By IE&M Research

In India dividends often meet with a step motherly treatment vis-à-vis capital appreciation. Investors tend to focus too much on the capital appreciation part of investing in stocks considering dividends to be only a miniscule overall value that is created. Nevertheless, various researches show that dividend can become a substantial part of your return if it is being reinvested in the same company.There are innumerable strategies for investing in equities, but ‘The Dogs of Dow’ strategy remain one of the most prominent and intriguing among them. This was first popularized in 1991 by renowned money manager Michael O’Higgins.

According to this strategy, investors should invest annually in the ten companies’, which are part of Dow Jones Industrial Average (DJIA) (DJIA is like Sensex in USA) whose dividend is highest as a fraction of their price. In other words, you pick the ten companies from DJIA with the highest dividend yield. You would then reshuffle this portfolio annually to maintain equal exposure to the top-ten dividend performers. This strategy is an extension of value investing. According to a study, based on this simple and low risk and low maintenance strategy, between 1957 and 2003, high-yielding stocks have outperformed the Dow 30 with an annual return of 14.3% versus the benchmark’s gain of 11%. In theory, high dividend yields should mean that a stock is undervalued, and undervalued stocks are normally due for a strong rebound. Even if the stock performs modestly, investors can still benefit from the high yield.

In other words, you pick the ten companies from DJIA with the highest dividend yield. You would then reshuffle this portfolio annually to maintain equal exposure to the top-ten dividend performers. This strategy is an extension of value investing. According to a study, based on this simple and low risk and low maintenance strategy, between 1957 and 2003, high-yielding stocks have outperformed the Dow 30 with an annual return of 14.3% versus the benchmark’s gain of 11%. In theory, high dividend yields should mean that a stock is undervalued, and undervalued stocks are normally due for a strong rebound. Even if the stock performs modestly, investors can still benefit from the high yield.

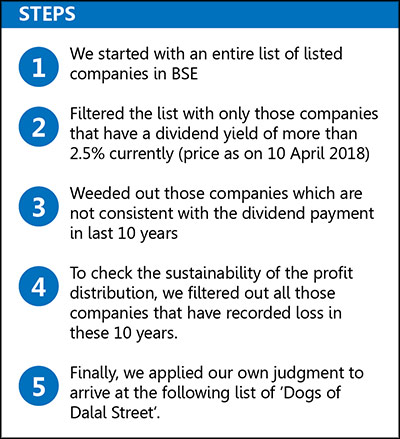

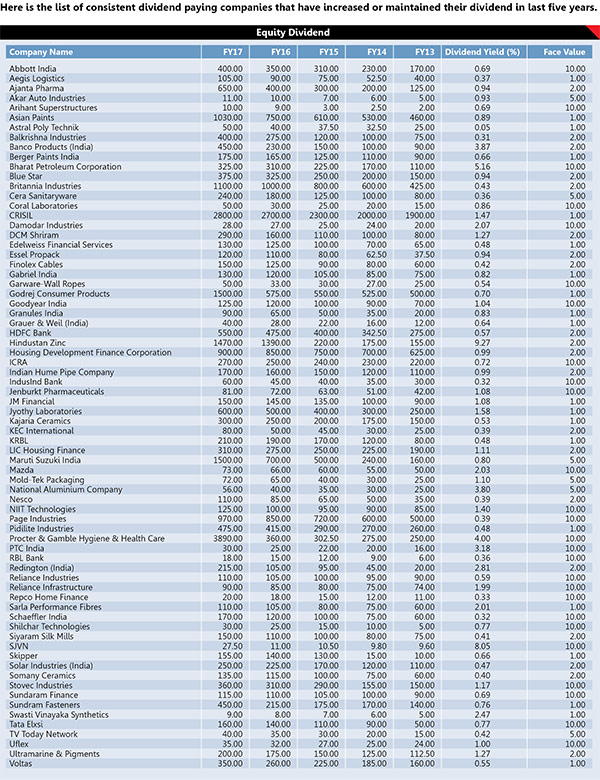

Extending the same logic in Indian equity market and making the list longer in terms of selecting companies we tried to replicate the strategy to find the best companies that fit into this strategy.

IE&M Portfolio of ‘Dogs’ of Dalal Street

Balmer Lawrie & Company Ltd. is a multi-activity, multi-technology, multi-location conglomerate with global footprints having diverse interests in manufacturing and services sector viz, Industrial Packaging, Grease & Lubricants, Leather Chemicals, Tea, Travel & Tours, Logistics Infrastructure & Services and Refinery & Oilfield Services. Presently the company is the largest in India in Steel Barrels Manufacturing, Greases Manufacturing, Freight Containers Manufacturing, Fat Liquor Manufacturing and Travel Business. The company is eyeing organic growth across all its six strategic business units since inorganic growth was not possible as the funds available for buyouts were limited. The company was facing challenges at the Kolkata plant of industrial packaging (IP), owing to lack of demand from the private sector. The container freight stations business of the logistics SBU had also been suffering because of the Centre’s directive of direct delivery to import points from the plants. Despite this, the logistics SBU contributed maximum to the turnover. Balmer Lawrie has also begun operations of a temperature- controlled warehouse. In addition to the cash dividend company is very much liberal in stock dividends in terms of bonus issue. It has recently issued bonus in the ratio of 3:1. For the quarter ending December 2017, company sales has increased marginally, however, profit has increased by 56.56%.

Bharat Petroleum Corporation Ltd. is one of the leading company in the petroleum sector in India. The company is into exploration, production and retailing of petroleum and petrol related products. The retail business unit of BPCL is into marketing of petrol, diesel and kerosene. The company also offers a full range of automotive engine, gear oils, transmission oils, specialty oils and greases as well as provides Aviation Turbine fuel (ATF) to its airline customers. Their LPG business unit “Bharatgas” also has a widespread presence throughout the length and breadth of the country. Recently the company has announced that it will shut its 120,000 barrels per day (bpd) joint venture Bina refinery from mid-September for 45 days to expand its capacity by 30%. During the shutdown, the company will carry out modifications at various units to raise the capacity of the plant to 156,000 bpd. The refinery will be stable and start operating at (an annual rate of) 7.8 million tonnes (156,000 bpd) before the end of this calendar year. The expansion is also aimed at producing cleaner fuels. Company’s fortune has turnaround after the deregulation of petrol and diesel prices. It is now having a better cash generation. For the quarter ending December 2017, on standalone basis company’s sales has increased by 10%, however, profit has declined by 6%.

Clariant Chemicals (India) Ltd. formally known as Colour-Chem Ltd is one of India’s leading specialty chemical companies and is a major player in pigments, textile chemicals and leather chemicals. The company’s product range includes a wide range of chemicals for pre-treatment, dyeing and finishing and dyes for various substrates and applications. It develops and produces pigments for paints, plastics, inks, cosmetics, detergents and special applications like viscose, latex etc, high-performance pigments to meet the exacting demands of the automotive, coil coating industries, etc. As one of the world’s leading specialty chemical companies, Clariant contributes to value creation with innovative and sustainable solutions for customers from many industries. Its portfolio is designed to meet very specific needs with as much precision as possible. At the same time, research and development is focused on addressing the key trends like energy efficiency, renewable raw materials, emission-free mobility, and conserving finite resources. The company’s business units are organized into four business areas: Care Chemicals, Natural Resources, Catalysis and Plastics & Coatings. Meeting of Board of Directors of the Company will be held on May 15, 2018, inter alia, to consider and take on record the Audited Financial Results for the year ended March 31, 2018. Company’s total operating revenue is `980.98 crore and Equity Capital is `23.08 crore for the year ended 31/03/2017.

Indian Oil Corporation Ltd. is India’s flagship national oil company and downstream petroleum major. The company operates the largest and the widest network of petrol and diesel stations in the country. The company offers a range of value-added services to enhance customer delight and loyalty. Large format Swagat brand outlets cater to highway motorists, with multiple facilities such as food courts, first aid, restrooms and dormitories, spare parts shops, etc. IOC is currently forging ahead on a well laid-out road map through vertical integration- upstream into oil exploration and production (E&P) and downstream into petrochemicals-and diversification into natural gas marketing, biofuels, wind power projects, besides globalization of its downstream operations. The company proposes to ramp up the petrochemical, fuel refining and biofuel manufacturing capacity of its Panipat Refinery. The expansion is a part of revised targets to increase the refining capacity from 15 million tonne per annum to 25 mtpa by 2023-2024 for the refinery. The company is spending `3,292 crore to upgrade from producing BS IV grade fuel to BS VI grade fuel. Company’s net operating revenue is `359873.16 crore and Equity Capital is `4739.34 crore for the Year ended 31st March 2017. It is the largest commercial enterprise in the country, with a net profit of `19,106 crore.

NMDC Limited, formerly known as National Mineral Development Corporation Limited is an iron ore producer and exporter. The Company operates in two business segments: iron ore and other minerals and services. The Company is engaged in the exploration of a range of minerals, including iron ore, copper, rock phosphate, limestone, dolomite, gypsum, bentonite, magnesite, diamond, tin, tungsten, graphite, and beach sands. It was incorporated in 1958 as a Government of India fully owned public enterprise. NMDC is under the administrative control of the Ministry of Steel, Government of India. Recently NMDC and Indian Rare Earth Limited (IREL) signed an MoU to jointly explore opportunities in rare earth elements in India and abroad. The two partners will also look at opportunities in setting up the downstream value chain of rare earth products. Rare Earth Elements (REE) are used extensively in almost every conceivable advanced technology products and also have commercial, industrial and military applications. China has a monopoly meeting 95% of the global demand. Domestically, IREL is the sole producer of REE compounds. The company is also eyeing for forward integration. It’s total operating revenue is `8828.14 crore and Equity Capital is `316.39 crore for the year ended FY17. The recent increase in prices of iron ore bodes well for the company and its cash generation.

Power Finance Corporation Limited (PFC) was set up as a financial institution dedicated to power sector financing and committed to the integrated development of the power and associated sectors. PFC is providing a large range of financial products and services like project term loan, lease financing, direct discounting of bills, short term loan, consultancy services etc. for various power projects in generation, transmission, distribution sector as well as for renovation and modernization of existing power projects. PFC is also the nodal agency for the implementation of the ambitious Ultra Mega Power Plants. The Centre has recently launched a pilot scheme for procurement of aggregate power of 2,500 megawatts on a competitive basis for three years under medium term, that is, from generators with commissioned projects, but without power purchase agreements and PFC Consulting Ltd, a wholly owned subsidiary of PFC Ltd., has been appointed as the nodal agency for the bidding process while PTC India Ltd. is the aggregator. As part of the bidding process, PFC Consulting will invite quotations from power developers in the form of a single lump-sum tariff. The company also has the mechanism of rating different state Power Utilities on its performance. Company’s total operating revenue is `27289.23 crore and profit after tax of `1604.3 crore for the year ended 31/03/2017.

NLC India formerly known as Neyveli Lignite Corporation Ltd, a “Navratna” Government of India Enterprise, under the administrative control of MOC has a checkered history of achievements in the last 56 years since its inception in 1956. NLC is engaged in lignite excavation and power generation using lignite excavated. The Company operates in two segments: lignite mining and power generation. The Company has four lignite mines: Mine-I – 10.5 MTPA, Mine-IA- 3.0 MTPA, Mine-II – 15.0 MTPA and Barsingsar Mine – 2.1 MTPA. The Company has four power generation plants and is also engaged in the business of Lignite Mining, Power Generation. The company currently operates four open cast lignite mines of total capacity of 30.6 Million Tonnes per Annum (MTPA) and five thermal power stations with a total installed capacity of 3240 MW. The company, through its subsidiary NTPL, has also recently commissioned a 1000 MW coal based power plant (comprising 2 Units of 500 MW capacity each), 10 MW solar plant and 30 MW wind power plant thus bringing the total installed capacity of the company to 4280 MW. For the quarter ending December 2017, company sales has declined by 9.58%, however, profit has increased by a huge 41.1%.

Hindustan Zinc Limited is India’s only integrated producer of zinc and lead. It is a subsidiary of Vedanta Resources. HZL is the world’s second largest zinc producer. The company manufactures three qualities of zinc – special high-grade zinc used in construction, infrastructure, household appliances, etc.; high grade zinc and prime western zinc. In addition, the company also manufactures pure lead used in lead acid battery, ceramic glazes, electrodes, etc. The company is also in the business segment of Wind Energy, Silver Metal, Zinc and Lead. HZL operates the world’s third largest open-pit mine, and World’s largest Zinc Mine in Rampura Agucha, Rajasthan. Other mines with HZL are located in Sindesar Khurd, Rajpura Dariba, Kayar and Zawar, all in Rajasthan. HZL is one of the lowest cost zinc producers in the World. The financial year 2018 was marked by strong performance. It has recorded EBITDA at `12,376 crore, up 27%; Net Profit at `9,276 crore, up 12%; annual production of refined silver at 558 MT, up 23%; annual production of refined zinc-lead at 960kt, up 18%. The board has announced a total dividend of `8.0 per share (400%). The company has reached a new milestone this year with a complete transition to underground mining and are on track to reach 1.2 mtpa mined metal capacity by FY2020.

SJVN formally named as Satluj Jal Vidyut Nigam, is engaged in hydroelectric power generation, originally established as a joint venture between the government and the state government of Himachal Pradesh to develop and operate the Nathpa Jhakri Hydro Power Station (NJHPS). The company is currently constructing the Rampur Project, which is expected to be a 412 MW hydroelectric power generation facility located downstream from the NJHPS. SJVN has also entered into an MoU with the state government of Uttarakhand for three hydroelectric projects. SJVN Limited has also signed a MoU with Ministry of Power and has diversified the operations to target hydroelectric power projects available outside India, and has been awarded the rights to construct and operate on a build, own, operate and transfer (BOOT) basis. In fiscal 2017-18, against the target of 8,950 million units, SJVN generated 9,280 million units from its projects under operation with an installed capacity of 1,964 MW. Currently, SJVN has four projects with a capacity of 1610 MW under construction and another four projects with a capacity of 2155 MW under various stages of clearances, soon to enter construction. SJVN envisages being a 5700 MW+ generating company in coming years. Company’s total operating revenue is `2468.66 crore and Equity Capital is `4136.63 crore for the year ended 31st March 2017.

The company was formerly known as Damodar Threads Limited and changed its name to Damodar Industries Limited in January 2013. It is a completely integrated and advanced production line for manufacturing fancy and specialty yarns. The Company’s segment is engaged in the manufacturing and sale of Textile Products. It is involved in spinning, draw-texturizing, air-texturizing, fancy doubling and yarn dyeing. The company has in-house manufacturing operations, which are essential building bricks of fashion. The product range of the company includes: Cotton Yarn, Fancy Yarn, Blended Fancy Yarn, Product Enquiry, Spun yarn in polyester/viscose and silk/polyester in various counts. The company has announced that the trial production at new plant of the Company situated at MIDC Amravati, Maharashtra was commenced on March 28, 2018. For the quarter ended December 2017, the company’s net sales from operations was `155.5 crore compared to `168.8 crore a year ago. Profit from operations before exceptional items was `4.7 crore, while net profit was `3.6 crore or `3.32 per basic and diluted share compared to `2.06 crore year ago. In the upcoming year, Damodar Industries’s earnings are expected to increase by 23.24%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.