By Pratit Nayan Patel

A Company with huge potential

Incorporated in 1945, RPG group’s KEC International Limited, together with its subsidiaries, primarily engages in engineering, procurement, and construction (EPC) business. It designs, manufactures, tests, supplies, and erects transmission lines on turnkey basis and undertakes EPC projects of high voltage electrical switching and distribution substations, distribution network, optical fiber networks, and telecom towers and HV/EHV cabling project works. The company also manufactures power cables, jelly filled telecom cables, and optical fiber cables; provides railways infrastructure EPC turnkey solutions, such as construction of bridges, buildings, platforms, workshop modernization, etc.; carries out track works, such as track laying and linking, preparation of ballast bed, and earthwork information; undertakes overhead electrification, traction substation, and general electrical works for railway electrification; and engages in interlocking works, and outdoor and indoor supply and installation works for signaling and telecommunication projects.

In addition, it undertakes civil construction projects, such as residential buildings, industrial plants, and commercial complexes; and integrated water and waste water management projects, including embankment and flood control, sewage and industrial effluent treatment, and potable water treatment and distribution projects. Further, the company provides solar EPC services that include design and engineering, project execution, project management, bid management, and project feasibility analysis for solar photovoltaic power plants. It operates in approximately 100 countries in Africa, the Americas, Central Asia, the Middle East, South Asia, and South East Asia.

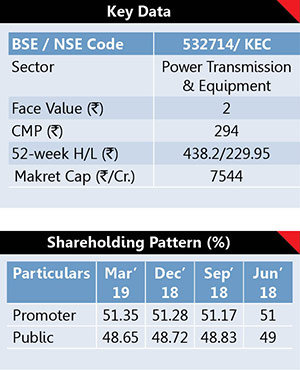

Equity capital & share holding

The Company’s equity is at Rs51.42 crore while it has huge reserve of around Rs2092.29 crore. Its share book value stood around Rs83. Promoters hold 51.35%, Mutual Funds hold 22.09%, FPIs hold 6.61%, LIC holds 1.70% while investing public hold 18.25% stake in the company. Promoters have increased their stake by 0.35% between July-March 2019.

Power Transmission & Distribution Business

This is the largest business vertical of the Company. With over seven decades of experience, KEC is a global leader in the Power Transmission & Distribution EPC segment. The Company’s T&D business has a presence in 64 countries across the globe (EPC footprint only).

SAARC region

The Company has significant footprint in this region and continues to consolidate its presence on the back of good order mix of Transmission and Substation projects. They are seeing an increase in private investments in Bangladesh, offering a new industrial market opportunity. There is also a growth in multilateral funding from agencies such as AIIB, ADB, JICA, Islamic Development Bank and EXIM Bank. In Afghanistan, there is a shift in focus towards power generation, including emphasis on renewables. In line with all these developments, the Company expects the SAARC Transmission & Distribution market to grow at over 20% between FY 2017 and 2022, and shall remain a key focus area for the company in the coming years.

Railways Business

KEC is an integrated player in the industry and executes various types of works such as track laying, doubling & tripling of tracks, building railway stations, tunnels & bridges, signalling & telecommunication works, and electrification. Over the years, the Company witnessed a significant growth in its Railway Business. The Company has successfully expanded its client portfolio to include CORE, RVNL, IRCON, RITES and PGCIL. Furthermore, the Company has succeeded in diversifying its project portfolio, with 70% of its order book comprising of composite and signaling & telecommunication works. The Company is pre-qualified in some packages of Dedicated Freight Corridor (DFC) projects and may bid selectively in consortium for DFC projects. The Company is also exploring relevant opportunities in the international arena.

Smart Infrastructure

The Company already ventured into the Smart Infrastructure business. The business will primarily target Smart Cities and Communication, Smart Mobility and Smart Utilities. It will act as the master system integrator and work closely with central and state governments and utility providers in developing digital infrastructure. Given the Company’s existing EPC credentials, well developed industry ecosystem, and focus on technology, it is working towards creating the right value proposition for its customers. The Smart City initiative was launched by the Prime Minister in November 2015, which has been followed up with the announcement of the construction of the first 100+ smart cities. With the completion of the initial time frame for policy making, it is expected that majority of the cities will embark on the smart journey from FY 2018-19.

The Government’s BharatNet project, which aims to provide fibre connectivity at the Gram Panchayat level is an ambitious plan and provides various opportunities in the EPC space for fibre optic cable laying and deployment of active and passive equipment. The Company also envisages leveraging its cable manufacturing capabilities to enhance its strength in building this business. The utilities are looking at upgrading and making the existing infrastructure smarter by adding an IT layer on the distribution side. In the power sector, this will enable peak load management, theft reduction, AT&C loss reduction, etc. The capabilities developed over the years in the power utility space, a core component of the Company, will provide a head start in the nascent phase of its Smart Infrastructure business.

Industry overview

With a generation of over 1,300 Billion Units (BU) during FY18, India is the 3rd largest producer and 4th largest consumer of electricity in the world. The country has the 5th largest installed capacity globally, which stands at 340 GW. The Indian power sector has witnessed significant growth in its energy demand, generation capacity and transmission & distribution networks in the last few years. In FY18, the sector witnessed a 5.3% growth in installed capacity with an addition of 17,170 MW, along with an addition of 23,119 ckm of transmission lines (growing 6% from last year) and 86,193 MVA of substation capacity (growing 12% from last year). Generation from renewable sources increased by 23% from last year. Presently, India has 340 GW of installed generation capacity; 3,90,970 ckm of installed transmission line length and 8,26,958 MVA of substation transformation capacity. The Indian Government envisages an addition of over 1,00,000 ckm of transmission lines and over 2,90,000 MVA of transformation capacity between 2017-2022, necessitating enormous investment to the tune of Rs2,60,000 crore, which is expected to unfold tremendous opportunities.

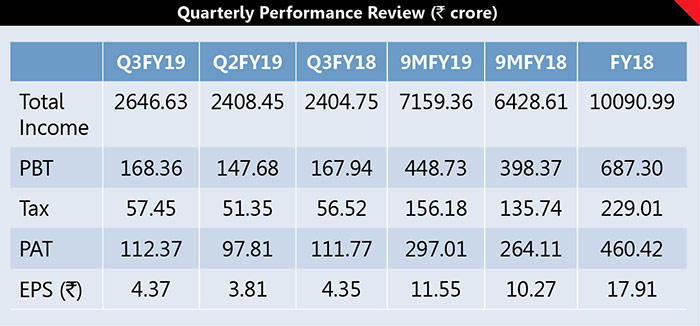

Financials

During Q3FY19, its net profit stood to Rs112.37 crore from Rs111.77 crore in Q3FY18 on 10.06% higher sales of Rs2646.63 crore fetching an EPS of Rs4.37. In 9MFY19 it has reported 11.32% higher sales of Rs7159.8 crore while net profit grew 12.46% to Rs297.02 crore against Rs264.11 crore fetching an EPS of Rs11.55. On PAT front, it has reported 62% CAGR growth in last four years. It has paid 80% dividend for FY17 and paid 120% dividend for FY18.

Our Take

KEC is a world leader in power transmission & distribution EPC space, with significant presence in other verticals including cables, railways, solar and civil, with a rich heritage of seven decades. The Company has strong order book of around Rs20,000 crore. Its cable business witnessed a successful turnaround with PBT positive. It has 3,13,200 MTs per annum capacity in tower manufacturing segment which is largest global tower manufacturing capacity. Currently the Company is executing projects in 37 countries.

At current market price, it is trading at PE ratio of 15.3x earnings. Based on above financial and performance parameters, the share looks quite attractive at the current level and investors can accumulate between Rs290-250 with a stop loss of Rs235 for an upper target of Rs425-450 in next 15 to 18 months.