Lots of Sustainable Advantages

By IE&M Research

The Chinese Government has banned the import of waste paper, which is the primary raw material for finished paper. Thus, the production of finished paper would be impacted in China. This in turn would lead to an increase in the prices of finished paper. Eventually, the paper manufacturing companies like Ruchira Papers Limited (RPL) would witness volume growth and also benefit due to the increase in paper prices.

Industry outlook

India holds for a long time 15th rank among paper producing countries in the world, however, the total installed capacity is increasing every year. The per capita consumption of paper is still one fifth against the global average of 52 kgs and the Asian average of 38 kgs. The industry is working at 93% capacity utilization. India is the fastest growing market for paper in the world with a growth rate of about 7% annually. According to estimate an increase of per capita paper consumption by one kg will increase the demand by about 1.25 million tonne per annum. At present, the packaging board market size is growing 12%.

The Company

Ruchira Papers manufactures writing

paper, printing paper and Kraft paper. The company’s white writing and printing paper is used in making notebooks and writing material, while the colored paper is used in the fabrication of spiral notebooks, shade cards, children’s coloring books, etc. Its Kraft paper is utilized in the packaging industry for making corrugated boxes/cartons and for other packaging requirements. The company’s writing and printing paper and Kraft paper are manufactured by using agricultural residues like wheat straw, bagasse, sarkanda and other materials. The Indian paper industry is estimated to grow at a CAGR of 7.5% over the next couple of years, in-line with India’s GDP growth. Further, Kraft paper segment is also growing at a faster rate due to strong demand from packaging industry (owing to increasing e-commerce and FMCG demand). The company has diversified product portfolio in both the segments, which would assist in capturing a growing demand.

Investment Rational

Ruchira Papers’ business model is a B2B model with focus on profitable product segments, superior production process and rising operating efficiency. Now, the company is investing in technology up-gradation and moving into high value-added products, which will drive higher growth and profitability. With faster growth in demand from packaging industry and steady growth in traditional paper segments, we expect Ruchira Papers to clock higher CAGR in net profit aided by volume growth and margin expansion. It has robust earnings growth outlook, strong balance sheet, improvement in return ratios, and a healthy free cash-flows.

Upgradation of existing units

Beside a plan to set up a greenfield project in Punjab RPL has planned a capex of `42 crore (funded by a term loan of `27 crore and balance through internal accruals) for upgradation and modernization of existing units. This will facilitate RPL to introduce a new range of value added products in its Kraft paper unit coupled with an increase in Paper Machine speed from 640 meters/minute to 700 meters /minute in writing and printing paper unit. The company will start reaping its benefits from 1QFY2019 onwards.

Sustainable competitive advantage

Ruchira Papers manufactures paper based on agro-residues with a chemical-recovery plant. Agro-based paper manufacturing requires less energy, less water, fewer chemicals and is highly environmental-friendly compared to companies using wood pulp, resulting in lower cost of production. This is a key sustainable competitive advantage for Ruchira Papers.

Steady growth with margin improvement

The company has invested huge sum towards technology up-gradation and process refinement leading to better efficiency and higher production output. Integrated chemical-recovery plant, improvement in operating efficiency and strategic shift towards high margin value-added products will drive margin expansion over the time.

Special benefits

Ruchira, plant being located in Himachal Pradesh, is enjoying several benefits. It gets 100% excise exemption (eligible this year also) for printing & writing paper capacity (33000 MT capacity and 59% of operating revenues). It also enjoys a concessional rate of central sales tax and most important, power tariff in Himachal Pradesh is cheaper comparatively than neighboring states.

Outlook and Concerns

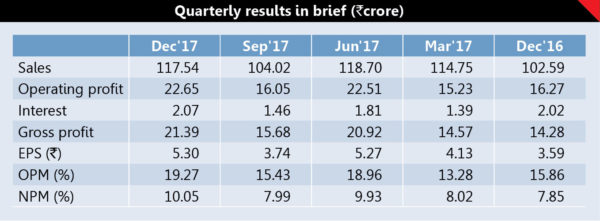

In the quarter ended December 2017 the net profit rose 47.70% to `11.89 crore as against `8.05 crore during the previous quarter ended December 2016 whereas sales rose 14.76% to `117.54 crore in the same quarter against `102.42 crore during the previous quarter ended December 2016. RPL is expected to record a healthy top -line of 12% CAGR over FY17-20E on the back of healthy demand growth. On the bottom – line front too 15% CAGR is expected, owing to strong improvement in operating performance. Improvement in manufacturing efficiency and benefits from increasing global finished paper prices would aid margins. Paper industry consumes a significant amount natural resources and releases wasteful chemicals. Proper wastes and chemical recovery management are critical for environmental certification standpoint. Further changes in environmental related compliance may increase the overall cost and business competitiveness.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)