By IE&M Research

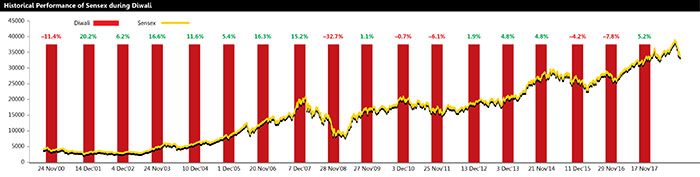

The festival of lights, Diwali, is just around the corner; however, the usual brightness in the stock market seems to be conspicuous by its absence. Comparing the current market with 2008 like sell-off would be exaggeration, however, strong storm clouds are gathering on the horizon suggesting a turbulent times ahead for equity investments.

We believe the domestic factors – the most important event before the next Diwali – the General Elections, as well as some international factors will keep the equity market on slippery ground for another six to nine months.

However, we also believe every investor has a different risk appetite and has a different level of return expectation from his/her investments. With this assumption, on this auspicious occasion, we are giving three different portfolios that they can choose from depending upon their risk appetite.

We have also decided to review this portfolio in next six months and update any change.

Sensex and Nifty have turned negative after hitting their lifetime highs just two months back which is certainly not good news. Further to that several domestic factors such as rupee depreciation, higher crude oil prices, and uncertainty over the next government at the center will continuously keep equity market on slippery ground. International factors such as geo-political tension, countdown to Brexit and latest Italy’s face-off with European Union has echoes of the Greek debt crisis, and these will not help equity markets either.

Markets want political stability and any instability will lead to a significant spike in market volatility. Hence, we believe volatility will be norm of the market. It would be only a guessing game how the above factors will take turn as these are highly unpredictable in nature but have a great influence over the equity market. Therefore, it becomes prudent to take a portfolio approach to investment. However, it should not be mistaken with diversification as diversification is like owning a lot of investments in each asset class. An index fund with 500 stocks inside of it could be said to be diversified, but it’s not a portfolio.

This story will guide the readers about portfolio construction, which will help them in organizing their investment in a holistic manner rather than a piecemeal. Therefore, this will help them to meet their investment objectives.

These portfolios are constructed on the ‘factor’ based investing. There are certain ‘factors’ such as —value, momentum, quality, low volatility, dividend, and size (small cap) that perform differently in different times. For example ‘value’ stocks perform well during expansion of the business cycle, when investor’s sentiment is positive and market cycle is in recovery mode.

We believe there’s no “one-size-fits-all” solution; what one should do depends upon one’s goals, needs, risk and tolerance. Every investor has a different risk appetite and has a different level of return expectation from his/her investments. We also presume that the reader also understands some of the nuances of the stock market. With this assumption we are giving three different portfolios that they can choose from depending upon their risk appetite.

As time progresses information from different arena and events at domestic as well as international forum impact the price and business of the companies. Therefore, the ‘factor’ that was present in the stock earlier might not be present now.

Hence, we have decided to review this portfolio in next six months and update any change in this portfolio.

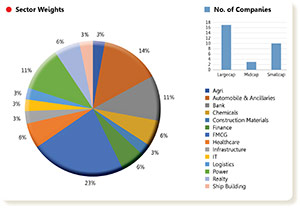

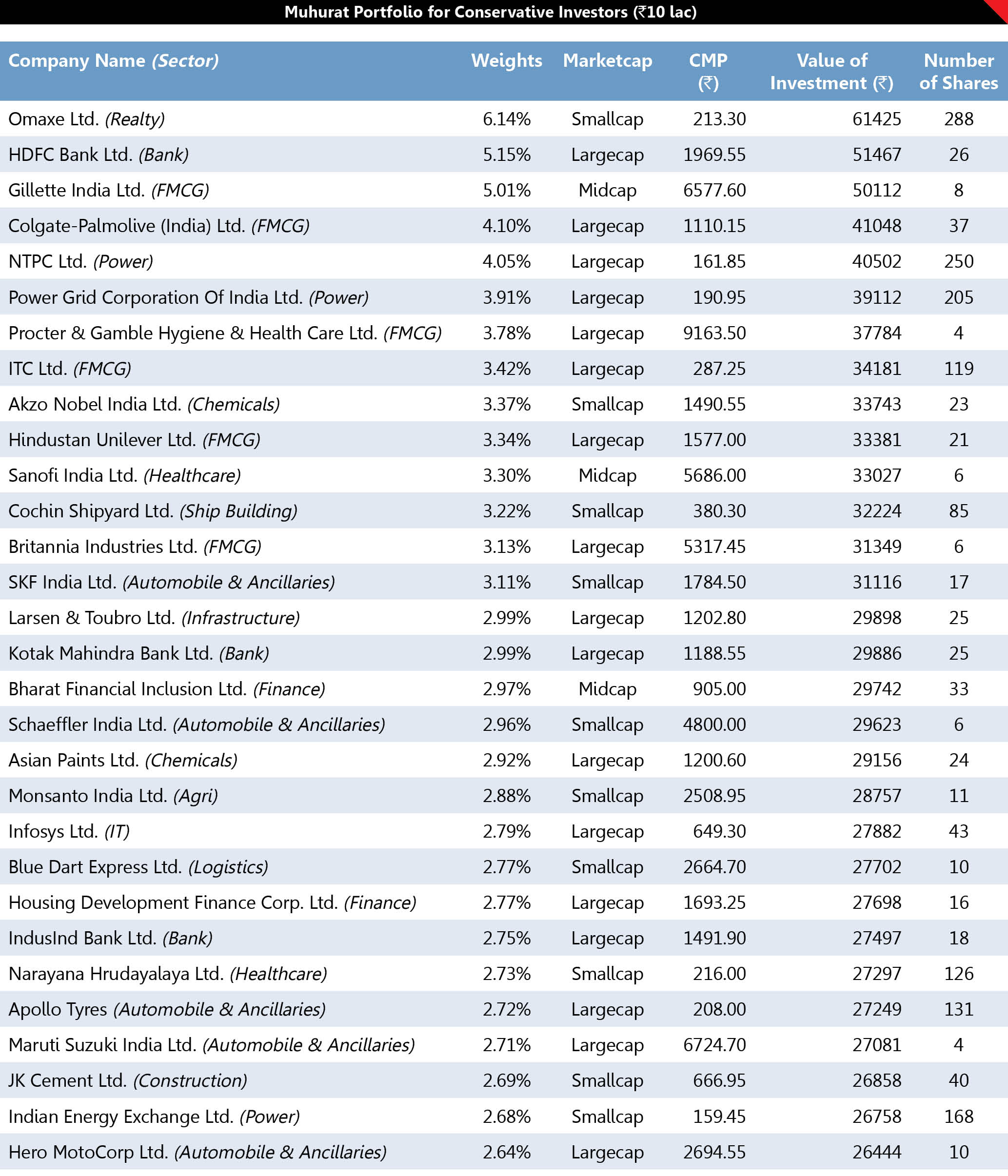

Portfolio for Conservative Investors

(when capital preservation is of prime importance)

In an environment of sustained uncertainty and stormy markets, investors typically grapple with a common question – how can one potentially reduce market risk while maintaining long term return benefits that equity generally provide. The conventional investment wisdom says that lower risk means lower returns. However, this is not always true. In longer run, one of the key reasons why portfolio performs is because they can handle downturn in the market in a better way. That is, they fall less during the falling market. It might be puzzling to many finance professionals since they have been taught that higher volatility is usually associated with higher returns.

According to the highly celebrated single factor pricing model – the Capital Asset Pricing Model (CAPM), one should expect lower return for taking lesser risk (volatility). Nevertheless, historically, we have seen that funds with lower volatility perform better in both during the expansion as well as contraction of the business cycle.

The prospect of achieving higher returns without taking the comparable risk associated with traditional market cap weighted strategies is one of the prominent reasons that low volatility based factor investing is gaining popularity globally.

This portfolio is best suited for someone with lower risk appetite.

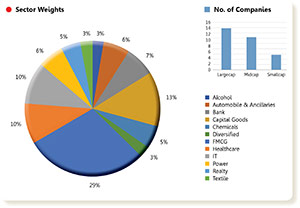

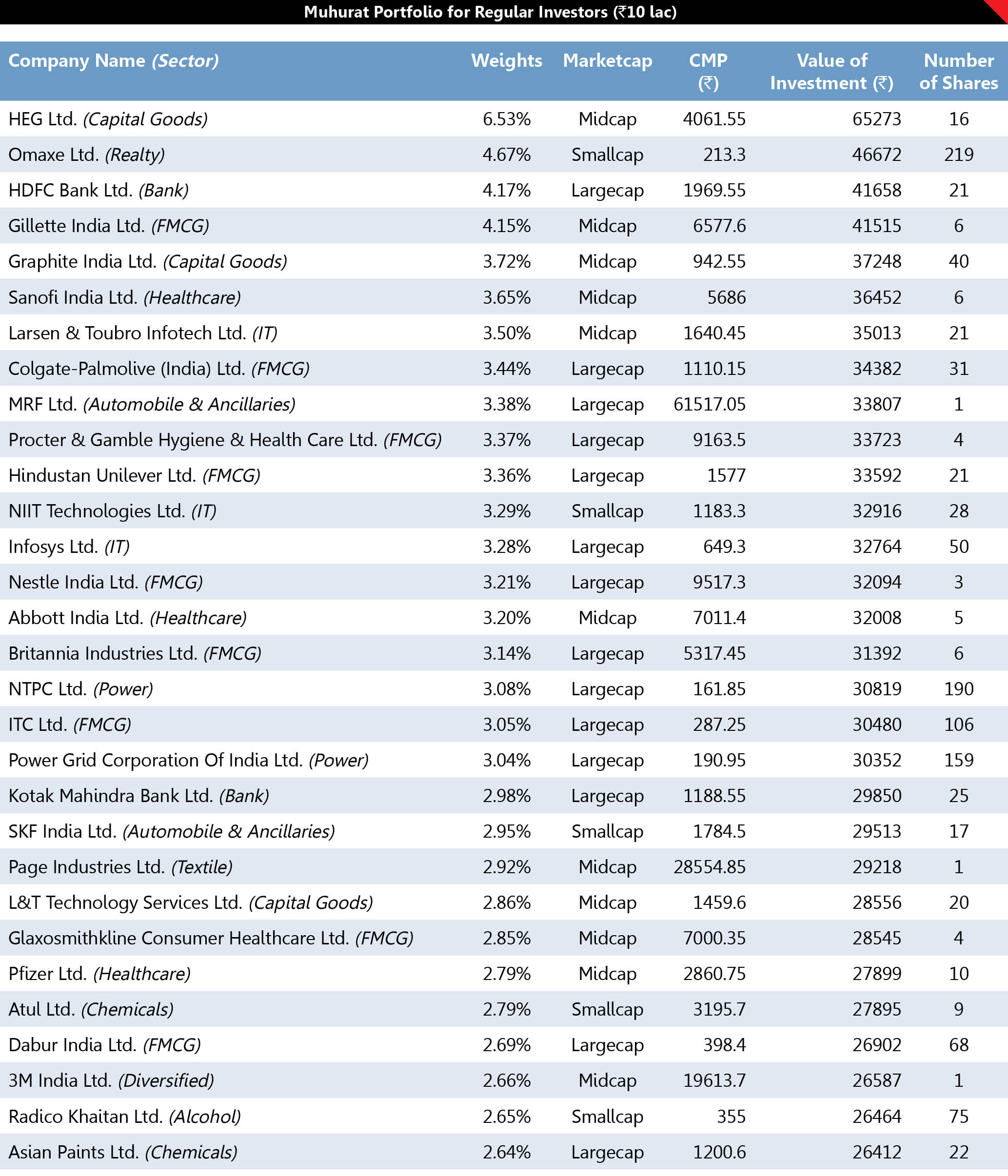

Portfolio for Regular Investors

(having best of both worlds)

This is probably one of the longest expansionary periods in the world economy. This has resulted into valuation of every major asset class stretched. The transition to the next phase of contraction could easily send markets into a tailspin. Economists are still debating when it will start, although that period is still away but is inevitable. So what should investors do?

Opting for a more defensive portfolio is often the default solution. However, it will fail to capture the gains made between the current time and when the contraction starts. Therefore, constructing a portfolio that has the ability to capture the upside as well as protect the downside becomes the logical option.

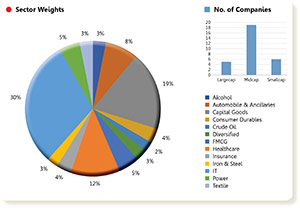

This regular portfolio is constructed on the same theory that will not only help the investors to gain from any uptrend but also protect them from any sudden fall in the market. It is like having best of the both worlds. We have added another factor ‘alpha’ to lower volatility to create this portfolio. Adding alpha can significantly improve returns with only a marginal increase in risk. A balanced approach to ranking stocks should complement the risk approach and allow for the potential for additional return without a material increase in risk.

This portfolio is best suited for someone with lower regular risk appetite.

Portfolio for Aggressive Investors

(when capital preservation is secondary)

Judging from most commonly used measurements of market pricing – such as market cap to GDP (the “Buffett ratio”), the Shiller Cyclically-Adjusted Price Earnings Ratio (CAPE), and the Q Ratio – most of the global equity markets, including India, looks expensive. However, this does not mean they are going to collapse soon. “The markets can remain irrational longer than you can remain solvent.” This is a quote of famous British economist John Maynard Keynes which he gave supposedly after he performed a series of highly leveraged trades, and he was humbled by the market. Therefore, we are giving this aggressive portfolio for those investors who believe market is going to touch new highs soon in next few quarters.

Aggressive Investment Strategy is focused on gaining maximum returns from a selection of the highly risky group stocks and the objective of capital preservation is secondary. This is only possible when the risk appetite of the investor is high. Such a portfolio would have the majority of its holdings in risky stocks. Only investors with high capacity to bear losses and who can bear capital depletion should go for an aggressive strategy.

Thus, this is suitable for people who have a strong corpus and the investment in this portfolio is not a part of their financial goals.