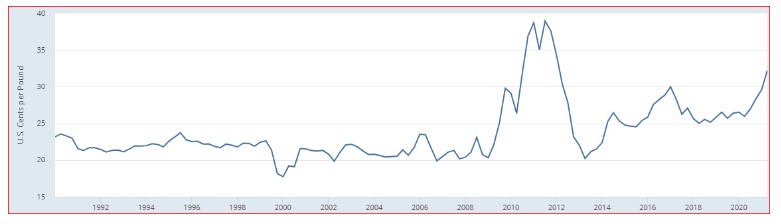

Recently global sugar prices have crossed US cents 20 per pound from a low of US cents 10 per pound one year back and more importantly domestic prices are following the global price trend and moved to a four-year high of Rs 34 per kg in Maharashtra and Rs 36 per kg in Uttar Pradesh. The impact of this on the share prices of sugar companies is substantial. Year till date most of the sugar companies’ shares have doubled in their values and some of them have even seen an increase by threefold.

Most old-time investors, who have seen many market cycles, might see this as another sugar cycle. They may also think that it will reverse soon. Their point of view has a reason behind it. They are still under impression that sugar is a highly regulated, cyclical commodity with a greater degree of the local level of politics. All these factors have led to sugar stocks being under-owned in one’s portfolio.

Global Sugar Prices

Sugar Economy Improving

Nevertheless, we believe that the current change in the landscape of the sugar sector is structural and will have far-reaching consequences on the entire sector. Factors such as improving sugar prices, government measures, and higher distillery CAPEX to leverage ethanol opportunity will help to sustain the current momentum in sugar companies.

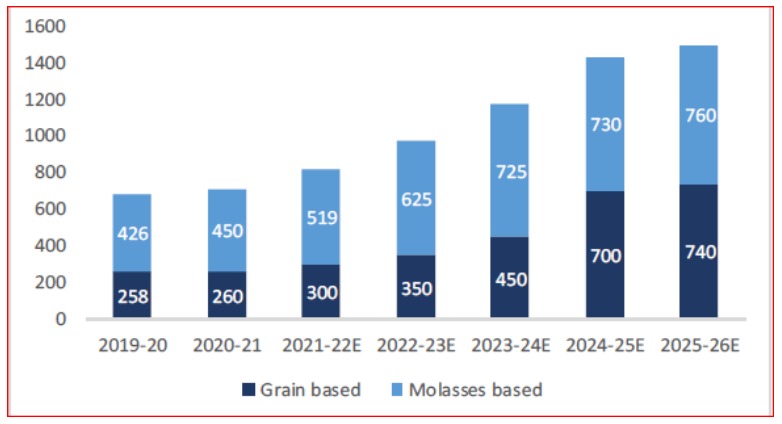

Massive Distillery Capex to Leverage Ethanol Opportunity

In June 2021, the government released a roadmap for the ethanol blending programme, which clearly set forth ethanol capacity requirement, raw material availability, planned storage capacity by oil marketing companies (OMCs), and change in engine, components requirement among other important factors. We believe this depicts the government’s seriousness in implementing the programme. With the increasing molasses and grain-based ethanol capacities, 10 percent and 20 percent ethanol blending by 2022 and 2025, respectively, is achievable. Out of the total requirement of 1350 crore liters (ethanol & Extra Neutral Alcohol) by 2025, sugarcane-based ethanol is expected to contribute 684 crore liters while grain-based ethanol would contribute 666 crore litres.

According to an estimate by a leading brokerage firm, ethanol blending at 20 percent would create a massive 1000 crore liter of annual ethanol demand every year by 2025. Currently, OMCs are procuring around 300 crore litres (nine percent out of this is grain-based ethanol). With the huge opportunity in the ethanol space, sugar & other agri-based companies are undertaking huge capacity expansions.

The sugar industry has added around 100 crore liter of distillery capacity in the last two years. Moreover, another around 300 crore liter of capacity would be commissioned in the next three years.

Expected cumulative distillery (Ethanol + ENA) capacities by 2025-26

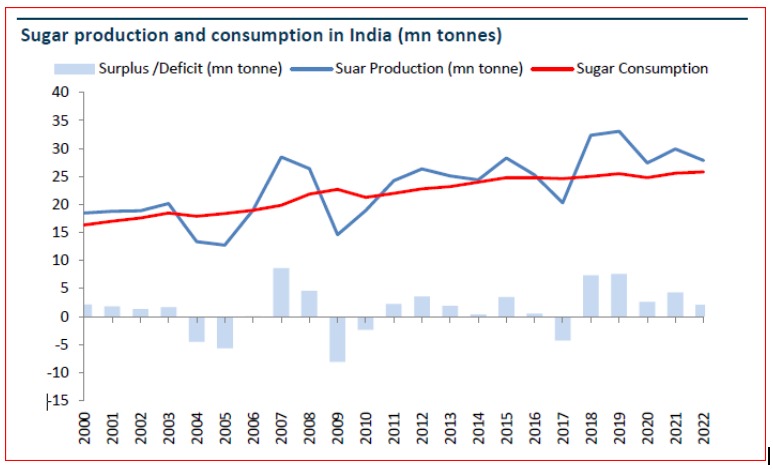

Currently, B-heavy & sugarcane-juice ethanol prices are far more remunerative compared to C-Heavy ethanol prices. We believe sugar companies would divert almost 75-80% of their sugarcane towards B-Heavy ethanol & 5-10 percent towards sugarcane juice ethanol. C-heavy ethanol/ENA would only be produced for mandatory levy requirement for country liquor in Uttar Pradesh. This would result in 20 percent or 6 million tonnes sugar diversion towards ethanol production, which would absorb the entire excess sugar production.

The process on the ethanol front is progressing on expected lines. The current blending levels are closer to 8.5 percent while OMCs have contracted to procure 318 crore liters of ethanol between December 2020 and November 2021. We believe ethanol blending would cross 10 percent by November 2022 given sugar companies are increasing distillery capacity 2-3x in the next two years. With the commissioning of massive distillery capacity by November 2022, blending levels would reach 20 percent levels by 2025.

The CAPEX would result in a 15-40 percent earning CAGR for sugar companies during FY21-24E. Moreover, the distillery segment (ethanol, ENA) would start contributing more than 25 percent to revenues. We believe the earnings of sugar companies have become much more stable compared to the pre-2018 period.

Higher Global Sugar Prices to Promote Exports

Global sugar prices have moved up 50 percent in the last year on the back of two consecutive years of lower sugar production by Thailand (a major sugar exporter). Moreover, despite the ongoing Brazilian crushing season, sugar prices have been firm considering the expected 5-6 MT sugar production decline due to severe drought & crop destruction due to frost in many areas in south-central Brazil. We expect global sugar prices to move up higher in the next year, which would help the Indian sugar exports to the tune of 6 MT in the 2021-22 season. Sugar exports are important given industry-wise distillery capacities would take two years to get commissioned.

MSP for Sugar Has Curbed Losses during Periods of Surplus

In the earlier sugar surplus cycle of 2015, domestic sugar prices corrected sharply – to a low of Rs 22 per kg from Rs 32 per kg – with an increase in sugar inventory to 9.1mn tonnes in September 2015 from 6.7mn tonnes in the previous season.

However, sugar prices in the current surplus scenario have remained stable at higher levels due to the government’s support of MSP for the domestic market at Rs 31 per kg. From June 2018, the government has fixed an MSP for mills to sell sugar in the domestic markets, which acts as a benchmark. Due to attractive MSP, sugar mills are now able to realize significantly higher prices for sugar in the domestic market, despite the country having one of the highest sugar inventories.

Consistent increase in sugarcane MSP by the government has resulted in higher production of sugarcane, resulting in a surplus situation for the past four years. The government’s proactive approach to protecting the interest of farmers is also seen in the decision of no deduction in the case of sugar mills, where recovery is below 9.5 percent. Such farmers will get Rs 275.50 per quintal for sugarcane in ensuing sugar season 2021-22 in place of Rs 270.75/qtl in current sugar season 2020-21.

The cost of production of sugarcane for the sugar season 2021-22 is Rs 155 per quintal. This FRP of Rs 290 per quintal at a recovery rate of 10 percent is higher by 87.1 percent over production cost, thereby giving the farmers a return of much more than 50 percent over their cost.

With the massive increase in distillery capacities by sugar companies, ethanol sales are likely to double for most companies. We believe ethanol sales would contribute almost one-third of revenues for major sugar companies by FY24 as their CAPEX completes. Moreover, reducing sugar inventories in the system is likely to push domestic sugar prices upwards. Both these factors would boost earnings for sugar companies in the next three years. Despite, the huge run-up in the sugar stocks, valuation multiples are still 5-10x FY23E PE.

Given the strong earnings growth visibility, sugar stocks are likely to command higher valuation multiples. In the following pages, we have handpicked five sugar stocks that are likely to outperform the sector. However, readers are advised not to rush up and buy these stocks. They should be attentive to the market and act when there is a sharp decline. It will be, considering the strong volatility in the market these days.