Since the entire world is suffering from the COVID-19 and global pandemic, Rushin Shah is analyzing how the Chinese healthcare ecosystem was able to overcome from this pandemic so quickly. For a reference point, he has taken 2003-04 year, as China had a SARS virus at that time, to 2019-2020, when COVID-19 hit China and the world. It will be interesting to see how China has built its medical infrastructure from 2003 to 2020, and what lessons India can draw from this period. The author presents the five main lines of medical infrastructure: new virus detection, vaccination, CXO, and pan medical services with relatively clear benefits from the pandemic.

Rushin Shah is analyzing how the Chinese healthcare ecosystem was able to overcome from this pandemic so quickly. For a reference point, he has taken 2003-04 year, as China had a SARS virus at that time, to 2019-2020, when COVID-19 hit China and the world. It will be interesting to see how China has built its medical infrastructure from 2003 to 2020, and what lessons India can draw from this period. The author presents the five main lines of medical infrastructure: new virus detection, vaccination, CXO, and pan medical services with relatively clear benefits from the pandemic.

How China improved its healthcare ecosystem after SARS?

China was quick to introduce a new policy. According to the Chinese construction standard of a general hospital and the construction standard of traditional Chinese medicine hospitals, the construction scale was determined reasonably. The capacity building of infectious disease treatment, like SARS and COVID-19, in county-level hospitals, should be “combined peacetime and wartime” and attach equal importance to traditional Chinese and Western medicine and can quickly open infectious disease beds when an epidemic occurs. The Chinese government also comes up with standard beds post-SARS.

In principle, counties with a population of less than 3,00,000 can open no less than 20, counties with a population of 3,00,000-5,00,000 can have no less than 50, counties with a population of 500K-1 million should not be less than 80, and counties with a population of more than 1 million should not be less than 100. All localities should do a good job in the capacity building of township health centers, community health service centers, village clinics, and other basic medical and health institutions to form a joint force of medical treatment and epidemic prevention and control in the county.

3,00,000 can open no less than 20, counties with a population of 3,00,000-5,00,000 can have no less than 50, counties with a population of 500K-1 million should not be less than 80, and counties with a population of more than 1 million should not be less than 100. All localities should do a good job in the capacity building of township health centers, community health service centers, village clinics, and other basic medical and health institutions to form a joint force of medical treatment and epidemic prevention and control in the county.

For the new virus detection, China has followed a two-way strategy. For the medium term, China has ramped up its manufacturing capacity of in vitro diagnostic device (IVD) in early 2006-07 and for the long term, China signed MOUs with multiple pharmaceutical and research companies. India also needs to ramp up its MOUs and joint ventures (JVs) with global pharmaceutical companies and not only for joint product development but also for the research and development of the new drugs and molecules.

Post-SARS, the Chinese became more aware of the virus and vaccination. Something, we can see globally happening in the post-COVID-19 era. People will be more careful and more aware of the viruses and the use of vaccination will be more frequent in the future than now. Because of sudden awareness and massive consumption of the vaccines, prices shot up in mid-2005-06 in China. So, even India, post-COVID-19, will experience a shoot up in both volume and price rise.

In the medium and short term, nothing is going to change for the CXO industry though we can expect countries will encourage companies to invest heavily in R&D by giving tax benefits. China did this in 2005 though it didn’t make commercial success. In the case of economic uncertainty, pharmaceutical companies need to improve R&D efficiency urgently. I believe that in this crisis, domestic CXO companies are facing more opportunities than challenges, and large companies are expected to seize the opportunity and increased more market share in the global innovative drug R&D segment.

CXO industry though we can expect countries will encourage companies to invest heavily in R&D by giving tax benefits. China did this in 2005 though it didn’t make commercial success. In the case of economic uncertainty, pharmaceutical companies need to improve R&D efficiency urgently. I believe that in this crisis, domestic CXO companies are facing more opportunities than challenges, and large companies are expected to seize the opportunity and increased more market share in the global innovative drug R&D segment.

Pan medical services are semi-commodity based industries and difficult to increase margin, so certainly more and more corporate will join the industry and it will become a more organized industry in India. China changed its policies related to pan medical services post-SARS. China makes sure that drug prices in the primary market gradually return to a reasonable level which leads to more integration among the players as they all try to capture the volume growth. No doubt about it that prices in India will also come to a reasonable level and margins will be influenced by volume rather than based on the price of the drug.

The Road Ahead For India

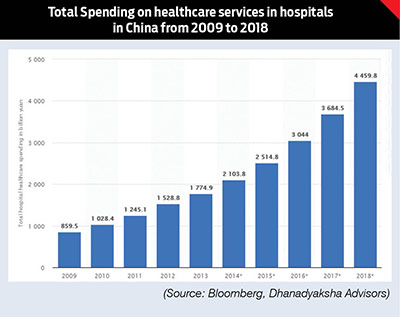

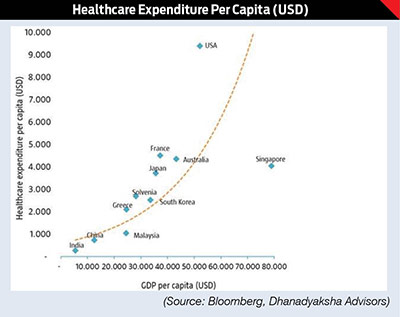

The Indian healthcare sector is much diversified and is full  of opportunities in every segment, which includes providers, payers, and medical technology. With the expectation of an increase in investments in the future, the industry will have a positive impact on their business. According to the Medical Council of India, the hospital industry in India is forecast to increase to USD132.84 billion by FY22 from USD61.79 billion in FY17 at a CAGR of 16-17 percent. The Government of India is planning to increase public health spending to 2.5 percent of the country’s GDP by 2025 which industry experts believe increased up to 4% in the post-COVID-19 era.

of opportunities in every segment, which includes providers, payers, and medical technology. With the expectation of an increase in investments in the future, the industry will have a positive impact on their business. According to the Medical Council of India, the hospital industry in India is forecast to increase to USD132.84 billion by FY22 from USD61.79 billion in FY17 at a CAGR of 16-17 percent. The Government of India is planning to increase public health spending to 2.5 percent of the country’s GDP by 2025 which industry experts believe increased up to 4% in the post-COVID-19 era.

India’s competitive advantage also lies in the increased success rate of Indian companies in getting the Abbreviated New Drug Application (ANDA) approvals. India also offers vast opportunities in R&D as well as medical tourism. To sum up, there are vast opportunities for investment in healthcare infrastructure in both urban and rural India.

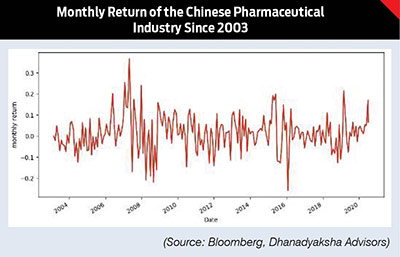

Since the post-SARS world, Chinese healthcare and pharmaceutical stocks have given 10.9545% CAGR return, which is not only inflation beat but also gave the hefty returns in the global financial crisis (GFC) and during COVID-19 period (2019-2020).

If we take this return as a reference point for India, India should be able to post higher than this return in the post-COVID-19 era because India enjoys the democracy premium over China and Indian pharmaceutical companies have more commercial success than China.