By IE&M Research

Mutual fund investment has become the preferred route of investment for many investors; however, investing in only right mutual fund schemes will give the desired result.

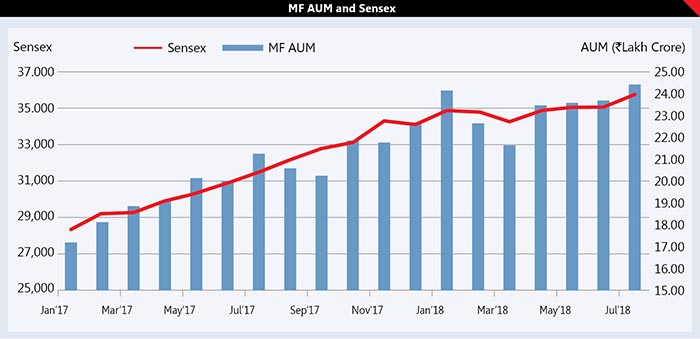

Mutual fund investment in last few years has become an indispensable part of the Indian financial system. While earlier it was dominated by institutional investors and that too in debt instruments, it is now the retail investors that are ruling the roost. Average assets under management (AAUM) of Indian Mutual Fund Industry for the month of July 2018 almost touched Rs 24 lakh crore and stood at Rs 23.96 lakh crore. The AUM of the Indian MF Industry has grown from Rs 5.41 lakh crore as on 31st July 2008 to Rs 23.06 lakh crore as on 31st July 2018, more than quadrupled in a span of 10 years. Such increase in the AUM was on back of higher number of accounts or folios.

The surging equity market motivates the new as well as existing investors equally to put money in the mutual fund. At the end of July 31, 2018, a total of Rs7.55 crore folios were there – the number of folios under Equity, ELSS and Balanced schemes; wherein the maximum investment is from retail segment which stood at Rs6.31 crore (63.1 million). This is 50th consecutive month witnessing rise in the number of folios.

What is important is that these investments are sticky in nature. This is being reflected by rise in systematic investment plans (SIPs) in mutual funds. Total investment through this route for the month of July stood at Rs 7,554 crore, a surge of 53% from the year-ago period. MFs have 2.33 crore SIP accounts through which investors regularly invest in Indian mutual fund schemes.

Despite such growth, AUM of the Indian mutual fund industry is low by global standard. The percentage of AUM compared to national GDP in India is mere 11 per cent compared to global average of 62 per cent. What this means is that there is lot of growth potential for mutual fund investment in India. According to various estimates by experts, the asset base is going to increase by two folds in next five years and may reach up to Rs 50 lakh crore in next five years. What will help such growth is growing middle class and large working population with huge investible surplus. The physical assets such as gold and real estate have also lost their sheen of late and hence MF becomes the preferred route of investment by retail investors.

Methodology

We started with the entire universe of equity diversified funds. After that we applied different filters. First filter was the time of existence of funds – we considered only those funds that have been in existence for more than three years and whose corpus size is more than Rs100 crore. We considered a trailing 3-year time frame because the period gives us the opportunity to judge the performance of fund on different phase of the market. Analyzing performance in these time periods will give clear idea about the resilience of the fund. Next, we ranked schemes based on their performance in four time periods of one month, six months, one year and three years. Then the ranks were given weightage, with 50 per cent weightage given to the 3-year rank, 30 per cent to 1-year rank and 10 per cent weightage each to the 6-month rank and one-month rank. The logic for this weightage was to give more importance to those funds that have consistently performed well in the long-term.

After this, we examined few ratios such as sharpe ratio, expense ratio and orientation of the fund that is where they have invested their large chunk of funds. Then we considered certain softer issues such as performance of funds where the same fund managers are managing the funds, to know if it is an aberration. For proper diversification we selected only one fund from each fund house. This way we arrived at the five best funds that have not only performed well in the past but are expected to perform better in these trying times.

Progress Report

They say the proof of pudding is in eating.

Hence our recommendation of the mutual fund scheme same month last year speaks for itself. Last year in our September issue we recommended five mutual fund schemes for our readers. These recommendations were from different fund houses and covered different style of investment.

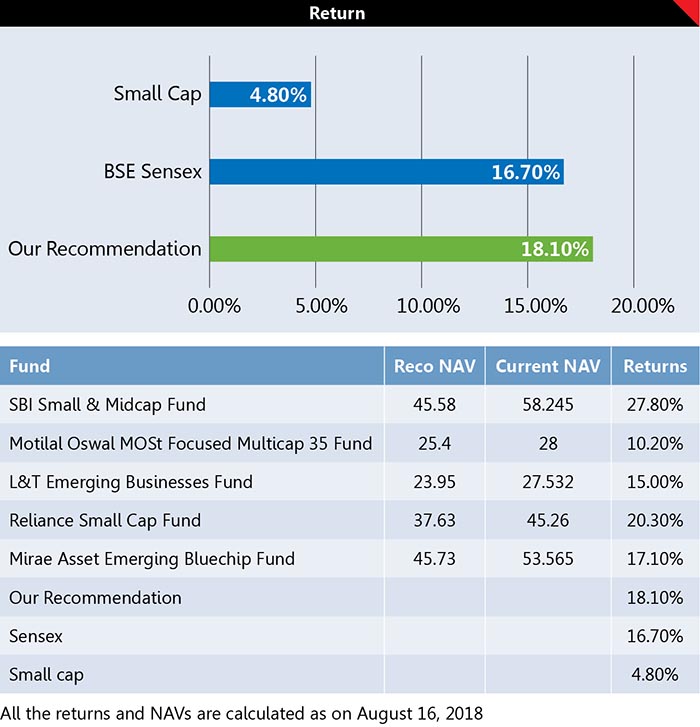

The average return generated by our recommendation in last one year is 18.1%. This is 140 basis points better than the Sensex performance during the same period. The best part is out of total five funds that we recommended three funds have outperformed the Sensex and have generated return better than frontline indices.

There were two funds that were small cap dedicated and that were the best performers. Even if we compare with the small cap index, our recommendations have beaten the index by huge margin. Against 4.8 per cent return given by BSE Small Cap our recommendation generated more than 18 per cent during the same period.

5 Funds

Axis Focused 25 Fund – Direct Plan

NAV: Rs. 31.11 as on Aug 16, 2018

Net Assets: Rs. 5498.5 crore as on Jul 31, 2018

Launch: January 2013

Benchmark: NIFTY 50 Total Return

Min Investment (Rs.): 5000

Min SIP Investment (Rs.): 1000

Exit Load: For units in excess of 10% of the investment,1% will be charged for redemption within 365 days

There has always been a debate whether

(An M.M.S. in Finance from Mumbai University Jinesh Gopani joined Axis Asset Management Company in 2009. He has a total experience of thirteen years in the capital markets. Prior to this he was with Birla Sun Life AMC, and has also worked with many reputed organizations.)

focused fund is better than a well-diversified fund. This has been further intensified with implementation of Sebi’s regulation on rationalization and categorization of scheme where the focused funds cannot have more than 30 stocks. Focused funds do not spread assets over many companies. Globally, they are also called “best idea funds,” as they choose 20-30 companies according to their mandate. The aim is to deliver high returns by investing in a limited number of companies.

Axis Focused Fund is one of such funds that has proved its mettle in every market since its launch in 2013. In every calendar year it has outperformed its benchmark. For example, in year 2017, it has outperformed its benchmark Nifty 50 TRI by 16.6 per cent. Even in the current year, when market is choppy, it managed to beat its benchmark. This performance has helped it to continuously improve its ranking in its category. From the laggard in its category in 2014 it has gained pole position in last couple of years. Every Rs 100 invested in the fund at its launch would have become Rs 311 now giving a CAGR of 17 per cent.

Fund is a large cap oriented as most of its portfolio is invested in large and giant cap stocks and only about 18 per cent is in mid cap stocks. This has helped the fund to outperform as large cap stocks have performed better than small and mid-cap dedicated funds. The fund holds 23 stocks at the end of July 2018. Focused funds are normally riskier than those of equity diversified funds with a larger number of stocks but also have the potential to deliver better returns if their bets play out well, which is the case with this fund. Hence, this fund is suitable for moderate risk taker investor.

Sundaram Large and Mid Cap Fund – Direct Plan

NAV: Rs. 36.37 as on Aug 16, 2018

Net Assets: Rs. 407.2 crore as on Jul 31, 2018

Launch: January 2013

Benchmark: NIFTY 200 TRI

Min Investment (Rs.): 5000

Min SIP Investment (Rs.): 250

Exit Load: 1% for redemption within 365 days

Sundaram Large and Mid-cap Fund which was

(An Engineering graduate and a PG Diploma in Business Administration from Loyola, Chennai, S Krishna Kumar joined Sundaram AMC in 2003. Voted amongst the Top 10 Best Fund Managers by ET Wealth, he has over 20 years of experience. He also manages Sundaram S.M.I.L.E, Sundaram Tax Saver, Micro cap Series I – X among others.)

earlier known as Sundaram Equity Multiplier Fund, is a well-diversified fund that has shown remarkable consistency in outperforming both its benchmark index and the category over many years. It takes a sharper tilt towards mid-caps compared to benchmark to create better returns. The fund manager has moderated exposure to his top bets. The top holding of the fund is Reliance Industries that constitutes only 4.66% of the total asset of the fund.

The fund boasts of a superior risk-reward profile compared to many of its peers. The risk adjusted return measured by Sharpe ratio of the fund is 0.54 compared to 0.41 of its benchmarks and 0.33 of its categories. The fund invests in stable large cap and growth oriented mid cap companies belonging to financial, construction, FMCG etc.

The fund was launched in the year 2009, and since inception it has generated CAGR of 11.79%. The fund has been generating better return since 2013 and has been able to beat its benchmark every year. The fund has remained more or less at par in 2018 and has underperformed the benchmark by 1.88 per cent. Nevertheless, it has outperformed both its category by huge margin. The fund has the mandate of minimum investment in equity & equity related instruments of large cap companies- 35% of total assets and minimum investment in equity & equity related instruments of mid cap stocks- 35% of total asset. Currently the fund has 37.34% of its assets into mid-cap stocks and rest in large cap stocks. The fund has overweight position in Financial, Construction and FMCG at the end of July 2018. The fund is suitable for investors who are risk aversive.

Invesco India Contra Fund – Direct Plan

NAV: Rs. 52.93 as on Aug 16, 2018

Net Assets: Rs. 2186.3 crore as on Jul 31, 2018

Launch: January 2013

Benchmark: NIFTY 500 TRI

Min Investment (Rs.): 5000

Min SIP Investment (Rs.): 500

Exit Load: 1% for redemption within 365 days

Contra as name suggests is something that is

(A Commerce graduate and CA Amit Ganatra is also a Chartered Financial Analyst from AIMR. He has over 14 years’ experience in equity research. He was earlier with DBS Cholamandalam Mutual Fund covering banking, property and construction sectors. Prior to DBS he was working with Fidelity as sector specialist covering the banking sector.)

opposite of popular belief. When we talk of contra in investment term, we are talking of those stocks that are now out of favour for general investors (for various reasons) and they are getting out of the stock or are overlooked by them. However, contra investors find value in those stocks and pick them up at lower price and make profit by selling them once market realizes its potential and share price increases. It is more like a value picking with slight twist of some bad news in the stock that has led to the hammering of the stock down.

Invesco India Contra Fund is one such fund that invests in such stocks that are currently out of favor. Nevertheless, if we look at the portfolio, we do not find anything “contra” in their holding either in sector or company. It was like any other equity diversified fund. For example, fund’s top pick, Reliance Industries and HDFC Bank do not look contra buying. However, there are some holdings that look contra buying but they are yet to perform.

Nevertheless, the fund has been able to perform. In last three-year period, fund has generated annualized return of 16.77% against the category return of 12.63%. Even in the shorter duration of 3 months the fund has given a return of 3.64% compared to 0.86% by category. Since its inception the fund has given return of 15.22 per cent annually. This astounding return has helped the fund to attract huge investments. The net assets, which was at mere Rs 27.43 crore at the end of 2008 has increased to Rs 1558.27 crore (31st July 2018). The fund may not be fully true to its label, however, it is suitable for a moderate risk investor.

SBI Banking & Financial Services Fund – Direct Plan

NAV: Rs. 17.89 as on Aug 16, 2018

Net Assets: Rs. 566.7 crore as on Jul 31, 2018

Launch: February 2015

Benchmark: NIFTY Financial Services TRI

Min Investment (Rs.): 5000

Min SIP Investment (Rs.): 500

Exit Load: 1% for redemption within 365 days

The performance of SBI Banking & Financial

(A graduate in Commerce, and a qualified CA, Sohini Andani joined SBI Funds Management in October 2007. She has an experience of more than 18 years in the field of financial services. Prior to this she was with ING Investment Management, and has also worked with many reputed organizations.)

Services Fund has been remarkable since the launch of the fund in Feb 2015. It has steadily remained at the pole position in its category. The reason for such stupendous performance is portfolio building strategy. They could achieve such feat by remaining ahead of the curve when it comes to selecting stocks. Credit goes to the fund manager and his team in identifying such companies for investment. This has helped fund to generate alpha for its investors. For example, ICICI bank and Axis bank are the top holding of the fund, which till few months back was under-performer among banking stocks.

At present, banking sector is facing twin problems of rising non-performing assets (NPAs) and weak corporate governance practices. While the problem is more acute in the public sector banking space, some large private sector banks, too, are embroiled in issues related to corporate governance. The holdings of the fund show that it has remained out of such banks or financial institution. There is not a single PSU bank in the top 10 holdings of the fund.

In terms of performance, the fund has been able to beat its category and benchmark year after year. For a three-year period, it has given return of 21.96% annually compared to 15.29% by category and 15.74 per cent by its benchmark, which is Nifty Financial Services TRI.

Currently the fund is highly concentrated and is holding 20 stocks in its portfolio and the top holding constitutes only 11.04 % of the fund. Looking at the constituent of the fund, it is suitable to investor who is willing to take higher risk. The reason being, it is a sectoral fund and moreover holdings of the fund are concentrated.

ICICI Prudential FMCG Fund – Direct Plan

NAV: Rs. 257.94 as on Aug 16, 2018

Net Assets: Rs. 456.9 crore as on Jul 31, 2018

Launch: January 2013

Benchmark: NIFTY FMCG TRI

Min Investment (Rs.): 5000

Min SIP Investment (Rs.): 1000

Exit Load: 1% for redemption within 15 days

The consistent performances of FMCG mutual

fund schemes over various time-frames have revived an old debate: Should regular investors opt for them? FMCG fund category has been consistently performing in one, three, five and 10-year time periods. Moreover, a recent report by Crisil said that the FMCG sector is likely to report 11-12 per cent rise in revenue in fiscal 2019, up 300-400 basis points from 8 per cent in fiscal 2018.

The demographic dividend of the country indicates that consumption is one theme that is going to play out for a long time in India. Even in last few months this has given good returns. This fund – which is a sector fund dedicated to FMCG, is one of the best performers in last one year. In fact in CY18, this fund did remarkably well and has been top performer among its category that has 13 funds.

In July 2018, the fund sported a very concentrated portfolio of 26 stocks wherein top ten stocks contributed little over 67 per cent of the total assets and the top holding of the fund is in ITC, which holds 34% of the entire assets. Though, the fund flaunts conservative portfolio through its giant and large-cap allocation of 68% compared to 61% by the category.

Atul Patel, fund manager of this fund has started to manage this fund recently from January 2018. The fund since then has been performing well. In last 6 months when the category average has given return of 1.95% the fund has given a return of 14.72 per cent. Thus, this fund is suitable to a investor who is willing to take lower risk.