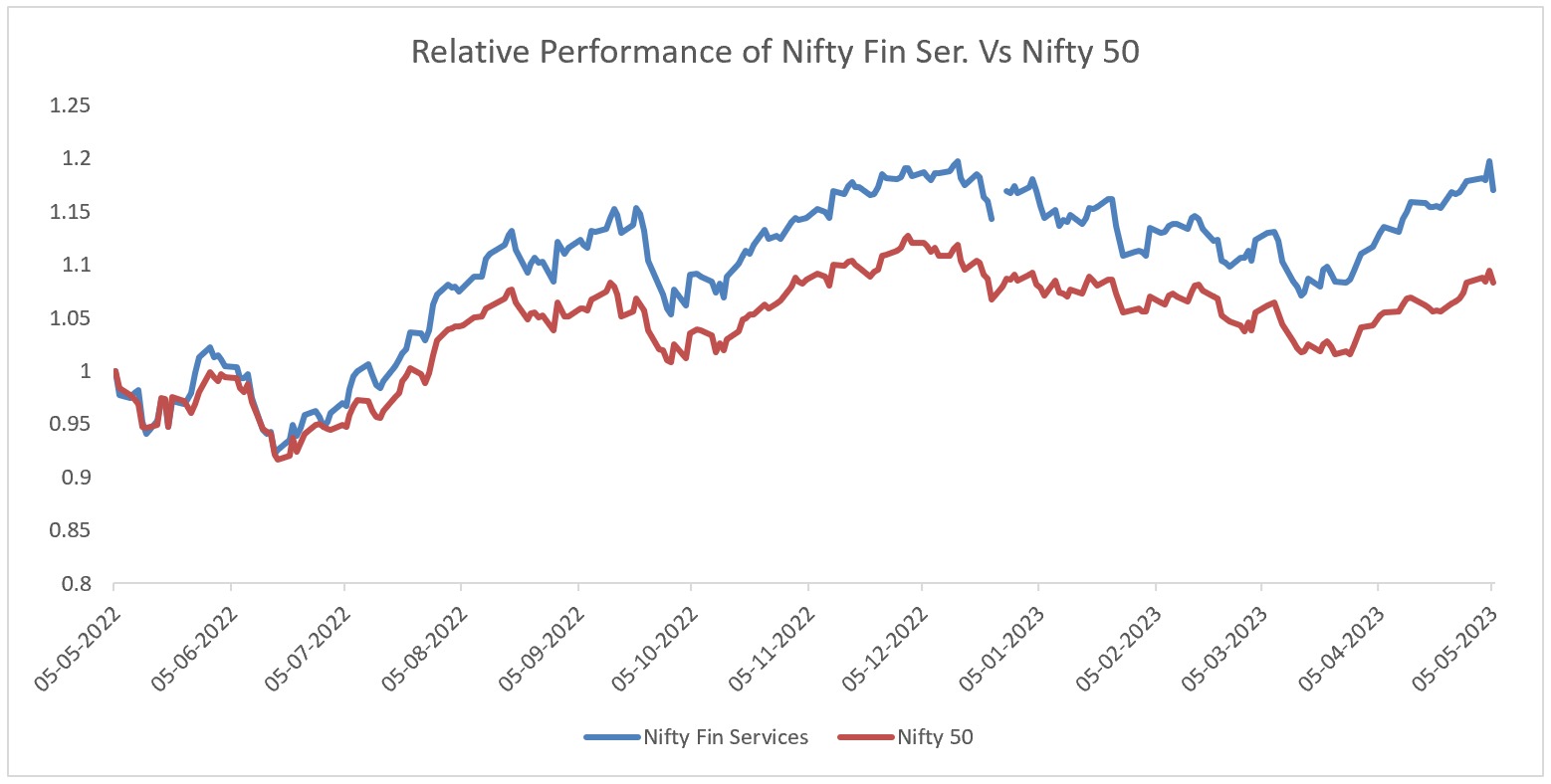

In a surprise move, after hiking repo rate by a cumulative 250 bps over the past year, the apex bank of India, decided to pause the rate hike in its last policy meeting. This has a positive spillover towards all the rate sensitive sectors including financial sector. This is clearly visible from the outperformance of Nifty Financial Services, which is constituted by banks and other financial companies, over Nifty 50. In last one year ending May 05, 2023 it has generated return of almost 17 per cent compared to just 8 per cent by Nifty 50. Even from the time when the rate pause was announced in the month of April, Nifty Fin Services index has outperformed Nifty 50 by 200 basis points.

NBFCs & Interest Rate

Even within the financial sector it was NBFCs that are likely to disproportionately benefit from the rate pause decision of the Reserve Bank of India. Shares of many companies from this sector are already trading at their 52-week high in last couple of weeks. NBFC have been under pressure in the last few quarters and its strain was felt on the net interest margins due to rising borrowing cost after the Reserve Bank of India move to hike the repo rate to fight against inflation. This had increased the cost of borrowing for NBFC who lack the low cost of deposits such as current account and savings account that a bank enjoys. Hence, they are likely to more benefit from Reserve Bank of India’s rate pause.

NBFCs are likely to benefit in a falling or plateau interest rate scenario for several reasons. First, a decrease in interest rates leads to lower borrowing costs for NBFCs, which can help them reduce their interest expense and increase their profitability. This, in turn, can help them offer loans at more attractive rates to customers and attract more business.

Second, in a low interest rate environment, investors tend to look for higher-yielding investments, which can make NBFCs an attractive investment option. This can lead to increased capital inflows for NBFCs, which can be used to expand their business and increase their loan portfolio.

Finally, falling interest rates can boost economic growth, which can lead to increased demand for loans from NBFCs. As economic activity picks up, more people are likely to seek loans for various purposes such as starting a business, buying a house or a car, or investing in the stock market. This is because NBFC’s have emerged as a principal institution in providing credit to the under-served in the economy. This is reflected in the rise in AUM of NBFC Industry that has jumped from Rs 17.7 trillion in 2016 to Rs 28.70 trillion in 2021.

Opportunities for NBFCs

There are numerous concerns and questions that many investors have about opportunities for NBFC sector given the banking sector’s fast credit growth, data accessibility, and their growth. Nevertheless, there is a lot of growth opportunities for NBFCs. To put things into perspective, the banking sector’s credit is currently around Rs. 140 lakh crores, with mortgages accounting for about Rs. 24-25 lakh crores, representing only one per cent of the overall mortgage market. In India, the mortgage to GDP ratio is only 11 per cent, which is 60 per cent, 70 per cent in many developing countries, and has been above 100 per cent in some developed countries like US indicating a significant lack of penetration in the mortgage market. In the last quarter, there has been a slowdown in affordable home loan demand due to the increase in interest rates and commodity prices. However, this is only a temporary phenomenon, and as interest rates decline, demand is expected to pick up again. NBFCs are likely to benefit out of it given the vast network of branches, there is significant untapped potential for growth.

Huge credit gap in the MSME Sector shall create opportunities for the business lending space. If you look at MSME sector, the MSME credit by banking sector is about Rs. 35 – 40 lakh crore to manufacturing, another Rs. 35 – 40 lakh crores for services. So, together, it’s Rs. 70 – 80 lakh crores. And still, everybody agrees from the government to banks to Reserve Bank that this credit in this sector is grossly under penetrated. So, again, there’s a long, long way for this industry to grow. And the size of business that NBFCs have in this segment is very insignificant compared to the potential.

Even gold loan and microfinance businesses primarily cater to MSME customers because they’re all small businesses and for income generating activity. Unorganized Gold loan segment presents immense opportunities for the organized players. Currently 35 per cent of the gold loan lending in India is done through the formal segment, whereas, 65 per cent is still served by the informal segment.

Is Pause a Pivot?

Most of the above trigger will act for NBFCs only if there is macro-economic stability interest rate scenario remains benign. We believe the Reserve Bank of India will remain on pause as long as inflation does not rise materially above its forecast. After hiking repo rate by a cumulative 250 bps over the past year, the central bank will watch the effects of these hikes on the domestic economy. The monetary policy typically impacts the real economy with a lag of 3-4 quarters. Hence, the rate hikes so far are expected to slow growth and moderate inflation this fiscal. The Reserve Bank of India is likely to respond by cutting rates towards the end of this fiscal.

Globally also major global central banks also seem to be close to the end of the rate hike cycle. S&P Global expects US Federal Reserve (Fed) rate peaking at 5.00-5.15 per cent and expects the Fed rate to be cut only from mid-2024. All this means that the phase of aggressive rate hikes may be behind us. Hence, we believe the current pause may convert as pivot.

Conclusion

The current state of macro stability is favorable and better than ever before. Inflation seems to have peaked out, and as a result, the interest rate has also peaked out, which was evident in the last policy. If the monsoon is good, it is expected that the rural demand will pick up. The GDP growth may hover around 6.5% to 7 per cent.

Although India’s potential is much higher, in today’s world, India is in a favorable position. The external environment and politics are stable, and the economy is performing well. With inflation and interest rates peaking out, the outlook for the economy and especially NBFCs, appears to be positive and optimistic.

In the following article, we have handpicked seven NBFCs that are expected to give you better return going ahead.

7 NBFC Stocks to Buy

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.