After a hiatus of a couple of weeks, equity indices are once again marching towards their lifetime high, thanks to the pro-growth Union Budget for FY22. The asset under management (AUM) of the domestic mutual fund industry is also witnessing a similar trend. At the end of December 2020, the total AUM of the mutual funds’ industry grew by 13.59 percent on yearly basis to Rs30.96 lakh crore. Equity AUM of domestic MFs touched a new high of more than Rs 9.5 lakh crore up by almost 15 percent on yearly basis in CY20.

This was led by a rise in market indices (Nifty 15.4 percent) and a marginal increase in equity scheme sales, up by two percent YoY to Rs 2.3 lakh crore.

The last three months of any financial year is a headache for many investors as they struggle to find the right avenue that will not only help them saving tax but also help the invested amount to grow. Equity-linked saving schemes are the closest that satisfy both these criteria. One of the most popular tax-saving options that will help you achieve both is an investment in Equity Linked Savings Scheme (ELSS). These types of tax-saving mutual funds were taken under the umbrella of section 80C of the Income Tax Act to increase retail participation in equity markets.

What is ELSS?

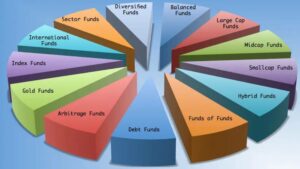

ELSS is one of the categories of equity mutual funds having an investment objective of providing capital appreciation along with the benefit of claiming deduction up to Rs 1.5 lakhs under section 80C of the Income Tax Act. Considering you are in a 30 percent tax bracket, you can save taxes up to Rs. 46,800. Although, it is important to know what are the traits of ELSS to make sure it is the best-suited investment for you. ELSS comes with a lock-in period of three years, which is the lowest among other tax-saving options. ELSS works similarly to a multi-cap fund. This means that they should have a minimum of 65 percent of investment in equity or equity-related securities and they are free to invest across the market cap.

So why ELSS is being talked about when we have an entire gamut of instruments with tax-saving benefits available u/s80c- like Public Provident Fund (PPF), National Savings Certificate (NSC), Unit Linked Insurance Plan (ULIP), etc.? It is because it provides the best of both worlds, i.e. tax savings and investment. The likes of PPF, NSC, and others carry lower risk; however, they come with lower coupon/interest rates, with which one ends up with lower returns on investment as compared to ELSS in the long run.

Why ELSS is being talked about when we have an entire gamut of instruments with tax saving benefits available u/s80c- like Public Provident Fund (PPF), National Savings Certificate (NSC), Unit Linked Insurance Plan (ULIP), etc.?

It is because it provides the best of both worlds, i.e. tax savings and investment. The likes of PPF, NSC and others carry lower risk; however, they come with lower coupon/interest rates, with which one ends up with lower returns on investment as compared to ELSS in the long run.

In simple terms, someone invested Rs1 lakh each in National Saving Certificates and an ELSS scheme five years back in 2016. At present, the money would have grown to Rs 1,47,933 assuming 8.1 percent of the annualised rate in NSC. In the case of ELSS, the money would have multiplied to Rs 1,71,500 at a rate of 11.8 percent (annualised average ELSS category return in the last five years) during the same period. This may look exciting because in the last one and a half years overall equity market gave positive returns. Nonetheless, it has remained one of the best performers in its class.

An investor turned to ELSS may end up investing in these funds because the tax-savings attract him and it has the shortest lock-in condition in its category. As equity markets generally fetch a good return in the long term, one can expect good returns after a period of three years, which will certainly encourage the investor to channelize his saving towards mutual fund investment, even if some of them do not offer the tax benefit.

Comparison of some of the important options available under Section 80C

| PPF | NSC | ELSS | Fixed Deposit | |

| Tenure | 15 years | 6 years | 3 years | 5 years |

| Returns | (Compounded Annually) 8.10 % | (Compounded half-yearly) 8.1% | No Fixed Returns | 5.5% |

| Minimum investment | Rs.500 | Rs.100 | Rs.500 | |

| Maximum investment | Rs.150,000 | No limit | No limit | No Limit |

| Amount eligible for deduction under Section 80C | Rs 1,50,000 | Rs 1,50,000 | Rs 1,50,000 | Rs 1,50,000 |

| Taxation for interest | Tax-free | Taxable | Dividends and Capital Gain tax-free | |

| Safety/ Rating | Safe | Safe | High Risk | Safe |