The outbreak of the COVID-19 has caused a pandemic for which vaccines and targeted therapeutics for treatment are unavailable as of now. The outbreak has caused major concerns about public health around the world. At the same time, there are growing concerns about the economic consequences as households are required to stay home to slow the spread of the virus. There is no single number that credibly captures or foresees COVID-19’s economic impact. How bad a COVID-19 recession would be? What the scenarios are for growth and recovery? Rushin Shah, by taking a careful look at market signals, recession and recovery patterns, as well as the history of epidemics and shocks, tries to draw insights into the path ahead.

As households are required to stay home to slow the spread of the coronavirus, man is no longer a social animal. This pause in the economy has a substantial impact on supply chains, industries are collapsing, elections are being postponed, and sporting events called off and jobs are beheaded. The banking industry is showing some serious crack in the financial system.

As the current situation is anomalous and developing rapidly, economic models may miss some of the key variables and may be too slow to update given the frequency with which economic data become available. GDP forecast is ambiguous when the virus trajectory is unknowable. There is no single number that credibly captures or foresees COVID-19’s economic impact. It has long been recognized that asset prices are useful as they reflect investors’ expectations about future payoffs. In particular, the movements in the stock market have received a lot of attention.

Global financial markets reacted strongly last  week when the virus spread to Europe and the United States, fueling fears of a global pandemic. Markets are collapsing because investors hate uncertainty. Markets are acting as if we are going to encounter the worst-case scenario. The market reaction is more extreme than any of the likely possible outcomes would justify. The markets are reacting to uncertainty rather than expectations.

week when the virus spread to Europe and the United States, fueling fears of a global pandemic. Markets are collapsing because investors hate uncertainty. Markets are acting as if we are going to encounter the worst-case scenario. The market reaction is more extreme than any of the likely possible outcomes would justify. The markets are reacting to uncertainty rather than expectations.

How bad a COVID-19 recession would be? What the scenarios are for growth and recovery? And whether there will be any lasting structural impact from the unfolding crisis? The COVID-19 was the black swan event to cause a downturn, which surprised me. While it is an extremely serious disease that will produce many harmful economic jolts, these events alone don’t scare me; however, when combined with long-term interest rates hitting the 0% floor, and crude at $20, it worries me. I have written substantially on the potential global recession and failure of monetary policies across the world earlier.

Financial Contagion

The world is now more deeply in debt as it was when the global financial crisis (GFC) hit in 2008. But the largest and most risky pools of debt have shifted from households and banks in the United States to corporates all over the world. Factory closures and an abrupt halt in the assembly and shipment of final goods matter for firms as debts must be serviced regardless. Even though principal on these debts is due far out in the future, interest payments must be serviced at high frequency – every three to six months – and interest payments are normally financed from proceeds generated through operating activities. When the output is not being shipped, the assembler/seller of final goods in China does not have inflows to pay the suppliers of intermediate goods, so firms in Japan, Korea, and Taiwan are not having inflows either – every firm along the supply chain starts to become a potential defaulter.

Consider, for example, a Southwest Airlines that  stops having inflows due to reduced demand to fly to, from the US and across the globe. The initial positive impact on cash flow comes from the reduced demand for jet fuel – which is also mirrored in the reduced cash flow needs of commodity companies that would fund the sourcing and shipment of jet fuel for airlines – but the deficits accumulate over time from keeping pilots and cabin crews on payroll, paying the rent on parking spots and gates at hundreds of airports the world over, and servicing the debt that finances the fleet of aircraft. The longer passengers don’t fly, the longer the planes are grounded, and the more the airline’s dollar deposits are depleted: the airline gradually becomes a defaulter. This example demonstrates well how the outbreak can impact a growing range of industries globally. As more and more companies report negative earnings guidance globally, they are becoming potential defaulters.

stops having inflows due to reduced demand to fly to, from the US and across the globe. The initial positive impact on cash flow comes from the reduced demand for jet fuel – which is also mirrored in the reduced cash flow needs of commodity companies that would fund the sourcing and shipment of jet fuel for airlines – but the deficits accumulate over time from keeping pilots and cabin crews on payroll, paying the rent on parking spots and gates at hundreds of airports the world over, and servicing the debt that finances the fleet of aircraft. The longer passengers don’t fly, the longer the planes are grounded, and the more the airline’s dollar deposits are depleted: the airline gradually becomes a defaulter. This example demonstrates well how the outbreak can impact a growing range of industries globally. As more and more companies report negative earnings guidance globally, they are becoming potential defaulters.

As businesses deal with the prospect of a sudden stop in their cash flows, the most exposed are a relatively new generation of companies that already struggle to pay their loans. These companies earn too little even to make interest payments on their debt, and survive only by issuing new debt.

The level of debt in America’s corporate sector amounts to 75 percent of the country’s gross domestic product (GDP), breaking the previous record set in 2008. Among large American companies, debt burdens are exuberantly high in the auto, hospitality and transportation sectors — industries taking a direct hit from the COVID-19. As a result, policymakers, businesses, and market participants have lowered growth expectations in the short-, medium-, and long-run.

Market participants did not lower the growth expectations due to the Wuhan lockdown. Following the lockdown in Italy, growth expectations started to deteriorate. The travel restriction on the visitors to the US from the EU leads to a sharp deterioration of growth expectations and once again following the declaration of the national emergency and the subsequent actions by the Federal Reserve. The estimate of GDP growth over the next year is down by 1.00% and 2.3% in the US and the EU respectively.

Why Is Stock Market Collapsing?

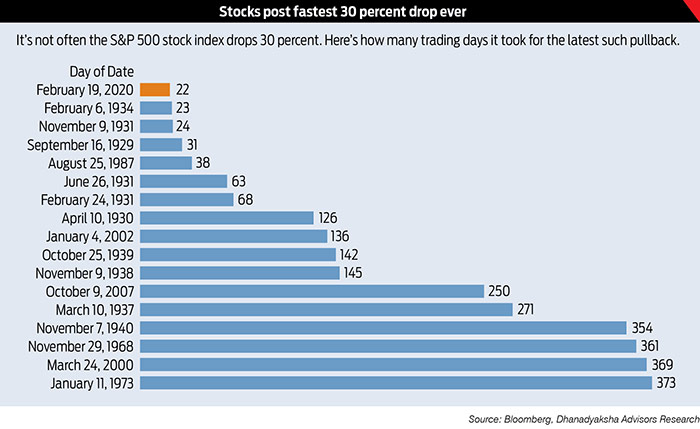

The stock market is going through its most turbulent period in recent memory. The Dow Jones Industrial Average (DJIA) fell from a record February 12 into a bear market on March 19 – defined as a decline of at least 30% – in 22 trading days, the fastest such plunge ever. The S&P 500 suffered a similar drop which brings an abrupt halt to an 11-year bull run that began in the distress of the financial crisis. Trading wiped $15 trillion in market value from the broad stock-market index. Treasury yields go into new lows, reflecting furious buying of safe government bonds. Oil prices fell at rates not seen since the 1991 first Gulf War. Investors ran away from riskier debt, afraid companies that loaded up on credit amid low-interest rates would have trouble repaying.

The stock market has been plunging as investors struggle to judge the impact of the coronavirus, a price war in oil and their impact on the global economy. The outlook for investors started turning dire the weekend of February 22, after a surge of coronavirus cases outside China. The global stock markets did not respond strongly to the outbreak in China or the lockdown of Wuhan, China, on January 23. However, once it is apparent that the outbreak spread to Italy, South Korea, and Iran, around February 20, stock markets declined sharply. Fears it could spread globally and tip economies into recession smashed a long stretch of tranquility in financial markets.

In response to the US decision on March 12 to severely restrict travel from the EU and decisions by governments in the EU to lockdown to various degrees, stock markets around the world declined by 10% or more. By March 16, stock markets have dropped more than 30% from their peak. In search of safety, investors’ demand for long-term government bonds issued by the US increased. Over the same period, the yield on 30-year US treasuries decreases by almost a percentage point, driving prices on 30-year bonds up by approximately 30%.

HFTs, Volatility, and Sell-off

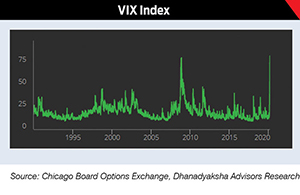

In a dramatic shift since the financial crisis, the market today is dominated by high-frequency trading (HFTs or computer-driven traders) whose machines react to a series of technical and other factors. For HFTs a stock is simply a thing or a number that moves, whether the company makes shoes or airplanes or frozen pizza, it doesn’t matter. And how much a stock moves – how sudden and sharp are its swings–is a factor as important as any other in whether to buy or sell it, which is called Volatility. On the way up, as volatility fell, HFTs bought risky assets; now volatility is rising, so they’re selling.

Computer traders are selling shares and other investments to manage their risks rather than to profit from a plunge. They can amplify the downturns they are hoping to avoid by offloading shares just as the market drops, adding to the turmoil. They buy and sell assets based on how risky they appear at any given time. In addition to investors who have been selling as volatility soared, others have been getting out solely because of moves in the value of stock options they have sold.

In recent years, traders have turned to options, which give investors the right to buy or sell shares later at agreed-upon prices. In calm markets, when it’s safe to assume most options will never be exercised, some investors sold options just to collect the premium. Banks and trading firms also sell options to investors looking to hedge. When markets fall and volatility increases, sellers of put options – which give the buyer the right to sell at a certain price, and which typically rise in value as the market stumble – can be caught in a bind. They rushed to dump shares and stock futures to try to hedge or to minimize their growing losses. Options are handy when investors are fearful of stock declines and can provide a buffer against losses. If it’s difficult to trade them in times of stress that could leave investors handcuffed. That was the case recently with options. Maybe the best defense is just unwinding your portfolio to return to cash.

The result? More decline in stock prices.

Big banks have backed away from trading since the global financial crisis (GFC) in 2008, leaving fewer players in many markets. The trades that get done can move prices more, causing greater havoc. It’s become harder to trade assets from Treasuries to stocks and derivatives during the selloff. The number of Treasuries available to buy or sell near the best prices has dropped and is near levels not seen since late 2008.

Comparison to the Global Financial Crisis of 2008

The Global Financial Crisis, which was triggered by the failure of Lehman Brothers in September 2008, occurred when the collapse of the market for collateralized debt obligations (CDOs) left the financial institutions holding them without adequate capital and made it impossible for them to continue operating. It was a financial crisis. In contrast, the sharp slowdown in global economic activity due to the COVID-19 began because of a simultaneous plunge in corporate cash flows and household incomes caused by people staying at home. In other words, it originated in the real economy.

The US responded to the GFC in two ways. First, they shored up the financial sector that was the source of the problem with a series of recapitalizations thereby preventing a complete breakdown of the financial sector. Next, the government strengthens GDP with fiscal stimulus. Today, in contrast, GDP has already contracted sharply, and the decline was triggered by a sharp drop in corporate and household incomes. Revenues have fallen to substantially of their peaks in some of the affected industries, and the decline in household incomes has also been severe. The ability of households and businesses, around the world to withstand it, will depend to a large extent on the amount of financial assets they have accumulated.

The US administration is talking about  sending $250 billion in a first round of stimulus next month, or $1,000 per adult, with another $1,000 to follow in May if the economy’s still suffering. The administration is also working on a plan to help leisure and hospitality workers, who are now a far bigger and more vulnerable percentage of the workforce than in the past. They need paid sick leave, extended unemployment benefits, and much more monetary benefits. The Federal Reserve’s frantic actions are only designed to avoid a credit crisis. It will take a lot of government money to avoid a prolonged recession. Several companies and industries will have debt problems that will likely lead to restructuring.

sending $250 billion in a first round of stimulus next month, or $1,000 per adult, with another $1,000 to follow in May if the economy’s still suffering. The administration is also working on a plan to help leisure and hospitality workers, who are now a far bigger and more vulnerable percentage of the workforce than in the past. They need paid sick leave, extended unemployment benefits, and much more monetary benefits. The Federal Reserve’s frantic actions are only designed to avoid a credit crisis. It will take a lot of government money to avoid a prolonged recession. Several companies and industries will have debt problems that will likely lead to restructuring.

Theoretically, the Fed could buy other assets like stocks, but that won’t materialize because it’s very controversial, questionable at best under the Federal Reserve Act, it likely requires congressional approval, and it wouldn’t have much of an impact anyway.

Let’s compare the market’s response to COVID-19 to the global financial crisis of 2008. Today the VIX (volatility index) is of similar magnitude as that observed during the global financial crisis. Stock prices have also dropped as much as in the fall of 2008, at least when measured over 30-year treasuries. These observations underline the severity of the outbreak of COVID-19.

The New Economic World Order

Urbanization and its link to disease go as far back as the Industrial Revolution. Nearly 300 years later, we still assume that epidemics and outbreaks are the outcomes of unsanitary conditions and food habits alone. This is short-sighted as there are a lot of scientific proofs that large-scale deforestation and urbanization have contributed a lot to epidemics. Forest cover is being cleared like never before, and urban planning is virtually non-existent. Cities are becoming congested. Hopefully, now humans will realize how ecosystems outside and within us are integrated.

As 2020 began, investors were optimistic the economic expansion would continue, as calming trade tensions between the U.S. and China and three recent interest-rate cuts from the Fed lifted stocks to record levels. For years, it paid to buy each dip in stocks and to bet against the return of volatility. It is well known that it is difficult to identify the economic shocks that caused asset prices to move. The unique feature of the ongoing events is that the nature of the shock is clear. It is comforting that even during a period of high financial turmoil, the future prices appear well linked to fundamentals and align well with realizations.

In periods of economic and financial distress, getting accurate, forward-looking measures of the expected path of the economy is key for policymakers. It requires much greater fiscal stimulation that is targeted to hit the most important pain points, with the cooperation of central banks holding rates down and providing plenty of liquidity. Society will test the wealth and political gaps and their abilities to cooperate and help rather than hurt each other in dealing with these problems.