RBI Keeps Repo Rate Unchanged

The Reserve Bank of India’s Monetary Policy Committee has decided to keep the policy repo rate unchanged at 6.5 per cent. The six-member committee voted

The Reserve Bank of India’s Monetary Policy Committee has decided to keep the policy repo rate unchanged at 6.5 per cent. The six-member committee voted

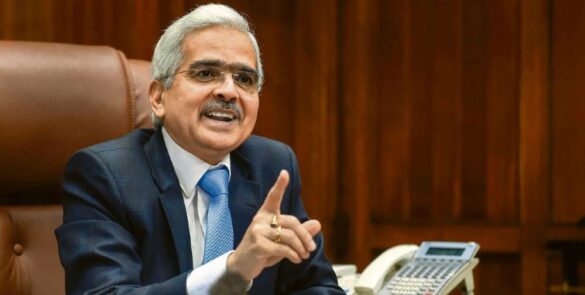

Indian economy should record a growth rate of 7 per cent in the next fiscal and inflation is likely to ease further, RBI Governor Shaktikanta

RBI has maintained the status quo again as its six-member Monetary Policy Committee (MPC) has kept the key lending rate — repo rate unchanged at

The Reserve Bank of India will present its third bi-monthly monetary policy for FY22 on Friday, 8 October 2021. Since March 2020, RBI has reduced

Recently Reserve Bank of India has unpacked many measures to enhance fund flow to the healthcare sector and to inject more liquidity into the system,

The role and significance of the Non-Banking Financial Company – Micro Finance Institutions (NBFC-MFIs) has been increasing over time. As of the end of September

The government has indicated that it will soon introduce a Bill in Parliament that will explicitly ban private cryptocurrencies such as bitcoin. The Bill will

With unemployment rates going through the roof, there has been a phenomenal crash in demand. In such a scenario, focusing almost solely on liquidity measures can be only as good as applying some plaster. Only time will tell, but it does make one wonder whether, without demand being stimulated, these policies will ever be enough.

The Central Bank’s framework to constrict inspection of large NBFCs is crucial for fiscal steadiness. The shift from a common line of light touch control to one that screens larger players almost as closely as it does banks is a welcome move. This could be the biggest refurbishment of the governing structure for such finance companies or shadow banks in over twenty years if executed effectively.

SBI Research has revised its projection. Now it says the contraction forecast for the current fiscal year in GDP growth is expected to be 7%.

The Finance Ministry’s monthly report released recently states that the Indian economy is estimated to contract 7.7 percent in the current financial year, mainly due

The Reserve Bank of India’s Monetary Policy Committee has voted unanimously to keep the policy rate unchanged at 4%. In its first post-budget meet, the