Adlabs Entertainment Ltd.

BSE Code/ NSE: 539056/ ADLABS

Face Value: Rs 10

CMP: Rs 11.37

52 Weeks H/L (Rs): 72.50 – 8.85

Market Cap: Rs (crore): 97

Promoter’s Holding: 47.51%

Adlabs Entertainment Ltd (AEL) is mainly engaged in the business of theme park and entertainment industry. AEL own and operates Adlabs Imagica, India’s first and only family holiday destination near Mumbai and Pune. It is the perfect weekend getaway which includes an International Standard theme park, a water park and a premium hotel. At Imagica Theme Park, guests can bump into the in-house characters of Tubbby – The Elephant, Roberto – The Star Chef, The Lost Astronaut, Mogambo of Mr. India fame and The Gingerbread Man while hopping from one ride to another. If we talk about theme park undoubtedly it is one of best entertainment place for families but when we talk about its financial it is not worth an investment idea.

Now look on its last FOUR year’s financial numbers. The Company came out with an IPO in March 2015, offered shares to the public at Rs180 per share and raised Rs276.67 crore. It had allotted shares worth Rs60 crore to anchor investors, including funds operated by Daiwa, HDFC, Axis, IL&FS and L&T Mutual Funds at Rs221 per share. Before IPO in October 2014, it had undertaken private placement worth Rs50 crore to PE fund NYLIM JACOB BALLAS at an effective price of Rs187. In listing week it had made life time high of Rs207. After that stock has made one side lower top lower bottom formation and now it is trading near its face value of Rs10. It has posted almost Rs561.44 crore loss after listing which is more than the funds it has raised. Now its financial condition turns very weak and we are not expecting any miracle with this balance sheet. So don’t try to bottom fishing in this counter. Stock may fly with some rumors but that will be a exit opportunity only.

8k Miles Software Services Ltd.

BSE Code/ NSE: 512161/ 8KMILES

Face Value: Rs10

CMP: Rs140

52 Weeks H/L (Rs): 928.00 – 55.00

Market Cap: Rs (crore): 214

Promoter’s Holding: 48.94%

The company, formerly known as P.M. Strips Limited and incorporated in 1985, changed its name to 8K Miles Software Services Limited in October 2010. It is a global Cloud & Security Solutions provider and Next Generation Cloud MSP headquartered in the San Francisco Bay area and a publicly traded company listed on Indian Stock Exchanges. The Company offers secure Cloud solution allowing for organizations in highly regulated industries to embrace the Cloud. It has Cloud solutions that can meet GxP, HIPAA, PCI, SOX and GLB making it easy to meet regulatory compliance on the Cloud.

On 1st January 2014, stock was traded around Rs36 level. From that level it had shown one-sided rally and it went up to Rs1030 in November 2017. Suddenly stock crashed like anything and touched Rs55.4 in November 2018 and now trading around Rs140 level.

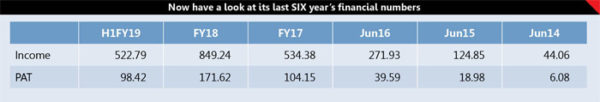

Now look on its last FIVE year’s financial numbers. Numbers the Company has posted in last five years are excellent but we have not seen this type of growth in any IT. Recently the Company has informed that 2570000 equity shares (8.42 % of total equity holdings) held by the Promoter Suresh Venkatachari, in his demat accounts held with Quantum Global Securities and Kumar Share Brokers have wrongfully and illegally transferred through Off Market transactions on various dates to various parties without his knowledge/consent. He has filed a police complaint on September 17, 2018 against Quantum Global and Kumar Share Brokers and others for fraudulent and unlawful transactions.

If we believe this story then many questions arise. In Company’s September Quarter result the Company has shown Promoters stake 48.94% against 57.40% in June Quarter. That means it all has happened between July-September but share price already came down from Rs1030 to Rs490 on 29th June 2018. Between November 2017 to June 2018 most of IT stocks had shown superb upmove then how can this type of growth oriented company’s stock came down 50%. Today stock is trading 2.3x on its TTM EPS which speak lots. Our advice is don’t try to bottom fishing in this type of stock.