By IE&M Research

Jet Airways Ltd.

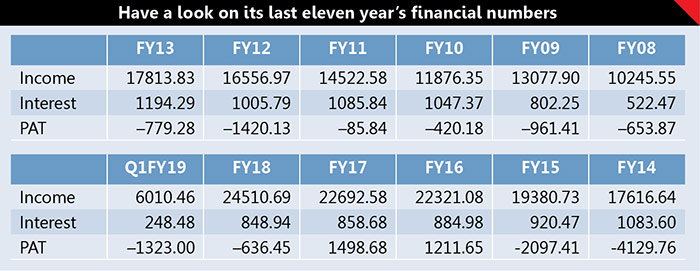

OUT OF 11, IT HAS REPORTED LOSS IN 9 YEARS

BSE Code/ NSE: 532617/ JETSAIRWAYS; Face Value: Rs10; CMP: Rs 220

52 Weeks H/L (Rs): 883.65 / 163; Market Cap Rs (crore): 2506

Domestic airlines registered about 18.95% growth in passengers flown during September compared to that a year ago. IndiGo further increased its dominance in the market in terms of passenger carriage by flying 43.2% of the total passengers during the month of September. Jet Airways followed IndiGo in terms of market share, by flying 15.8% of the passengers flown during the month. Jet Airways is second largest private sector airline company but airline business is one of the riskiest business in the world. Fuel cost is major cost for aviation companies and higher crude oil prices and lower rupee are major negative factor for domestic airline companies. India’s largest aviation company IndiGo has posted first ever loss in September quarter and we are expecting poor numbers from Jet Airways in September quarter.

Just look at its financial. It has an equity base of Rs113.6 crore. Reserve is around (-Rs7252.73 crore) and net worth is around (-Rs7139.13 crore). Book value of the stock is negative Rs628.48. Current market cap is above Rs2506 crore. Company has debt above Rs5295.12 crore in its book which is horrible.

The most astonishing aspect is its loss pattern. The Company has posted loss in nine years out of last eleven years. In Q1FY19 it has posted huge loss and our estimate indicates that it may post loss at the end of FY19. According to the media reports Jet Airways has once again defaulted on the salaries of its employees. In last 10 months, stock plunged from Rs884 to Rs163 level and now it is trading around Rs 200 level. It is certainly not a bottom fishing candidate. Anyone who wants to play on aviation sector, for him, IndiGo (Interglobe Aviation Ltd. – BSE/ NSE: 539448 INDIGO) may be best candidate but it can give returns only in lower crude price scenario.

Aban Offshore Ltd.

DANGER LURKS BENEATH THE SURFACE

BSE Code/ NSE: 523204/ ABAN; Face Value: Rs 2; CMP: Rs 72

52 Weeks H/L (Rs): 280.40 / 71.85; Market Cap Rs (crore): 433

Aban Offshore Limited offers a diverse range of offshore drilling services to clients in India and abroad – Exploratory services; Drilling services; Production of hydrocarbons; and Manning and management.

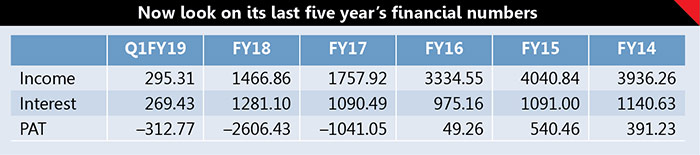

Once upon a time this stock was darling stock for traders and investors. Its price went up to Rs5400 level in FY08. Now it is available at just Rs72. Many investors might be feeling that it is available at a throw away price but as per financial analysis it is not cheap stock even at this price.

Just look at its financials. It has an equity base of Rs11.67 crore. Reserve is around Rs7.01 crore and net worth is around Rs18.68 crore. Book value of the stock is Rs3.2 and price to book value is around Rs23. Current market cap is above Rs425 crore. Company has debt, hold your breath, above Rs12000 crore in its book which is horrible.

Company has posted almost Rs4000 crore loss in last two years and debt remains at same level. Company has appointed Deloitte Touche Tohmatsu India LLP as their adviser to assist them in hammering out a resolution plan for the debt-laden company but as per our view, there are lots of opportunities available in the market after sharp crash so don’t try to buy stocks like Aban Offshore whose future is not only uncertain but very bleak.