At sweet spot with tremendous opportunities

By IE&M Research

The Indian chemical industry is the 3rd largest in Asia and 6th by volume in the world. By 2025, the industry is projected to reach $403bn. The Indian pharmaceuticals market is the 3rd largest in terms of volume and 13th largest in terms of value. India is the largest producer of generic drugs globally with Indian generics accounting for 20% of the global exports in terms of volume. The Indian pharma industry, which is expected to grow over 15% per annum between 2015 and 2020, will outperform the global pharma industry.

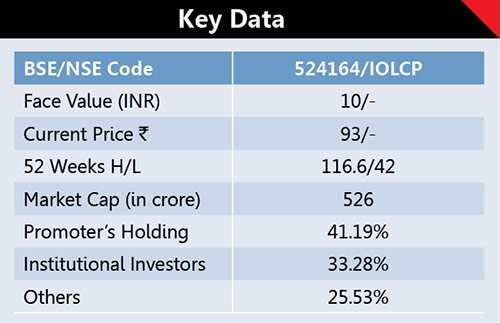

IOL Chemicals and Pharmaceuticals Limited (IOLCP) is one of the largest players in Specialty Organic Chemicals and Bulk Drugs (API’s). Headquartered in Ludhiana (Punjab) IOLCP operates in two business segments, Specialty organic chemicals and pharmaceuticals (Bulk Drugs) with its manufacturing facility at Barnala (Punjab).

Business Model

IOLCP has two business segments, i.e.  chemicals and pharmaceuticals. The chemical segment manufactures Ethyl Acetate, Iso Butyl Benzene (IBB), Acetyl Chloride and Mono Chloro acetic Acid (MCA), while under pharmaceuticals, the company manufactures active pharmaceutical ingredient (APIs) i.e. ibuprofen. The company sells branded formulation and ibuprofen in export markets like Europe, Latin America and Middle East. Apart from Ibuprofen, it also manufactures Metformin Hydrochloride, Lamotrigine, Fenofibrate and Clopidogrel Bi sulphate. The chemical and pharmaceutical segments contribute equally to the revenue, but management wants to take pharma business revenue upto 65% over a period of time. The company has a co-generation plant of 17MW to meet the energy demands of its production units. It’s R&D lab is DSIR approved and is fully equipped to validate the existing processes. IOLCP has its footprints in 56 countries regularly supplying its high quality products to major pharmaceutical players like Sanofi Aventis (India and Hungary), Aristo Pharmaceuticals, Prati Donaduzzi E Cia Ltda (Brazil), Cipla, BASF (USA), UPL, Abbot India and ZIBO XINUA-Perrigo Pharmaceutical (China). With its backward integrated USFDA accredited Ibuprofen plant, IOLCP has emerged as favorable supplier abroad.

chemicals and pharmaceuticals. The chemical segment manufactures Ethyl Acetate, Iso Butyl Benzene (IBB), Acetyl Chloride and Mono Chloro acetic Acid (MCA), while under pharmaceuticals, the company manufactures active pharmaceutical ingredient (APIs) i.e. ibuprofen. The company sells branded formulation and ibuprofen in export markets like Europe, Latin America and Middle East. Apart from Ibuprofen, it also manufactures Metformin Hydrochloride, Lamotrigine, Fenofibrate and Clopidogrel Bi sulphate. The chemical and pharmaceutical segments contribute equally to the revenue, but management wants to take pharma business revenue upto 65% over a period of time. The company has a co-generation plant of 17MW to meet the energy demands of its production units. It’s R&D lab is DSIR approved and is fully equipped to validate the existing processes. IOLCP has its footprints in 56 countries regularly supplying its high quality products to major pharmaceutical players like Sanofi Aventis (India and Hungary), Aristo Pharmaceuticals, Prati Donaduzzi E Cia Ltda (Brazil), Cipla, BASF (USA), UPL, Abbot India and ZIBO XINUA-Perrigo Pharmaceutical (China). With its backward integrated USFDA accredited Ibuprofen plant, IOLCP has emerged as favorable supplier abroad.

The Specialty Chemicals Segment

IOLCP is a major manufacturer in the specialty organic chemical space. It is one of the largest producers of Ethyl Acetate (87,000 TPA) and ISO Butyl Benzene in India with over 30% of the global market share and a major player in Ibuprofen. It has forward integrated this vertical to the pharmaceutical segment with end products such as IBB (9000 TPA), MCA (7200 TPA) and Acetyl Chloride (5200 TPA) used as key raw materials for Ibuprofen. It plans to explore its presence in other industries such as paints, flexible packaging and glass. In line with this approach, it has added many MNC giants to its customer base like Akzo Nobel, BASF, Strides, Granules etc.

Pharmaceuticals Segment

With a presence in over 56 countries, IOL Chemicals & Pharmaceuticals has established itself as a major player in Ibuprofen with over 30% of the global capacity. It is the world’s only backward-integrated Ibuprofen producer (8,000 TPA) that manufactures all intermediates and key starting materials at one location. It has augmented its pharma business by moving up the value-chain by entering into lifestyle drugs for pain management, anti-depressant, anti-diabetic, anti-platelet and anti-convulsion. Currently, 6 APIs are already commercialized and 10 APIs are in the advance stage of development. IOLCP’s Ibuprofen plant is USFDA, EDQM and EUGMP certified by the National Institute of Pharmacy and Nutrition, Hungary.

Investment Rational

Turnaround in nos:

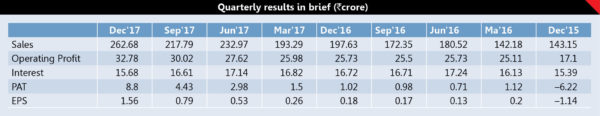

IOLCP has heavily suffered from losses in the past, though it has arrested losses in FY17 by posting a profit of `4.2 crore. It has posted profits of `16.2 crore in 9MFY18 which is substantially higher than the total profit of FY17. Looking at the management’s plan to increase the focus on pharma, led by capacity expansion, it seems these activities will substantially boost the profitability in the coming years. The company will invest about `100 crore every year for two years to increase their capacity by 30% every year, to meet the growing demand of Ibuprofen. Currently the company is working with full capacity utilization at 8000 TPA out of which it has added 800 TPA capacities in Q3FY18 and management believes by the end of H2FY19 it will reach to the capacity level of 10,000 and rest 2000 TPA will be added gradually. The company will also enhance the capacities of its backward integrated products, i.e. ISO butyl benzene from 9000 TPA to 12000 TPA, MCA from 7200 TPA to 10500 TPA and Acetyl Chloride from 5200 TPA to 8400 TPA. The company has already completed and commercialized unit 3 to manufacture Fenofibrate, Clopidogrel and Lamotrigine etc. with an investment of `16.48 crore met through internal accruals. It has successfully started the Metformin, an anti-diabetes drug with an annual capacity of 3000 MT in February 2018.

Ibuprofen – A Goldmine For IOLCP:

Globally, Ibuprofen has installed manufacturing capacity of 31,350 TPA, while it has a demand of around 38,000 TPA, which is quite high compared to its supply. According to industry reports, the demand of Ibuprofen is likely to increase in a couple of years. Prices of Ibuprofen have increased substantially in the western markets like USA and Europe due to lack of capacity expansion by existing manufacturers. Industry checks suggest prices of Ibuprofen have increased by 50% in the USA and Europe while in India it has increased by 30%. IOLCP is the only Ibuprofen manufacturer who is expanding capacity to meet the shortage demand. Currently, it is running at full capacity.

Outlook and Concerns

Looking at the immense growth potential in Ibuprofen led by the massive improvement in operating matrix IOLCP looks at sweet spot. Recently management has announced its guidance for 30% CAGR growth in topline. With this certainly the bottomline will increase at substantially higher rates.

(Disclaimer: The views expressed herein are based on publicly available information and other sources believed to be reliable. The information contained in this document does not have regard to specific investment objectives. Neither IE&M nor any person connected with the organisation, accepts any liability arising from the use of this document.)