Against the conventional wisdom that higher beta stock performs better, it is lower beta stocks that have performed better than the higher beta stocks in the longer run.

By Krishna Kumar Mishra

Among many finance theories proposed by the academia’s there are very few being adopted by the practitioners and even lesser that is being used as widely as Capital Asset Pricing Model (CAPM). This fundamental theory of finance suggests that return on any investment is directly dependent upon the risk you take, which in this case is represented by ‘beta’ (β).

ERi: Expected return of investment

Rf: Risk-free rate

Βi: Beta of the investment

ERm: Expected return of market

(ERm – Rf) = Market risk premium

Beta in layman terms is defined as the sensitivity of a stock or any other investment returns to a broader market returns. Therefore, it basically measures the movement of an investment with respect to a benchmark.

The theory suggests that return on investment on any stock, a mutual fund scheme or any other investment will depend upon its sensitivity to broader market returns. This sensitivity is better known as ‘beta’. Therefore, a higher beta stock is likely to perform better than the market when the market is rising. In a shorter duration, however, when the market is falling, we may find lower beta stocks performing better than the rest of the market. Since the market is rising in longer duration, the higher beta stocks are likely to perform better than the market as well as lower beta stocks.

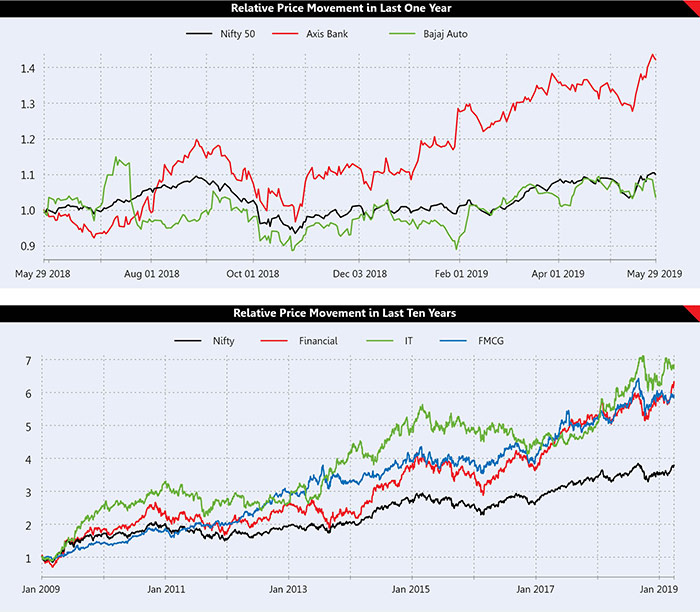

The following price graph for last one year clearly shows how a stock (Axis Bank with a beta of 1.14) with beta greater than one has outperformed the return of a stock (Bajaj Auto with a beta of 0.73) with lower beta and broader market (Nifty 50 with a beta of 1).

The facts from the real world in long run, however, suggest something different from this common wisdom that a higher beta generates better returns in long run. Many times it is a lower beta that has generated better returns in the longer run.

To understand this we did study returns of last 10 years of different sectors. To highlight this fact that lower beta generates a better return in the long run we selected different sectors that have similar returns during this period.

We see that IT has performed better than the Financial Services in the last 10 years and they both have performed better than the frontline equity index in the last 10 years. Nonetheless, if you check ‘Beta’ of these indices, we see that Nifty IT with significant lower beta has performed slightly better than Nifty Financial Services. They even have lower volatility measured by the standard deviation of the daily returns. Ideally Nifty Financial Services with higher beta should be giving better returns.

the Financial Services in the last 10 years and they both have performed better than the frontline equity index in the last 10 years. Nonetheless, if you check ‘Beta’ of these indices, we see that Nifty IT with significant lower beta has performed slightly better than Nifty Financial Services. They even have lower volatility measured by the standard deviation of the daily returns. Ideally Nifty Financial Services with higher beta should be giving better returns.

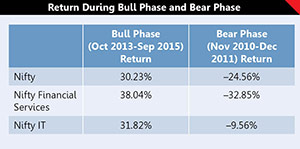

The reason for such anomalies lies in the  performance of these sectors during bull and bear phase. We have defined ‘bear phase’ as that phase when the market has fallen by more than 20% from its recent peak. The bull phase is defined as a period when the market kept on increasing before the start of a major fall in the market that is 20%.

performance of these sectors during bull and bear phase. We have defined ‘bear phase’ as that phase when the market has fallen by more than 20% from its recent peak. The bull phase is defined as a period when the market kept on increasing before the start of a major fall in the market that is 20%.

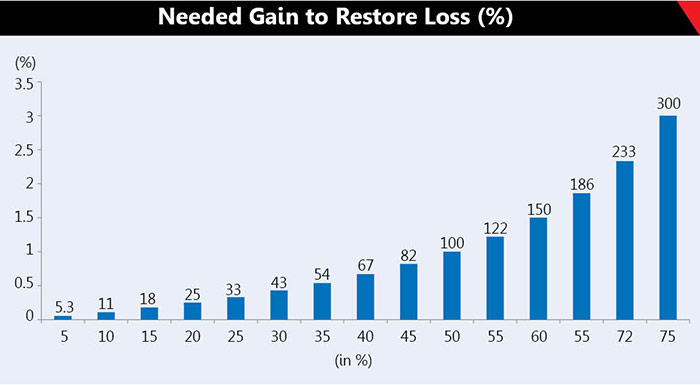

The above table shows how different sectors have given returns during the ‘bull’ phase and ‘bear’ phase. It clearly shows why lower beta sector or stocks perform better than the higher beta stocks. Lower beta sector fall less during the bear phase. During the bull phase, they underperform the higher beta sector; however, the underperformance is far lower than their outperformance during the falling market. Moreover, since lower beta stocks fell less, it takes them a lesser percentage gain to recoup losses. For example if a stock has fallen by 25% it needs to gain 33% to reach its previous level, however, if a stock has fallen by 33% it needs to rise by 50% to recoup its entire losses.

This is best explained by the graph (Graph 1).

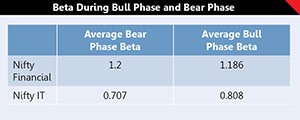

Bear Phase Beta and Bull Phase Beta

The difference in return in different phase is  determined by the difference in beta. In bear phase, IT had a lower beta compared to what it has during the bull phase. Similarly, in the case of Nifty Financial, it has higher beta during the bear phase and lower beta during the bull phase.

determined by the difference in beta. In bear phase, IT had a lower beta compared to what it has during the bull phase. Similarly, in the case of Nifty Financial, it has higher beta during the bear phase and lower beta during the bull phase.

What this means is that lower beta stocks fall less when the market corrects, however higher beta stocks fall more when the market corrects. However, in case of a rising market, the beta declines for higher beta stocks while it increases for lower beta stocks.

fall less when the market corrects, however higher beta stocks fall more when the market corrects. However, in case of a rising market, the beta declines for higher beta stocks while it increases for lower beta stocks.

Therefore, until and unless one is not actively managing his/her portfolio it’s better to maintain a portfolio of lower beta stocks for a longer period. Historically it has been seen that companies with lower beta tend to generate higher alpha than the companies with lower beta.

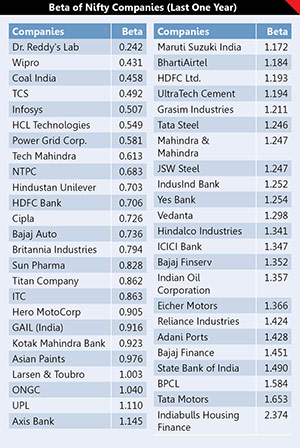

Once we know that lower beta generates better returns, we list down the companies from Nifty 50 along with their beta based on last one-year price movement. Investors may pick 5-8 of them based on their risk appetite to make a somewhat technically sound and grand portfolio.