Investments in infrastructure yield significant benefits, including job creation, enhanced global competitiveness, the attraction of Foreign Direct Investment (FDI), seamless economic integration, and improved living standards. The evolving geopolitical landscape and diversification of the global value chain present an opportunity for India to emerge as a major global force after the pandemic. To seize this opportunity, India must enhance domestic preparedness, improve competitiveness, and minimize logistics costs. India’s share in global merchandise exports is only 1.8 per cent (2022), emphasizing the need to sign new trade agreements and increase its global exports. However, to fully capitalize on access to global markets, India must enhance its competitiveness.

John F. Kennedy, the then President of the United States, way back in 1962, once wisely remarked, “America’s roads are good not because America is rich. America is rich because of its good roads.”

As India approaches national elections, the government is ramping up public expenditure to stimulate economic growth and augment citizens’ incomes. A pivotal aspect of this heightened spending revolves around infrastructure development, especially the construction of highways.

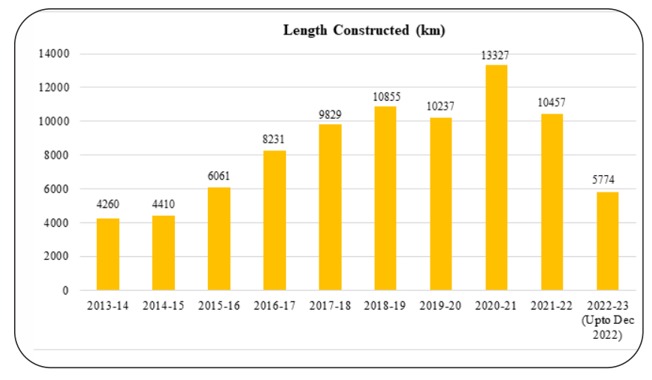

The government has set forth an ambitious target to construct an average of 45 kilometres of highways daily in the upcoming financial year, marking a monumental endeavour. Over the next six months leading up to the general elections, the government aims to award road projects worth 3 lakh crore, with the goal of building 10,000 kilometres of roads. This is poised to become one of the most extensive road project awards within a six-month span. With this Ministry of Road Transport and Highways (MoRTH) is aiming to achieve a total of 12,500 kilometres in highway awards by the conclusion of FY24, surpassing the achievements of previous years.

One pivotal factor contributing to this surge in projects is the resolution of pending land acquisition issues by government agencies responsible for construction, which has unlocked new stretches for bidding. What was once a bottleneck in the project pipeline has now transformed into a situation where numerous projects are primed for bidding. This is expected to provide a significant impetus to highway construction and awards, which have experienced a slowdown over the past two and a half years.

According to MoRTH, Financial Year 2022-23 was characterized by consolidating the gains resulting from significant policy decisions made in the preceding eight years, with a focus on monitoring ongoing projects, overcoming obstacles, and sustaining the impressive pace of work achieved in previous years. Despite the government’s push for record-breaking construction in FY24 to showcase progress in anticipation of the 2024 elections, highway construction has, until now, been progressing in the slow lane. Nonetheless, it is set to change in next couple of months

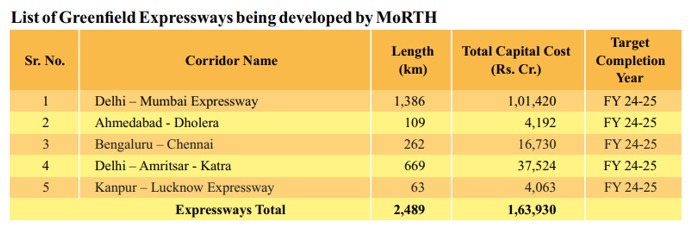

The discussed highway awards pertain to projects originally included in the ambitious Bharatmala initiative, which boasts a robust pipeline of 34,800 kilometres of road projects, all scheduled for completion by FY28. Furthermore, MoRTH is in the final stages of shaping its Vision 2047 document, which will introduce new alignments spanning approximately 30,000 kilometres of fenced-off highways, ready for bidding.

This strategic development not only stimulates the economy but also significantly enhances nationwide connectivity. A pivotal aspect of India’s development strategy revolves around the circulation of money and its capacity to generate income swiftly. In this context, road projects stand out as catalysts for employment, particularly benefiting economically disadvantaged individuals who tend to allocate a larger portion of their earnings. When such employment opportunities are widespread across vast regions of the country, the stimulative effect on economic activity becomes even more far-reaching.

The highway network assumes a crucial role in India’s Gati Shakti Mission, aimed at augmenting the efficiency of freight movement and curtailing logistics expenses. The Ministry of Road Transport and Highways has set an ambitious target of reducing logistics costs from the current estimate of around 16 percent of GDP to no more than nine percent by the end of 2024. This endeavour promises to be a game-changer for India’s economic landscape and roads are going to play a pivotal role.

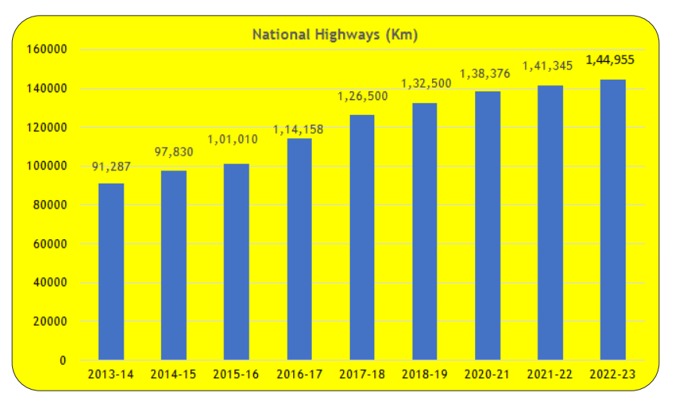

The capacity of National Highways in terms of handling traffic (passenger and goods) needs to keep pace with economic growth. India has the second largest road network in the world of about 63.32 lakh km. This comprises National Highways, Expressways, State Highways, Major District Roads, Other District Roads and Village Roads. Historically, investments in the transport sector have been made by the Government. However, in order to encourage private sector participation, the Ministry has laid down comprehensive policy guidelines for private sector participation in the development of National Highways.

Growth Drivers of Road Project

Streamline the Process

To bolster the momentum of construction projects, a series of strategic initiatives have been launched to reinvigorate stalled endeavours and fast-track the completion of new ones. These initiatives encompass the government’s identification of Model National Highways in each state for comprehensive development, facilitating streamlined land acquisition procedures where a significant portion of land is secured prior to project bid invitations. Projects are meticulously awarded following robust preparation, ensuring that all necessary elements such as land acquisition and clearances are in place. Swift resolutions for Change of Scope (CoS) and Extension of Time (EoT) cases are a priority, adhering to defined timeframes.

The process for approving General Arrangement Drawings for Rail Over Bridges (ROBs) has been simplified and made accessible online. Enhanced coordination with other ministries and state governments, coupled with one-time financial injections, ensures efficient project management. Regular reviews at various administrative levels play a vital role in identifying and eliminating any bottlenecks that might impede project execution. Furthermore, considerations are being made for an exit strategy for equity investors. Together, these initiatives collectively drive the rapid and efficient development of infrastructure projects.

National Highway Expansion

PM Gati Shakti Master Plan for Expressways will be formulated to facilitate faster movement of people and goods. The National Highways network will be expanded and length of national highways to reach 200,000 km.

Growing Demand

With the increase in consumer demand and nuclear families, need for two-wheelers and compact cars have been on the rise and is expected to grow even further. The market for roads and highways in India is projected to exhibit a CAGR of 36.16 per cent during 2016-2025, on account of growing government initiatives to improve transportation infrastructure in the country. Almost 40 per cent (824) of the 1,824 Public-Private Partnerships (PPP) projects awarded in India until December 2019 were related to roads.

Crucial For Economic Growth

Infrastructure is crucial for economic growth and development. As India strives for sustainable and inclusive progress in the next 25 years (Amrit Kaal) following its 75th year of Independence in 2021, infrastructure development becomes even more vital. Investments in infrastructure yield significant benefits, including job creation, enhanced global competitiveness, the attraction of Foreign Direct Investment (FDI), seamless economic integration, and improved living standards. The evolving geopolitical landscape and diversification of the global value chain present an opportunity for India to emerge as a major global force after the pandemic. To seize this opportunity, India must enhance domestic preparedness, improve competitiveness, and minimize logistics costs. India’s share in global merchandise exports is only 1.8 per cent (2022), emphasizing the need to sign new trade agreements and increase its global exports. However, to fully capitalize on access to global markets, India must enhance its competitiveness.

In the World Economic Forum’s Global Competitiveness Index (2019), India ranked 68th overall and lagged in utility infrastructure (rank 103), despite performing relatively better in transport infrastructure (rank 28). Logistic infrastructure plays a critical role in boosting a country’s overall competitiveness. India’s logistic costs as a percentage of GDP are estimated to be 14-18 per cent, higher than the global benchmark of 8 per cent. Efforts have been made in recent years to develop roads, railways, ports, airports, last-mile connectivity, and warehousing. Although India’s ranking in the World Bank’s Logistic Performance Index improved to 38th in 2023 from 44th in 2018, it still lags behind economies like Germany (3rd), Japan (13th), the United States (17th), and China (19th).

In the forthcoming years, the road sector is poised to play a pivotal role in elevating India’s standing in the aforementioned indices. A promising future beckon for companies involved in road projects.

In the following section, we’ve identified SEVEN SUCH FIRMS that are well-positioned to outperform and provide robust returns for investors. However, it’s important to underscore that the outcome largely hinges on the results of the upcoming general election. While the prevailing expectation is for the current government to maintain its position, any deviation from this scenario could potentially impact these companies’ performance in a manner not aligned with our projections.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.

Bharatmala Pariyojana

This is the umbrella program for the highways sector that aims to optimize the efficiency of road traffic movement across the country by bridging critical infrastructure gaps. The Phase I of the Bharatmala Pariyojana approved in October 2017, focuses on development of 34,800 km of National Highways. The Pariyojana emphasized on a “corridor based National Highway development” to ensure infrastructure symmetry and consistent road user experience. The key components of the Pariyojana are Economic Corridors development, Inter-corridor and feeder routes development, National Corridors Efficiency Improvement, Border and International Connectivity Roads, Coastal and Port Connectivity Roads and Expressways.

The Bharatmala (approved for estimated cost of Rs 6,92,324 crore including other ongoing schemes) is to be funded from CRIF Cess (Rs 2,37,024 crore) collected from Petrol & Diesel (as per Central Road & Infrastructure Fund Act, 2000, erstwhile CRF Act, 2000), amount collected from toll remittances (Rs 46,048 crore) apart from additional budgetary support (Rs 59,973 crore), expected monetisation of NHs through TOT (Toll-Operate-Transfer) (Rs 34,000 crore), Internal & Extra Budgetary Resources (IEBR) (Rs 2,09,279 crore) and Private Sector Investment (Rs 1,06,000 crore) as per Financing Plan upto 2021-22.

Under Phase-1, about 23,500 km. has been awarded and about 11,400 km. has been completed. The balance projects are targeted for award by Financial Year 2024-25. According to the MoRTH Annual Report 2022-23, Bharatmala Pariyojana envisages 60% projects on Hybrid Annuity Mode (HAM), 10% projects on BOT (Toll) Mode and 30% projects on EPC mode respectively. Total aggregate length of 25,713 km with a total capital cost of Rs 7,81,845 crore have been approved and awarded till date under Bharatmala Pariyojana (including 6,649 km length of residual NHDP with a total capital cost of Rs 1,51,991 crore).