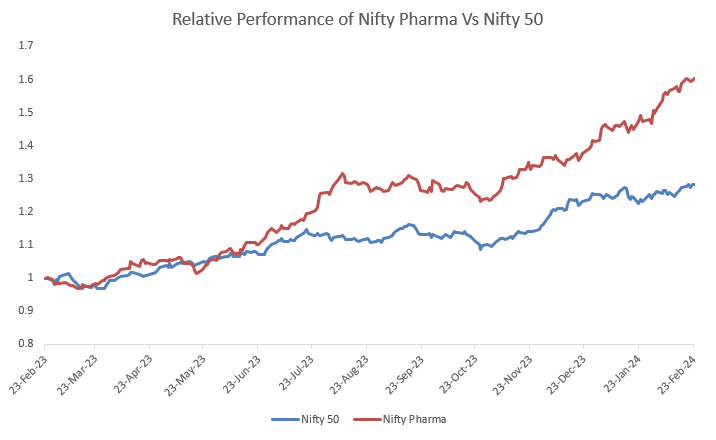

In last one year equity market has generated huge return for their investors, however, some of them have outperformed by huge margins to the wider market. One of the sectors is pharmaceuticals. After going into a downturn post pandemic, they have shown a remarkable return in last one year. The Nifty Pharma index have clocked healthy gains, significantly outperforming the equity benchmark Nifty 50. The performance data clearly illustrates the significant outperformance of the Nifty Pharma Index compared to the frontline equity index Nifty 50 across various durations.

Nifty Pharma is consistently demonstrating superior returns. Over one year, for instance, Nifty Pharma surged by an impressive 60.39 per cent, more than doubling the return of the Nifty 50 at 28.30 per cent. Data show that the Nifty Pharma index has gained 24.95 per cent while the Nifty 50 has risen 14.64 per cent in the last six months. If we consider the shorter timeframe, the pharma index has gained by 20.69 per cent in the last three months while the Nifty 50 has gained 12.37 per cent.

This substantial outperformance underscores the strength and resilience of the pharmaceutical sector, likely driven by factors such as innovative drug pipelines, global demand for healthcare, and increased focus on healthcare spending, thereby positioning Nifty Pharma as a standout performer in the equity market landscape.

Performance Stats of Nifty Pharma Vs Nifty 50

| State | Nifty 50 | Nifty Pharma |

| MTD | 2.38% | 6.41% |

| 3 Months | 12.37% | 20.69% |

| 6 Months | 14.64% | 24.95% |

| Year Till Date | 2.39% | 13.41% |

| 1 Year | 28.30% | 60.39% |

Why Pharma is at Pink of the Health?

A confluence of factors has played in favour of pharma companies.

Continued Strength in US Generics Market: The US generics market, the world’s largest and also Indian company’s largest market is expected to maintain steady growth in coming futures due to factors like:

- Patent expirations: As patents for branded drugs expire, generic alternatives gain market share, benefiting Indian pharma companies with their cost-effective production. It is estimated that almost 50 drugs are going off patent in next couple of years with billions of dollar of opportunities to Indian generic companies.

- Rising healthcare costs: As healthcare cost is increasing in US, there is clear focus on affordability in US healthcare, which could lead to a greater push for generics.

- Aging population: A growing elderly population in the US is likely to translate to higher demand for pharmaceuticals.

- These Factors Will Lead Pharma Companies to witness a revenue growth of 9-11 per cent in FY2024 primarily supported by 11-13 per cent growth from the US, its key market. Key factors supporting growth in the US market include new product launches, reduced pricing pressures and faster ANDA approvals, partly also attributed to shortages being witnessed in some products. Indian pharmaceutical companies reported a healthy YoY growth of revenues in Q3 FY2024, supported by 16.8 per cent and 21.9 per cent YoY growth in the US and European markets, respectively.

Rising Domestic Demand:

- India’s growing middle class and increasing disposable income are expected to fuel domestic demand for pharmaceuticals. Revenue growth of pharma companies from the domestic market is expected to be in higher single digit in FY2024. This is supported by both increase in prices as well as new product launches.

- Government initiatives like Ayushman Bharat, a national health insurance scheme, are also likely to boost domestic pharma consumption.

- Increasing awareness about healthcare and rising prevalence of chronic diseases will further contribute to domestic growth.

Focus on Innovation and R&D:

- Indian pharma companies are increasingly investing in research and development (R&D) to develop new drugs, biologics, and complex generics. This will help them to advance in value chain.

- This focus on innovation could lead to higher margins and open doors to new markets.

- Government incentives for R&D can further accelerate this trend.

Favourable Government Policies:

- The Indian government has shown a commitment to supporting the pharma industry through various initiatives like production-linked incentives (PLIs) for bulk drugs and medical devices.

- Streamlined regulatory processes and easier approvals can also benefit pharma companies.

But not without its risks –

It’s also important to note that the pharma sector is not without its risks:

- Increased competition: Competition from other emerging markets and potential price controls in the US market can put pressure on margins.

- Regulatory hurdles: Stringent regulatory requirements in key markets like the US can delay product launches.

- Currency fluctuations: Fluctuations in the rupee can impact export profitability.

All the above factors are clearly visible in latest quarterly results. The Indian pharmaceutical industry has experienced significant growth as anticipated. The industry achieved an impressive year-on-year revenue increase of nearly 10 per cent, accompanied by a substantial 22 per cent rise in the overall net profit. Companies such as Mankind Pharma Ltd., Piramal Pharma Ltd. and Ajanta Pharma Ltd. saw a substantial rise in their revenues.

The recent spotlight on US drug shortages has presented India’s pharmaceutical industry with a unique opportunity to leverage its competitive advantages and bolster its sustainable outlook on the global stage. With its prowess in generic drug production, cost-effective manufacturing, and a burgeoning role in healthcare services, India’s pharmaceutical industry is poised for a bright future. Also, the results and guidance have been in line with or better than the low expectations which has given a boost to pharma stocks.

Pharma stocks have been underperforming in the last two to three years due to lofty valuations and a slowdown in the US economy. Currently, the environment is expected to improve during the year with a drop in the US Fed rate and price erosion in the US healthcare sector. Indeed, inflows are expected to improve in pharma sector.

In the following pages we have selected 7 stocks from this sector that have shown good potential and are likely to give better returns going ahead. One of the company, based on media reports, has recently received a tax notice and is under investigation. The share price of the company initially saw a sharp downturn, however, has recovered since then. We suggest to avoid this company if something concrete comes out of it.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.