Where to invest?

Advice for investing in the market downturn

By Krishna Kumar Mishra & Pratit Nayan Patel

On the celebratory night of the last 31st December who could have imagined that within two months millions of people around the world would be sitting idle at home, asked by the governments to stay two feet away from each other, schools closed, and all public gatherings cancelled. No airplane in air and no trains on Railway tracks. Industries closed, production stopped, workers staying home, most of them without any salary and a very big number of labourers leaving cities and industrial towns going back to their homes high and dry without any hope.

Right now the coronavirus, or COVID-19, pandemic has spread across 180 countries. Globally, there have been over 10.3 lakh confirmed cases and at least 54,500 people have died so far. The United States, Italy, France and Spain have registered more deaths than China, where the outbreak started.

The outbreak is having a major impact on global economy which is heading for the deepest downturn since the Second World War. While the recovery could be swift in some countries, there are rising fears of a long-term hit to jobs and growth. Global economic growth and trade will continue to be affected until the disease is contained across the world. Still consumer and business confidence could remain subdued as the return to relative normality takes time to take hold, not least if fears of a second wave of the virus linger. On the macro front, austerity policies could be used by many governments to control rising debt levels, and demand for foreign travel might remain subdued for years, on the micro front some companies would struggle to repay loans, and may take a few years to come back to the previous production levels. All these are troubling signs for the whole world, including the developed nations.

Fear on the Dalal Street

The global markets continue to take a hit amidst the COVID-19 pandemic and there seems to be no stability. The sentiment on the Dalal Street also has been sombre since the outbreak of coronavirus but in the past three weeks situation has become really serious. While benchmark indices were completely hammered down in March, the broader market took a bigger knock. In March, Sensex and Nifty fell more than 33 percent each from their record highs formed in January. In the financial year 2019-20, the fall was 24 percent and 26 percent, respectively. In FY20, BSE Midcap index fell 32 percent and Smallcap index declined 36 percent, and several stocks hit multi-year lows. Mid and smallcap stocks were in fact already under pressure before COVID-19 started to spread. Among midcaps, 83 percent stocks closed the financial year 2020 in the red with 113 stocks falling in double digits. Out of that, 48 plunged 50-90 percent. In the smallcap index, more than 93 percent stocks were caught in the bear grip with 733 stocks closing with double-digit losses. Out of that, 474 crashed 50-99.6 percent during the year.

Magnitude of the shock

There is almost no doubt that 2020 will be a bad year for all companies. The magnitude of the shock to corporate bottom lines and the speed with which it has happened has put companies at risk. While many investors may argue that there is too much uncertainty now to even try to value companies in the midst of a market and economic crisis unlike any in history, we feel, that this is exactly the time to go back to basics and try valuing companies, uncertainty notwithstanding. We have seen that every major crisis creates changes in business environment, regulations and business models that reshape the economy. Thus, for some companies, the bad news on revenues and earnings this year may be a precursor to superior operating performance in the post-virus economy. We have seen it happening in the past and hopefully will see in future also. That’s where we can try to search a small flicker in this unusual long tunnel.

We still feel this downtrend will continue at least till the receding of coronavirus cases globally and the finding of vaccine for the virus, which will really provide the biggest boost to the markets around the world. At no point, we expect V-shaped recovery immediately. We strongly feel that when all is going to be well, even then, the markets/asset classes will consolidate for at least 5-6 months. Then there will be volatility and the economy will take longer to recover.

Air has become heavier

Stock market is typically a leading indicator of the economy. It tends to peak before the onset of an economic recession and bottom before an economic recovery. However, the world is living in an entirely different yet single time zone and COVID-19 epidemic has made forecasting an eventual stock-market recovery very difficult. While looking at the equity prices nearing their most attractive levels many investors are tempted to find a lifetime opportunity whereas some analysts also are arguing that the equity market may have already begun a bottoming process. But bottoms are virtually impossible to predict. This time it is more difficult since the stock market has become a strange place and bottom is impossible to know at least until the threat of Covid-19 has been quelled. Then again, it’s tough to see a bottom on the horizon if the economy is faced with massive bear market catalysts. The US market has its own (US jobless claims rose to 6,648,000 for March 28 week) whereas the emerging markets have their own catalysts. India has too many to even count.

A solution to all this will take longer time  than we are expecting. This is a medical emergency and it may run to 3 months and maybe 6 months, no one can guess. The longer it runs, the longer time the markets and economy will take to recover. The same will apply to all the major sectors, including FMCG. But there is one sector which will have the least impact – Pharmaceuticals. If someone is diabetic he has to take his medicine whatsoever happens. Hospitals and Pharmacies will open every day whatever comes. Hence, we feel equity investors can expect to get good return only from the pharma counters at this point in time.

than we are expecting. This is a medical emergency and it may run to 3 months and maybe 6 months, no one can guess. The longer it runs, the longer time the markets and economy will take to recover. The same will apply to all the major sectors, including FMCG. But there is one sector which will have the least impact – Pharmaceuticals. If someone is diabetic he has to take his medicine whatsoever happens. Hospitals and Pharmacies will open every day whatever comes. Hence, we feel equity investors can expect to get good return only from the pharma counters at this point in time.

Those who are not convinced with this argument can go in for Index Fund or NIFTYBEES, or Nifty ETF, whichever suits them. Later they can come back to equities when the market starts showing a recovery by selling their investments at profits.

We have strong conviction that stability in this market will come only when the disease is contained across the world. As long as the fears of a second wave of the virus linger the world will continue to live in fear – that’s what we are witnessing in China, if the media reports are true. But we also believe success with containment could be tenuous, and the world could remain on a kind of indefinite lockdown until a vaccine or treatment is found.

But when a treatment will be put on sale, that’s a big question.

Keeping all the above mentioned factors in mind we have selected 11 pharma companies and discussed in detail. However, we advise buying the discussed stocks in a gradual manner to take the maximum benefits when the actual recovery starts. Readers must apply their discretion to pick and choose from these 11 companies. However, there is every possibility that they may see still more downside movement in these counters, but it would be advisable to start accumulating in the same pattern and at the same price range given to each company to get the best return.

We strongly feel that a patient investor with a 2-3 years time horizon is bound to generate handsome returns by investing in these stocks and also in these times of uncertainty and fear.

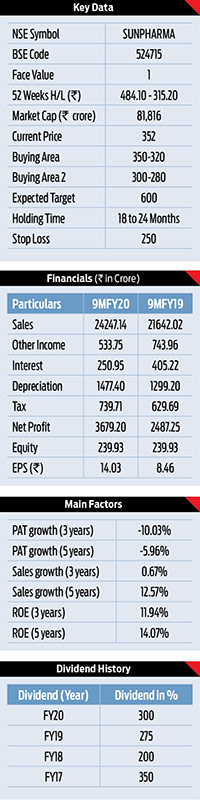

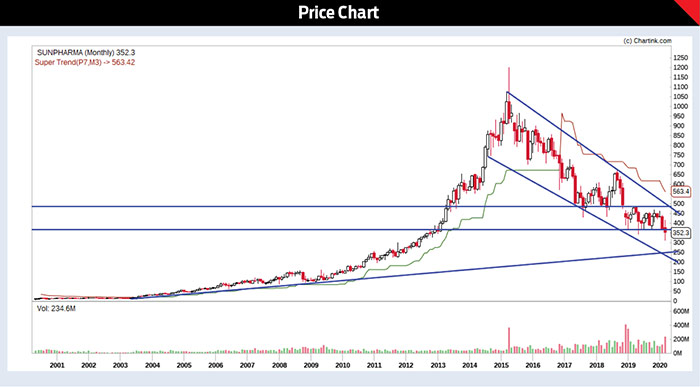

Sun Pharmaceutical Industries Ltd.

This is world’s fourth largest specialty generic  pharmaceutical company and India’s top pharmaceutical company. A vertically integrated business and a skilled team enable it to deliver high quality products, trusted by customers and patients in over 100 countries across the world, at affordable prices. Its global presence is supported by manufacturing facilities spread across 6 continents and approved by multiple regulatory agencies, coupled with a multi-cultural workforce comprising over 50 nationalities. Sun Pharma fosters excellence through innovation supported by strong R&D capabilities across multiple R&D centers, with investments of approximately 7% of annual revenues in R&D.

pharmaceutical company and India’s top pharmaceutical company. A vertically integrated business and a skilled team enable it to deliver high quality products, trusted by customers and patients in over 100 countries across the world, at affordable prices. Its global presence is supported by manufacturing facilities spread across 6 continents and approved by multiple regulatory agencies, coupled with a multi-cultural workforce comprising over 50 nationalities. Sun Pharma fosters excellence through innovation supported by strong R&D capabilities across multiple R&D centers, with investments of approximately 7% of annual revenues in R&D.

Equity & Reserves

The Company has an equity capital of `239.93 crore supported by reserves of `43151.54 crore. The promoters hold 54.56% of the equity capital, Mutual Funds hold 10.60%, FPIs & AIF hold 13.95%, and insurance companies hold 7.39% which leaves 13.5% stake with the investing public.

Financials

For 9MFY20, the Company posted 48% higher PAT of `3679.20 crore on higher income of `24247.14 crore and an EPS of `14.03.

Valuation

At the current level, the stock is trading at a P/E multiple of 21.1x on its TTM EPS. It has paid 275% dividend for FY19 and paid 300% interim dividend for FY20.

Targets

The stock is in down trend since long time but its financial has improved. First Buying Area is around `350-320 and Second Buying Area is around `300-280. One can accumulate this stock in 4-5 parts between these buying areas. The recommended levels of stop loss is `250 and it could zoom to `600 in 18 to 24 months.

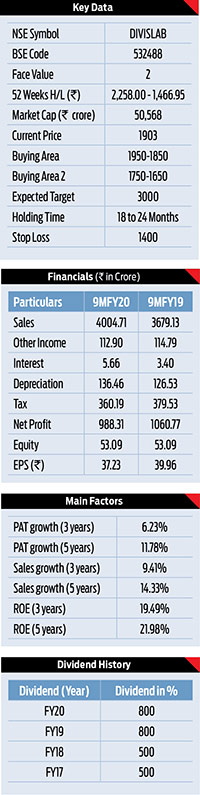

Divi’s Laboratories Ltd.

Divi’s Laboratories is a leading manufacturer  of active pharma ingredients (API) with predominance in exports to advanced markets in Europe and America which constitute about 73% of its revenue. The Company recently reached the milestone of being one among the top three API manufacturers in the world. More than 1700 employees work in Quality Assurance and Quality Control functions to form the backbone of its Quality System. It has two World class manufacturing units and one of it is World’s largest API manufacturing facility. Its quality control testing and validation labs are fitted with state-of-the-art analytical equipment and testing facilities.

of active pharma ingredients (API) with predominance in exports to advanced markets in Europe and America which constitute about 73% of its revenue. The Company recently reached the milestone of being one among the top three API manufacturers in the world. More than 1700 employees work in Quality Assurance and Quality Control functions to form the backbone of its Quality System. It has two World class manufacturing units and one of it is World’s largest API manufacturing facility. Its quality control testing and validation labs are fitted with state-of-the-art analytical equipment and testing facilities.

Equity & Reserves

The Company has an equity capital of `53.09 crore supported by reserves of `7024.46 crore. The promoters hold 52% of the equity capital, Mutual Funds hold 14.89%, FPIs hold 19.70% which leaves 13.41% stake with the investing public.

Financials

For 9MFY20, it posted PAT of `988.31 crore on higher income of `4004.71 crore and an EPS of `37.23.

Valuation

At the current levels, the stock is trading at a P/E multiple of 41.25x on its TTM EPS. It has paid 800% interim dividend for FY20.

Targets

Stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `1950-1850 and Second Buying Area is around `1750-1650. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `3000 in 18 to 24 months. After buying in 4-5 parts at recommended levels keep a stop loss of `1400.

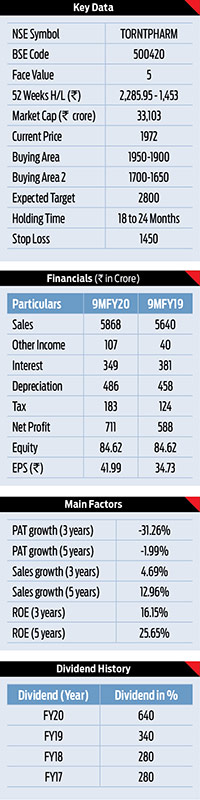

Torrent Pharmaceuticals Ltd.

Torrent Pharma, with annual revenues of more  than `7600 crore is the flagship Company of the Torrent Group. Torrent Pharma continues to be at the forefront of the Indian pharmaceutical industry with many of its products ranking among the top 500 brands (AIOCD Dataset) in India. Its widespread international presence also includes several markets where Torrent is amongst the leading pharmaceutical companies in the respective countries. It is ranked amongst the leaders in therapeutic segment of cardiovascular, central nervous system, gastro-intestinal and women healthcare. It has significant presence in diabetology, pain management, gynaecology, oncology and anti-infective segments.

than `7600 crore is the flagship Company of the Torrent Group. Torrent Pharma continues to be at the forefront of the Indian pharmaceutical industry with many of its products ranking among the top 500 brands (AIOCD Dataset) in India. Its widespread international presence also includes several markets where Torrent is amongst the leading pharmaceutical companies in the respective countries. It is ranked amongst the leaders in therapeutic segment of cardiovascular, central nervous system, gastro-intestinal and women healthcare. It has significant presence in diabetology, pain management, gynaecology, oncology and anti-infective segments.

Equity & Reserves

The Company has an equity capital of `84.62 crore supported by reserves of `4988 crore. The promoters hold 71.25% of the equity capital, Mutual Funds hold 9.45%, FPIs hold 8.48%, and insurance Companies hold 1.18% which leaves 9.64% stake with the investing public.

Working

For 9MFY20, it posted 21% higher PAT of `711 crore on higher income of `5868 crore and an EPS of `41.99.

Valuation

At the current level, the stock is trading at a P/E multiple of 60x on its TTM EPS. It has paid 340% dividend for FY19 and paid 640% interim dividend for FY20.

Targets

The Stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `1950-1900 and Second Buying Area is around `1700-1650. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `2800 in 18 to 24 months. After buying at recommended levels keep a stop loss of `1450.

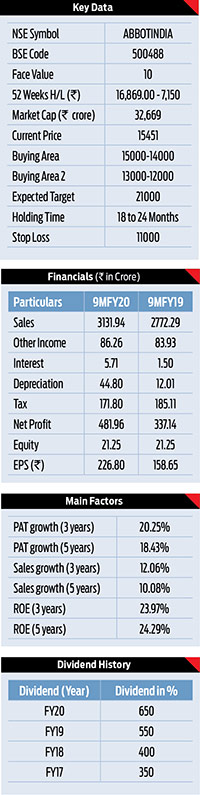

Abbott India Ltd.

Since 1910, Abbott has been dedicated to helping  people in India live healthier lives through a diverse range of science-based nutritional products, diagnostic tools, branded generic pharmaceuticals, and diabetes and vascular devices. Headquartered in Mumbai, Abbott India Limited, a publicly listed company and a subsidiary of Abbott Laboratories, takes pride in offering high-quality trusted medicines in multiple therapeutic categories, such as women’s health, gastroenterology, cardiology, metabolic disorders and primary care. It is one of India’s fastest-growing pharmaceutical companies with expertise across product development, manufacturing, sales and customer service dedicated to providing high-quality, reliable products with the expert clinical support.

people in India live healthier lives through a diverse range of science-based nutritional products, diagnostic tools, branded generic pharmaceuticals, and diabetes and vascular devices. Headquartered in Mumbai, Abbott India Limited, a publicly listed company and a subsidiary of Abbott Laboratories, takes pride in offering high-quality trusted medicines in multiple therapeutic categories, such as women’s health, gastroenterology, cardiology, metabolic disorders and primary care. It is one of India’s fastest-growing pharmaceutical companies with expertise across product development, manufacturing, sales and customer service dedicated to providing high-quality, reliable products with the expert clinical support.

Equity & Reserves

Abbott has an equity capital of `21.25 crore supported by reserves of `2111.11 crore. The promoters hold 74.99% of the equity capital, Mutual Funds hold 4.98%, FPIs & AIFs hold 2.56% which leaves 17.47% stake with the investing public.

Working

For 9MFY20, the Company posted 43% higher PAT of `481.96 crore on 13% higher income of `3131.94 crore and an EPS of `226.80.

Valuation

At the current level, the stock is trading at a P/E multiple of 55x on its TTM EPS. It has paid 650% dividend for FY19.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `15000-14000 and Second Buying Area is around `13,000-12,000. One can accumulate this stock in 4-5 parts between these buying areaa. On the upper side it could zoom to `21,000 in 18 to 24 months. After buying at recommended levels keep a stop loss of `11000.

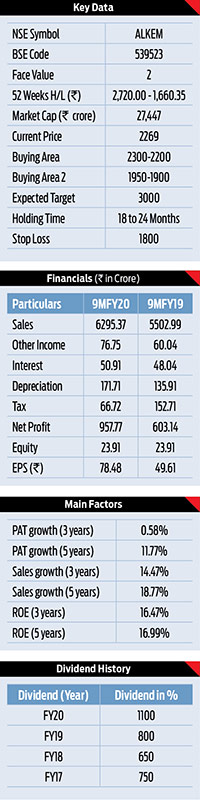

Alkem Laboratories Ltd.

Established in 1973 and headquartered in  Mumbai, Alkem Laboratories is a leading pharmaceutical company with global operations, engaged in the development, manufacture and sale of pharmaceutical and nutraceutical products. The Company produces branded generics, generic drugs, active pharmaceutical ingredients (APls) and nutraceuticals, which it markets in India and International markets. With a portfolio of more than 800 brands in India, Alkem is ranked the fifth largest pharmaceutical company in India in terms of domestic sales. The Company also has presence in more than 50 international markets, with the United States being its key focus market.

Mumbai, Alkem Laboratories is a leading pharmaceutical company with global operations, engaged in the development, manufacture and sale of pharmaceutical and nutraceutical products. The Company produces branded generics, generic drugs, active pharmaceutical ingredients (APls) and nutraceuticals, which it markets in India and International markets. With a portfolio of more than 800 brands in India, Alkem is ranked the fifth largest pharmaceutical company in India in terms of domestic sales. The Company also has presence in more than 50 international markets, with the United States being its key focus market.

Equity Reserves

The Company has an equity capital of `23.91 crore supported by reserves of `5851.40 crore. The promoters hold 66.04% of the equity capital, Mutual Funds hold 9.04%, FPIs & AIF hold 2.99%, and insurance companies hold 2.10% which leaves 19.83% stake with the investing public.

Financials

For 9MFY20, it posted 59% higher PAT of `957.77 crore on higher income of `6295.37 crore and an EPS of `78.48.

Valuation

At the current level, the stock is trading at a P/E multiple of 25.3x on its TTM EPS. It has paid 800% dividend for FY19 and paid 1100% interim dividend for FY20.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `2300-2200 and Second Buying Area is around `1950-1900. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `3000 in 18 to 24 months. After buying at recommended levels keep stop loss of `1800.

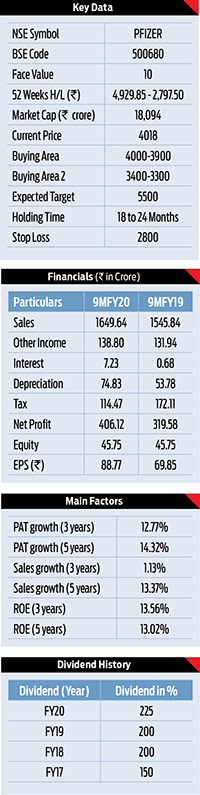

Pfizer Ltd.

Pfizer Limited began its operations in India in 1950.  Today, with annual sales of `2030 crore, it is the third largest multinational pharmaceutical company in India. The Company has a portfolio of over 150 products across 15 therapeutic areas. Its top brands include Prevenar 13, Lyrica, Corex – DX, Dolonex, Enbrel, Becosules, Gelusil and Folvite among others. Pfizer Limited has a state-of-the-art, award-winning manufacturing facility in Goa that produces more than a billion tablets annually. The Company employs 2,631 people across commercial, manufacturing and other functions, and is committed to providing therapies to prevent and treat some of the most critical diseases.

Today, with annual sales of `2030 crore, it is the third largest multinational pharmaceutical company in India. The Company has a portfolio of over 150 products across 15 therapeutic areas. Its top brands include Prevenar 13, Lyrica, Corex – DX, Dolonex, Enbrel, Becosules, Gelusil and Folvite among others. Pfizer Limited has a state-of-the-art, award-winning manufacturing facility in Goa that produces more than a billion tablets annually. The Company employs 2,631 people across commercial, manufacturing and other functions, and is committed to providing therapies to prevent and treat some of the most critical diseases.

Equity & Reserves

Abbott has an equity capital of `45.75 crore supported by reserves of `3110.33 crore. The promoters hold 63.92% of the equity capital, Mutual Funds hold 9.45%, FPIs & AIFs hold 4%, and insurance companies hold 2.60% which leaves 20.03% stake with the investing public.

Financials

For 9MFY20, it posted 27% higher PAT of `406.12 crore on higher income of `1649.64 crore and an EPS of `88.77.

Valuation

At the current level, the stock is trading at a P/E multiple of 35.7x on its TTM EPS. It has paid 225% dividend for FY19.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `4000-3900 and Second Buying Area is around `3400-3300. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `5500 in 18 to 24 months. After buying at recommended levels keep stop loss of `2800.

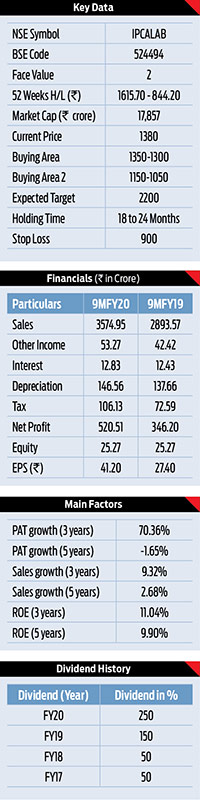

Ipca Laboratories Ltd.

Ipca is a fully-integrated Indian pharmaceutical  company manufacturing over 350 formulations and 80 APIs for various therapeutic segments. It is one of the world’s largest manufacturers and suppliers of over a dozen APIs. These are produced right from the basic stage at manufacturing facilities inspected by the world’s most discerning drug regulatory authorities like US-FDA, UK-MHRA, EDQM-Europe, WHO-Geneva and many more. Ipca is a therapy leader in India for anti-malarials with a market-share of over 34% with a fast expanding presence in the international market as well.

company manufacturing over 350 formulations and 80 APIs for various therapeutic segments. It is one of the world’s largest manufacturers and suppliers of over a dozen APIs. These are produced right from the basic stage at manufacturing facilities inspected by the world’s most discerning drug regulatory authorities like US-FDA, UK-MHRA, EDQM-Europe, WHO-Geneva and many more. Ipca is a therapy leader in India for anti-malarials with a market-share of over 34% with a fast expanding presence in the international market as well.

Equity & Reserves

IPCALAB has an equity capital of `25.27 crore supported by reserves of `3372.75 crore. The promoters hold 46.07% of the equity capital, Mutual Funds hold 22.76%, FPIs & AIF hold 15.52%, and insurance companies hold 1.59% which leaves 14.06% stake with the investing public.

Financials

For 9MFY20, it posted 50% higher PAT of `520.51 crore on higher income of `3574.95 crore and an EPS of `41.20.

Valuation

At the current level, the stock is trading at a P/E multiple of 28.5x on its TTM EPS. It has paid 150% dividend for FY19 & paid 250% interim dividend for FY20.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `1350-1300 and Second Buying Area is around `1150-1050. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `2200 in 18 to 24 months. After buying at recommended levels keep stop loss of `900.

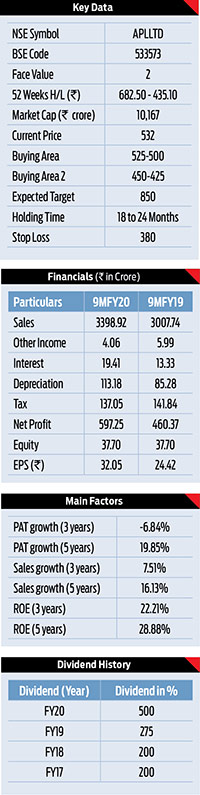

Alembic Pharmaceuticals Ltd.

Alembic Pharmaceuticals Limited, a vertically integrated  research and development pharmaceutical company, has been at the forefront of healthcare since 1907. Headquartered in India, Alembic is a publicly listed company that manufactures and markets generic pharmaceutical products all over the world. With an emphasis on innovation, the company has established research facility – Alembic Research Centre -including formulation research, and 150-bed bioequivalence facility at Vadodara. Alembic’s state of the art research and manufacturing facilities are approved by regulatory authorities of many developed countries including the USFDA. Alembic is one of the leaders in branded generics in India.

research and development pharmaceutical company, has been at the forefront of healthcare since 1907. Headquartered in India, Alembic is a publicly listed company that manufactures and markets generic pharmaceutical products all over the world. With an emphasis on innovation, the company has established research facility – Alembic Research Centre -including formulation research, and 150-bed bioequivalence facility at Vadodara. Alembic’s state of the art research and manufacturing facilities are approved by regulatory authorities of many developed countries including the USFDA. Alembic is one of the leaders in branded generics in India.

Equity & Reserves

The Company has an equity capital of `37.70 crore supported by reserves of `2924.45 crore. The promoters hold 72.97% of the equity capital, Mutual Funds hold 5.12%, FPIs & AIF hold 9.27%, and insurance companies hold 1.36% which leaves 11.28% stake with the investing public.

Financials

For 9MFY20, the Company posted 30% higher PAT of `597.25 crore on higher income of `3398.92 crore and an EPS of `32.05.

Valuation

At the current level, the stock is trading at a P/E multiple of 13.75x on its TTM EPS. It has paid 275% dividend for FY19 & paid 500% interim dividend for FY20.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `525-500 and Second Buying Area is around `450-425. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `850 in 18 to 24 months. After buying at recommended levels keep stop loss of `380.

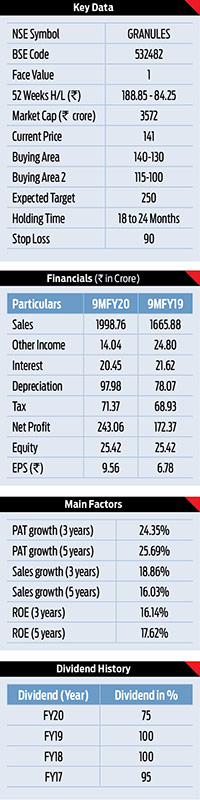

Granules India Ltd.

Granules India Limited is a large-scale vertically integrated  Company founded in 1991 manufacturing Active Pharmaceutical Ingredient (API), Pharmaceutical Formulation Intermediate (PFI) and Finished Dosage (FD). With a strong presence across all three vertical, the Company has created a leadership position in the off-patent drugs segment along with ensuring a strong presence in ‘first line of defense’ products such as Paracetamol, Ibuprofen, Metformin and Guaifenesin. It is also home to one of the World’s largest Paracetamol API facilities. The Company is having 4 operational plants located in Hyderabad (Jeedimetla, Bonthapally and Gagillapur) and one in Vizag Pharma City.

Company founded in 1991 manufacturing Active Pharmaceutical Ingredient (API), Pharmaceutical Formulation Intermediate (PFI) and Finished Dosage (FD). With a strong presence across all three vertical, the Company has created a leadership position in the off-patent drugs segment along with ensuring a strong presence in ‘first line of defense’ products such as Paracetamol, Ibuprofen, Metformin and Guaifenesin. It is also home to one of the World’s largest Paracetamol API facilities. The Company is having 4 operational plants located in Hyderabad (Jeedimetla, Bonthapally and Gagillapur) and one in Vizag Pharma City.

Equity & Reserves

Granules has an equity capital of `25.42 crore supported by reserves of `1675.34 crore. The promoters hold 42.90% of the equity capital, Other DIIs hold 3.21%, FPIs hold 17.74% which leaves 36.15% stake with the investing public.

Financials

For 9MFY20, it posted 36% higher PAT of `243.06 crore on higher income of `1998.76 crore and an EPS of `9.56.

Valuation

At the current level, the stock is trading at a P/E multiple of 11.75x on its TTM EPS. It has paid 100% dividend for FY19 & paid 75% interim dividend for FY20.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `140-130 and Second Buying Area is around `115-110. One can accumulate this stock in 4-5 parts between these two buying areas. On the upper side it could zoom to `250 in 18 to 24 months. After buying at recommended levels keep stop loss of `90.

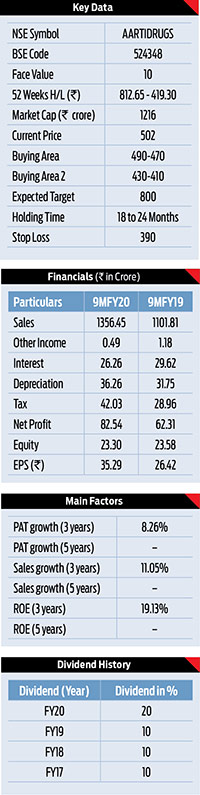

Aarti Drugs Ltd.

Aarti Drugs Ltd. was established in the year 1984 and  forms part of $900 Million Aarti Group of Industries with robust R&D Division at Tarapur, Maharashtra Industrial Development Corporation (MIDC) in close vicinity to manufacturing locations. The Company is engaged in the manufacturing of Active Pharmaceutical Ingredients (APIs), Pharma Intermediates, Specialty Chemicals and also produces Formulations with its wholly-owned subsidiary – Pinnacle Life Science Private Limited. Products under APIs include Ciprofloxacin Hydrochloride, Metronidazole, Metformin HCL, Ketoconazole, Ofloxacin etc. whereas Specialty Chemicals includes Benzene Sulphonyl Chloride, Methyl Nicotinate etc. The Company aims at becoming the first choice of expanding market through better products, ensuring quality and timely delivery.

forms part of $900 Million Aarti Group of Industries with robust R&D Division at Tarapur, Maharashtra Industrial Development Corporation (MIDC) in close vicinity to manufacturing locations. The Company is engaged in the manufacturing of Active Pharmaceutical Ingredients (APIs), Pharma Intermediates, Specialty Chemicals and also produces Formulations with its wholly-owned subsidiary – Pinnacle Life Science Private Limited. Products under APIs include Ciprofloxacin Hydrochloride, Metronidazole, Metformin HCL, Ketoconazole, Ofloxacin etc. whereas Specialty Chemicals includes Benzene Sulphonyl Chloride, Methyl Nicotinate etc. The Company aims at becoming the first choice of expanding market through better products, ensuring quality and timely delivery.

Equity & Reserves

The Company has an equity capital of `23.30 crore supported by reserves of `546.40 crore. The promoters hold 61.62% of the equity capital, Mutual Funds hold 4.19%, FPIs and AIF hold 1.32% which leaves 32.87% stake with the investing public.

Financials

For 9MFY20, it posted 32.46% higher PAT of `82.54 crore on higher income of `1356.45 crore and an EPS of `35.29.

Valuation

At the current level, the stock is trading at a P/E multiple of 10.6x on its TTM EPS. It has paid 10% dividend for FY19 and 20% interim dividend for FY20.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `490-470 and Second Buying Area is around `430-410. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `800 in 18 to 24 months. After buying at recommended levels keep stop loss of `390.

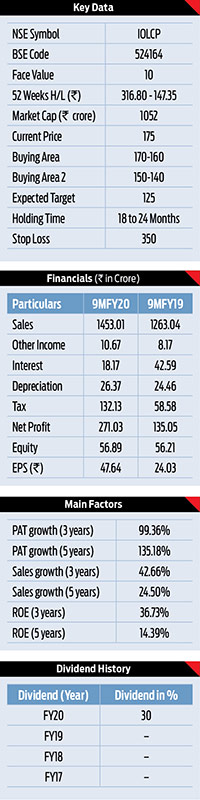

IOL Chemicals & Pharmaceuticals Ltd.

This is a leading APIs/ bulk drugs Company and a  significant player in the specialty chemicals space. It has presence across major therapeutic categories like, pain management, anti-convulsants, anti-diabetes, anti- cholesterol and anti-platelets. Its product portfolio includes Ibuprofen, Metformin, Fenofibrate, Clopidogrel, Lamotrigine, Pantoprazole and specialty chemicals such as Ethyl Acetate, Iso Butyl Benzene, Mono Chloro Acetic Acid and Acetyl Chloride. Company is World’s largest producer of the Ibuprofen with an installed capacity of 12,000 TPA and having backward integrated manufacturing facility.

significant player in the specialty chemicals space. It has presence across major therapeutic categories like, pain management, anti-convulsants, anti-diabetes, anti- cholesterol and anti-platelets. Its product portfolio includes Ibuprofen, Metformin, Fenofibrate, Clopidogrel, Lamotrigine, Pantoprazole and specialty chemicals such as Ethyl Acetate, Iso Butyl Benzene, Mono Chloro Acetic Acid and Acetyl Chloride. Company is World’s largest producer of the Ibuprofen with an installed capacity of 12,000 TPA and having backward integrated manufacturing facility.

Equity & Reserves

IOLCP has an equity capital of `56.89 crore supported by reserves of `589.09 crore. The promoters hold 41.89% of the equity capital; FPIs hold 1.32% which leaves 56.79% stake with the investing public.

Financials

For 9MFY20, it posted 101% higher PAT of `271.03 crore on higher income of `1453.01 crore and an EPS of `47.64. The Company has pre-paid the Term Loan aggregating `225.37 crore till date (i.e. `205.32 crore during the Current FY and `20.05 crore in Previous FY) and now there is no outstanding against any Term Loan.

Valuation

At the current level, the stock is trading at a P/E multiple of 2.75x on its TTM EPS. It has paid 30% maiden interim dividend for FY20.

Targets

The stock is still in uptrend on long term charts. It gives strong buying opportunity on dips. First Buying Area is around `170-160 and Second Buying Area is around `150-140. One can accumulate this stock in 4-5 parts between these buying areas. On the upper side it could zoom to `350 in 18 to 24 months. After buying at recommended levels keep stop loss of `125.