By Krishna Kumar Mishra

(There is a fine margin between growth and stagnation. Decades of inconsistent growth of Indian economy limited the need for huge levels of reform and innovation. Growth doesn’t happen by default anymore, so it really was the time to become innovative. India has deep structural issues with age-old self destructive institutional arrangements. Demographics are the country’s biggest advantage over the likes of an ageing China. However, young population is an opportunity as well as a threat.

And the sheer scale of the task before the government is tempering the optimism of many citizens. It seems the present Indian leadership at Centre knows it best with its just and only two agenda – growth and development. Last three budget papers laid out a vision that extended beyond just a 12-month horizon.

Now the government has presented a mature road map to boost the country’s chronic infrastructure bottlenecks, to cut red tape, deficit reduction without taking any extreme step, eliminate graft and welcome foreign investment that has sent investors and markets into an India-crazed frenzy. The good news for them is, despite strong criticism coming from the opposition and vested interests the Government is determined not to blink. The country is now at an inflection point. 2014 to 2024, if it could be termed a decade, is a special moment for India. Seize it.)

Various bold and unconventional steps (some even politically disastrous) taken by the government of India in the last three years have now started to show its impact on the economy and the way it is perceived around the world. Almost all the latest data clearly indicate the economy is poised to take off. World Bank’s 2017 Ease of Doing Business report has just confirmed it where India has moved into the top 100 global rankings, an unprecedented jump from its 130th position in 2016 – the result of a sustained business reform. Niti Aayog CEO Amitabh Kant has expressed hope that in the next three years India should target to be in the top 20. No doubt reforms implemented and many others in the pipeline will enable the country in realizing this achievement.

At the same time, it has dusted all the gloom that was set after a dismal GDP number for the first quarter of FY18. There were murmurs that the economy will take longer than expected to revive; reason, demonetisation. The slowdown in consumer spending and export led to a mere 5.7% growth, dipping below 6%, slowest in last three years. It was disturbing to witness a continuous decline after touching a high of 9.1% in the fourth quarter of FY16.

But it was all a temporary economic slowdown that has bottomed out and to get the economy to cruise faster, government has tried to ensure that all the four engines of growth that is domestic consumption, private investment, exports and public investment, fire together. In the past, only a couple of engines supported and that too without moving in tandem. Recently the government has initiated some more long term reforms, programmes and projects which, without an iota of doubt, will successfully take Indian economy at far greater heights which neither any government so far, nor its citizens had ever even imagined in their wildest dreams to touch with the rampant corruption and sluggish administrative machinery.

Public Expenditure: Doing the Bulwark

In absence of private investments, it was a targeted and effective government spending that played an important role in driving growth. Public investments by central, state, local governments and public-sector enterprises (PSEs) saw a 21 % rise last fiscal, a record move in last two decades. Private investments (households and corporate) in the same period contracted 1.4% year-on-year. Public spending this year has already crossed Rs11.4 lakh crore (till September 2017) an increase of 10.5% on a yearly basis. Capex target of Government of India (GOI) for 2017-18 is at Rs 3.09 lakh crore, a rise of 31.28% on a yearly basis, out of which Rs1.46 lakh crore spent till September’17. Even the capex target for GOI controlled public sector enterprises is expected to cross Rs3.85 lakh crore this financial year. Such expenditure has played a vital role, but was limited to a few sectors such as railways, power, housing, road and digital infrastructure. Going ahead the GOI spending thrust is likely to continue in these basic sectors which are important for growth of other sectors.

The government has announced the biggest highway construction plan so far in the country, to develop approximately 83,677 km of roads at an investment of Rs 6.92 lakh crore by 2022. It is aimed at pushing economic activity and generating at least 14.2 crore man-days across the country over the next five years. The programme includes the Bharatmala scheme, under which 34,800 km of highways would be constructed at the cost of Rs 5.35 lakh crore. Another major step taken by GOI recently is planned historic capitalisation of the state-owned banks. Government has planned to infuse Rs 2.11 lakh crore in PSBs. In last couple of years, PSBs grappling with higher NPAs were unable to lend.

Private Investment: Green Shoots Emerging

Early signs of corporate investment recovery are already reflected in latest data of index of industrial production (IIP). After witnessing an average growth of 0.4% in June-July, IIP grew at a rate of 4.3% for the month of August on yearly basis, fastest in the last nine months. What is heartening is that growth is board based including increase in capital goods production data. It is taken as proxy for investment demand in the economy. Since the start of FY18, there has been a sustained contraction in the capital goods production data, however, for the month of August it expanded at a rate of 5.4%. Even the consumer durables production recovered and grew at 1.6% compared to a contraction of 3.6% in the preceding month.

Other important leading indicator pointing to a recovery in manufacturing activity and ultimately investment is Nikkei India Manufacturing Purchasing Manager’s Index (PMI). It came at 51.2 for September, same as August. A reading above 50 indicates expansion. PMI also indicates that there has been increase in both output and new orders. These readings clearly show that the disruptions caused by GST are now behind and manufacturing is gaining momentum in the new GST regime.

Growth in investment also becomes important as it has been well documented that consumption led growth is scientifically weaker than the investment led growth. Moreover, other components of GDP growth too get a better boost if it is led by investment growth. Going forward a strong consumption story will drive investment as was seen during 2003-08.

Consumption: Gaining Momentum

Consumption that has remained at forefront of GDP growth saw a sharp drop in the third quarter of last fiscal year due to demonetisation. Implementation of the landmark tax reforms GST too had a temporary impact on consumption. However, now it has returned with vengeance. Consumption has even surpassed GDP growth rate in recent quarters. More recently the growth in consumption has been reflected in the 2-wheeler and passenger vehicle sales, which are showing good traction. One factor that helps this engine to fire at full throttle is lower inflation rate. Lower inflation means additional consumption and stronger economic growth. Inflation in last one year has remained under control and within the RBI’s comfort level.

Inflation measured by the Consumer Price Index (CPI) has remained unchanged month on month for September 2017 at 3.3%. Good part is that inflation has come below what the street was estimating, and it has happened five times in last six months. Going forward, inflation may inch up; however, it will be below RBI’s projections. This will have a cascading impact on the entire economy. Increase in exports and consumption will help the economy to improve capacity utilisation. Higher capacity utilisation will ultimately lead to increase in corporate investment, which had remained a laggard.

Exports: Showing Sustained Rise

Exports, which were showing a declining growth trend since the start of this financial year, witnessed the recovery in last three months and since September 2017, it was 25.7%, highest for this fiscal year. The fact that it grew despite facing pressure from a strong rupee (has appreciated by almost 4% on REER basis since January 2017) speaks a lot about its sustainability. According to a report, after a gap of almost four years, both emerging market and developed market economy are recovering simultaneously. This will lead exports to remain healthy with global industrial activity reviving. Continuous and extensive support such as imposition of anti-dumping duty on Chinese steel product has aided the growth of export. Earlier it was seen that either export was pulling up the growth or consumption. Nevertheless, the latest data indicates that all engines of economic growth are going to fire at the same time. Moreover, first time in many years exports and consumption both are exhibiting growth in tandem.

Curtain Raiser: Corporate Results

Early corporate results are pointing that economy is on strong footing. Some of the biggest companies from various sectors have come out with their second quarter results. Except for the few, results till now are quite encouraging. Companies like HUL, Dabur, Marico proxy to consumption are showing a good volume increase – 4%, 7.2% and 8% respectively. Urban demand has remained strong for these companies. Going forward increase in minimum support price, government spending and normal monsoon will give required impetus to rural demand. Rural markets offer an opportunity for expansion and sustainable growth to many sectors. Innovations in Agri-tech, Fin-tech, Health-tech, Edu-tech, clean water, renewable energy, housing & infrastructure are going to be the key focus areas for rural economy.

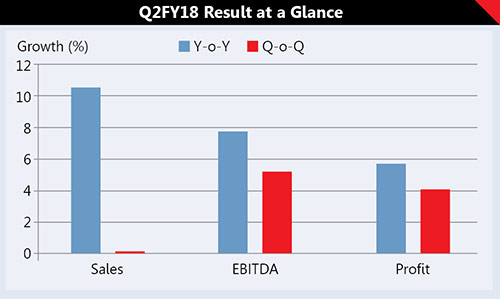

An analysis of 464 companies (results till Nov 2, 2017) shows a growth of 10.47% in topline on a yearly basis; nonetheless, sequentially it remains flat. However, EBITDA has increased by 5% on a quarterly basis while on a yearly basis it has increased by 8%. The story for profit after tax is no different and q-o-q basis, it has increased by 6%, while on y-o-y basis it has increased by 4%. In terms of industry, construction & contracting has given best results. 11 companies from this sector on aggregate basis have seen their sales increasing by 49%, while profit increased by 106%. Citigroup has revised their Sensex target upwards from an earlier target of 32,200. In a note it has mentioned that the government’s measures on bank recapitalisation, infrastructure, and crop prices, coupled with domestic flows, would support India stocks.

Upcoming Digital Revolution

For many years, the tech sector served companies globally, on their technology needs. It went from $2.5 billion in the late ‘90s to more than $110.0 billion today. The sector has been a huge force multiplier in GDP growth beside creating almost 50% of all organized jobs in the past five years. Given the benefit of a dynamic young population – with more than half of the country’s population below the age of 25, coupled with flagship programs viz. Digital-India Make-in-India, Start-up-India. Stand-up-India government seems to have grasped this change. These campaigns are opening a huge opportunity in education, agriculture, and power. India’s second-generation digital revolution will spread across the economic spectrum, from agriculture, rural-commerce, healthcare, education, financial & other services, manufacturing to infrastructure development and create a new set of jobs and render some existing ones obsolete.

The Hope, The Future, The Conviction

India’s economy was constrained by supply, which was a deliberate move – the reasons not unknown. It created a lobby of corrupt politicians, bureaucrats, businessmen, and a strong politically correct group of people. With the crackdown on such souls now India’s growth is at an inflection point. This is something the world will see pan out over the next 10 to 15 years. According to McKinsey Global Institute (MGI) report, India’s going to be the third-largest incremental GDP growth engine for the planet by 2030. That’s significant considering India’s size relative to the other massive geographies out there, like China or the US. Any apolitical person will agree that India is well poised at the cusp of high-growth due to the breakthrough economic reforms and forward-looking policy transformations. In the process, opening up unlimited opportunities for entrepreneurs to innovate newer and disruptive models, like never before. India is forecasted to be a $5 trillion economy by 2025.

The Endgame

As economy enters the robust phase of growth stocks, bonds and commodities all rally. After a gap of many years emerging market and (EM) and developed market (DM) are growing together and hence capital chases growth rather than safety. India will remain primary beneficiary of such shift. Uncertainty triggers capital flight to safety while stable growth brings capital to EMs. Currently markets are primarily driven by low inflation and higher financial savings. Although market valuations appear expensive, companies which are witnessing earnings growth are the ones which are appreciating in price. Price to Earnings Ratio (PER) of Indian stocks have expanded to 18x. Indian markets are still into a bull market and next leg of uptick is expected to be driven by revival in earnings, which is being witnessed in Q2FY18. Equity bellwether indices are currently trading at life time high and without doubt the best part of the bull run or appreciation is yet to come.