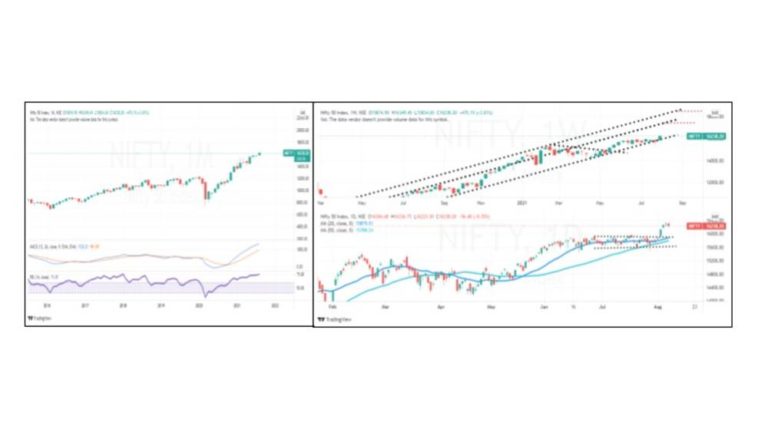

Monthly Chart Analysis

It is the first week of the month of August. We begin our analytical process by looking at monthly charts because we are interested in the monthly close as of July 2021. IT was a small ranged candle that closed at the midpoint of the month; more of a Doji pattern. It is a “Northern Doji’ in the middle of a sharp uptrend. This is more of a continuation pattern rather than a reversal pattern. The MACD remains bullish on the monthly time frame and RSI is above 60. Monthly charts is the tall pane to the left of the chart.

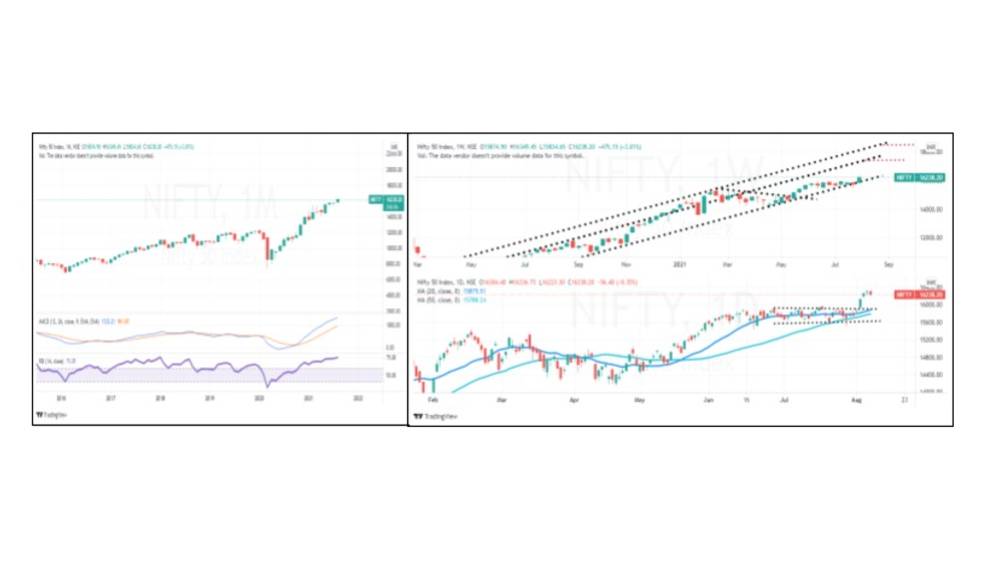

Weekly Chart Analysis

On the weekly time(top pane right side) frame we see Nifty in a rising trajectory taking support at the rising trendline. Nifty saw a pop-out eight-week rectangle pattern and this is a bullish development. A breakout of a rectangle pattern is bullish. Will nifty try to hit the rising channel that is the top line on the chart. If this prediction is true we are likely to see Nifty rallying towards 17500 as a conservative target and an optimistic target is around 18000. MACD line has hooked up in a weekly context. The underlying sentiment has turned bullish over the next several weeks.

Daily Charts

On the daily time frame (bottom right pane) the price action shows a pop out of the rectangle sideways pattern. The breakout was on a series of green candles. In the last two days of trading Nifty has gone in a trading range which is just a pause within an ongoing trend. Nifty has a support at 16120-16150 as this is a gap-up area. Expect a small drop to breakout range at 15950 if Nifty breaks below 16120-16150. But this is a buying opportunity. As long as Nifty holds above 15600 we will look to buy dips to support. On the upside the potential is huge. This is the best buying opportunity in the last two months.

Bank Nifty

Our choice for the sector over the next two weeks is Bank Nifty. BankNifty broke out of an inverse Head and Shoulder pattern way back in May 2021 and the index started to trade in a range of 36100-34150 for the last eight weeks. These two months of a build-up of energy could see Bank Nifty on the verge of a huge trending move on the upside. With Nifty gaining traction and near its all-time highs; BankNifty is yet to register a fast directional move in the market.

During the course of the week, BankNifty registered a breakout of the range with a couple of strong momentum candles. If the breakout beyond 36100 sustains and Bank Nifty starts to trade higher we could see a massive move in Bank Nifty. BankNifty offers a great reward to risk opportunity. If the breakout beyond 36100 holds expect upsides to 38000 and beyond in the coming months. As long as BankNifty holds above 35200 the view remains bullish.