Many of us believe that wealth is a privilege of few. However, the reality is that even if you have little money to save and invest and time in your side, still you can make more money by planning in a better way and fulfill your dreams and mutual funds are definitely one of them.

Investors are realizing this and the trend is reflected in the mutual fund inflows numbers. The year 2020 was the seventh consecutive year when the equity asset under management (AUM) has increased. At the end of the year 2020, the equity AUM stood at Rs 9.5 lakh crore, which is more than doubled than what was at the start of 2016. In the last five years equity dedicated mutual funds have cumulatively created a wealth of Rs 1.28 lakh crore for mutual fund investors. Out of these five years, equity dedicated mutual fund has been able to create wealth for three years.

There are reasons, why we believe that for not-so-active investors, the mutual fund remains one of the best tools to create wealth and achieve their financial goal.

Creating Wealth through Mutual Fund

The road to wealth through mutual fund investment is long and arduous, however, if you start early and keep investing, it will help you to create wealth. The earlier you start investing, the more wealth you can create. The essence is to invest early and remain invested for long so that your money gets the maximum time to grow to the required levels and at the required time.

Start Early

The power of compounding gives you the edge—the more time your money gets to grow, the more you gain. Take an example of Shyam Sharan Shukla, who started investing Rs 2,500 per month at 25 years; while his friend Pankaj Jha, started investing twice of what his friend was investing, however, he started after 10 years at the age of 35. When both friends turned 45, Shyam would have amassed a corpus of Rs 22.78 lakh, while Pankaj had only half as much as his friend assuming their investment grew at 12 percent return. This is the power of starting early

Consistently Invest

Domestic equity dedicated mutual fund has been witnessing a continuous net outflow for the last seven months in a row. This shows that many investors are trying to time the market and cashing out with the rising market. Think of an investor who had redeemed his mutual fund investment in the month of July 2020, he easily lost the opportunity to gain more than 30 percent. Hence, investing in MF requires a lot of discipline and avoid trying to time the market as it very hard to do on a consistent basis.

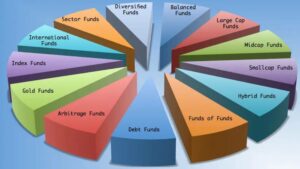

Diversification and asset allocation

Protecting your wealth is part of your wealth-building. One of the best ways to protect your wealth is through diversification. You should invest in the different asset classes and sub-asset classes to get the benefit of diversification. Mutual Fund aids you with diversification at a much lower cost. There should be rationality to it as over-diversification may be counterproductive. Using different types of mutual funds allows you to modify the risk of your investments to match your personal risk tolerance. When you are under the age of 50, you still have enough years to make up for any losses you suffered from risky investments, so allocating more of your investment money to aggressive growth funds might create greater profits. As you approach your retirement, however, allocating the majority of your assets to conservative debt funds protects you from large losses if the market unexpectedly drops.