Mutual fund has now become one of the most trusted investment vehicles by common investors. Thanks to the high decibel investment awareness programme by the industry body and a proactive regulator that has made MF product easy to understand and safe to invest. There is yet a lot to be done to truly democratise it.

Mutual fund investments are not for shorter duration. There may be a phases when the equity market and mutual funds dedicated to them may see a subdued performance, however, in longer run, mutual fund tend to give better returns. To have a better investment experience through mutual fund, an investor should understand the mutual fund, its types and most importantly how to select them. In the following paragraphs, we will try to cover most of these aspects that are important for you to make an informed decision on mutual fund investment.

There are various reasons why a novice investor should go through mutual fund to start his investment journey. Mutual fund helps in portfolio diversification, planning for financial goals, managing investment risk and many more.

Managed by Professionals

Mutual funds are managed by highly qualified and experienced fund managers who are trained to manage money. With their expertise, fund managers are able to manage portfolio risk quite efficiently. An individual might not have the same expertise as fund manager, even if has, he might be lacking the infrastructure and time to manage his investments in a proficient way.

Diversification

As goes the adage, “never put all your eggs in one basket”, similarly, parking all your money in single asset or security is a way to risk your wealth. Spreading your investment across assets or securities is diversification. There are two types of diversifications – diversification across assets and diversification across securities. Mutual funds offer both. Mutual funds not just diversify across stocks or bonds; there are funds like hybrid funds and multi asset allocation funds that diversify across asset classes. Therefore, in terms of diversification, nothing beats mutual funds.

Ease of investing

Mutual funds are quite easy to get started with. You can invest in mutual funds with few clicks. The only thing that you require is PAN Card and you must be KYC verified. You don’t even require to have a Demat account to invest in mutual funds.

Well Regulated

Mutual fund in India is regulated by Securities and Exchange Board of India (SEBI). In the year 1996, SEBI came up with Mutual Fund Regulation. Further, SEBI has been quite active in protecting investor’s interest.

How to select a Mutual Fund Scheme

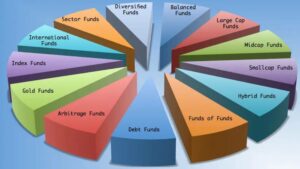

When it comes to mutual fund investment, an investor is lost by number of options that he has. There are different categories of mutual fund and within this broader category there are sub-categories (Types of Mutual Funds). For new investor it becomes difficult to go through the myriad of options to select the right fund for him.

Types of Mutual Funds

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution Oriented Schemes

- Other Schemes