By IE&M Research

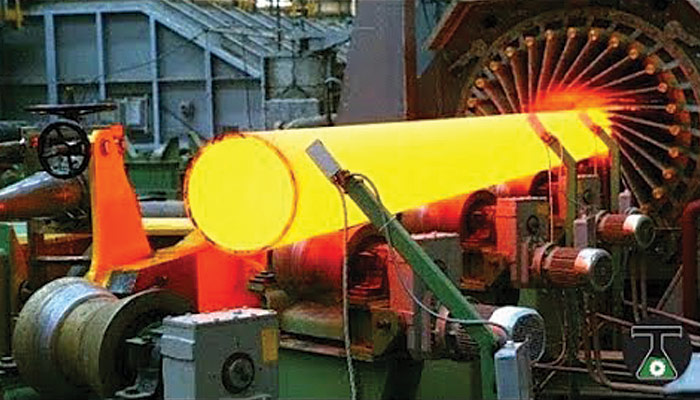

Steel is now Gold

Iron ore Pellets prices are on fire. Now sales are getting booked at Rs 8500-10000 per ton. It was earlier far below, an increase from Rs 6200 in Q4FY18. This will work wonders for companies like Godawari Power and Jindal Steel & Power.

Welspun Enterprises

BSE Code/ NSE: 532553 WELENT; Face Value: Rs10; CMP: Rs172

52 Weeks H/L (Rs): 202.85 – 130.50; Market Cap Rs (crore): 2544

Promoters of the company recently bought 1.70% of company’s equity from the open markets. This shows the immense confidence the company has on future business prospects. The company has already reported 99.6% jump in its Q1FY19 (April-June) at Rs 22.8 crore against Rs 11.4 crore in the same quarter last fiscal. Its revenue rose 70.3% at Rs 355.1 crore versus Rs 208.5 crore.

PC Jeweller Ltd.

BSE Code/ NSE: 534809/ PCJEWELLER; Face Value: Rs10; CMP: Rs83

52 Weeks H/L (Rs): 600.65 – 65.35; Market Cap Rs (crore): 3330

PC Jeweller has cut its net debt by about 10% during the first quarter of the current fiscal to Rs 4,064 crore and targets to bring it down to less than Rs 3,000 crore by September. It has reduced bank liabilities from internal accruals and better realisations from inventory. Recently the company said it has Rs 1,162 crore as cash balance in books of accounts. This fund would be utilised to further reduce bank liabilities to less than Rs 3,000 crore by September end. PC Jeweller has posted 4.5% growth in its net profit at Rs 142 crore during the first quarter of this fiscal. Its sales rose by 14.4$ to Rs 2,423 crore for the quarter ended June. Out of total sales, domestic market contributed Rs 1,616 crore while exports were to the tune of Rs 807 crore. These are positive developments.

Rajesh Exports Ltd.

BSE Code/ NSE: 531500/ RAJESHEXPO; Face Value: Rs1; CMP: Rs664

52 Weeks H/L (Rs): 872.30 – 561.95; Market Cap Rs (crore): 19640

With the recent acquisition of Valcambi, the world’s largest gold refinery in Switzerland, Rajesh Exports has built up a total capacity to refine 2,400 tonne of gold per annum. It is also in the process of building a world class gold refinery at Bengaluru. The company has reported 34.43% jump in consolidated net profit to Rs 399.1 crore for the quarter ended June 30, 2018. Net profit in the year-ago period stood at Rs 296.8 crore. Total income declined to Rs 43,926.7 crore from Rs 50,408.2 crore in the year-ago period. The order book stood at Rs 44,628.7 crore till June-end. A sharp analyst has been recommending this stock to be as a permanent fixture to its clients’ portfolios.

(Disclaimer: Readers must not forget that these are not recommendations and may not be backed by strong fundamentals. The information has been collected by IE&M team from analysts, brokers, fund managers and other market sources. Great care should be taken before taking any decision based on this information as the source might be prejudiced.)