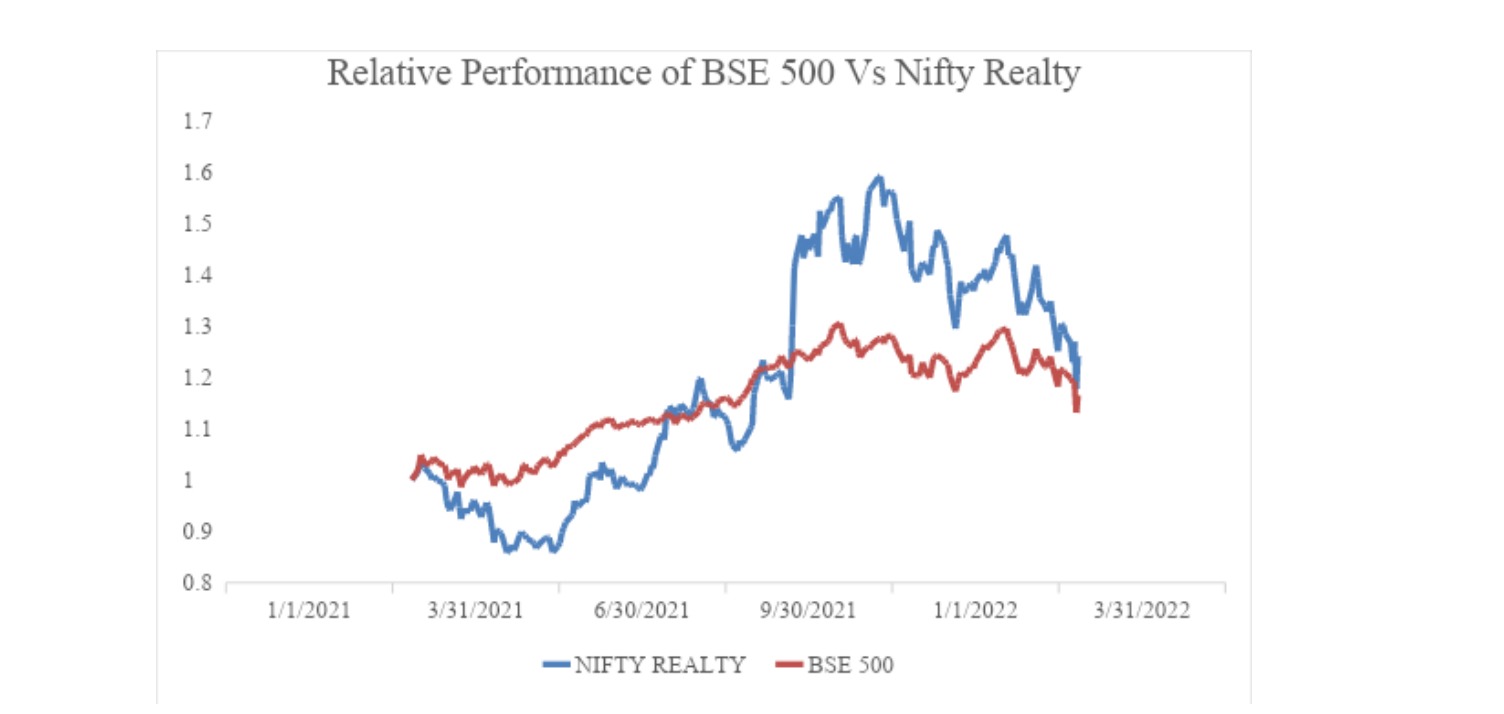

The long lull in the property market seems to have ended with start of the pandemic. The NSE realty index is up by more than 215 per cent from the lows of March 2020. Even in last one year it is up by 24 per cent compared to 16 per cent by BSE 500 index. The momentum in the realty sector has surpassed many other indices. Nonetheless, if we take little, longer history, we see this index is still down by 67 per cent from its peak reached in 2008. Even the share price of companies that were trading in four digits in 2008 are trading in three digit and many shares that were trading in three digits are trading in double digit and some companies cease to exist now.

In the same period Nifty and Nifty midcap indices, these large and midcap indexes, have increased 3.5 times and 4.5 times respectively since the start of FY08.

Since the virus outbreak, real estate players have been hit hard across the value chain. Service providers were struggling to mitigate health risks for their employees and customers. Many developers were not able to obtain required permits and were facing construction delays, stoppages, and potentially shrinking rates of return. Meanwhile, many asset owners and operators faced drastically reduced operating income, and almost all were nervous about how many tenants will struggle to make their lease payments.

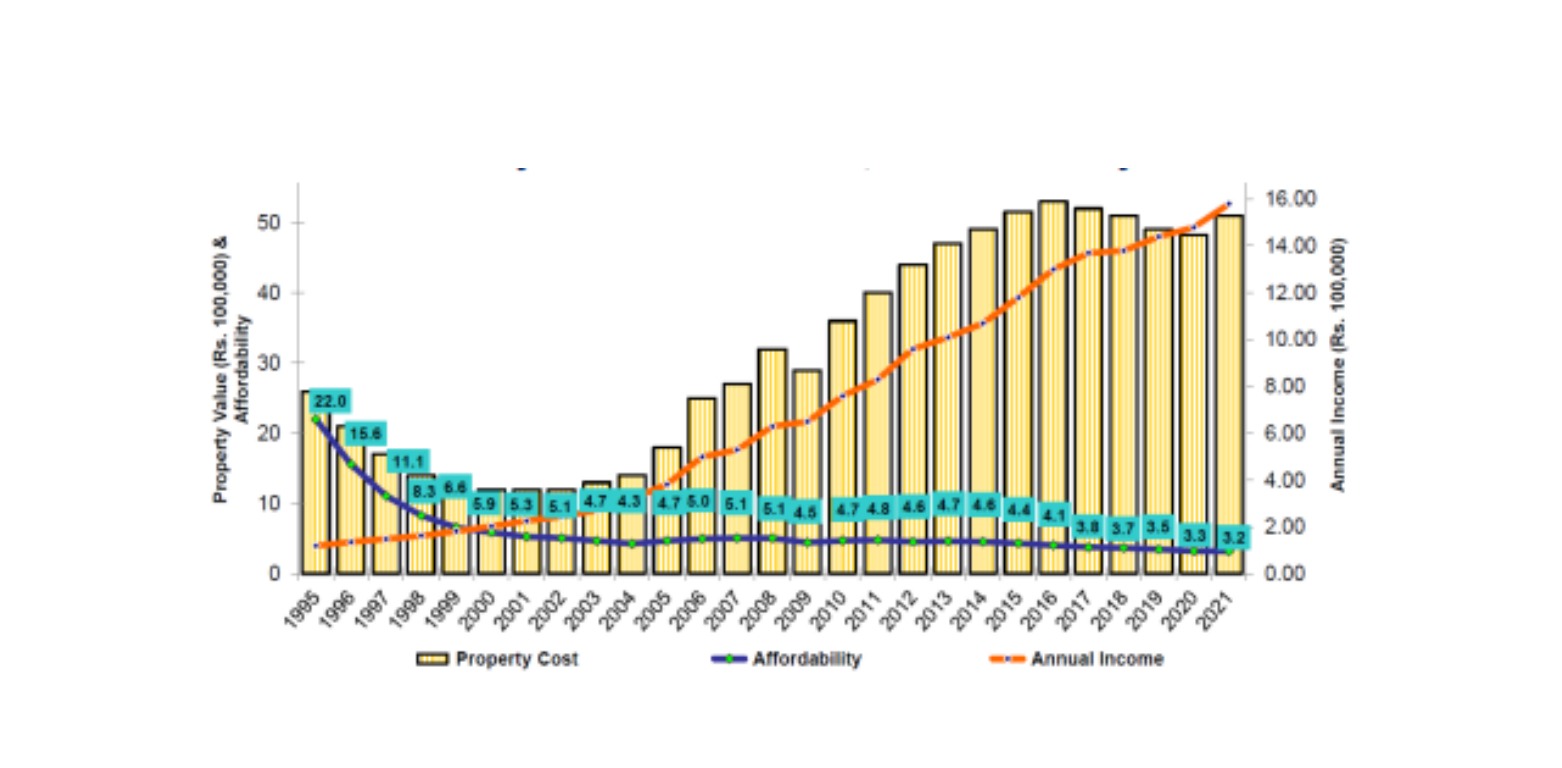

Nevertheless, it seemed to be transitory and COVID-19 stood out not as a big real estate disruptor and accelerated housing demand conversion. Some of the catalysts that fuelled this include stamp duty cuts, developer discounts, high attrition and resultant hikes, democratization of ESOPs to cover a broader employee spectrum, achievement of accelerated unicorn status, and stock market rally. All-time low mortgage rates and all-time high affordability have provided the supporting environment.

Going forward also following factors will help real estate sector to maintain momentum.

Higher Affordability

Going ahead, we believe that momentum is likely to continue. Mortgage rates offered by most large lenders are in the 6.5-7.0% range for 20-year housing loans and is the lowest ever historically since 2005. Even assuming that mortgage rates may inch up over H2FY22-23E, we believe that mortgage rates of 7.5-8.0% (assuming 100bps increase) are still affordable and would not significantly dent buying decisions.

Consolidation in the Sector

Going ahead, consolidation in the sector is likely to improve organised player’s position. We believe that owing to healthy balance sheets, access to capital and many unlisted, weaker developers being shunted out of the market, the market share of large organized developers is set to grow further in the next 2-3 years. Most developers in the listed space have aggressive launch plans from H2FY22 and are looking to grow at a double-digit sales value CAGR over the next 2-3 years which would likely lead to market share gains assuming that even industry size remains stagnant.

Office Leasing Recovery on the Cards

While vacancy levels may remain flat in Q4CY21, it is expected this trend will reverse from Q1CY22E (Jan’22 onwards) with the improved pace of vaccinations across India, select corporates recalling employees to offices and gradual pick up in international travel. The Indian Commercial Real Estate (CRE) office market saw record leasing in CY19 with 42msf of annual net absorption. The office market has been in an up cycle over CY14-19 with rising rentals, falling vacancies, consolidation among developers and emergence of REITs. At the beginning of CY20 (January 2020), the outlook was bright with healthy pre-leasing for upcoming supply. However, the evolving global situation owing to the COVID-19 has led to CY20 net office absorption of 20msf which is a 50% YoY decline. Nonetheless, as employees start returning back to office, we may see this also picking up.

Many will believe that inflation is a key risk since it may drive input cost and mortgage rates higher and derail the recovery. Nevertheless, there are reasons to believe developers have headroom to absorb inflation as greater transparency over time has reduced costs of capital and organised developers enjoy 25-30% lower funding costs than tier-2 players.

Out of many listed real estate players, in the following pages we are giving seven players that are likely to gain most out of the developments mentioned above. One can invest in any two or three players to build a strong portfolio.

If you are reading this on a mobile app, you should check this page

DLF Ltd.

DLF is one of the largest real estate players in this sector. The company has a unique business model with earnings arising from development and rentals. DLF has also forayed into infrastructure, SEZ and hotel businesses. They operate in all aspects of real estate development, ranging from acquisition of land, to planning, executing, constructing and marketing. The group is also engaged in the business of generation and transmission of power, provision of maintenance services, hospitality and recreational activities. The business of DLF is organized on a SBU basis. The Homes SBU caters to 3 segments of the residential market – Super Luxury, Luxury and Mid-Income. Its offices portfolio is an integrated mix of office spaces with food and beverage and leisure amenities. It has developed approximately 27.96 million square meter residential area and 4.2 million square feet retail space.

For the quarter ended Q3FY22, DLF booked record pre-sales of Rs 2000 crore which is 98% higher on y-o-y basis while 34% higher on Q-o-Q basis on the back of an overwhelming response received by project ‘ONE Midtown’. It has already surpassed its Rs 4000 crore of pre-sales guidance for FY22, with 9MFYTD sales coming in at Rs 4500 crore; thus, it revised its sales guidance upwards to Rs 6000-6500 crore. Net debt continues to trend down for DLF, it has come down to Rs 3200 crore vs Rs 4000 crore in September 2021. Given there are price hikes in the premium segment, higher pre-sales guidance, and robust launch plans, one can add this industry leader to portfolio.

Godrej Properties Ltd.

Godrej Properties brings the Godrej Group philosophy of innovation, sustainability, and excellence to the real estate industry. The Company is engaged primarily in the business of real estate construction, development and other related activities. The Company focuses on developing residential and commercial projects. It operates in approximately 12 domestic locations. The Company operates in India across cities such as Mumbai, Pune, Kolkata, Nagpur, Chennai, National Capital Region (NCR), Bangalore, Ahmedabad, Mangalore and Chandigarh. The company was established in 1990 and is currently developing projects that are estimated to cover more than 89.7 mn sqft.

For Q3FY22, company’s consolidated revenue registered a solid 63.6% YoY growth to Rs. 279 crore led by a steady pickup in demand for homes and office spaces, as companies look to gradually move back to offices post pandemic. Gross profit margin improved from 31.1% in Q3FY22 to 34.9% this quarter. As a result, EBITDA improved to Rs five crore loss vs Rs. 54 crore loss in Q3FY21. PAT rose 171.4% YoY to Rs 39 crore, boosted by higher other income of Rs 188 crore, which is up by 33.8% YoY.

Q3FY22 witnessed a total booking volume of 2.22mn sqft worth Rs 1,541 crore against the total booking volume of 2.4mn sqft worth Rs. 1,488 crore in Q3FY21. On the business development front, the company has added three new projects with saleable area 2.4mn sqft. For 9MFY22 total booking at Rs. 4,613 crore and total booking volume at 6.60mn sqft, vs Rs 4,093 crore and 6.64mn sqft, respectively, in 9MFY21.

With strong pedigree and robust execution capability one can add this to their portfolio.

Indiabulls Real Estate Ltd.

Indiabulls Real Estate is engaged in operations encompassing construction and development of real estate and providing consultancy and advisory services to companies engaged in construction-development of real estate and infrastructure projects. It is one of the largest real estate companies in India, with a well-diversified presence in both commercial and residential real estate development and has projects across the price spectrum, from mid income, premium to the super luxury space.

The company’s sales rose to Rs 874 crore for the half-year ended September from Rs 368 crore a year ago, while collections for the period rose to Rs 654 crore against Rs 284 crore. Earlier this year the company sold around 40 acres of land in Gurugram for Rs 850 crore for the development of housing and commercial projects. Last year, the merger between Embassy and Indiabulls Real Estate moved towards completion, with both companies filing the requisite joint application with the jurisdictional bench of NCLT for its approval to the scheme of merger. The application for approval is listed in the current quarter. The merger marks Indiabulls Group management’s complete exit from the real estate business.

The move would help Indiabulls become one of the most diversified real estate companies with huge land banks and significant developmental potential across the key markets of MMR, NCR and Bengaluru. The merged entity would be well-placed to benefit from the current consolidation across both commercial and residential markets given that Embassy Group was an experienced real estate developer and the Blackstone Group (owner of Sky/Sky Forest assets; shareholder of merged entity) would bring in additional benefits.

Kolte Patil Developers Ltd.

Kolte Patil Developers has emerged as Pune’s leading Real Estate Developer. The Company is primarily engaged in business of construction of residential, commercial, IT Parks along with renting of immovable properties and providing project management services for managing and developing real estate projects. The Company has developed and constructed approximately 50 projects, including residential complexes, commercial complexes and IT parks covering a saleable area of over 12 million square feet across Pune and Bengaluru. The Company markets its properties through two brands: Kolte-Patil, which addresses the mid-income segment and 24-K, which addresses the luxury segment. It has executed projects in multiple segments, such as standalone residential buildings and integrated townships. Its projects include Tuscan Estate, 24K Glitterati, 24K Allura, Floriana Estates, City Centre, City Bay, City tower, Commerspace, Ispace, Giga Retail, Shopper’s Orbit, City Mall and Bizzbay.

The company reported robust earnings performance in the December quarter. Among the key highlights of its Q3FY22 results were: Quarterly sales of 0.86 million square feet, up 56% year-on-year (y-o-y) and highest in the last seven years. Similarly, sales value at Rs 561 crore, rose 77% y-o-y, a multi-year high. Further, net debt declined by Rs 42 crore during the quarter and stands at Rs172 crore. With that, one of the key metrics the net debt-to-equity ratio declined to 0.91 times. Even the commentaries on the launches were upbeat. Management had indicated about a robust pipeline of launches for the next few quarters across three core markets with aggregate saleable area of 5.38 million square feet and aggregate topline potential of Rs 4,600 crore.

Oberoi Realty Ltd.

Oberoi Realty is engaged in the activities of Real Estate Development and Hospitality. On the real estate development front, the Company develops residential, commercial, retail and social infrastructure projects. The Company’s segments include Real estate and Hospitality. The Company is involved in the development of approximately 40 projects that aggregates over 9.18 million square feet of space. It handles residential, commercial, retail, social infrastructure and hospitality projects. Its residential projects include Oberoi Splendor, Oberoi etc. Its commercial projects include Oberoi Chambers, Commerz and Commerz II. Its retail project includes Oberoi Mall. Its social infrastructure project includes Oberoi International School. Its hospitality project includes The Westin Mumbai Garden City.

In Q3FY22 revenue went up 10.3 on sequential basis to Rs 832 crore led by a steady pickup in demand for homes and also for office spaces, as companies look to gradually move back to offices post pandemic. EBITDA however declined 10.8% QoQ to Rs 346 crore as EBITDA margin contracted 980bps QoQ to 41.6% on lower average realisations and higher operating costs. Owing to a gain of Rs 235 crore from share of associates, PAT rose 75.4% QoQ to Rs. 468 crore.

Company achieved highest 9M gross booking value of Rs 3,151 crore, inclusive of the Rs 1,000 crore gross booking of Tower B of Elysian project in Goregaon. During Q3FY22, company raised Rs 1,000 crore through issuance of non-convertible debentures with tenure ranging from 2-4 years. The company has several projects progressing on track. We expect the offloading of existing inventory to pick up pace in the coming quarters and lead company’s PAT to grow at 34.0% in next couple of years.

Prestige Estates Projects Ltd.

Prestige Estates Projects Limited (PEPL) is one of the largest real estate developers with well-established presence in India’s high-growth locations. Its residential properties cater to premium and mid-segment customers. Spread across multiple cities, it designs and develops contemporary living spaces. Its residential projects span townships, apartments, luxury villas, mansions, row houses, town homes, golf developments and plots. Its retail spaces comprise malls that garner thousands of footfalls every day. The malls built and operated by Prestige have become landmarks of major Indian cities, housing several international and domestic brands. In association with global players such as Hilton, Sheraton, Marriott, and Oakwood, it builds and operates modern hotels, located at prime locations. The Company’s geographical segments include Bengaluru, Chennai, Kochi, Hyderabad and Mysuru.

Prestige Estates Projects registered the highest-ever quarterly pre-sales at Rs 4270 crore in Q3FY22, which almost doubled on yearly basis and collections at Rs 2430 crore up by 70% in the same period. Volume-wise, gross sales were at 5.6msf, witnessing a growth of 87% on YoY basis. Given robust booking and enquiry traction, the company expects to cross Rs 10,000 crore of pre-sales in FY22. While net D/E rose to 0.57x due to land acquisitions and Capex, the company is committed to maintaining it below 0.35x. It will utilise proceeds from Blackstone deal and divestment of its stake in StarTech to deleverage the company. Also, Prestige Estates Projects wants to set up an alternate investment fund to finance future land acquisitions so as to not bloat up balance sheet debt and keep growing sales further.

Sobha Ltd.

Sobha Limited operates through two segments: real estate segment, and contractual and manufacturing segment. The Company’s contractual and manufacturing segment comprises development of commercial premises and other related activities, also includes manufacturing activities related to interiors, glazing and metal works and concrete products. It also provides backward integration to Company’s turnkey projects.

Sobha has ongoing real estate projects with 30.7 mn sq feet of saleable area, and ongoing contractual projects aggregating to 5.9 mn sq ft under various stages of construction. As on Q3FY22, the company has delivered 115.9 mn sq ft of developable area. The company has a real estate presence in 10 cities.

Sobha reported a strong operating and financial performance. The sales volume of 1.32 mn sq ft (up 17% YoY) valued at Rs 1,048 crore was up 18% YoY). Further, average price realisation during Q3FY22 has grown 4% QoQ. The overall sales were primarily driven by good sale numbers achieved in Bengaluru, Gurugram and Pune. On the financial front, company reported revenues down 2.4% YoY at Rs 668.2 crore, with relatively lower real estate revenues recognition (down 4% YoY at Rs 447 crore). EBITDA at Rs 227.5 crore, was up 27.4% with margins of 34%, up 800 bps YoY. PAT at Rs 32.7 crore was up 51% YoY.

It has managed to reduce its net debt position by Rs 123 crore on QoQ basis and its net debt at the end of December 2021 stood at Rs 2,654 crore (net D/E: 1.07x). Also, the cost of borrowing came down to 8.65% (from 8.85% a quarter ago). Going forward, the company is targeting D/E to lower than one. All this augur well for the company.