Jitendra Kapoor was a happy and carefree retiree enjoying his second inning. He was healthy with no responsibilities otherwise. Only regret he had was that his retirement corpus invested in bank fixed deposits were not earning him enough to beat high inflation. He was worried that he may outlive his retirement corpus.

Nevertheless, one of his morning walk friend gave him unsolicited investment advice of investing in stocks instead of keeping it in fixed deposit. His first reaction was that stocks are too risky and are very volatile. Nonetheless, his friend gave him list of 10 companies that paid high dividend last year, which was above the return provided by bank fixed deposits. Add to this the potential of capital appreciation. This was music to the ear of Jitendra, as it was best of both worlds. So he withdrew most of his investment out of bank fixed deposit and equally invested in top five companies shared by his friend, based on their dividend yield.

METHODOLOGYWe started with companies with dividend yield of greater than 4 per cent. After that we checked their consistency. They should have paid continuous dividend in last five years. Dividend payout ratio should be less than 100% of profits earned. Earnings growth of these companies should be greater than 10 % in last three, five or seven years. From the final list we selected five companies based on other qualitative factors.

First few years he received dividend as expected and he took pride in his decision. But soon he started to receive lower dividend by couple of companies and some almost stopped paying dividend. To his dismay he saw share price of these companies also declining leading to capital loss. Few calls to his friends and he realized that companies are not obligated to pay dividend and there are also restrictions on companies on paying dividend.

There are many such investors who might share the experience of Jitendra. Hence, it is important to keep various factors before investing in high dividend yielding companies. There are various metrics that should be used to evaluate them. While high dividend yield stocks are not bad, high yields can be the result of a stock’s price falling due to the risk of the dividend being cut. That’s called a dividend yield trap.

Here are some steps you can take to avoid falling for a yield trap:

- Use the payout ratios to gauge a dividend’s sustainability.

- Use a company’s dividend history — of both payout growth and yield — as a guide.

- Study the balance sheet, including debt, cash, and other assets and liabilities.

Consider the company and industry itself. Is the company’s business at risk from competitors, weak demand, or some other disruption?

Should You Invest in Dividend Stocks Now?

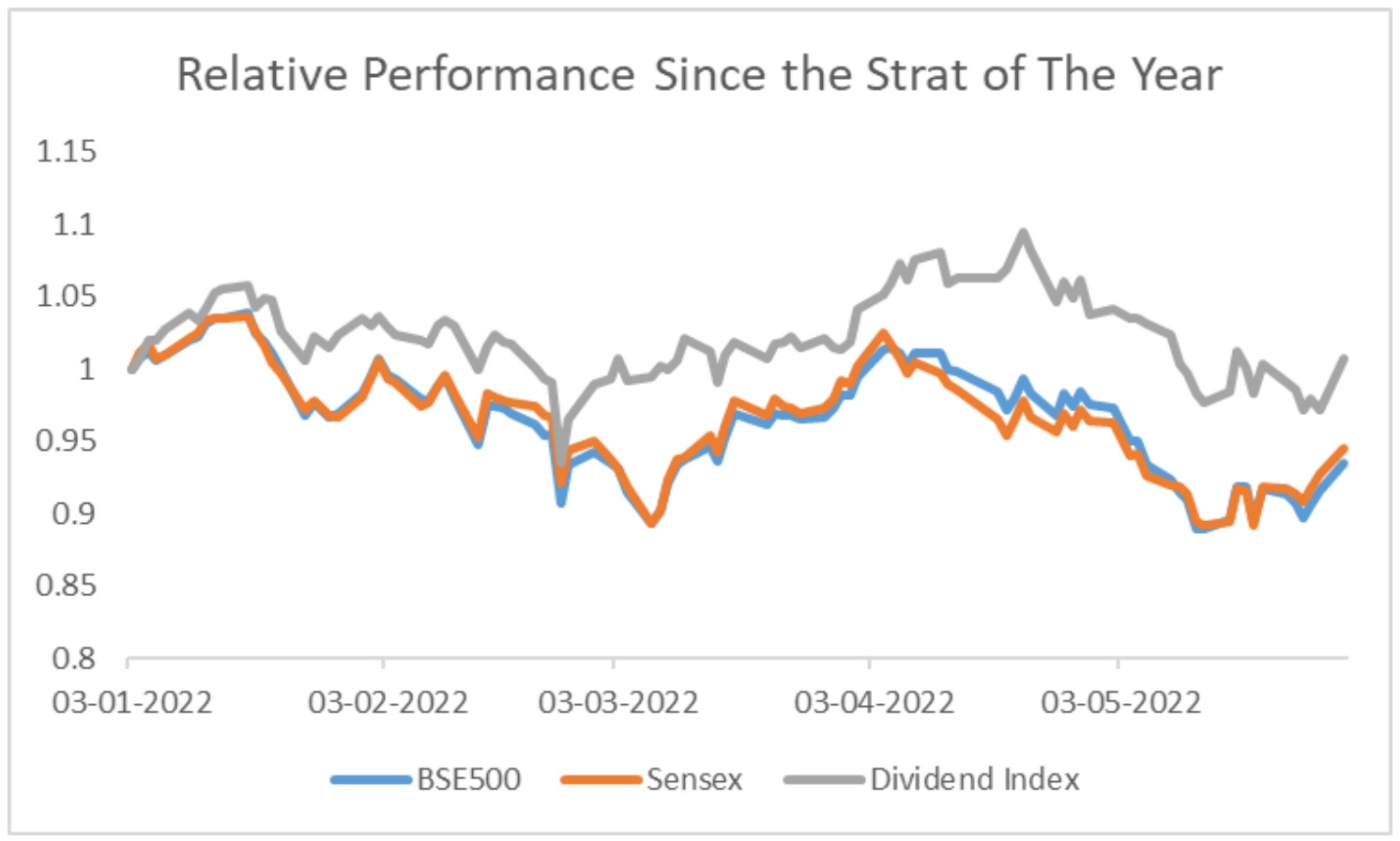

Since the start of the year we are witnessing heightened volatility in the market with negative bias. BSE Sensex and BSE 500 are down by 3.9 % and 5.2% respectively since the start of year. In the same time, S&P BSE Dividend Stability Index, which is designed to measure the performance of the companies from S&P BSE Large Cap, that have followed a policy of increasing or stable dividend income for at least 7 out of 9 years, has remained in a positive territory. Dividend stocks, especially those in companies that consistently increase their dividends, have historically outperformed the market with less volatility. Because of that, dividend stocks are a great fit for any portfolio as they can help you build a diversified portfolio.

It is not unusual to see a fall in stock price getting arrested owing to high dividend yield that stock has to offer. During the downturn of the market, investors look for companies that give better dividend yield as they get solace in the dividend they receive. This pushes their prices higher. Hence, in a falling market you see such stocks outperforming other. The high dividend paying companies are often matured businesses and do not fall in the growth category of stocks. These companies have lower capex requirement with predictable cash flows. This allows them to have generous payout. In a volatile market these factors give stability to share price and hence such companies do better during the market downturn. Therefore, it makes sense to invest in such companies now.

In the following paragraphs we have handpicked five high dividend yielding companies from both PSU and Private sector. Investors can chose to invest in 2-3 stocks based on their risk appetite and their existing portfolio.

If you’re reading this on mobile apps, please click here to read

Coal India Limited

Coal India Limited (CIL) is a holding company, which is engaged in the production and sale of coal. The Company offers products, including Coking Coal, Semi Coking Coal, Non-Coking Coal, Washed and Beneficiated Coal, Middlings, Rejects, Coal Fines/Coke Fines, and Tar/Heavy Oil/Light Oil/Soft Pitch. CIL operates through approximately 82 mining areas spread over eight states.

CIL is the world’s largest coal mining company with a FY23 target of 700mt of production and dispatch. The company is steadily closing its non-profitable, manpower intensive underground mines, while opening mega open cast mines where mining is through large mechanized operations. In addition, the company also plans to diversify into non-coal businesses, likely setting up solar parks, coal to gas, fertilizer, among other businesses.

CIL had registered a strong e-auction premium from November’21 to March’22. However, it lagged volumes in Apr ’22, given the pressure to increase supplies to the Power sector. With the onset of the monsoon, demand for coal from the Power sector is likely to reduce. However, demand from the non-Power sector is unlikely to diminish, given the strong global prices. This should result in higher volumes for the non-regulatory sector (NRS) in coming months.

The strong demand for coal in the international market is ultimately likely to translate into a higher e-auction premium. Currently, the e-auction volumes have been lower than the normal run-rate due to strong demand from the fuel supply agreements (FSA) segment. Once the incremental demand wanes, we believe CIL will be able to sell more coal in e-auction.

At CMP, the stock offers an attractive dividend yield of 11% with a DPS of Rs 22.5 per share.

ICICI Securities Limited

ICICI Securities (ISEC) offers a range of financial services including brokerage, financial product distribution and investment banking and focuses on both retail and institutional clients. The Company’s segments includes: Broking and commission, which consists of its equity, currency and derivative brokerage services, the distribution of third-party products, research, and fees from financial planning/education, Advisory services, which consists of equity capital markets services and financial advisory services that cater to corporate clients, the government and financial sponsors, Investment and trading, which consists of treasury and proprietary trading activities.

ISEC reported its Q4FY22 numbers, which missed the consensus estimates mainly owing to lower brokerage income driven by weak market sentiments arising from the geopolitical tensions. Nonetheless, the momentum on the client addition has been strong for the quarter on yearly basis. The digital sourcing and open architecture approach continue to aid new customer sourcing with 80% of new customer additions coming from non-ICICI Bank channels against 69% in Q4FY21.

The age group of the company’s customer base has also shifted with ~66% of customers being less than 30 years vs 62% YoY. This gives ISEC the opportunity to partner with them in their financial journey. Currently, 40% of the revenues are generated by this category of customers. The company’s revenue stood at Rs 892 crore for the quarter ended March 2022, which is 21% above last year same quarter. However, healthy growth in the distribution business revenues supported revenue growth. Company’s cost to income ratio inched up to 49% owing to higher marketing costs and technology investments. The company’s EBITDA stood at Rs 563 core up by 16 YoY. PAT stood at Rs 329 crore up by 3% YoY.

The company’s share price is offering dividend yield of 5.52 per cent.

Power Finance Corporation

Power Finance Corporation, only ‘Maharatna’ in financial space is primarily engaged in providing financial assistance to the power sector. The Company’s fund-based products include project term loans, lease financing for the purchase of equipment, short/medium-term loan to equipment manufacturers, corporate loan, among others. The Company also offers consultancy and advisory services in financial, regulatory and capacity building. Its subsidiaries include REC Limited and PFC Consulting Ltd.

The company has reported total income of Rs 18873.55 crore during the period ended March 31, 2022 as compared to Rs 19215 crore during the period ended December 31, 2021and Rs.18155.14 crore during the period ended March 31, 2021. In terms of bottomline, company posted net profit of Rs. 3205.88 crore for the period ended March 31, 2022 as against net profit of Rs. 3580.26 crore for the period ended December 31, 2021 and Rs.2921.87 crore for the period ended March 31, 2021.

Recently PFC announced that its wholly owned subsidiary, PFC Consulting has incorporated three wholly owned subsidiaries (SPVs) Siot Transmission (for creation of 400/200 kV, 2x 315 MVA S/S at Siot, Jammu & Kashmir), Fatehgarh III Beawer Transmission (For development of transmission system for evacuation of power from REZ in Rajasthan (20 GW) under Phase III Part G) and Beawer Dausa Transmission (For development of transmission system for evacuation of power from REZ in Rajasthan (20 GW) under Phase III Part H).

PFC, has been a consistent dividend paying company. Last financial year (FY22) company paid total of Rs 10.

At current market price, the dividend yield comes to around nine per cent, which is better than the interest earned in the best of the fixed deposits.

Polyplex Corporation

Polyplex Corporation is a holding company engaged into manufacturer of thin polyester terephthalate (PET) films. The Company has the 6th largest capacity of polyester thin (PET) film globally. It manufactures plastic films and resins. Its business portfolio includes biaxially oriented polypropylene (BOPP) films and cast polypropylene (CPP) films. Its geographical segments include India and Outside India. The company has large international presence with 6 manufacturing & distribution operation facilities spread across countries like India, Indonesia, Thailand, Turkey, USA, and Netherlands, with total base film capacity of 3, 81,837 MT per annum and delivering its products to more than 80 countries.

The Company’s shareholder includes some of the prominent HNIs name such as Dolly Khanna’s. The shareholding of foreign institutional investors (FII) grew from 9.29 per cent to 10.23 per cent in the latest quarter and the total number of FIIs grief from 110 to 131.

The company has reported total income of Rs 1947.04 crore during the period ended March 31, 2022 as compared to Rs.1351.43 crore during the period ended March 31, 2021. The company has posted net profit / (loss) of Rs 185.78 crore for the period ended March 31, 2022 as against net profit / (loss) of Rs. Rs.125.32 crore for the period ended March 31, 2021. The increasing prices in natural gas and crude oil haven’t affected the margins of Polyplex Corp. In fact, their margins have grown from 14 per cent to 16 per cent in tandem with increasing prices of raw materials used.

The Company has been consistently paying dividend since 2008 and despite its share price quoting above Rs 2500 comes to four per cent.

Swaraj Engines

Swaraj Engines is primarily engaged in the business of diesel engines, diesel engine components and spare parts. It manufactures diesel engines for fitment into Swaraj tractors, which are manufactured by Mahindra & Mahindra Ltd. (M&M). It supplies diesel engines in the range of approximately 22 horsepower (HP) to 65 HP. It is also manufacturing hi-tech engine components. The Company has supplied approximately 1.2 million engines for fitment into Swaraj tractors.

Net operating revenue of company grew by 15% yoy in FY22 and crossed the Rs1,000 crore mark for the first time and stood at Rs1,138.15 crore as compared to Rs 986.57 crore for the last year. The company’s net operating revenue for Q4FY22 declines 20.52% yoy at Rs242.35 crore as compared to Rs304.91 crore in Q4FY21. The commodity prices witnessed further hikes during the quarter and the impact was mitigated to the extent possible by aggressively focusing on operational efficiencies.

PAT during the quarter under review witnessed a drop of 33% yoy at Rs21.86 crore as compared to Rs32.56 crore in the previous corresponding quarter. PAT for FY22 grew by 18% yoy to reach Rs109.47 crore as compared to PAT of Rs92.54 crores during the previous year. – The highest ever net profit for any financial year.

The Board, while approving the annual accounts, has recommended an equity dividend of 800% at Rs80 per share for the financial year ended March 31, 2022 – the highest ever dividend, both in terms of per share and absolute payout.

This debt free company comes with a dividend yield of greater than five per cent.

Dividend yield and other key metrics to look forDividend Yield: This is the annualized dividend represented as a percentage of the stock price. For instance, if a company pays Rs 100 in annualized dividends (including interim and final) and the stock costs Rs 2000 per share, then the dividend yield would be 5%. Yield is useful as a valuation metric when you compare a stock’s current yield to its historical levels. A higher-dividend yield is better, all other things being equal, but a company’s ability to maintain the dividend payout — and, ideally, increase it — matters even more. However, an abnormally high dividend yield could be a red flag.Dividend Payout Ratio: This is the dividend as a percentage of a company’s earnings. If a company earns Rs 1 per share in net income and pays Rs 0.50-per-share dividend, then the payout ratio is 50%. In general terms, the lower the payout ratio, the more sustainable a dividend should be.Cash Dividend Payout Ratio: This is the dividend as a percentage of a company’s operating cash flows minus capital expenditures, or free cash flow. This metric is relevant because accounting net profit is not a cash measure, and various non-cash expenses can cause a company’s earnings and its free cash flow to vary significantly from one period to the next. This variability can render a company’s payout ratio misleading at times. Investors can use the cash dividend payout ratio, along with the simple payout ratio, to better understand a dividend’s sustainability.Total Return: This is the increase in stock price (known as capital gains) plus dividends paid. For example, if you pay Rs 100 for a stock that increases in value by Rs 10 and pays a Rs 5 dividend, then that Rs 150 you’ve gained is equivalent to a 15% total return.