By IE&M Research

SEBI’s latest circular on categorisation and rationalisation of schemes will help an investor to compare funds between two different mutual fund houses.

Mutual Fund Industry is going through one of the best time since it started way back in 1963 with the formation of Unit Trust of India. Investors are pumping in money in huge tranche. Best part is that equity fund that always played a second fiddle to debt fund is now getting its due importance. According to monthly data published by Association of Mutual Funds in India (Amfi), equity and equity-linked schemes attracted over `80,000 crore, and balanced funds received more than `47,000 crore in the first six months of FY18. Such a good time has prompted market regulator to take some long-awaited important investor-friendly decisions so as to make life of an investor easy. According to G. Mahalingam, member SEBI, as industry is going through good times, it’s the best time for bitter medicine.

The Sweeping Change

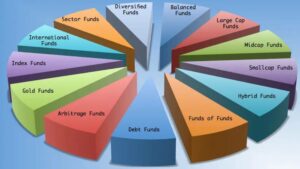

SEBI’s latest circular on categorisation and rationalisation of schemes is turning out to be one of the bitter medicine for industry. According to this circular, the mutual fund schemes need to be classified into five broad categories namely equity schemes, debt schemes, hybrid schemes, solution oriented schemes and other schemes. Solution-oriented schemes will comprise of retirement or children funds.

Equity schemes will be further classified only into 10 sub-categories such as large, mid, small cap, multicap etc. Similarly debt schemes can be classified into 16 sub-categories while hybrid funds can be further classified into six sub-categories. More importantly, only one scheme per category will be permitted. Further the fund needs to stick to their mandate. For instance, mandate of a large-cap fund is one which invests a minimum 80% in the top 100 stocks by market capitalisation. A focussed fund cannot own more than 30 stocks. A long duration fund needs to maintain minimum portfolio duration of 7 years.

In order to comply with the latest circular, fund houses need to review their classification and submit their proposal with SEBI within two months detailing their plans on merging, winding up or tweaking the ones that don’t fit in. Once SEBI clears their proposal they will have to carry out the necessary changes within three months’ time. A fund house will be allowed to have only one scheme per category to ensure that there is no duplication.

Impact on Investors

These changes, if implemented with right sprit, will go a long way in making mutual fund as preferred way of channelizing savings of retail investors. An investor can make an informed decision and be more confident about the scheme. It’ll also help him in a better asset allocation. For example, if an investor aged 35-45 is investing in small cap fund, he is willing to take risk in the expectation of good return. Nonetheless, if that fund manager starts allocating more funds to large cap, it may not solve the entire purpose of his investing.

Besides, it will help an investor to compare funds between two different mutual fund houses. The current practice makes it a bit difficult because each fund house follows its own logic when it comes to defining caps. Therefore, within a large cap category the weighted average market capitalisation of mutual funds range between `29,000 crore to `1,90,000 crore.

Nonetheless, the SEBI’s circular clearly defines large, mid and small cap stocks. Large cap will be defined as 1st to 100th companies in terms of full market capitalization. 101st to 250th company as per full market capitalization will be termed as mid-caps and from 251st company onwards will be classified as small cap. This uniformity will help an investor to choose right funds.

Impact on performance of funds

Performance of the fund may be impacted as currently large cap oriented schemes have the freedom to invest a portion of their portfolio in mid and small cap stocks, which helps them generate alpha, which might not be possible once the new classification is implemented. Moreover, in order to fit into particular category fund may need to do lot of portfolio churning hence impact on performance of funds. And this process of rebalancing of funds according to its mandate need to be followed every six months, which again may impact its performance. Overall, we find the latest initiative taken by SEBI will help mutual fund industry to grow faster and become more vibrant, although, there are short term pains.