Reliance Industries Ltd (Reliance) is India’s largest private sector company and its activities span hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, retail and digital services. Reliance is the top-most ranked company from India to feature in Fortune’s Global 500 list of ‘World’s Largest Companies’ – currently ranking 96th.

Last 5 Years Laid Strong Foundation to Evolve as an Economy

Reliance has made tremendous achievements over the last 5 years in its diversification initiatives. In FY2017, Oil & Gas related business (petrochemicals, refinery and oil & gas) contributed 89% of gross revenues, but 97% of overall consolidated Profit Before Interest & Tax (PBIT). From a mere 3% PBIT contribution in FY2017, new-age businesses like Digital Services, Retail, etc. increased their share in PBIT to little over 45% during the first nine months of FY2022 (9MFY2022).

From 2010 to 2017, Reliance Jio built the world’s largest 4G and LTE-only network. It involved 250,000 kilometers of fiber optic cables and 90,000 4G towers. Built in partnership with foreign network providers like British Telecom and Deutsche Telecom, the network was green field. This offered vast advantages over its competitors – whose networks were upgraded from the 2G and 3G days. In 6 years of its launch, Reliance Jio has become India’s largest wireless carrier by gross and active users and the number one Home Broadband Service Provider in India.

Over the last 5 years, Reliance Retail has emerged as India’s largest organized retailer in terms of revenue and store network. It has 14,000+ stores in India spread over 40 million sq. ft. Retail revenue has grown 5x in the last five years (FY2017-22). In addition, Reliance Digital is India’s largest electronic specialty retail chain in India with 400+ stores across 170+ cities.

Reliance: Building Three Futuristic Businesses to evolve as an Economy

Reliance having built two largest businesses (telecom and retail) in India within a decade, now it is set to repeat such success stories in three more areas: E-commerce, New Energy (Renewable / Green Energy / Mobility Solutions) and Electronics manufacturing over the next 5 years and thereby evolve itself into a mini economy.

1) E–Commerce and Online Retail

Reliance has now built an end-to-end retail strategy across “New Commerce”, Offline Retail and e-commerce. New commerce will empower the unorganized kirana stores.

E-commerce Build Up

Digital commerce orders grew 2x yoy in the recent quarter. Merchant partner’s orders grew 4x. Digital and new commerce account for 20% of core retail sales (as of 2QY2022). These include AJIO, Reliancedigital.in, and JioMart’s B2C businesses. New business continued to deliver with Netmeds (daily orders up 1.6x, MAU up 2x), Zivame (100 stores, 9000 SKUs), Urban Ladder (2x yoy);

New commerce scales up: Reliance is building its new commerce business as it targets ~15-20 million Kirana stores. New commerce was up 3x yoy in 3QFY2022 and now available in 3,500+ cities. Kirana digitization strategy offers brands reach to merchants, better analytics. Consumers can order from kiranas directly through JioMart;

Premiumization of Brands

Reliance has a strong premium brand portfolio. Reliance Retail added 50+ leading India and international brands in the recent quarter. Indian affluent consumers are increasingly focusing on premium brands that improve their lifestyle choices. This has resulted in premium becoming the fastest growing category;

Reliance recently announced acquisition of 89% equity stake in Purple Panda Fashions, which owns and operates the Clovia business, an industry leader in the bridge-to-premium intimate wear category (online lingerie retailer), with an investment of Rs.950 crore. With this acquisition, Reliance will further strengthen its portfolio in the innerwear segment, having already acquired Zivame and Amante brands.

Reliance is also expanding its presence in the luxury and retail landscape. Last year, it entered into strategic partnerships with investments in Manish Malhotra’s brand and has an equity investment in fashion designer Raghavendra Rathore’s company and Abraham & Thakore. It also recently entered into a joint venture with fashion designers Rahul Mishra and Anamika Khanna.

2) New Energy Foray

Reliance launched its New Energy foray to meet the green energy mandate via building four Giga factories, to establish/enable at least 100GW of solar energy by CY2030:

- To enable solar energy, Reliance will build an integrated solar photovoltaic (PV) module factory;

- To store intermittent energy, Reliance will build an advanced energy storage battery factory;

- To make green H2, Reliance will build an electrolyzer factory; and

- For converting H2 into motive and stationary power, Reliance will build a fuel cell factory;

Reliance is reportedly making huge investments in these initiatives over the next three years and also in value chains, partnerships and future technologies, including upstream and downstream industries. Total initial investment in New Energy from Reliance could be as high as Rs.75,000 crore in three years.

Reliance has planned four Giga factories to manufacture/integrate all critical components of its New Energy ecosystem across key value chains, viz. a solar photovoltaic module factory, an energy storage battery factory, an electrolyser factory and a fuel cell factory. The strategy is to synergize battery storage with solar PV (used to power electrolysers), to boost electrolyser utilization and thus, optimize green H2 production ecosystem. Reliance is aggressively pursuing acquisition routes to build a scale in Solar Energy. It has acquired REC Solar, NexWafe and Sterling & Wilson (S&W) to aid its solar PV module factory.

Advanced Energy Storage Battery

Reliance is pursuing acquisition routes in the case of advanced energy storage battery business also. It has invested in Faradion/Ambri Inc. Such companies will help build grid energy storage batteries. Faradion has identified/exploited the potential of sodium-ions in rechargeable batteries. Ambri makes calcium and antimony electrode-based cells as also containerized systems that are more economical than lithium-ion batteries. Such cells are meant to last for +20 years with minimal degradation.

Lithium Werks, founded in 2017, is a leading provider of cobalt free and high-performance Lithium Iron Phosphate (LFP) batteries. The management of Lithium Werks will bring over 30 years of battery expertise and nearly 200 MWh annual production capacity including coating, cell and custom module manufacturing capability to Reliance.

Reliance’s grid battery acquisitions (Faradion, sodium-ion based and Ambri, calcium based) claim superior tech than existing lithium-ion/lead-acid battery tech, longer life (~20 years), cheaper raw material and meagre China dependence for raw material. Thus, Reliance may not only source cheapest grid battery tech, but also evade China-centric raw material risk. Sodium/calcium are commonly available commodities, globally.

Green Energy Investments

Reliance is targeting to become one of the largest producers of blue hydrogen globally, producing the zero-emission fuel at costs that will be half of the global average. Reliance will reportedly re-purpose a Rs.30,000 crore plant that currently converts petroleum coke into synthesis gas to produce blue hydrogen for $1.2-1.5 a kilogram. Reliance has a first mover advantage to establish a hydrogen ecosystem, with minimal incremental investment, in India.

Reliance and Denmark-based Stiesdal signed a cooperation agreement for technology development and manufacturing of Stiesdal’s HydroGen electrolyzers in India. Stiesdal PtX Technologies, an arm of Stiesdal, has developed an H2 technology, HydroGen, a new electrolysis system type that can convert RE electricity to green H2, at a cost cheaper than other available electrolysis technologies.

3) Foraying into Electronic Manufacturing

Reliance and Sanmina Corp have agreed to jointly make high-technology electronics hardware in India as the government offers incentives to boost domestic manufacturing. Reliance will hold a 50.1% equity stake in the joint venture with Sanmina owning the rest with an investment of Rs.1,670 crore. This JV will prioritize manufacturing high-technology infrastructure hardware for communications, including 5G networking, cloud infrastructure, hyperscale data centers, medical and healthcare systems, industrial and cleantech, and defense and aerospace.

In FY2021, India imported electronic products valued Rs.3.17 lakh crore and these imports have grown consistently from Rs.1.27 lakh crore in FY2011 to Rs.3.17 lakh crore in FY2022. With import bills of crude oil and edible oil and fertilizers shooting up substantially, there is a tremendous pressure for the government to minimize the import of electronic products. Therefore, the government would give maximum incentives possible to reduce import of electronic products. These products have got a scale also. Hence, Reliance is in a sweet spot to tap the Indian high-technology electronics infrastructure market and build a scale.

Evolution of Reliance Industries into “Reliance Economy” Over next Five Years!

Reliance has already proved its capability in building leadership positions in two large industries (telecom and retail) in the short span of time. Now e-commerce, new energy and electronic manufacturing also have a scale to offer and hence, they provide an opportunity to Reliance to build a large business size in India. Within the next 5 years itself Reliance could build a leadership position in these three new businesses as the existing business platforms have the potential to play a complimentary role in these new businesses.

Most importantly, Reliance’s balance sheet is ready to replicate what it achieved in the last 5 years in these new businesses over the next five years. Within 3 years, Reliance brought down its peak net debt level from Rs.1.82 lakh crore in September 2018 to a net cash of Rs.3,585 crore in September 2021 – a rare achievement in the Indian corporate history!

Reliance kicked off the process of reducing debt it took to fund telecom and petrochemical businesses by diluting ownership in the businesses, in favor of foreign players. On June 20, 2020, the company announced that it has become debt-free after it managed to raise Rs.1,68,818 crore in just 58 days.

Key Financials (Consolidated)

| Y/E March (Rs. crore) | FY2021 | FY2022 | FY2023E | FY2024E |

| Net Sales | 466,924 | 667,701 | 767,857 | 856,160 |

| Growth % | -21.9% | 43.0% | 15.0% | 11.5% |

| EBITDA | 79,922 | 110,171 | 121,321 | 132,705 |

| EBITDA Margin (%) | 17.1% | 16.5% | 15.8% | 15.5% |

| PAT | 49,128 | 59,408 | 68,753 | 77,854 |

| Growth % | 24.8% | 20.9% | 15.7% | 13.2% |

| EPS (Rs) | 76.23 | 87.85 | 101.68 | 115.13 |

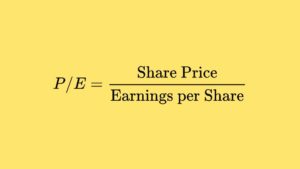

| PE (x) | 33.3 | 28.9 | 24.9 | 22.0 |

Source: BSE, Equinomics;

Outlook and Valuation

We expect Reliance to continue to grow significantly already well-established three core businesses viz., oil & gas related business, mobile telecom and retail over the year. We firmly believe that Reliance would succeed in building a scale in three new businesses viz., e-commerce, new energy and electronic manufacturing over the next 5 years. These new initiatives should lead to substantial build up in its revenues and profits over the next 5 years, in our view.

Our Observations

- We expect Reliance to grow its EPS consistently to Rs.200/ over the next 5 years i.e., by FY2027.

- It is worth noting that Reliance has more than doubled its consolidated net profit in the last 5 years. By evolving itself into a mini economy over the next 5 years, we firmly believe that Reliance could once again more than double its net profit by FY2027.

- Hence, we expect a market price of Rs.5,000 per share in FY2026 – this is based on the rationale that FY2027 estimated EPS of Rs.200/ would be discounted by the market in FY2026 itself at a PE ratio of 25.

- We believe that the profit contributions from the oil and gas related business segment in the total company’s consolidated PBIT, which stands at 55% in FY2022, will come down to less than 25% by FY2027.

- Dominance of new businesses in the total profit contribution would augur well for the substantial upgrade in its valuation multiple by the markets in the future.

- However, we maintain a medium term (with one-year investment horizon) price target for Reliance at Rs.2,925/, which is 25.4x FY2024E EPS of Rs.115.13/.

Key Risks: Any possible further steep jump in inflation rates or any severe global / domestic deflationary conditions or any possible war in the Asia region could be possible risk factors for the stock in the medium to long-term term.

Disclosure: I, G. Chokkalingam and my dependents and Equinomics do not hold shares Reliance Industries Ltd.