance such as voting! Encrypted and uneditable entry feature makes blockchain technology a useful upgrade of the existing EVMs. It could increase the credibility of the voting process because the entries are tamper proof.

Eventually, while deployment of blockchain in financial transactions is a given when there is a favorable regulatory framework and supporting infrastructure, the social applications of blockchain will be taken up once the social benefits exceed the cost of such deployment. The larger question which we want to leave at – are we to choose data driven smart contracts between parties for engagement or create a sui generis system that leverages society, smart contracts and block chain.

(Authors are Assistant Professor at NITIE, Mumbai)