“Inditrade group to emerge as a dominant player

with pan India presence, over the next five years”

Says Sudip Bandyopadhyay, Group Chairman of Inditrade (JRG) Group

Founded in 1994 as JRG Securities Ltd., Inditrade Capital over the years emerged as one of the leading financial service providers in the state of Kerala and other southern states. The listing of the company happened in 2006. In 2007 Barings India PE Fund acquired a majority shareholding in the company and subsequently took management control in 2009. Inditrade Capital was a multiple product company offering amongst others, equity, commodity, currency and insurance broking services. The company was also distributing mutual funds and other financial products along with providing depository services.

In 2015 the current management team lead by Sudip Bandyopadhyay, Group Chairman of Inditrade Capital Ltd., acquired Barings India PE Fund’s entire shareholding in the company and made a mandatory public offer to the minority shareholders under the SEBI Takeover Code. Post the public offer, the current management team owns 72% of the company with balance 28% wtih retail investors. Post this acquisition, the company has, through its subsidiaries (JRG Fincorp – NBFC and Inditrade Micro Finance – NBFC MF) expanded rapidly into Agri commodity financing and Micro Finance over the last couple of years.

In an engaging interview, Mr. Bandyopadhyay whose diverse experience of over three decades in the world of Finance includes long stints with ITC, Reliance ADA Group and Destimoney, before taking over reins of Inditrade Capital, shares his views with Krishna Kumar Mishra, on the recent developments at Inditrade.

Inditrade has forayed into Agri commodity financing business and had acquired a similar business from Edelweiss Group in 2016. What motivated this decision and what is your vision for this segment of the business?

India is amongst the top producing and consuming countries of almost all Agri-commodities. However, just about 12-18% of the post harvest, Rs 6 lakh crore Agri-commodity market is served by banks and financial institutions, presenting a colossal untapped opportunity. There is immense scope for a non-banking financial company, such as ours, to enter and effectively professionalise this space. Our vision is to become the leading Agri-commodity financing player in India, largely facilitating post-harvest financing of non-essential, exchange-traded commodities.

Post acquisition of Inditrade Capital from Barings, we started Agri commodity financing business in Southern India where the company had a significant presence. However, we realised very soon that large markets also exist in Northern and Western part of the country and organic growth would be time consuming. Thus, in November 2016, we went ahead and acquired the Agri commodity business of Edelweiss group to ramp our presence in the large Northern and Western markets of India. Since then, the company has been rapidly growing its presence with clear focus on non-essential and exchange traded Agri commodities. This being a cyclical business, the loan tenure is on an average for three months. However, during the last year, the company provided loans of around Rs 1000 crore with net outstanding of around Rs 200 crore in March 2018.

The net worth of the NBFC (JRG Fincorp) is around Rs 110 crore and we want to scale up the business significantly in the current financial year. There are plans of raising Tier I and Tier II capital during the latter half of the current fiscal. We will be targeting an average net portfolio of around Rs 500-600 crore and loan disbursal of around Rs 2000-3000 crore, during the current fiscal.

What are the fee based services you provide in the Commodity Segment to Banks and Institutions?

Out of the total post harvest credit demand of around Rs 6,00,000 crore, about 10% is i.e. Rs 60,000 crore is being catered to by banks and other financial institutions. These institutions lend against the security of relevant commodities. On an average around 5% and these loans turn into NPA resulting in the need for the banks / institutions to liquidate stocks held as security of around Rs 3000 crore per annum. Generally the banks neither have the expertise nor the network to effectively dispose of such commodities and maximise realisation.

Post acquisition of the Agri commodity business of Edelweiss in November 2016, Inditrade Captial has a large network of agents spread across mandis in India. This is in addition to the large in-house team we have. This presence helps us to effectively help the banks in disposing of the above referred commodities. Inditrade Capital over the years have been empanelled with most of the prominent banks and institutions and is helping them to dispose their commodities as and when required through both physical and electronic auctions. For these services we earn a fee income. We believe that this segment has significant potential to grow as more and more players get into post harvest commodity financing and we get further empanelled with more players in this segment.

Last year in April 2017, Inditrade launched its Micro Finance operations in Maharashtra and then in the southern state of Tamil Nadu in August 2017, through its subsidiary, Inditrade Microfinance Ltd. Tell us about how you decided to move into the microfinance sector, the progress of the micro-finance arm so far and where you envisage the business, going forward.

Micro Finance is grossly an under penetrated sector in India in spite of the excellent work done by many organised players in this sector. As per available estimates, only 20% of the demand for micro finance loans is being currently met by organised players. Inditrade Micro Finance decided to operate in the semi urban industrial markets of the country in a calibrated manner.

The business was launched in April 2017 at Solapur in Maharashtra. By the end of the year, we had 7 branches in Maharashtra and 18 branches in Tamil Nadu with a total disbursement of close to Rs 100 crore. The portfolio performance was outstanding with 99.99% collection efficiency. During the current fiscal, we have already started operating in Kerala with 2 branches operating in the Palakkad district. We plan to have a total of 10 branches in Kelara within the first six months of the current fiscal. We are also entering Orissa during the first half of the year with plans for expansion in Rajasthan, Madhya Pradesh, Chattisgarh and Karnataka during the second half of the year. Our loan disbursals on a cumulative basis should reach more than Rs 400 crore by the end of current fiscal.

We plan to become a pan India player by the end of next fiscal year.

Over the years, Inditrade has grown both organically and inorganically into a multi-product firm which currently offers equity, commodity brokerage and insurance services, besides mutual fund, depository, fund management and other financial services. What has motivated the Group to now sell its equity broking arm, which was originally the bread and butter business?

The market dynamics have significantly changed over the years, resulting in financial attractiveness of the equity brokering business significantly getting reduced for a standalone broking company. The banks having the broking arm, benefit from CASA (Current A/c. and Savings A/c.) deposits of their customers. While the standalone brokers don’t benefit from such client deposits. Cost of operations, predominantly led by incremental compliance requirements and technology needs, have shot up significantly. Usual inflation has also led to a significant increase in costs, including salary, etc. Thus, over the years, the cost of running an equity broking business, has gone up significantly. On the other hand, competition has continuously brought down the brokerage rates and with launch of discount brokerage, the rates may even come down further. Significant increase in F&O trades and corresponding reduction in cash market volumes, has also led to erosion of brokerage income as the brokerage earning on F&O trade is minuscule compared to a cash segment trade.

“We hope to be in a position to disburse close to Rs 2500 – 3000 crore loan during the current fiscal and significantly increase our performance on all fronts including both top line and bottom line.”

Under the circumstances, the option for standalone broker is either to scale up significantly and try to gain larger market shares and thereby spread the operational cost on large volumes of business or become a niche player catering to small segments of the market and remain at the mercies of market volatility. Our Board has been examining the situation critically for a long time. The Board also examined the necessity of further infusion of funds in our rapidly growing NBFC, Micro Finance and other new businesses. It may be pertinent to note that we have also applied to National Housing Bank for housing finance license, which would require capital infusion. We have also elaborate plans for entering the Merchant Cash Advance (MAC) business and scale up the same pan India over the next couple of years.

After reviewing the overall scenario, the Board at its meeting held on 18th May 18 decided to exit Equity Broking through slump sale of the business and deploy the proceeds to further strengthen our various lending business verticles.

Tell us about Inditrade’s foray into the housing finance segment and its plans to enter the merchant finance business.

As I mentioned earlier, we plan to enter into the housing finance segment with a focus on promoting affordable housing. We have applied for a license and filed applications with the regulator National Housing Bank and are now awaiting approval. Through the housing finance business, which will be operated through a separate subsidiary, we aim to sanction Rs 40 crore in loans in the current year itself. The individual loan size will be between Rs 10 – 25 lakhs.

Where merchant finance is concerned, we realised that there are many small businesses which do not get loans from banks and NBFCs. We want to change that by launching loan products for these entities. Small merchants using POS (Point of Sale) terminals will be our customers. We will tie up with POS vendors for customer acquisition as well as loan repayment facilitation. The loans will range between Rs 5 lakhs – 25 lakhs and will be generally for duration of twelve months. The market potential is huge and organised players are very few. We will launch the business in Mumbai and gradually move to other large cities like Pune, Hyderabad, and Kochi etc.

Could you give us a sense of how you see the company’s growth emerging from here on?

Going forward, the company will have four clearly defined verticals, Agri commodity financing, Micro Finance, Affordable Housing Finance, and Merchant Cash Advance. We will predominantly operate in a niche where the motto is to bring organised financing to sectors which are dependent on informal sources of credit. Our study and all available information indicate that there is significant scope for expansion in all the above segments. It may also be noted that large banks and NBFCs are not generally present in these segments. We wish to continuously expand in the next couple of years in these segments by moving into new geographies and service more and more customers in the chosen segments.

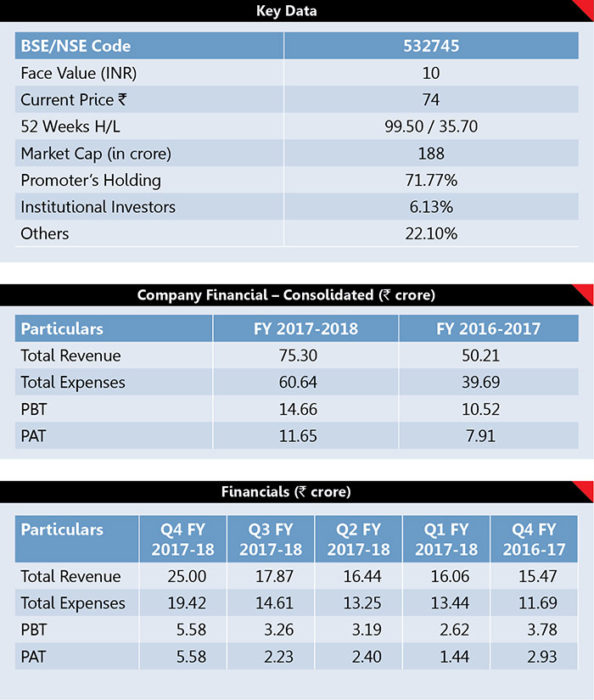

We want to examine both organic and inorganic growth opportunities available in these segments. While we have our own resources and support from banks and financial institutions, we will also look forward to further expand our capital base during the current financial year and raise about Rs 200 crore through a combination of long term debt and equity to expand our businesses. We should be in a position to disburse close to Rs 2500 – 3000 crore loan during the current fiscal and significantly increase our performance on all fronts including both top line and bottom line.

What is the long term plan for the Group?

We are completely focussed on catering to segments not serviced by banks and large NBFCs. These are the small businesses, entrepreneurs and unorganised sectors. Our aim is to finance progress of these neglected and underserviced customers. We see Inditrade group emerging as a dominant player in this segment with pan India presence, over the next 5 years.