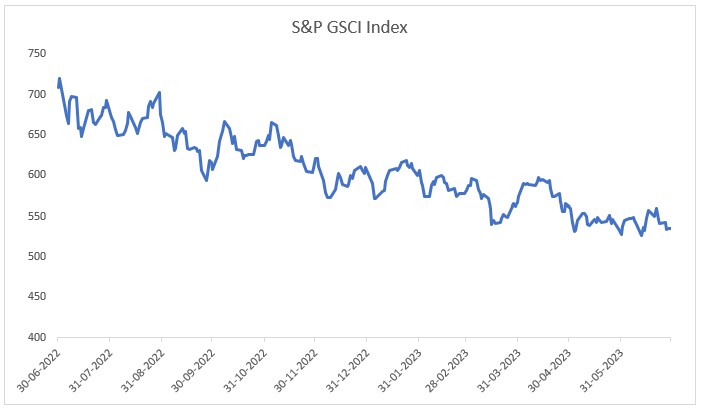

India Inc. reported a healthy year-on-year (y-o-y) jump in net profit growth in the June 2023 quarter, aided by declining input costs. The S&P GSCI, a composite index of commodities that measures the performance of the commodities market, fell 6.7% between 31 March 2023 and 30 June 2023. However, a higher base effect, weak global demand, and a drop in realisations impacted the y-o-y growth in the topline.

Overall Results

The quarterly results analysis of Indian companies for the quarter ending June 2023 paints a picture of resilience and growth. On a yearly basis, there has been a healthy 7.22% increase in revenue, reflecting the strength of demand and business operations. Even more encouraging is the net profit growth, which has surged by an impressive 13.91%, showcasing the ability of these companies to not only drive top-line growth but also manage their costs effectively. Fall in the commodity prices definitely helped them.

The operating profit growth of 17.14% and the EBIT growth of 18.2% highlight the operational efficiency and profitability improvements achieved by India Inc.

Result at Glance

(All the growth no. are taken on median basis)

| Particular | |

| Revenue Growth YoY % | 7.22 |

| Net Profit Growth YoY % | 13.91 |

| Oper. Profit Growth YoY % | 17.14 |

| EBIT Growth YoY % | 18.2 |

| No. of companies that have announced results are Pos. Results | 2082 |

| No. of companies that have announced results are Neg. Results | 1736 |

In terms of results, a significant number of companies have announced positive outcomes, with 2082 firms reporting favourable results (growth in profit on yearly basis), underscoring the overall health of the corporate sector. On the other hand, 1736 companies have announced negative results (growth in profit on yearly basis). Nonetheless, the overall performance indicates a positive trend in India Inc.’s ability to navigate economic fluctuations and deliver growth in a dynamic business environment.

The side table shows the top and bottom performers in different parameter for the quarter ending June 2023. Numbers in bracket shows total of Positive and Negative Result of that parameter.

| Parameters | Top 1 | Top 2 | Top 3 | Top 4 | Top 5 |

| Revenue Growth YoY % | Gems & Jewellery (21.0/21.0) | Broadcasting & Cable TV (14.0/11.0) | Iron & Steel Products (38.0/23.0) | Banks (38.0/0.0) | Internet Software & Services (23.0/8.0) |

| Net Profit Growth YoY % | Construction & Engineering (61.0/35.0) | Construction Materials (10.0/18.0) | Internet Software & Services (23.0/8.0) | Electronic Components (9.0/9.0) | Auto Tyres & Rubber Products (8.0/15.0) |

| Oper. Profit Growth YoY % | Internet Software & Services (23.0/8.0) | Construction Materials (10.0/18.0) | Consulting Services (11.0/11.0) | Iron & Steel Products (38.0/23.0) | Electronic Components (9.0/9.0) |

| EBIT Growth YoY % | Construction Materials (10.0/18.0) | Internet Software & Services (23.0/8.0) | Consulting Services (11.0/11.0) | Investment Companies (16.0/11.0) | Iron & Steel Products (38.0/23.0) |

| Oper. Profit Margin Growth YoY % | Other Apparels & Accessories (29.0/23.0) | Healthcare Services (16.0/4.0) | Furniture-Furnishing-Paints (23.0/9.0) | Housing Finance (11.0/8.0) | Heavy Electrical Equipment (26.0/8.0) |

| Parameters | Bottom 1 | Bottom 2 | Bottom 3 | Bottom 4 | Bottom 5 |

| Revenue Growth YoY % | Consulting Services (11.0/11.0) | Containers & Packaging (16.0/40.0) | Commodity Trading & Distribution (72.0/95.0) | Transportation – Logistics (13.0/15.0) | Fertilizers (3.0/23.0) |

| Net Profit Growth YoY % | Movies & Entertainment (14.0/20.0) | Containers & Packaging (16.0/40.0) | Fertilizers (3.0/23.0) | Edible Oils (13.0/16.0) | Heavy Electrical Equipment (26.0/8.0) |

| Oper. Profit Growth YoY % | Fertilizers (3.0/23.0) | Containers & Packaging (16.0/40.0) | Edible Oils (13.0/16.0) | Textiles (74.0/176.0) | Commodity Chemicals (21.0/45.0) |

| EBIT Growth YoY % | Containers & Packaging (16.0/40.0) | Fertilizers (3.0/23.0) | Movies & Entertainment (14.0/20.0) | Edible Oils (13.0/16.0) | Heavy Electrical Equipment (26.0/8.0) |

| Oper. Profit Margin Growth YoY % | Aluminium and Aluminium Products (5.0/14.0) | Paper & Paper Products (21.0/27.0) | IT Consulting & Software (85.0/33.0) | Textiles (74.0/176.0) | IT Software Products (17.0/23.0) |

BSE 500 Results

As many as 499 companies of the BSE 500 index reported an aggregate revenue and net profit (excluding extraordinary items) growth of 6.8% and 45%, respectively, on a y-o-y basis. Excluding financial sector stocks (banks, financial services and insurance), the aggregate EBITDA of 461 stocks grew 30% y-o-y. The benefit of falling costs was also visible in EBITDA margins. As many as 371 (or 80.4%) out of 461 stocks witnessed a y-o-y improvement in the June 2023 quarter.

The energy, automobile, and healthcare sectors have witnessed substantial surges in their EBITDA margins. However, not all sectors enjoyed the benefits of reduced input costs or commodity prices, particularly those within the metals, consumer discretionary, and chemicals segments, which experienced notable declines in margins on a year-on-year basis. The prolonged period of lower commodity prices had a dual impact: acting as a growth stimulant for sectors benefitting from reduced commodity expenses while adversely affecting commodity-dependent sectors, particularly metals.

The financial, energy, and automobile sectors emerged as the primary contributors to corporate profitability. Excluding these sectors, the aggregate net profit growth of BSE 500 companies moderated to a 12.13% year-on-year increase. Conversely, the metals sector, encompassing both ferrous and non-ferrous metals, significantly weighed down the overall performance. Excluding metals, the consolidated net profit showed robust growth, expanding by 97.5% year-on-year, with revenues surging by 30% on an annual basis.

When comparing reported earnings to expected earnings, several companies in sectors such as IT, real estate, chemicals, and utilities posted earnings below estimates. Nevertheless, when considering the broader spectrum, the ratio of companies surpassing estimates to those falling short in the June quarter leaned in favour of the former. According to Refinitiv’s earnings estimates data, which included a minimum of two analysts’ assessments, out of the 311 companies in the Nifty 500 index, a noteworthy 55%, or 171 companies, reported figures exceeding consensus estimates.

In the following paragraphs, we are analysing few sectors that are important for the economy along with top 5 companies from the sector that have posted best profit on yearly basis.

SECTOR PERFORMANCE

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.