In recent years, the Indian public sector companies, commonly referred to as PSUs (Public Sector Undertakings), have demonstrated a remarkable turnaround in their performance financial as well as in the stock market returns. Share of companies such as RVNL (Rail Vikas Nigam Ltd.) is up by more than 400 per cent in last one year alone. Its share price has jumped from around Rs 34 at the start of October 2022 to Rs 169 currently. So every Rs one lakh invested in the share of the company one year ago would have become Rs 4 lakh today. And this is not the case of a single company, there are many companies in this list. For example, shares of Mazagon Dock Shipbuilders has gained by as much as 3.5 times in last one year.

The list goes on and the list of top gainers in last one year is dominated by PSU companies. Even within the banks in the last one year, 8 government-owned banks have more than doubled investor wealth. UCO Bank has been the top gainer in the list with an unstoppable rally of 270 per cent. Punjab and Sind Bank has also grown over 3 times while Central Bank of India, Bank of Maharashtra, Indian Overseas Bank, Union Bank of India, Bank of India and Indian Bank are other multibaggers in the list.

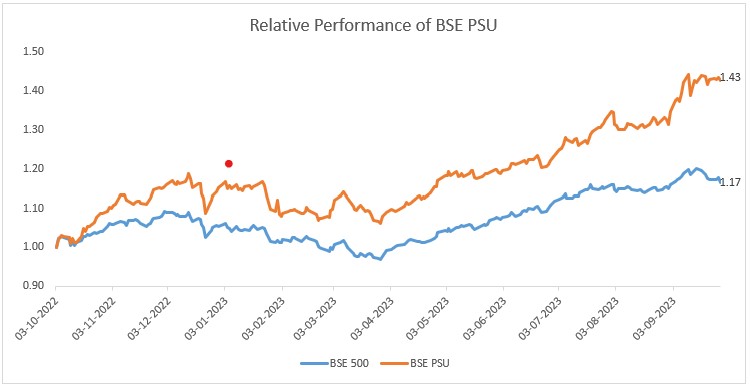

This is clearly reflected in the performance of BSE PSU, which consists of major Public Sector Undertakings listed on BSE, against the BSE 500. In last one year BSE PSU index is up by 43 per cent compared to 17 per cent by BSE 500. Nonetheless, it has not always been the case. When we analyse the historical performance, we saw that most of the time PSU have underperformed the broader market.

Historical Performance

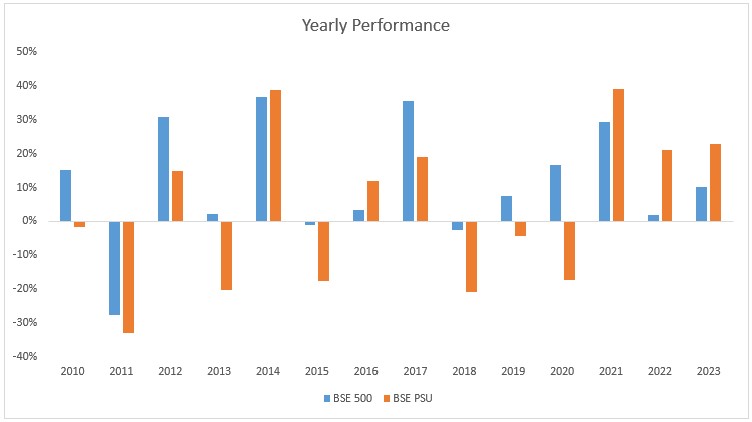

The historical performance of the BSE PSU Index compared to the broader BSE 500 Index over the past decade has been characterized by a persistent underperformance, especially in the earlier years. From 2010 to 2019, the BSE PSU Index consistently lagged behind the BSE 500, with negative returns in some years, such as 2010, 2011, 2013, 2015, and 2018. This underperformance could be attributed to various factors, including sluggish economic growth, policy uncertainties, and challenges faced by public sector undertakings post global financial crisis.

Significant Change in the Last 3 Years

However, the scenario underwent a significant change in the last three years, from 2021 to 2023. During this period, the BSE PSU Index exhibited remarkable outperformance. In 2021, the index recorded an impressive 39 per cent growth, surpassing the BSE 500. This trend continued into 2022 and 2023, with gains of 21 per cent and 23 per cent, respectively, as compared to the more modest growth of the BSE 500 during the same period.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.