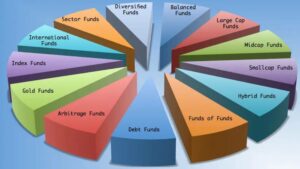

There are different types of equity mutual fund schemes and each offers a different type of underlying portfolio that has different levels of market risk.

Equity mutual funds are known for their high-return potential but also carry a high risk. These funds are divided into categories based on market capitalisations, investment strategies and tax benefits. An equity fund is a mutual fund scheme that invests predominantly in equity stocks.

In the Indian context, as per current SEBI Mutual Fund Regulations, an equity mutual fund scheme must invest at least 65% of the scheme’s assets in equities and equity related instruments.

An Equity Fund can be actively managed or passively managed. Index funds and ETFs are passively managed. Equity mutual funds are principally categorized according to company size, the investment style of the holdings in the portfolio and geography.

Equity funds are also categorized by whether they are domestic (investing in stocks of only Indian companies) or international (investing in stocks of overseas companies). These can be broad market, regional or single-country funds.

Some specialty equity funds target business sectors, such as health care, commodities and real estate and are known as Sectoral Funds.

In many ways, equity funds are ideal investment vehicles for investors that are not as well-versed in financial investing or do not possess a large amount of capital with which to invest. Equity funds are practical investments for most people.

The price of the equity fund is based on the fund’s net asset value (NAV) less its liabilities. A more diversified fund means that there is less negative effect of an individual stock’s adverse price movement on the overall portfolio and on the share price of the equity fund.

There are ten types of equity schemes:

Multi-Cap Fund

Multi-cap fund are those funds that have minimum 65 per cent of the assets invested in equity and equity related instruments. They are free to invest across market capitalization.

Large-Cap Fund

Large-cap funds are required to have minimum 80 per cent of their assets invested in equity and equity related instruments of large-cap companies. They have to invest minimum 80 per cent in 1st to 100th company in terms of full market capitalization.

Large & Mid-Cap Fund

This category of funds are required to invest minimum 35 per cent of the assets in equity and equity related instruments of large-cap companies and minimum 35 per cent of the assets in equity and equity related instruments of mid-cap companies. In case of large-cap, the fund manager has to invest minimum 35 per cent in 1st to 100th company in terms of full market capitalization and in case of mid-cap, he has to invest minimum 35 per cent in 101st to 250th company in terms of full market capitalization.

Mid-Cap Fund

Mid-cap fund are those funds that have minimum 65 per cent of assets invested in equity and equity related instruments of mid-cap companies. This means that they have to invest 65 per cent only in 101st to 250th company in terms of full market capitalization.

Small-Cap Fund

A small-cap fund need to invest minimum 65 per cent of assets in equity and equity related instruments of small-cap companies. They have to invest 65 per cent only in 251st company onwards in terms of full market capitalization.

Dividend Yield Fund

This category of funds can invest in any stocks of any market capitalisation. They have to invest minimum 65 per cent of assets predominantly in dividend yielding stocks.

Value Fund/Contra Fund

AMCs (Asset Management Companies) can choose to have only one either a value fund or a contra fund. Value fund have minimum 65 per cent of assets invested in equity and equity related instruments and follows value investing strategy. On the other hand, contra fund also have minimum 65 per cent of assets invested in equity and equity related instruments and follows contrarian investment strategy.

Focused Fund

Focused funds need to invest minimum 65 per cent of assets in equity and equity related instruments and can only invest in maximum of 30 stocks.

Sectoral/Thematic Fund

Sectoral fund and thematic fund needs to invest minimum 80 per cent of assets in equity and equity related instruments of a particular sector or a particular theme.

ELSS

Equity-Linked Savings Scheme or popularly known as ELSS has to invest minimum 80 per cent of their assets in equity and equity related instruments. They are free to invest across market capitalization but they come in with a lock-in period of 3 years. However, the good news is that you can avail tax deduction under section 80C up to Rs 1.5 lakhs by investing in ELSS.