Investors keep on looking for sectors and companies that will help them to outperform the broader equity market. One of the sector with some of the robust companies that comfortably can beat the performance of BSE 500 is Gas sector.

A series of regulatory changes, better economic growth accompanied with consistent focus on climatic changes will act as perfect tailwind for Gas Stocks in short term and long term.

This is exemplified by share price movements of some companies, for example share price of Mahanagar Gas Ltd. is up by 27 per cent in last one year ending March 31, 2023, compared to negative return of 2 per cent by BSE 500 in the same period. Even a PSU company like GAIL was able to outperform BSE 500 by seven per cent in last one year.

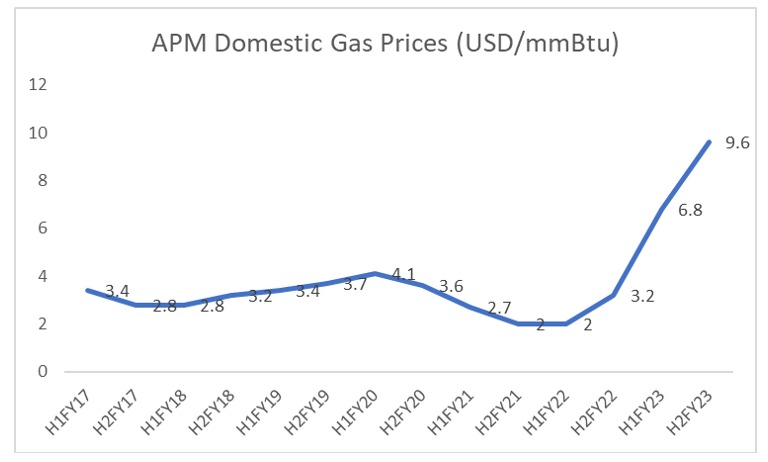

In last one year, when most of the sectors were struggling to generate alpha, gas sectors stocks are the one that standout in their performance. They remain favourable in short as well as in long run. Recently, there was some volatility in stock prices, we believe it was temporary in nature. The fall happened, because an expected yet much-awaited announcement by the government, didn’t happen in time. On Friday (March 31, 2023), the government said that it will provisionally keep the price of locally produced gas from old fields at USD 8.57 per million metric British thermal units (mmBtu). In fact domestic gas prices were to undergo a revision. It was to be implemented on First April 2023, based on the report submitted to the government by a committee led by Kirit Parikh.

Now, the Cabinet has implemented the committee report and gas stocks are once again rising.

The Cabinet Committee on Economic Affairs (CCEA) on Thursday (April 6, 2023) approved the revised domestic natural gas pricing guidelines for gas produced from nomination fields of state-run ONGC and OIL, New Exploration Licensing Policy (NELP) blocks and pre-NELP blocks, where Production Sharing Contract (PSC) provides for government’s approval of prices.

The price of such natural gas shall be 10 per cent of the monthly average of Indian crude basket and shall be notified on a monthly basis. For the gas produced by ONGC and Oil India from their nomination blocks, Administered Price Mechanism (APM), price shall be subject to a floor and a ceiling. Gas produced from new wells or well interventions in the nomination fields of ONGC and OIL, would be allowed a premium of 20 per cent over the APM price. Floor and ceiling price to go up by 25 cents per year after two years.

The new guidelines are intended to ensure a stable pricing regime for domestic gas consumers while at the same time providing adequate protection to producers from adverse market fluctuation with incentives for enhancing production. Customarily the government bi-annually fixes prices of domestically produced natural gas, which is converted into CNG for use in automobiles, piped to household kitchens for cooking and used to generate electricity and make fertilisers.

Last year’s geopolitical tension led to rates of locally produced gas climbing to record levels – USD 8.57 per million British thermal unit (MmBtu) for gas from legacy or old fields and USD 12.46 per mmBtu for gas from difficult fields. Now as it has been revised it will lead to greater stability in input gas prices for city gas distributors. While the floor price of USD 4/mmBtu will mean they will not be able to benefit from very low international gas prices, as witnessed during 2016-21, they will be insulated from the very high gas prices – as was seen in 2015 and since 2022

Factors That Give Bright Outlook of Gas Sector

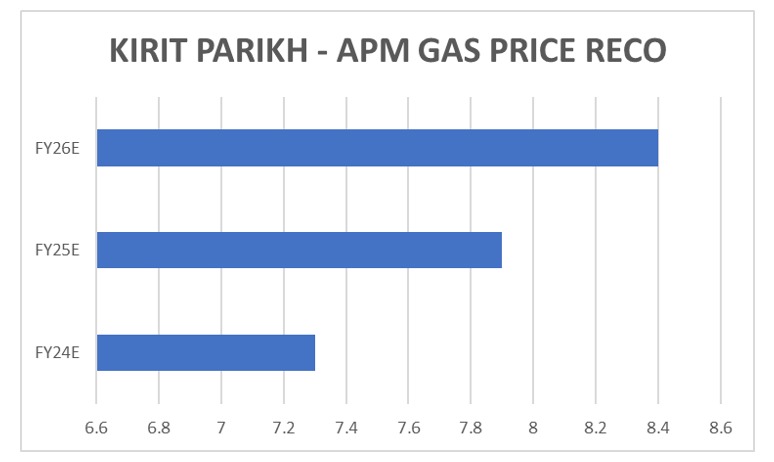

Kirit Parikh Committee (KPC) Recommendations to Reduce Domestic Gas Costs for Priority Sector

City gas distributors could reduce prices of compressed natural gas (CNG), used by vehicles, and piped natural gas (PNG), used by homes, by 9-11%, with the government accepting the key recommendations of the Kirit Parikh Committee. Had the previous pricing regime continued, prices would have likely risen. This revised gas pricing norms would lend greater stability to gas prices for city gas distributors and sustained competitiveness with alternative fuels, thus driving demand and supporting massive capex plans.

We believe lower sourcing costs that is Rs 6-8 per scm to benefit the City Gas Distribution (CGDs) on the margin front to an extent and rest be passed onto to customers.

Current domestic gas price for the old fields stands at USD8.57/mmbtu, which were revised from USD 6.1/mmbtu on October 1, 2022. This led to an increase in gas sourcing cost of Indraprastha Gas Ltd. (IGL), Mahanagar Gas Ltd. (MGL), and Gujarat Gas and impacted their margins. Although these companies have taken price hikes, they aren’t sufficient to pass on the increase in gas costs. As the Kirit Parikh Committee recommendation are adopted and prices get revised to USD 6.5/mmbtu, the gas sourcing costs for CGDs would decline by USD2/mmbtu. This would improve their margins and would also likely lower the CNG and domestic PNG sales price.

It became more important currently as despite the recent softness, applicable weights for January-December have risen sharply. Unusually warm weather in most parts of Europe and weak demand in Asia have kept gas prices in check over December 2022 and February 2023. However, since the applicable period for domestic gas prices for April 2023 is January-December 2022 prices, the calculated price for H1FY24E comes to USD 13.1 per mmbtu while for H2 it may decline to USD 10.4 per mmbtu, which was substantially high from proposed Kirit Parikh Committee recommendation.

With APM prices now benchmarked to crude oil, it would ensure sustained competitiveness of CNG and residential PNG with alternative fuels such as petrol, diesel, and liquefied natural gas (LNG). The CNG discount over petrol and diesel, and residential PNG over LNG will increase to 25-40 per cent under the new regime from 20-35 per cent currently. This can accelerate and sustain adoption of city gas and support distributors that have planned capex of Rs 90,000 crore over the next 4-5 fiscals.

Gas from the old fields is sold to CGDs for the priority sector (CNG and domestic PNG) needs. Priority sector contributes around 80 per cent and 86 per cent to the volume mix of IGL and MGL, respectively. For Gujarat Gas, this is around 35%. Hence, Indraprastha Gas Ltd., and Mahanagar Gas Ltd. are likely to be benefitted to a greater extent if the price revision goes ahead as planned.

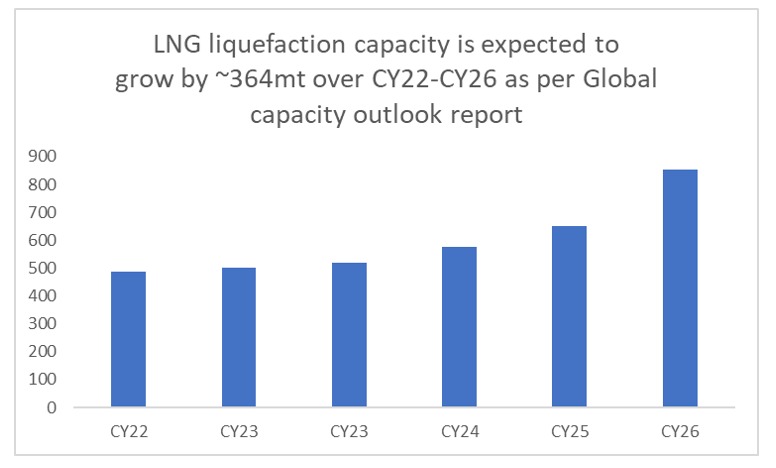

Rising Global Supplies

The ever changing geopolitical landscape has made a structural change in global economy. While the prospects for meaningful growth in LNG supplies in the next 12 months remain low, stronger pricing and meaningful changes in trade flows are driving a new wave of proposed capacity additions, specifically in the USA by CY26-27E.

New estimates of Bloomberg indicates a massive 200mt of new export capacity globally (50 per cent increase against CY22) by CY27E, which is a material positive for supply scenario. Higher supplies are likely to moderate and control the price rise of gas.

Rise in Indian Supplies

Indian domestic supplies can rise over CY24-26E, somewhat mitigating supply risks. Indian domestic oil and gas production has remained broadly stagnant over the last 5- 6 years and this has exacerbated the pressure on Indian sourcing costs, with LNG imports at 48 per cent of Indian gas consumption by FY22 vs 41 per cent in FY16. We believe post a long hiatus, upstream production will see an uptick over FY24-26E, with multiple developments of Reliance Industries Ltd., ONGC and Oil India likely to drive steady improvement over FY23-26E. In absolute terms that translates to 32kb/d of oil production increase and a material 20-22mmscmd of net production increase in gas over FY23-26E.

This will help insulate India from the relatively tight LNG supply environment over FY24-25E and also to keep overall gas costs under control.

Based on the above positive development we believe investors can now accumulate some of the gas stocks, discussed on the following pages, at lower price in a staggered manner.

- The APM formula is now revised and determined as a 10 per cent slope to crude oil prices, but with a floor and ceiling price of $4/mmBtu and $6.5/mmBtu, respectively.

- Basis last month’s average crude price at $78 per barrel, the ceiling price of $6.5/mmBtu will kick in, providing relief to city gas distributors.

- Structurally, the revised regime will lead to greater stability in input gas prices for city gas distributors.

Fuel Your Portfolio with These 6 Gas Stocks

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.