Mutual Funds for New Investors

There are so many aspects that you need to consider before investing in mutual funds. New investors may start with a mutual fund advisor to

There are so many aspects that you need to consider before investing in mutual funds. New investors may start with a mutual fund advisor to

Mutual funds have wide variety of schemes that suit almost all types of individuals under various risk categories. So, if you are a conservative risk

Once you are aware of different type of mutual fund products you can select the best that suits you in terms of risk and return.

Myth: Mutual funds are only for the long term Fact: Mutual funds are available in all duration including short term, medium term and long term

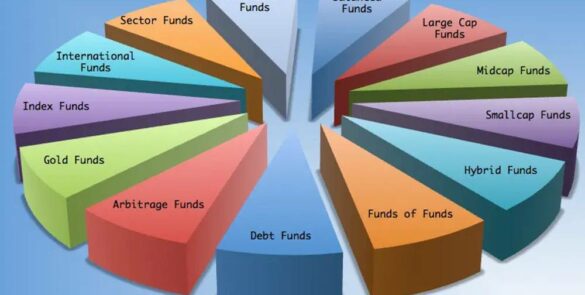

SEBI (Securities and Exchange Board of India) has categorized mutual funds into 5 main categories viz. equity schemes, debt schemes, hybrid schemes, solution oriented schemes

Mutual fund has now become one of the most trusted investment vehicles by common investors. Thanks to the high decibel investment awareness programme by the

Inflows into equity mutual funds in June was much lower compared to the net inflow of Rs 18,529 crore seen in May, data from the

Mutual funds offer wide variety of schemes in order to meet the needs and goals of the investors. Investors willing to invest in equity can

The Indian Mutual Fund industry saw an exceptional performance in last year and almost all categories and funds performed. This year investors need to be cautious while selecting funds.

There are different types of equity mutual fund schemes and each offers a different type of underlying portfolio that has different levels of market risk.

A lot has been written on the importance of evaluating risk and returns of mutual fund investments. Nevertheless, there are other factors beyond this that

There are thousands of funds to choose from, scattered among dozens of investment categories. How can investors find the best funds that fit their needs, goals, and risk tolerance?