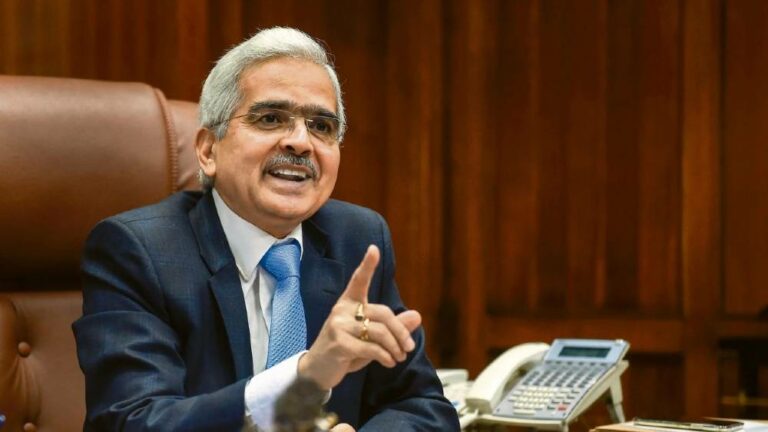

Reserve Bank of India’s Monetary Policy Committee has decided to keep the repo rate steady at 6.5 per cent for the seventh consecutive time. Governor Shaktikanta Das highlighted the committee’s majority decision of 5:1 to maintain the current stance, focusing on liquidity management to curb inflation. The Standing Deposit Facility rate remains at 6.25 per cent, while the Marginal Standing Facility rate and Bank Rate stand at 6.75 per cent. This was the last MPC meeting before the 2024 Lok Sabha elections.

RBI Governor elaborated on the decision, stating that inflation has decreased from its peak of 5.7 per cent. He noted favorable growth-inflation dynamics and a steady decline in core inflation, reaching its lowest point in nine months. Despite volatile food inflation in February, core inflation, excluding food and fuel, has shown a downward trend. Concerns remain regarding the impact of weather variations on inflation and economic stability.

The RBI Governor also said that taking economic conditions into account, he predicts a GDP growth rate of 7 per cent in FY25. Some of the key takeaways of the MPC meeting –

- Repo rate: It has been more than a year when the repo rate was changed. The RBI last changed the repo rate in February 2023, when it raised it from 6.25 percent to 6.50 per cent, an increase of 25 basis points (bps).

- GDP forecast: The RBI Governor says that real GDP growth for FY25 is expected to be at 7 per cent. He said the GDP growth is expected to be 7.1 per cent in Q1, 6.9 per cent in Q2, and 7.0 per cent in Q3 and Q4 each.

- Inflation forecast: Das said that CPI inflation in FY25 is expected to stay at 4.5 per cent. CPI inflation in April–June 2024 (FY25 Q1) is expected to fall to 4.9 per cent from the earlier estimate of 5.0 per cent. The July–September 2024 (FY25 Q2) inflation is also expected to fall to 3.8 per cent from 4.0 per cent. CPI inflation for the October-December 2024 is expected to remain the same at 4.6 per cent, while its projection for January–March 2025 is 4.5 per cent against the previous projection of 4.7 per cent.

- Accommodative Stance: The RBI has also maintained its stance on the the withdrawal of an accommodative stance. The governor said that five out of six MPC members voted in favour of the withdrawal of the accommodative stance.

- UPI facility: Das said that people can now deposits at cash deposit machines by using UPI. Deposit of cash through cash deposit machines is primarily being done through debit cards. Given the experience gained from card-less cash withdrawal using UPI at the ATMs, it is now supposed to also facilitate deposit of cash in CDMs using UPI, said Das.

- Foreign exchange reserves: Das said that India’s foreign exchange reserve reached at a record level of USD 645.6 billion as of March 29, 2024.

- FPI outflows saw turnaround: Das said that the country saw a USD 46.6 billion FPI outflows in the financial year ending March 2024. He said that it is much higher than the previous two years, when it was USD 14.1 billion and USD 4.8 billion, respectively.

- G-Sec app: To felicitate retail investors in the RBI retail direct scheme, the central has bank has launched a G-Sec app. “The scheme was launched in November 2021 for enabling the retail investors to participate in the G-Sec market, both primary and secondary market auctions and operations. It has now launched the mobile app to help retail investor’s access the retail direct portal. This will be a great convenience to retail investors and deepen the G-Sec market further,” said Das.