Remember: The free markets are dead

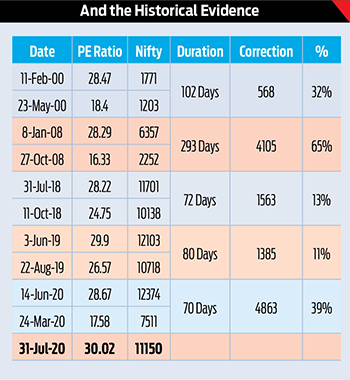

Relative to earnings power, the Nifty Index at 11150 today is more expensive than it was six months ago at 12430 even though, in nominal terms, it is at 10% discount.

Stock investors must require to be agile and evolve as markets do consistently. Risk assessment must often question the theories as history need not repeat, certainly not necessarily in the same form and shape. Because the players, their pockets and therefore, the rules, keep changing. For example, unlike twenty years ago in the year 2000, this time around, government plays big active interventionist role.

Whenever you trade on stocks, know who your opponent is. The free markets are dead as governments and central banks undertake on gigantic scale long term running new monetary experiment.

Passive index ETFs (exchange traded funds) that buy only index constituent stocks as much proportionate to their weights in the index, today have assets under management (AUM) of over Rs 1.80 tn, that is about 25% of all active equity mutual funds. More than 80% of these ETFs are held by EPFO, other retirement funds and institutions.

traded funds) that buy only index constituent stocks as much proportionate to their weights in the index, today have assets under management (AUM) of over Rs 1.80 tn, that is about 25% of all active equity mutual funds. More than 80% of these ETFs are held by EPFO, other retirement funds and institutions.

Founded on analysts’  extrapolations based on the historical data, these amounts are invested in the ETFs only due to their belief and faith in the one-side upward trajectory of the index. All of these ETFs inflows have been invested in the last less than three years, which partly explain the disconnect between the real economy and financial markets.

extrapolations based on the historical data, these amounts are invested in the ETFs only due to their belief and faith in the one-side upward trajectory of the index. All of these ETFs inflows have been invested in the last less than three years, which partly explain the disconnect between the real economy and financial markets.

In the last six months, the price (P) has run much ahead of the earnings (E), so the premium to earnings has rather increased while earnings have declined, more so in US dollars.

Relative to earnings power, the Nifty Index at 11150 today is more expensive than it was six months ago at 12430 even though, in nominal terms, it is at 10% discount.