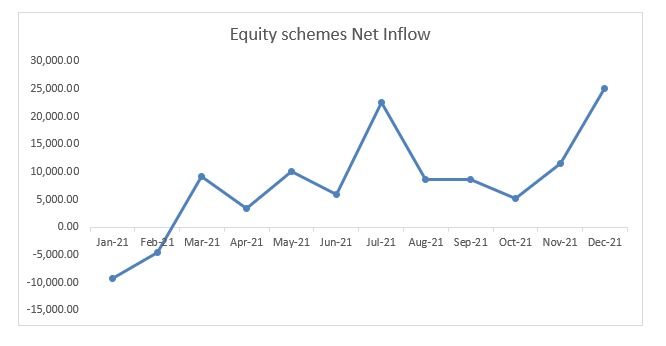

The soaring equity market has a rub off impact on mutual fund industry. This is what many of us believe. The reason for such belief is continuous net outflow of funds from equity dedicated funds that we saw between July 2020 and February 2021. Nonetheless, a latest month inflow of funds towards equity dedicated fund depicts entirely a different picture about mutual fund industry.

The monthly data released by industry body, Association of Mutual Funds in India (AMFI), for the month of December 2021 was very encouraging from equity mutual fund perspective.

According to the monthly data from AMFI, inflows of equity mutual funds has more than doubled to Rs 25,077 crore in December 2021 compared to Rs 11,615 crore that we witnessed in the month of November 2021 and against an outflow of Rs 10,147 crore in same month last year. Net inflows registered in December 2021 in equity MF is the highest since April 2018.

Even investment through SIP route in the month of December 2021 has come at Rs 11305 crore, which seems to be highest ever figure.

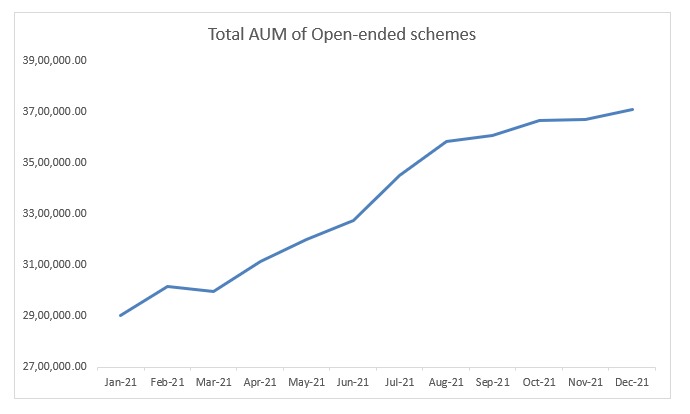

Considerable inflows surprised positively, and underlying quality and granularity have improved too, with robust SIP flows, up month on month in Apr-Dec 21, averaging nine per cent of annualised equity assets under management (AUMs). SIP ticket sizes have gradually declined from Rs 2900 thousand per SIP account in FY19 to Rs 2000 now, implying improved SIP flow granularity. Apart from healthy inflows, strong market returns of 22 per cent have also aided 36 per cent growth in equity AUMs.

Good inflows along with healthy surge in the equity market have led to increase in share of equity schemes in overall AUM of domestic mutual fund. It has increased from 31 per cent at the start of the year to 36 per cent by the end of the year 2021.

Last one year return provided by equity mutual funds has been exceptionally well. There were three categories that on an average generated return in excess of 50 per cent. Best part is baring couple of categories all generated return in excess of 20 per cent.

In a normal year, best performing category would have generated return of 20 per cent.

Average Return of Different Categories of MFs in 2021

| Category | Average Return (%) |

| Information Technology | 64.08 |

| Small Cap | 63.31 |

| INFRA | 51.61 |

| Mid Cap | 45.08 |

| Multi Cap | 43.69 |

| Energy | 43.66 |

| DIV Y | 39.06 |

| Large&Mid Cap | 37.98 |

| PSU | 37.08 |

| Value | 36.62 |

| THEMATIC | 35.90 |

| Flexi cap | 33.48 |

| ELSS | 32.32 |

| MNC | 29.90 |

| Consumption | 28.18 |

| Large Cap | 26.60 |

| Pharma | 20.80 |

| BANK | 15.82 |

| International | 11.38 |

Best Performing Equity Funds of 2021

Small Cap

| Fund Name | Returns (%) | Expense Ratio (%) | Net Assets (Cr) | Latest NAV | 52-Week High NAV | 52-Week Low NAV |

| Quant Small Cap Fund – Direct Plan | 89.9 | 0.56 | 1,375 | 144.754 | 150.14 | 72.59 |

| L&T Emerging Businesses Fund – Direct Plan | 78.19 | 0.73 | 8,190 | 51.205 | 53.188 | 27.832 |

| Nippon India Small Cap Fund – Direct Plan | 74.12 | 1.03 | 18,832 | 96.42 | 100.942 | 53.991 |

| Tata Small Cap Fund – Direct Plan | 72.46 | 0.35 | 1,897 | 23.69 | 24.342 | 13.454 |

| Canara Robeco Small Cap Fund – Direct Plan | 72.22 | 0.45 | 1,914 | 25.23 | 25.89 | 13.96 |

Mid Cap

| Fund Name | Returns (%) | Expense Ratio (%) | Net Assets (Cr) | Latest NAV | 52-Week High NAV | 52-Week Low NAV |

| PGIM India Midcap Opportunities Fund – Direct Plan | 65.12 | 0.4 | 4,070 | 49.25 | 50.97 | 29.97 |

| Baroda Midcap Fund – Direct Plan | 58.5 | 1.64 | 95 | 19.3 | 20.22 | 12.19 |

| Motilal Oswal Midcap 30 Fund – Direct Plan | 56.41 | 0.95 | 2,634 | 50.801 | 52.758 | 31.806 |

| Union Midcap Fund – Direct Plan | 53.25 | 1.25 | 383 | 28.85 | 30.13 | 18.72 |

| Quant Mid Cap Fund – Direct Plan | 52.05 | 0.57 | 248 | 126.967 | 131.668 | 79.127 |

Large Cap

| Fund Name | Returns (%) | Expense Ratio (%) | Net Assets (Cr) | Latest NAV | 52-Week High NAV | 52-Week Low NAV |

| Quant Focused Fund – Direct Plan | 37.76 | 0.57 | 60 | 56.266 | 59.179 | 40.154 |

| Invesco India Largecap Fund – Direct Plan | 34.11 | 1.02 | 467 | 51.99 | 54.07 | 37.49 |

| Franklin India Bluechip Fund – Direct Plan | 33.25 | 1.18 | 6,735 | 763.943 | 803.361 | 579.254 |

| Tata Large Cap Fund – Direct Plan | 33.24 | 1.66 | 1,116 | 371.898 | 387.01 | 272.866 |

| Nippon India Large Cap Fund – Direct Plan | 32.7 | 1.07 | 11,017 | 54.656 | 57.047 | 39.929 |

Multi-Cap

| Fund Name | Returns (%) | Expense Ratio (%) | Net Assets (Cr) | Latest NAV | 52-Week High NAV | 52-Week Low NAV |

| Quant Active Fund – Direct Plan | 57.49 | 0.58 | 1,596 | 440.601 | 456.189 | 271.213 |

| Mahindra Manulife Multi Cap Badhat Yojana – Direct Plan | 52.87 | 0.58 | 919 | 23.015 | 24.085 | 14.651 |

| Baroda Multi Cap Fund – Direct Plan | 48.8 | 1.53 | 1,182 | 190.46 | 200.51 | 125.95 |

| Nippon India Multi Cap Fund – Direct Plan | 48.5 | 1.26 | 11,044 | 159.695 | 164.777 | 102.972 |

| Sundaram Multi Cap Fund – Direct Plan | 46.87 | 1.71 | 1,754 | 261.718 | 272.092 | 174.43 |

Flexi-Cap

| Fund Name | Point to Point Returns (%) | Expense Ratio (%) | Net Assets (Cr) | Latest NAV | 52-Week High NAV | 52-Week Low NAV |

| Quant Flexi Cap Fund – Direct Plan | 57.25 | 2.38 | 42 | 62.431 | 64.991 | 38.002 |

| ICICI Prudential Retirement Fund – Pure Equity Plan – Direct Plan | 48.48 | 1.16 | 145 | 18.05 | 18.74 | 12.28 |

| BOI AXA Flexi Cap Fund – Direct Plan | 47.78 | 1.17 | 180 | 20.86 | 21.58 | 13.63 |

| Parag Parikh Flexi Cap Fund – Direct Plan | 46.76 | 0.82 | 19,933 | 53.247 | 55.316 | 37.457 |

| PGIM India Flexi Cap Fund – Direct Plan | 45.6 | 0.39 | 3,302 | 29.97 | 31.39 | 20.39 |

The growth in mutual fund industry remains underpenetrated in India, with an attractive long-term story on financial savings. Regulatory tailwinds in the past four years have led to acceptance of mutual fund investment as one of the attractive investment avenues.

India asset management is relatively underpenetrated, with AUMs-to-GDP of just 13- 15 per cent vs a global average of about 75-80 per cent. Equity AUMs-to-GDP are also low, at five per cent.

In the following paragraphs we are going to give you five recommendations from five different categories. You can invest in them according to your risk appetite.

BOI AXA Small Cap Fund

- Every investment of Rs 10,000 in the fund three years back would have yielded Rs 27,900

- In last three-year this fund has given annualised return of around 40 per cent

- Fund is well diversified with 72 stocks

BOI AXA Small Cap Fund has remained one of the performers in its category. In last three-year fund has given annualised return of around 40 per cent, which is best in its category. In last one year it has given return of around 64 per cent, which once again is one of the best in industry. Every investment of Rs 10,000 in the fund three years back would have yielded Rs 27,900 (on Jan 27, 2022). And monthly SIP of Rs 10,000 or investment of total Rs 3.6 lakh would have become now Rs 7.51 lakh.

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity-related securities of small cap companies. Under normal market conditions, the fund will invest 65% to 100% of assets in a diversified portfolio constituting equity and equity related instruments of small cap companies. The fund has the flexibility to invest upto 35% of its assets in equity and equity related instruments of companies other than small cap companies. Mr. Ajay Khandelwal has been managing the Scheme since December 19, 2018.

The fund is benchmarked to NIFTY Smallcap 250. The current portfolio of the fund is highly diversified and contains 72 stocks, which is way above the category average. Small cap accounts for 40 per cent of the portfolio against fund’s mandate to invest 65%. Mid-cap shares 57 per cent of total portfolio. Large cap has hardly any presence in the fund’s portfolio. In terms of sector weights, Chemicals sector stocks dominates with 14.82 per cent, technology and financial are the other two sectors that form part of the top three sectors and constitute 13.49 per cent and 10.77 per cent respectively.

Canara Robeco Bluechip Equity Fund

- Launched in August 2010 (Regular Plan) always remained in the top two quartile in terms of performance.

- In the three and five-year period, the fund has outperformed its average category returns by 5.46 and 4.08 per cent.

- The fund has put on a consistent show of outperformance since 2017.

Bluechip companies are generally associated with large cap stocks that sell widely accepted product and services. Large-cap funds are required to have minimum 80 per cent of their assets invested in equity and equity related instruments of large-cap companies. They have to invest minimum 80 per cent in 1st to 100th company in terms of full market capitalization.

Canara Robeco Bluechip Equity Fund, launched in August 2010 (Regular Plan) has always remained in the top two quartile of the large-cap funds category of Morningstar quartile ranking for five consecutive year through 2021.

The fund’s month-end assets under management increased to Rs 5691 crore in December 2021, from Rs 135 crore in October 2018. The fund’s investment objective is to provide capital appreciation by predominantly investing in large-cap stocks. The fund has put on a consistent show of outperformance since 2017 and has emerged a worthy bet in the embattled large-cap space.

In the three and five-year period, the fund has outperformed its average category returns by 5.46 and 4.08 per cent. The reason behind such a performance is its tactical allocation across sectors. At the end of December 2021, the fund’s sectoral portfolio seemed concentrated as the top three sectors were financials, technology and energy, which together contributed about 57.06 per cent of the total assets of the fund. While 48 stocks portfolio seemed quite diversified, the top 5 holdings contributed 35.38 per cent of the total assets. In terms of individual holdings, Infosys, ICICI Bank, HDFC Bank, Reliance Industries and Tata Consultancy Services are the top five holdings of the fund.

Considering the fund’s performance over the years, and its asset allocation strategy, investors with moderate to high risk-taking ability can take exposure in this fund.

PGIM India Midcap Opportunities Fund

- The fund manager prefers running an index agnostic portfolio

- The fund has outdone the average category by 15.73 and 7.52 per cent in three years and five years, respectively

- The fund has always remained in the top quartile in one year, three years and five years period.

Earlier known as DHFL Pramerica Midcap Opportunities, the fund is now run solely under the banner of PGIM India since its 100 per cent acquisition of the erstwhile joint venture. The change of ownership was followed by strengthening of internal processes under new CIO Srinivas Ravuri. Under its present fund manager, the fund places firm emphasis on low debt, strong cash flows and clean corporate governance. It avoids bets on sectors with high or rising competitive intensity. The fund manager prefers running an index agnostic portfolio. While it struggled for years till 2018, its performance has picked up since, boasting a much superior risk-return profile in its category. The fund has managed to beat the category returns on a consistent basis since then and has outdone the average category by 15.73 and 7.52 per cent in three years and five years, respectively.

The fund as per mandate needs to invest minimum 65 per cent of assets invested in equity and equity related instruments of mid-cap companies. This means that they have to invest 65 per cent only in 101st to 250th company in terms of full market capitalization. Rest it is on the discretion of fund manager where he wants to invest.

Currently the fund has invested in 49 stocks and its top 10 stocks form 31.63 per cent of the portfolio. At the end of December 2021, the fund was overweight on engineering, technology and healthcare. In terms of individual holdings, Mphasis forms the highest share of the fund’s net assets followed by Coforge and ICICI Bank. Looking at the aggressive portfolio it makes a suitable choice for an investor with a high-risk appetite.

Mirae Asset Hybrid Equity Fund

- Fund is among the top performer in the aggressive hybrid fund category.

- As of December-end 2021, the scheme had around 53 per cent of its net assets in large-cap stocks.

- In debt, the scheme has mostly invested in the highest credit quality debt papers and AAA rated corporate bonds.

Mirae Asset Hybrid Equity Fund was launched in July 2015 and is among the top performer in the aggressive hybrid fund category. The scheme’s large-cap bias in equity and focus on high credit quality in debt make it a good investment for those with a high-risk appetite.

Hybrid funds invest in a mix of equity and debt and modify their equity allocation based on factors such as market valuations. This ensures that the equity-debt allocation is based on rules and is not impacted by an investor’s impulsive moves in and out of equity.

These funds are suitable for those with an appetite for risk and an investment horizon of five years or longer. The scheme typically invests 70-75 per cent of its net assets in equities and follows a bottom-up approach to pick growth businesses available at reasonable valuations. As of December-end 2021, the scheme had around 53 per cent of its net assets in large-cap stocks, 10.98 per cent in mid-caps and 9.5 per cent in small-caps. Higher allocation to large-cap will give stability to returns. Sector-wise, as of December-end 2021, fund is overweight on Financials and Technology. In debt, around only four per cent of the scheme corpus was invested in below AAA-rated debt papers. Besides it holds paper of medium to short duration, which will help it to contain volatility in interest rate. The scheme has always been mostly invested in the highest credit quality debt papers —government securities and AAA rated corporate bonds.

HDFC Floating Rate Income Fund

- Floater funds usually do well when the interest rates are about to rise

- HDFC Floating Rate Debt Fund is one of the top-performing floater funds

- Floater funds are debt funds, and long-term capital gains are taxed at 20 per cent after indexation

Last one and half year has not been very good in terms of returns from the fixed-income securities and debt investments. They have been offering lower returns. Nevertheless, the situation is likely to change as Reserve Bank of India may increase the interest rates in near future. Hence, it makes sense to invest in securities whose returns are tied with interest rate movements – floater funds. Floater funds usually do well when the interest rates are about to rise, as the securities readjust their yields on par with prevailing interest rates. The returns of floater funds rise when interest rates rise, while returns drop when interest rates fall. They are debt funds that invest a minimum of 65 per cent of their assets in floating-rate securities. Floater funds are debt funds, and long-term capital gains are taxed at 20 per cent after indexation, which is beneficial for those in higher tax brackets.

HDFC Floating Rate Debt Fund is one of the top-performing floater funds according to Morningstar rating. The fund invests primarily in bonds that keep seeing change in interest rate in line with prevailing interest rate in the economy. In existence since the year 2013, the fund has offered a return of 8.12% and its benchmark is CRISIL liquid fund index. Assets of the fund as on December 31, 2021 is Rs. 23,584 crore. Expense ratio is 0.23%. In a span of 3 years, Rs. 10000 monthly SIP has grown in value to Rs. 3.97 lakh. Top investments of the fund include floating rate debt instruments, fixed rate instruments, swapped for floating rate returns and money market instruments.