In a resounding response to our planet’s escalating environmental imperatives and a sharpened comprehension of finite resources, the financial landscape is undergoing a transformative upheaval. Amid the cacophony of global challenges, the clarion call of the circular economy resonates, commanding attention not just from conscientious consumers but from the very core of the financial realm. This paradigm shift, where circularity reigns supreme, is not just a moral imperative—it’s an unprecedented financial opportunity.

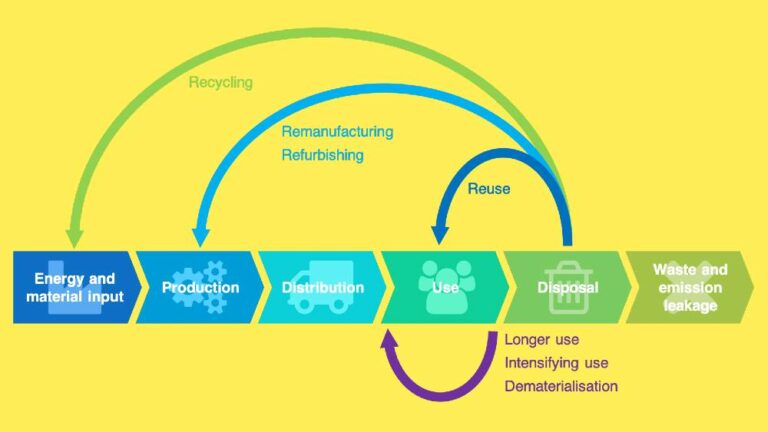

Once tethered to the linear “take-make-dispose” model, the traditional narrative of economic growth is giving way to an epoch-defining realization: the linear path is unsustainable. It’s not a mere shift. It’s an irrevocable departure from convention, an embrace of circularity that transcends ethical considerations to embrace a new frontier of financial possibility.

The circular economy, with its reusability, regeneration, and waste minimization principles, injects a dynamic vibrancy into the financial industry and is rewiring the financial DNA.

Amid the swells of concern for environmental sustainability, the financial sector is recalibrating its role from mere fund allocator to a proactive change agent. Circular investments, a nascent yet rapidly burgeoning territory, are rewriting the financial DNA. The rules of engagement are changing as stakeholders recognize that financial portfolios can encompass not just profit but significant social and environmental impact.

The appeal is multifaceted. Circular investments, characterized by their focus on resource efficiency, recycling, and reducing waste, are presenting an avenue where monetary returns intertwine with tangible contributions to the global ecological equilibrium. It’s no longer a trade-off; it’s a marriage of monetary prudence and ecological stewardship.

Often seen as a harbinger of risk mitigation, the financial industry is navigating this brave new circular frontier with a calculated vision. While risks are palpable, from market acceptance of circular products to the regulatory winds of change, these challenges are being transformed into the crucibles of innovation. Financial institutions, renowned for their risk assessment expertise, are tapping into their analytical acumen to evaluate the feasibility of circular projects, thereby minimizing potential setbacks.

Moreover, regulatory transformations are gaining momentum.

Governments, attuned to the urgency of the circular shift, are crafting supportive frameworks that incentivize circular practices. These alliances between financial institutions and governmental bodies exemplify a rare unity—a convergence where economic evolution dovetails harmoniously with environmental aspirations.

The heart of these collaborations beats in empowering the communities most vulnerable to the ramifications of unsustainable practices. Instead of treating these communities as passive beneficiaries, these collaborative circular initiatives cast them as active partners in the journey of change. Corporate giants, harnessing their resources and expertise, play a pivotal role in catalyzing local transformation.

Imagine an alliance between a consortium of companies and a visionary local government in an area besieged by pollution and waste mismanagement. Together, they propel initiatives that not only cleanse the environment but also offer training and employment in circular industries to those who have long been marginalized. This isn’t a mere act of charity; it’s a demonstration of corporate power aligned with community resurgence. Yet, the symphony doesn’t confine itself to local crescendos. Collaborative partnerships cast a wide global net. International financial institutions are now teaming up with intergovernmental organizations and transcontinental NGOs, funneling funds into projects of sweeping significance.

The circular economy’s ascendancy is catalyzing a seismic transformation. Collaborative investment initiatives have assumed a pivotal role in shaping this evolution. Beyond forging sustainable models and investments, these collaborations chart a trajectory toward a more resilient, resource-efficient, and ecologically attuned future.

While these collaborative efforts mark a momentous stride toward a circular economy, the journey is far from over. As we forge ahead, we beckon individuals, corporations, and governments to deepen their involvement in these transformative initiatives. The grandeur of a sustainable, circular world is within reach—capturing it demands the steadfast commitment of all stakeholders involved. Through collaboration and dedication, we can pave the way to a brighter, more regenerative future that echoes across generations. This transformation, driven by collaborative circular initiatives, encompasses not only the financial sphere but our collective commitment to a harmonious existence with our planet. As financial giants, governments, and NGOs unite in a symphony of sustainability, the promise of a circular future grows stronger, one investment at a time.