By IE&M Research

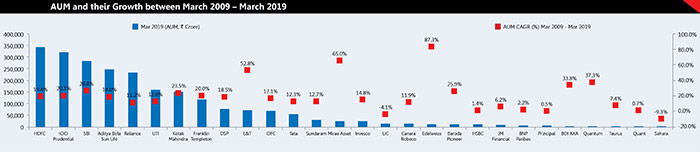

The mutual funds are slowly and steadily becoming a very important investment vehicle for a common investor. This is being reflected in the rise of both assets under management (AUM) by the domestic mutual fund companies and the number of investors joining the mutual fund industry every month. The average assets under management (AAUM) of Indian Mutual Fund Industry for the month of March 2019 stood at Rs24.58 lakh crore. It has grown from Rs4.17 lakh crore as on 31st March, 2009 to Rs23.80 lakh crore as on 31st March, 2019. It has increased by more than five times in a span of 10 years witnessing a growth of almost 20 per cent annually. Most of the increase has come in last few years. In the last five years, the growth has been higher at an annualised rate of almost 25%.

The Industry’s AUM had crossed the milestone of Rs10 lakh crore for the first time in May 2014 and in a short span of about three years, the AUM size had increased more than two folds and crossed Rs20 lakh crore for the first time in August 2017. The growth has moderated since then; however, they are still growing.

The below graph clearly shows how the AUM of some of the prominent fund houses have increased in the last 10 years ending March 2019.

The growth in the size of the Industry has been possible due to the twin effects of the regulatory measures taken by SEBI in re-energising the Mutual Fund Industry and the support from mutual fund distributors in expanding the retail base. SEBI abolished the entry load to stem investor confidence and reduce charges from the overall fee structure of funds.

The industry body, AMFI, too has taken huge initiatives to educate investors on investment in mutual funds. The other important financial intermediary, mutual fund distributors (MFDs), also played an important role in the growth of the industry. MFDs have been providing the much needed last mile connect with investors, particularly in smaller towns and this is not limited to just enabling investors to invest in appropriate schemes, but also in helping investors stay on course through bouts of market volatility and thus experience the benefit of investing in mutual funds.

In fact, even though FY2018-19 was not a very good year for the Indian Securities Market, the MF Industry witnessed steady positive net inflows month after month, even when the FIIs were pulling out in the initial part of the financial year, though they returned in a huge way in last couple of months. This is also evidenced from the number of accounts or folios that have increased in last one year. Growing investor interest in mutual funds has led to an addition of over 1.11 crore new folios in the financial year 2018-19, taking the total to an all-time high of 8.24 crore at the end of March 2019. Although the additions were lower than the 1.6 crore investor accounts in FY18 fiscal, it was higher than 67 lakh folios added in FY17 and 59 lakh in FY16. Even the number of folios under Equity, ELSS and Balanced schemes, wherein the maximum investment is from retail segment stood at 6.93 crore at the end of March 2019 and it was the 58th consecutive month witnessing rise in the number of folios.

Systematic Investment Plan (SIP) has been gaining popularity among Mutual Fund investors, as it helps in rupee cost averaging and also in investing in a disciplined manner without worrying about market volatility and timing the market. AMFI data shows that the MF industry had added about 9.13 lacs SIP accounts each month on an average during the FY2018-19, with an average SIP size of about Rs3,070 per SIP account.

Going ahead, looking at our demographic composition, under-penetration of the financial products especially mutual funds and economic growth, the next 10 years will be far better than the previous ten years.

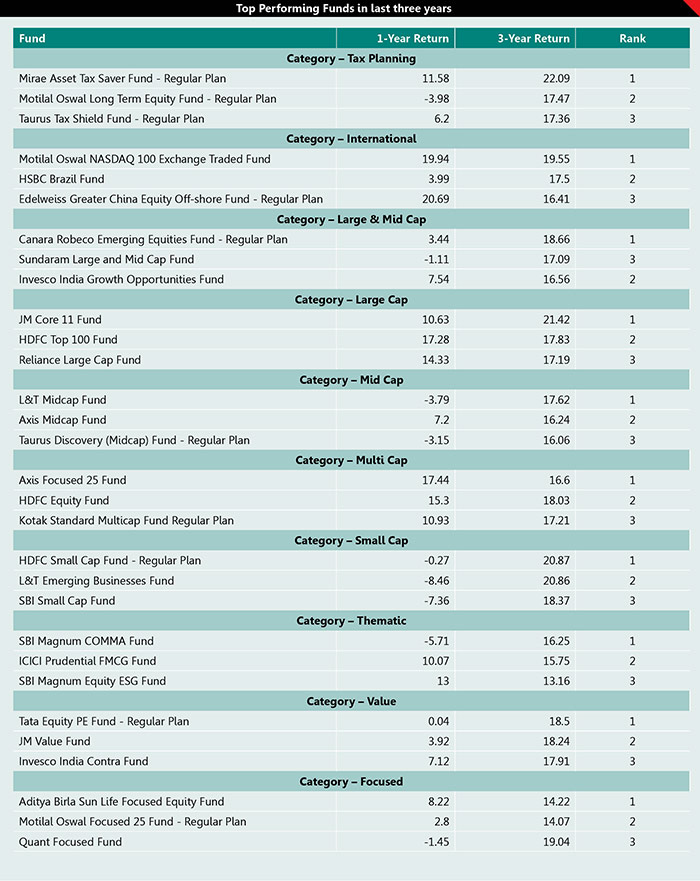

In the following pages, we are presenting for our readers the list of 10 best performing equity mutual funds from individual categories along with the first and second runner up. We have come with this list on the basis of three years of returns.

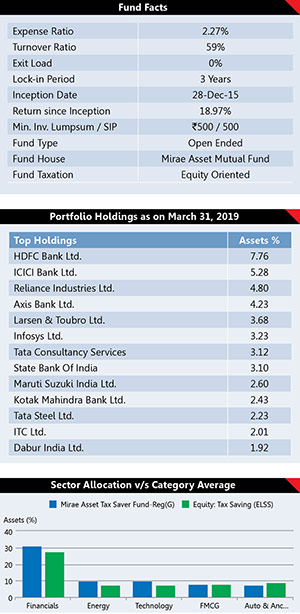

Mirae Asset Tax Saver Fund

Reg(G)-Regular Plan-Growth Option

Category: Equity: Tax Saving (ELSS)

Benchmark Index: S&P BSE 200 – TRI

Fund Manager: Neelesh Surana

Growing at CAGR of 12.85%

For moderate risk-taking investor

NAV as on April 15, 2019: Rs17.73

AUM as on March 31, 2019: Rs1839.4 crore

Among ELSS schemes, Mirae Tax Saver has remained the best performing scheme in last three years. In last three year ending April 15, 2019, the fund has generated return of more than 21% compared to category average of 13.34 per cent and benchmark return of 15.64 per cent. The performance has come despite the fund being one of the youngest in its category. The fund which was launched in December 2015 is a relatively new entrant in the space. The fund follows a multicap strategy and has built up a diversified portfolio. The scheme’s fund manager Neelesh Surana has invested a little over 70% in large-sized companies, close to 13% in mid-sized companies and the remaining in small-sized companies at the end of March 2019. Financials, Energy and Technology are the top themes on which the fund is betting on. As on March 31, 2019, fund has a cash holding of less than one per cent, which means 100 per cent of fund’s corpus invested in equities. This fund has a well-diversified portfolio, holding 57 stocks and a large-cap orientation. If one wants to select a tax saving investment vehicle in Mutual Fund in one fund then one can consider this fund. Nevertheless, one should also understand that when he/she invests in a tax saving fund, the investment amount would get stuck for three years.

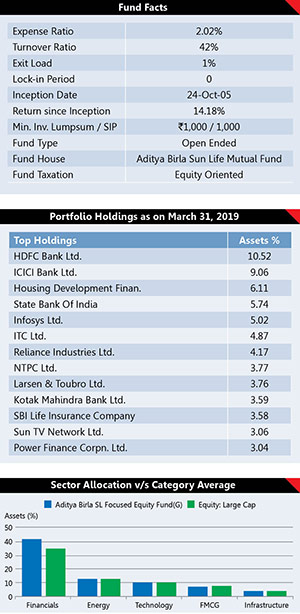

Aditya Birla SL Focused Equity Fund(G)

Regular Plan-Growth Option

Category: Equity: Large Cap

Benchmark Index: NIFTY 50 – TRI

Fund Manager: Mahesh Patil

Growing at CAGR of 12.85%

For moderate risk-taking investor

NAV as on April 15, 2019: Rs59.79

AUM as on March 31, 2019: Rs4268.4 crore

Aditya Birla SL Focused Equity Fund is a large cap dedicated fund. This is one of the best performing schemes in its category in the last three years. Every one lakh invested in the fund three years ago would have become Rs1,48,278; currently growing at CAGR of 12.85%. This solid performance has helped the fund to increase its AUM from `1800 crore three years ago to Rs4200 crore currently. The investment objective of the scheme is to achieve long term capital appreciation by investing in up to 30 companies with long term sustainable competitive advantage and growth potential. Currently, the fund’s concentration is more towards the financial sector and that too in banks. Out of top 5 holdings, there are three banks. They are HDFC Bank (10.52%), ICICI Bank (9.06%) and State Bank of India (5.74%) of total assets. The share of banking sectors in the fund’s portfolio is higher than its category. The fund is being managed by the Mahesh Patil since its inception. As Co-Chief Investment Officer, Mahesh Patil spearheads Equity Investments at Birla Sun Life Asset Management. He has over twenty-three years of rich experience in fund and investment management. Since the fund is focused on only 29 stocks, it is suited for moderate risk-taking investor.

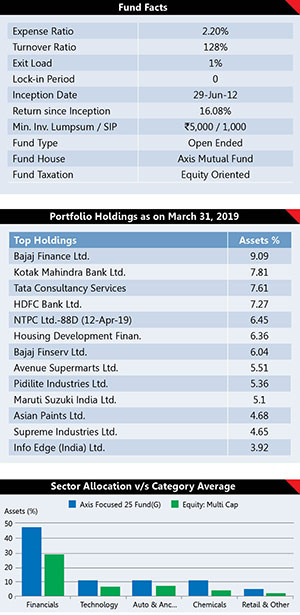

Axis Focused 25 Fund(G)

Regular Plan-Growth Option

Category: Equity: Multi Cap

Benchmark Index: NIFTY 50 – TRI

Fund Manager: Jinesh Gopani

Growing at CAGR of 16.79%

NAV as on April 15, 2019: Rs27.55

AUM as on March 31, 2019: Rs7189.8 crore

This fund from the Axis Mutual Fund has remained one of the best performers in its category that is multi-cap in last three years. Every one lakh invested in the fund three years ago would have become Rs1,58,433; currently growing at a CAGR of 16.79%. Whereas every one lakh invested in the fund five years ago would have become Rs2,16,355.62. It has been able to outperform both the benchmark index and the category average over the period. The fund is large-cap oriented as compared to its peers. In the last one year, large-cap weights have been at 80 per cent of the corpus and mid-caps at 20 per cent. There are no small-cap companies in its portfolio. The fund is currently holding 19 stocks in its portfolio. Financial and Technology are the two sectors where fund has been overweight. The fund is managed by Jignesh Gopani, who knows the art of stock picking. He selects and invests in funds that have the capability to grow in the next 3-5 years and deliver better returns. While investing in these companies he also checks the valuation, which should be reasonable. But valuation is not a strict criterion of investment until it fulfills growth and quality parameters. The fund typically invests the majority part of its assets in large-cap stocks. The fund is benchmarked against NIFTY 50 TRI.

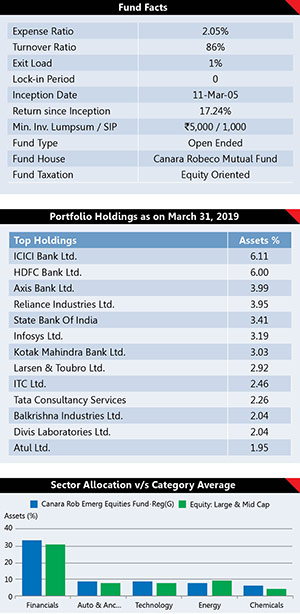

Canara Rob Emerg Equities Fund-Reg(G)

Regular Plan-Growth Option

Category: Equity: Large & Mid Cap

Benchmark Index: Nifty LargeMidcap 250 Index – TRI

Fund Manager: Miyush Gandhi

NAV as on April 15, 2019: Rs94.19

AUM as on March 31, 2019: Rs4598.7 crore

Canara Robeco Emerging Equities fund which was earlier categorised as mid cap fund has now been moved into large and mid-cap category, after SEBI announced its new classification norms, in year 2018. Every one lakh invested in the fund ten years ago would have become Rs10,36,937.03. The fund seeks to generate capital appreciation by investing in diversified portfolio of large and mid-cap stocks. Although the fund has been a consistent performer, it looks good in current environment as large cap stocks are giving stable returns while the mid cap stocks are likely to give better returns going ahead. In the past three-year and five-year periods, the scheme has returned 17.27% and 24.23% returns while its benchmark index Nifty 200 TRI has given 14.94% and 18.06% returns in the same period respectively. What is worth noting is that the fund has been performing extremely well over long duration. Every one lakh invested in the fund 10 years ago would have become more than Rs10 lakh, which is ten times of its original investment. The fund is heavily betting on private sector banks as its top three holdings comprise of India’s largest private sector banks, which together constitutes little over 16% of assets. It has invested 51 per cent of its corpus in large cap companies while mid cap companies account for 37.4 per cent of total assets.

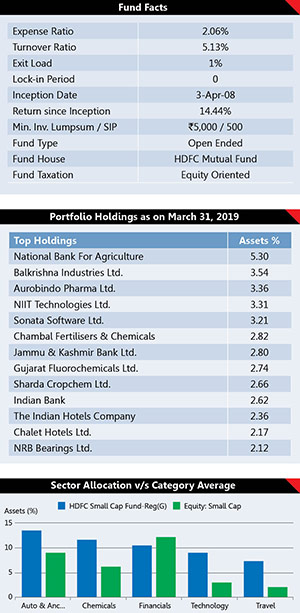

HDFC Small Cap Fund-Reg(G)

Regular Plan-Growth Option

Category: Equity: Small Cap

Benchmark Index: Nifty Smallcap 100 – TRI

Fund Manager: Chirag Setalvad

NAV as on April 15, 2019: Rs44.47

AUM as on March 31, 2019: Rs7543.6 crore

This is a fund from India’s largest domestic mutual fund house, whose performance has been best in its category. In last one year when the small cap stocks or funds was one of the worst performing categories, this fund managed to contain its losses. In last one year ending April 15, 2019 when its benchmark index, Nifty Smallcap 100 TRI lost around 27 per cent, the fund fell by only 4 per cent. In last ten years fund has given annualised return of more than 20 per cent. The fund was launched in year 2008, before the ‘Lehman Brother’ crisis, despite that it has given a return of 14.44% since its inception. The top overweight stocks in the fund are NABARD and Balkrishna Industries that account for 5.3% and 3.4% of total corpus. In terms of sector the fund is overweight on Automobile and Chemical sector. It has a highly diversified portfolio and total number of stocks being held by fund at the end of March 2019 is 71. Moreover, top 10 stocks form only 28.79% of the total portfolio. Every one lakh invested in the fund ten years ago would have become Rs6,45,461.68. The expense ratio is 2.06% while turnover ratio is 5.13% and exit load is only one percent. The fund is being managed by, Chirag Setalvad, who is ranked as a top fund manager in the small and mid-cap category by Morningstar.

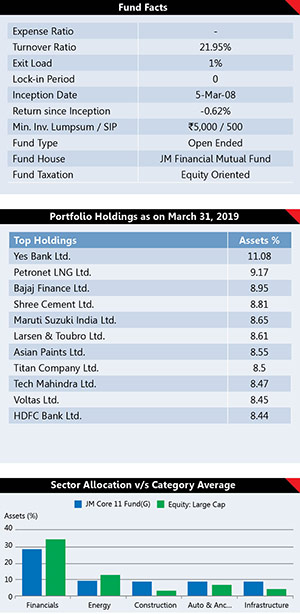

JM Core 11 Fund(G)

Regular Plan-Growth Option

Category: Equity: Large Cap

Benchmark Index: S&P BSE SENSEX – TRI

Fund Manager: Asit Bhandarkar

NAV as on April 15, 2019: Rs9.34

AUM as on March 31, 2019: Rs43.8 crore

This is a large cap fund that has performed exceptionally well in the last three year and five years period. In this period it has remained the top performer in its category. For the period ending 3 years and 5 years the fund has been able to generate return of 20 per cent and 17.75 per cent respectively. There is certain peculiarity that makes this fund stand out among its category. The fund invests in a highly concentrated portfolio of 11 stocks. Any wrong move by fund manager can cost you dear. Currently, the fund’s top holding Yes Bank corners fund’s 11 per cent of assets followed by Petronet LNG, which holds 9.17 per cent. Even in terms of sector allocation, fund is not following its category. It is under-weight on Financials and Energy while overweight on Construction and Infrastructure. Fund’s portfolio is rebalanced every fortnight. JM Core 11 has 89% allocation in stocks of large cap companies and close to 9% allocation in stocks of mid cap companies. Such unconventional idea has not always helped the fund. Its performance has been below the category average in most periods. Since its inception in the first quarter of 2008, the fund has given an annualised negative return of 0.62%, which may be one of the worst performer among the category in that period.

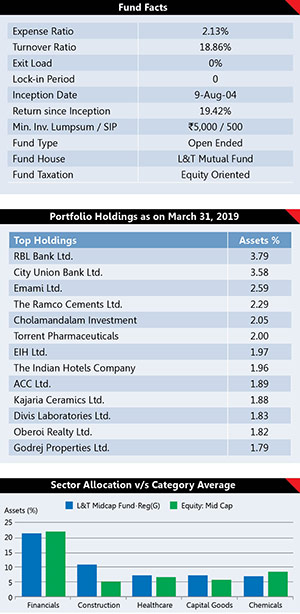

L&T Midcap Fund-Reg(G)

Regular Plan-Growth Option

Category: Equity: Mid Cap

Benchmark Index: Nifty Midcap 100 – TRI

Fund Manager: Soumendra Nath Lahiri

Good for risk taking investors

NAV as on April 15, 2019: Rs135.65

AUM as on March 31, 2019: Rs4389.7 crore

This is a fund with a history of almost 15 years. The L&T Midcap Fund was launched in August 2004 and featured in the Small and Midcap category of CRISIL Mutual Fund Rankings (CMFR) up to December 2017. Post the rationalisation of mutual funds by Sebi, it was repositioned as a mid-cap fund. The fund is managed by Soumendra Nath Lahiri who is CIO of the fund house. He has been managing the fund since 2013 and later joined by Vihang Naik in June 2016. The fund invests in companies that are on top of his conviction list. The stock selection strategy followed by the fund manager is bottom up. Typically those companies are selected that have strong management or promoter and are efficient asset allocator reflected in higher return ratios. The fund manager prefers having a diversified portfolio and hence as 78 stocks at the end of March 2019. Moreover, at a stock level there is no company that has weightage of more than four per cent. RBL Bank has the largest weight of 3.79% of total assets. In terms of sector weight the top three sectors include Financials, Construction and Healthcare, together contributed around 46.16 per cent of the fund’s net assets. Every one lakh invested in the fund ten years ago would have become Rs7,60,958.35. The fund is well suited for risk taking investors.

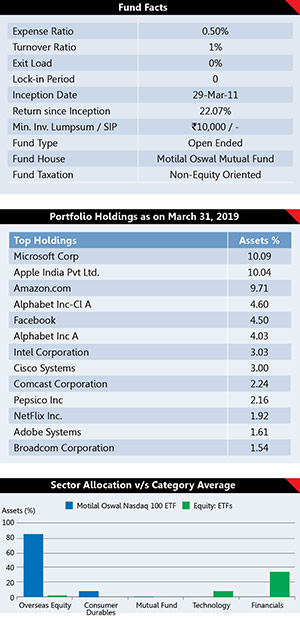

Motilal Oswal Nasdaq 100 ETF

Regular Plan-Growth Option

Category: Equity: ETFs

Benchmark Index: Nasdaq-100

Fund Manager: Swapnil P Mayekar

NAV as on April 15, 2019: Rs514.40

AUM as on March 31, 2019: Rs141 crore

One mutual fund that ought to be in the portfolio of any investor who is seeking diversification from the Indian markets is the MOSt Shares Nasdaq-100 ETF. Launched in 2011, the fund, which tracks the Nasdaq-100 Index has given an impressive return. The Nasdaq-100 includes some of the world’s most promising technology securities listed on the Nasdaq Market. It features globally recognised names such as Apple, Microsoft, Amazon, Facebook and Alphabet. The scheme has delivered an impressive return of 20 per cent over a five-year period and a similar return in a three-year period. However, there is a catch – only high net worth individuals can invest in this fund as it requires a higher sum to invest. Therefore the fund has launched a follow-on offering of MOSt Nasdaq-100 ETF to address such issues. Before investing in this fund one also needs to understand that equity mutual funds held over a year qualify for long term capital gains tax – returns in excess of Rsone lakh in a financial year is taxed at 10 per cent. In the case of an international fund, it is treated as debt funds. Therefore, the Fund of Funds (FoFs) investments sold before a year attract short term capital gains tax – the returns are added to the income and taxed according to the income tax slab applicable to the investor. Investments sold after three years are taxed at 20 per cent with indexation benefit.

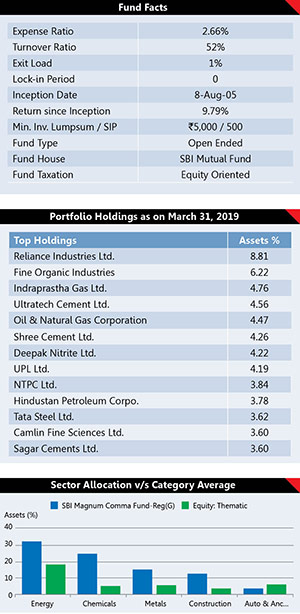

SBI Magnum Comma Fund-Reg(G)

Regular Plan-Growth Option

Category: Equity: Thematic

Benchmark Index: NIFTY COMMODITIES – TRI

Fund Manager: Richard Dsouza

Good only for high risk investors

NAV as on April 15, 2019: Rs35.94

AUM as on March 31, 2019: Rs263.2 crore

SBI Magnum COMMA Fund is a thematic fund based on commodities. The fund invests money in companies focusing on commodities business. It seeks to invest in companies in Oil & Gas, Metals, Materials and Agriculture sectors. With growth in population consumption of commodities and therefore, value of these companies are expected to rise. The portfolio has 55% exposure to large cap companies, 16% exposure to mid-cap companies and 28% exposure to small cap companies. At the end of March 2019, the fund holds 32.43% of its assets into Energy companies. It is followed by Chemicals and Metals that has 21.37% and 18.72% of assets respectively. It also shows that the fund is predominantly a large-cap biased fund. At the end of March 2019, the funds hold 25 stocks in its portfolio and look concentrated. The top ten stocks contributed almost half of the net assets. The fund is being managed by Mr. Richard who has over 19 years of experience in equities as a portfolio manager and as a research analyst on the sell side. He has been associated with SBI Fund Management Pvt. Ltd. from April 2010 as fund manager for the retail PMS division. This fund is suitable only for high risk investors as it has a concentrated portfolio both in terms of sector and companies.

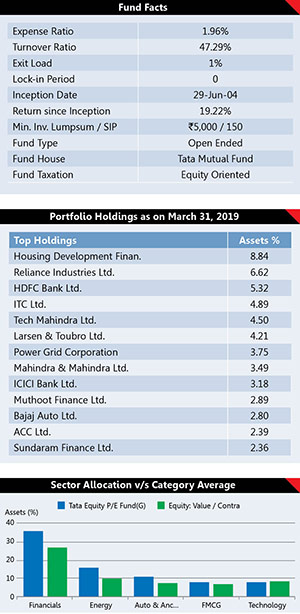

Tata Equity P/E Fund(G)

Regular Plan-Growth Option

Category: Equity: Value / Contra

Benchmark Index: S&P BSE SENSEX – TRI

Fund Manager: Sonam Udasi

Good for risk taking investors

NAV as on April 15, 2019: Rs135

AUM as on March 31, 2019: Rs5538.9 crore

If value investing and occasional profit bookings are what one prefers then value fund Tata Equity P/E Fund may be suitable for him. This strategy allows the fund to restrict exposure to stocks that have higher price-earnings multiple. The fund’s investment objective is to provide reasonable and regular income and/or possible capital appreciation. It is currently managed by Sonam Udasi. The fund’s performance has been a mixed bag across the market phases under analysis. It has outperformed its category and the benchmark in bull market phases, particularly. The fund delivered the top-notch performance in the last three years, five years and ten years. It has been able to generate almost 20 per cent of return in the last 10 years and also beat the performance of its benchmark and peers in all the long term time frame. The fund holds 43 stocks at the end of March 2019. Its 65 per cent of the portfolio is held by large-cap stocks while the rest is distributed between midcap and smallcap in the proportion of 26% and 8% respectively. While it held a diversified portfolio of 43 stocks with top ten stocks accounting for 47.69 per cent of net assets. The funds top three sectors are namely Financials, Energy and Automobile and have contributed almost 64.17 per cent of the net asset in totality.