Pratit Nayan Patel

Inching towards its previous level

Incorporated in 1981, Kalpataru Power Transmission Limited (KPTL) is one of the largest and fastest growing specialized EPC companies in India engaged in power transmission and distribution, oil and gas pipeline, railways, infrastructure development, civil contracting and warehousing and logistics business with a strong international presence in power transmission and distribution. With proven experience and expertise spanning over three decades, KPTL today has established its footprints in over 50 countries, executing marquee projects with comprehensive capabilities that deliver complete solutions covering design, testing, fabrication, erection and construction of transmission lines, oil and gas infrastructure and railways projects on a turnkey basis. The Company is currently executing several contracts in India, Africa, Middle East, CIS, SAARC and Far East.

The Company has an annual production capacity of over 180,000 MT of transmission towers at its three state-of-the-art manufacturing facilities in India and an ultra-modern tower testing facility, making it amongst the global largest power transmission EPC Company. The Company is providing railways EPC services for executing civil infrastructure, track laying, signaling and telecommunication and over-head electrification projects for railways in India.

KPTL has expanded its operations under the promising transmission line BOOT projects under Public Private Partnership (PPP) mode. The Company has successfully developed many projects. KPTL has expanded its scope into Civil Construction, Infrastructure Projects, Road BOOT Projects as well as Agri-Logistics through its subsidiaries JMC Projects (India) Limited and Shree Shubham Logistics Limited.

Equity capital, Reserve & Promoter’s Holding

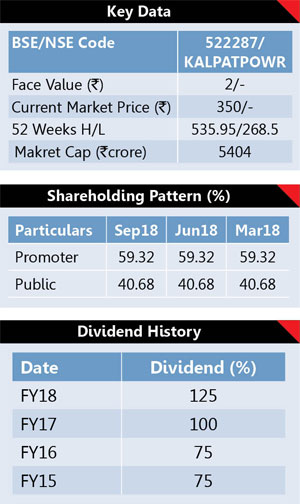

The Company’s equity is Rs 30.69 crore while it has huge reserve of around Rs 2642.71 crore. Its share book value stood at Rs183.75. Promoters hold 59.32%, Mutual Funds hold 20.04%, FPIs hold 4.74%, insurance companies holds 2.66%, while investing public hold 13.24% stake in the company.

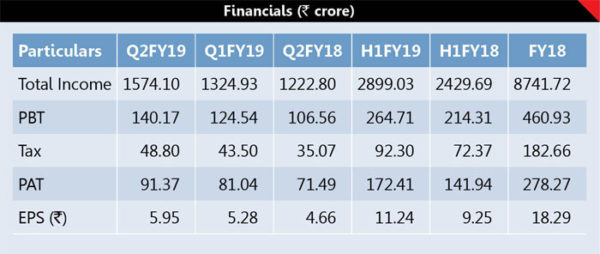

Financials

In FY18 it has reported 14.58% higher sales of Rs 8741.72 crore while net profit soared 76.9% to Rs 278.27 crore against Rs 157.3 crore in FY17 fetching an EPS of Rs 18.29. During Q2FY19, its net profit skyrocketed 27.81% to Rs 91.37 crore from Rs 71.49 crore in Q2FY18 on 28.73% higher sales of Rs 1574.10 crore fetching an EPS of Rs 5.95. For H1FY19, its PAT increased 21.46% to Rs 172.41 crore from Rs 141.91 crore in H1FY18 on 19.31% higher sales of Rs 2899.03 crore fetching an EPS of Rs 11.24. On PAT front, it has reported 37% CAGR growth in last three years. It has paid 100% dividend for FY17 and paid 125% dividend for FY18.

Industry Overview

By 2020, it is estimated that over USD 640 billion worth of transmission related investments are envisaged and subsequently another USD 500 billion would be invested during 2021 to 2025. Among these investments, about 76% would be allocated for Greenfield projects; in some countries it’s as high as 90%. Overall, around USD 1,145 billion is expected to be invested during FY2016-25 in the electricity transmission sectors across various countries. Approximately, 74% of this investment is expected to be spent on developing new high voltage projects, while 22% is envisaged to be spent on replacement and upgrades of transmission assets. Geographically, Asia led by China and India will account for the highest investment levels at 56% of the total for the six regions, followed by Europe and North America respectively.

Under the prospective transmission plan FY2014-34, it is envisaged that NR shall have a deficit of about 18,500-22,200 MW, while the deficit of SR shall be about 13,000 to 19,100 MW at the end of 13th Plan. Therefore, under the 13th National Electricity Plan (13th NEP), it is estimated that approximately Rs 2,60,000 crore would be invested. This reflects significant growth in the power transmission sector. About Rs 1,60,000 crore would come from states and the other Rs 1,00,000 crore from Power Grid Corporation of India. The Government is planning to increase the size of projects and scope of work in transmission. Also, the interconnections with neighboring countries like Bangladesh, Nepal, Bhutan, and Sri Lanka is given emphasis in the plan.

Our Take

The Company has strong order book of around Rs 14179 crore as on 30th September 2018. Recently it has received new orders of Rs 1322 crore. Its subsidiary JMC Project has strong order book of around Rs 10129 crore as on 30th September 2018 and it has recently won order worth Rs 514 crore. Its 52 week high is Rs 535.95 which was recorded on 12th January 2018. Stock has almost corrected 34% from 52 week high. At CMP, KPTL trades at PE ratio of 17.3X earnings. Based on above financial and performance parameters, the KPTL share looks quite attractive at the current level and investors can accumulate this share in staggered manner with a stop loss of Rs 270 for an upper target of Rs 500-550 in next 18 to 24 months.