In India, if you are a ‘crorepati’, it signifies that you are a part of the exclusive club of people who live lavish lifestyles. Therefore most of us aspire to be part of this club. For those who are not born with a silver spoon, it is very hard for them to join this club until and unless they are fortunate enough to win a lottery. Becoming a planned crorepati is quite a difficult task. However, thanks to mutual funds, which can possibly help you in creating such wealth.

Mutual fund investors need to have a well-developed financial strategy to get into that exclusive club. One of the most important aspects of financial planning is the consideration of inflation, which is a slow poison with the capabilities of reducing your purchasing power over a period of time. Therefore, it is always important to factor in inflation while calculating the required sum of money in the future. Now the question is how to achieve this figure? One of the most prominent ways to achieve it is through the right investment strategy.

Invest

You can become a crorepati through investments. Although this path is not that easy and you don’t just require your hard-earned money but also it requires you to be rational and disciplined with your investments. While choosing this path you need to be more abreast with the investments that you are doing.

Investment in itself is a large and diversified field. For the sake of simplicity and options that are available to the retail investors, we will study only a few of them that are being widely used by investors.

Bank Fixed Deposits (FDs)

Can you be a crorepati by investing in bank fixed deposits (FDs)? That’s a big question. Yet, many people are most comfortable with bank FDs. There are two main reasons for that, first being guaranteed interest rate until FD matures and secondly safety of capital, at least for limited capital. Hence, the general query that people tend to have is can they become crorepati by investing in bank FDs? Technically, one can become a crorepati by investing in bank FDs. Currently, on average, the interest rate on bank FDs with 10-year maturity is 7 percent (to simplify, taxation is ignored).

Let us say you invest for 20 years in bank FDs, assuming a 7 percent rate of interest. To become a crorepati at the end of the year 20 you need to deposit Rs 25.84 lakh upfront. If you invest in a staggered manner, you would be subject to reinvestment risk. This would be more evident in the falling interest rate scenario. For now, even if we ignore this risk and you invest in a staggered manner assuming 7 percent rate to be constant, you need to invest Rs 20 thousand per month for 20 years. In a real sense, the required amount would be more if we account for taxes. Therefore, even if you can be a crorepati by investing in bank FDs, you need to be lakhpati and the required amount of investment is quite high which makes it an inefficient way to be a crorepati.

Investing in Mutual Funds

Is investing in mutual funds an efficient way of becoming a crorepati? Indeed, mutual funds are one of the most efficient and effective ways of investing. Though, is this the way to become a crorepati or not we shall find it out in a moment.

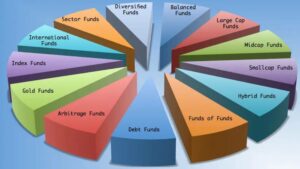

The advantage of investing in a mutual fund is that you can find various kinds of mutual funds that help to cater to different needs including wealth creation. Not just that, you can also create a portfolio of mutual funds that would help you fulfill your financial goals.

Becoming a crorepati by investing in thousands may look impossible, however, if you take the route of mutual fund SIP step-up calculator, it may make your journey easy. Back of the envelope calculation shows that one can enhance one’s maturity amount to almost double by just enhancing one’s SIP amount by 10 percent per annum. They say that an earning individual can increase one’s investment by 10 percent as this much hike in earning can be expected when he or she begins SIP.

In an equity mutual fund, one can expect at least 12 percent returns in the long-term. However, if you chose a fund from the mid-cap or small-cap category and the period of investment is beyond 15 years, then the return will be to the tune of 15 percent on average.

Therefore, if an investor decides to invest in a mid-cap or small-cap fund while doing SIP, then assuming the 15 percent returns that one can expect on his or her return, his or her maturity amount without annual step-up would be Rs 60,02,682 if the investment is done for a period of 20 years and SIP amount is Rs 4500. However, in the case of a 10 percent annual step-up, the maturity amount after the same period of 20 years would be Rs 1.12 crore. So, 10 percent annual step-up in the next 18 years would help the investor enhance his or her SIP maturity amount by Rs 52.94 lakh while one’s investment in this period would go up by Rs 20 lakhs.

In the case of SIP and step-up SIP, you get the benefit of risk management. This means that the investment volatility would be fairly low compared to lump-sum investment. This is because SIP has an added advantage of rupee cost averaging. Having said that, it seems to be quite difficult for an average salaried individual to invest such a big amount, however, SIP or step-up SIP can do the trick for them.