Myth: Mutual funds are only for the long term

Fact: Mutual funds are available in all duration including short term, medium term and long term

You can invest in mutual fund with various durations and one can invest according to his need, be it short term, medium term or long term. While liquid and short-term debt funds are suitable for short and medium-term requirements, equity funds can be used for your long-term needs.

Myth: One needs a large sum to invest in mutual funds

Fact: You could start investment with amount as low as Rs 500 every month

It is common perception among a large section of investors that they need a huge amount of money to invest in mutual funds. In reality, you can invest as low as Rs 500 per month via systematic investment plan (SIP) and Rs 5,000 through lump sum mode.

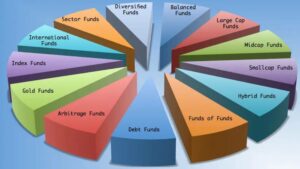

Myth: Mutual fund invests only in equity market

Fact: Mutual fund invests even in government securities, bonds, and other fixed income securities

There are various categories of mutual funds including equity, debt and hybrid. You can invest in them according to your need and risk appetite. So if you are a risk-averse investor, you may opt for a debt fund which invests in Government Securities, Bonds and other fixed income instruments. There are even mutual funds that invest in gold. All mutual funds do not invest in equity markets and you can choose a fund keeping in mind your risk appetite and financial goal.

Myth: Mutual Fund investment is risk-free

Fact: Investment in mutual fund involves various risk including market risk, liquidity risk etc.

Many investors believe that mutual fund investment is risk free. Nevertheless, experience of last year shows that risk is involved while investing in MF even in debt funds. Some of the most common risk associated while investing in MF is market risk, concentration risk, credit risk, liquidity risk etc. These risks can adversely impact your returns.

Myth: You need a Dematerialised Account to invest in Mutual Funds

Fact: Except for ETF, you do not need Demat Account to invest in mutual funds

There is absolutely no need to have a Dematerialised Account to invest in mutual funds. It is purely optional if you want to receive your units in physical statement or in a Dematerialised form. Nonetheless, if you want to invest in exchange traded funds (ETFs), you need to have a Demat Account as ETF is held in a Demat Account. For all other schemes including closed ended funds and other listed firms you do not need to have a Demat Account.

Myth: MF schemes with lower NAV are cheaper and hence likely to generate better returns

Fact: There is no relation between NAV and future returns of MF schemes

Another common myth among various investors is that MF schemes with lower NAVs are cheaper and are going to generate better returns going ahead. Their assumption is that the chances of a NAV moving from Rs 10 to Rs 12 that is moving up by 20% is greater than a fund’s NAV moving up from Rs 1000 to Rs 1200. The realty, however, is that NAV of a scheme is nothing but weighted aggregation of the market value of the underlying shares held by the fund on any day.

Myth: Always buy a top rated fund that will give you better returns

Fact: Rating of MF scheme depends upon their past performance, which does not guarantees future returns

The ratings of the fund are very dynamic and a fund which is top rated this year may not maintain its numero uno position next year. These ratings are reflection of fund’s past performance, which may not continue in future. Hence, your investment should be guided by your risk appetite and overall financial goals rather than ratings alone.