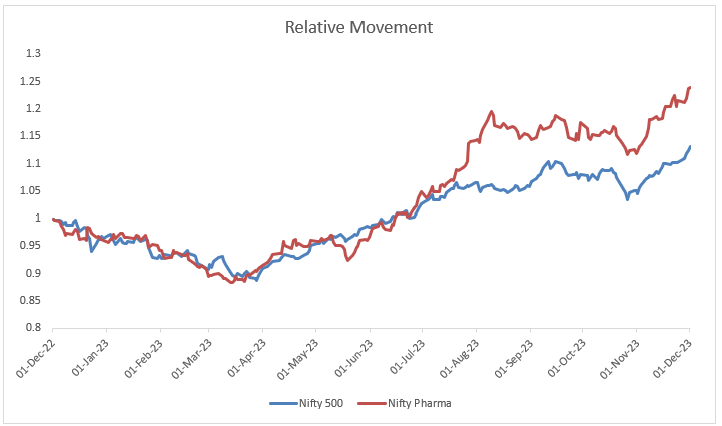

Over the past couple of quarters, the Indian equity benchmark indices have witnessed a significant rally, breaking away from their previously observed range-bound fluctuations. This momentum has propelled the indices to their life time high and, consequently leading to gains of around 10-11 per cent for both the BSE Sensex and Nifty 50 year till date. Nevertheless, from the lows of March 2023 these indices are up by almost 20 per cent. The robust performance can be attributed to an overarching positive sentiment that goes beyond the broader market and encompasses specific industries as well. Notably, the Nifty Pharma, an index tracking the pharmaceutical industry, has demonstrated exceptional resilience.

It outperformed many sectors with a remarkable surge of nearly 27 per cent over the same six-month period. Sizeable foreign investments in the industry, coupled with impressive quarterly performances from pharmaceutical companies, have been instrumental in fueling the strong upswing.

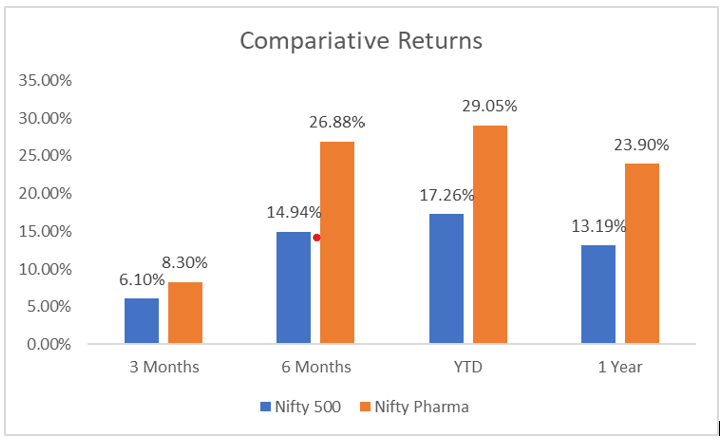

The pharmaceutical index has consistently showcased superior returns compared to the broader Nifty 500 across periods, substantiating its robust performance in the equity market. Over the short term of three months, the pharmaceutical index outperformed with a return of 8.30 per cent against the Nifty 500’s 6.10 per cent. This trend of dominance continued over more extended periods, as seen in the six-month and year-to-date (YTD) periods, where the pharmaceutical index yielded remarkable returns of 26.88 per cent and 29.05 per cent, respectively, significantly surpassing the Nifty 500’s returns of 14.94 per cent and 17.26 per cent. Even over a longer one-year horizon, the pharmaceutical index sustained its superior performance, providing investors with returns of 23.90 per cent compared to the Nifty 500’s 13.19 per cent. This consistent outperformance signifies the strength and potential of the pharmaceutical sector, showcasing its ability to deliver higher returns to investors relative to the broader market index, the Nifty 500.

Renewed Interest of Institutional investors

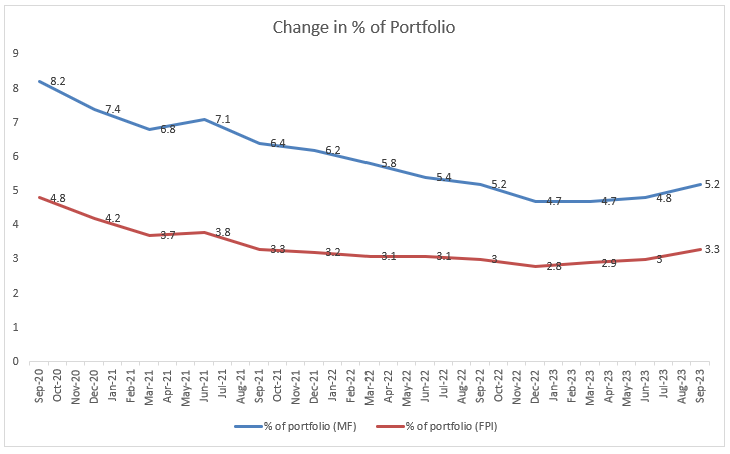

Recognizing the potential of the sector even the smart money is pouring funds in this sector. During the pandemic of 2020 we saw pharma companies attracting institutional flows however as pandemic got over, institutional holdings in Indian pharmaceutical companies underwent a noteworthy trend. Initially, both Foreign Portfolio Investors (FPIs) and Mutual Funds (MFs) demonstrated a decline in their respective portfolio percentages, reflecting a probable lack of immediate favour or uncertainty after pandemic. However, this dip seemed transient as subsequent quarters unveiled a remarkable shift. The percentages of holdings by both FPIs and MFs began an upward trajectory, signalling a renewed interest and increasing attractiveness towards pharmaceutical companies. Despite the initial decrease, the consistent rise in institutional holdings thereafter, as depicted by the ascending percentages across quarters, indicates a growing confidence among institutional investors in the prospects and potential of the pharmaceutical sector. This upward trend signifies a regained trust and heightened interest in pharmaceutical companies, suggesting a positive outlook and the perceived value of these entities among institutional investors.

Why Indian Pharma Sector is on limelight?

US Drug Shortages: India’s Competitive Advantage and Sustainable Outlook

Recently, the United States experienced one of the most severe drug shortages in many years. Various factors contributed to this issue, but one significant driver has been the stricter audits that have uncovered lapses in quality standards among companies with extensive supply arrangements in the US. These findings have temporarily disrupted supplies, further exacerbating the problem of drug shortages. Inadequate availability is observed in local anesthetics, fundamental hospital pharmaceuticals, commonly used oral and ophthalmic products, treatments for ADHD, and chemotherapy medications.

Historically, drug shortages have often served as a significant indicator for price increases, providing pharmaceutical companies with the opportunity to raise prices for scarce drugs multiple times. Given the substantial reliance of the United States on the supply of medicines and intermediates from India, domestic manufacturers and suppliers in India can potentially leverage this situation to their advantage. Conversely, the Indian pharmaceutical industry, bolstered by its robust capabilities are in limelight now.

Besides, during Q2FY24, companies experienced significant advantages within the US market due to a favourable pricing environment. This led to robust US sales driven primarily by increased volumes of existing products and a decrease in price erosion. Anticipating a continuation of this favourable trend into Q3, we foresee a scenario where despite a lack of approvals across several market players, the enhanced volumes and specific scarcity opportunities will compensate for this limitation.

Strength

The Indian pharmaceutical sector stands as a global powerhouse, exemplifying remarkable strengths and pivotal contributions to the healthcare industry. Boasting the third-largest volume globally, India’s pharmaceutical industry leads the charge, exporting essential medical supplies to over 200 countries. With a staggering 60 per cent share in vaccine supplies and a significant 20 per cent contribution to the global generic drugs market, India plays a pivotal role in meeting worldwide healthcare needs. Notably, as the largest exporter of generic drugs, it fulfils 40 per cent of the US and 50 per cent of Africa’s requirements, showcasing its critical role in global healthcare provisions.

Furthermore, India’s standing as the third-largest producer of Active Pharmaceutical Ingredients (APIs), with an 8 per cent share globally, marks a strategic shift, aiming to reduce dependency on Chinese imports. This sector’s growth potential remains immense, particularly as the country expands its healthcare infrastructure exponentially, with a surge in medical colleges and MBBS seats. Moreover, India’s emergence as a hub for medical tourism, fuelled by affordable healthcare services, has seen a meteoric rise, attracting a substantial influx of medical tourists. Bolstering this growth trajectory are governmental initiatives like PMJAY, the world’s largest healthcare scheme, alongside strategic reforms fostering a conducive investment environment. These strengths collectively position the Indian pharmaceutical sector as an indispensable global player, driving innovation, accessibility, and affordability in healthcare on a monumental scale.

Opportunities

The global landscape of healthcare is on the brink of significant transformation, propelled by the imminent demographic shift towards an ageing population. By 2030, an estimated 15 per cent of the world’s population will belong to the 65+ age bracket, a demographic characterized by substantially higher healthcare expenditures compared to younger age groups. This trend highlights a pivotal shift in healthcare spending patterns, with per capita healthcare expenditure in the 65 – 84 age range soaring by 70 per cent compared to the 45 – 64 age group.

Surge in Global R&D Spending

Concurrently, the pharmaceutical industry is witnessing a surge in global Research and Development (R&D) spending, set to escalate from USD 262B to USD 302B. This uptick signals burgeoning opportunities for outsourcing in Indian pharmaceutical companies. Furthermore, India’s medical tourism sector is poised for remarkable growth, projected to escalate to 30 lakhs by 2030, chiefly propelled by the nation’s reputation for quality treatment at affordable costs. Forecasts indicate a substantial expansion in the domestic pharma market, projected to surge from USD 55B presently to an impressive USD 132B by 2032, elucidating robust growth prospects.

Augmenting Healthcare Infrastructure

Despite these positive trajectories, India’s healthcare spending as a percentage of GDP remains relatively low compared to developed economies, underscoring a vast scope for augmenting healthcare infrastructure. Addressing this need, policies and budgetary allocations by the government, exemplified by a 13 per cent hike in health sector allocation for FY 2023-24 and initiatives like PMJAY, are poised to foster universal health coverage, envisaging a healthier and more robust healthcare ecosystem in the medium to long term. As India’s per capita income escalates, the healthcare sector stands on the cusp of witnessing a substantial surge in per capita healthcare spending, reflecting a promising trajectory for the sector’s evolution and enhanced accessibility in the foreseeable future.

In the following pages we will take you to seven pharma companies we believe will benefit out of the rising opportunities in the pharma sector in India.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.