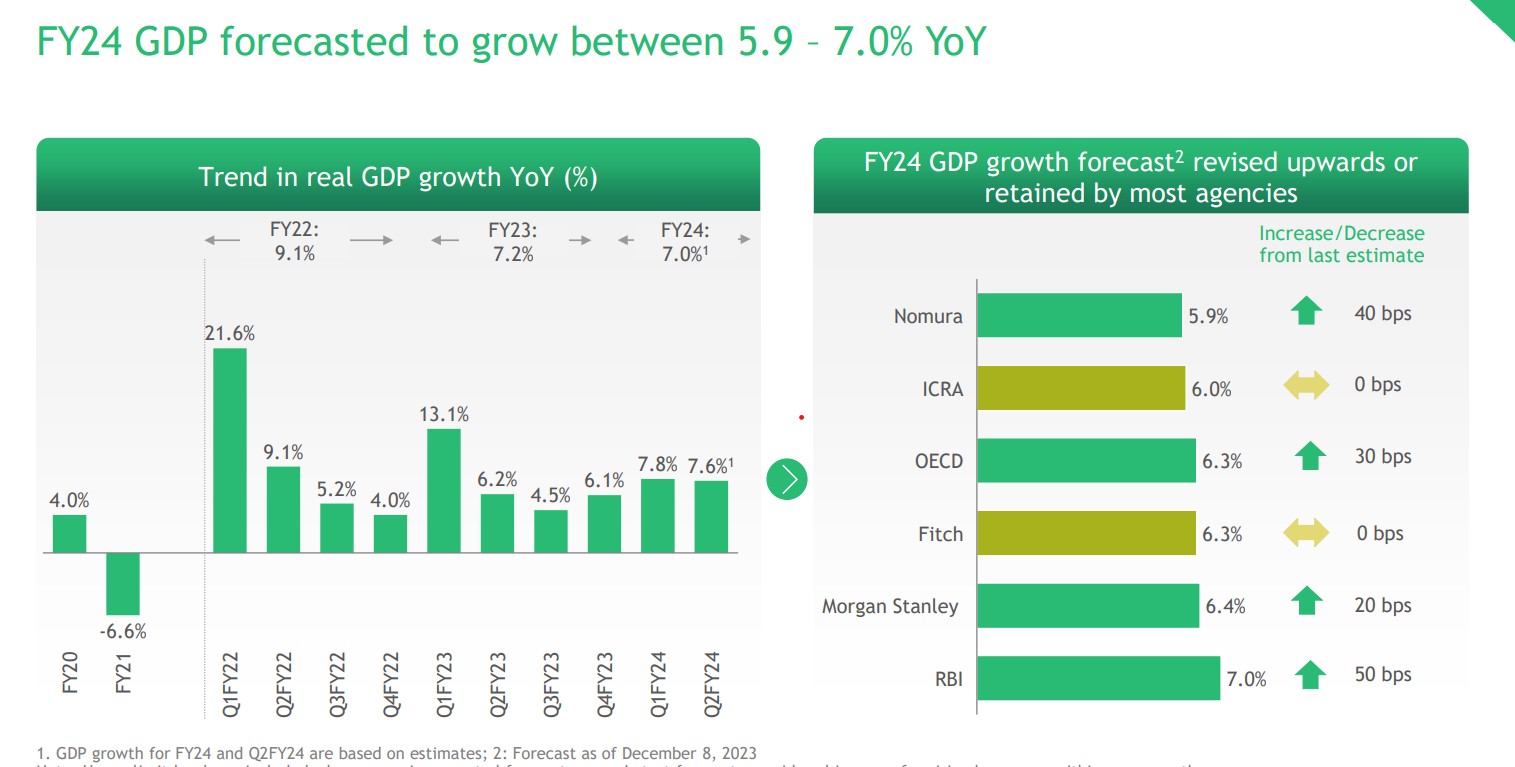

The Indian economy has showcased remarkable growth, surpassing major global counterparts over the past few years. According to projections by the International Monetary Fund (IMF), India is expected to maintain its robust growth trajectory and retain its position as one of the fastest-growing major economies globally. Recent GDP figures, indicating a 7.6 per cent growth in Q2FY24, further reinforce this positive outlook. Projections for FY24 anticipate a growth range between 5.9 to 7.0 per cent YoY, prompting agencies to revise their forecasts upward for the entire year and year beyond the current financial year.

NBFCs Performance

Crucially intertwined with this economic surge are the NBFCs, whose growth trajectory has surpassed that of traditional banks. The credit growth of NBFCs has hit its highest levels since 2019, outpacing their banking counterparts. Net Interest Margins (NIMs) for both NBFCs and banks have seen a consistent uptick, with NBFCs leading the charge, marking a 44 bps increase YoY in the first half of FY24. Despite marginal increases in credit costs, owing to RBI’s incremental repo rates, NBFCs have adeptly managed these escalations, resulting in a downward trend in Gross Non-Performing Assets (NPA).

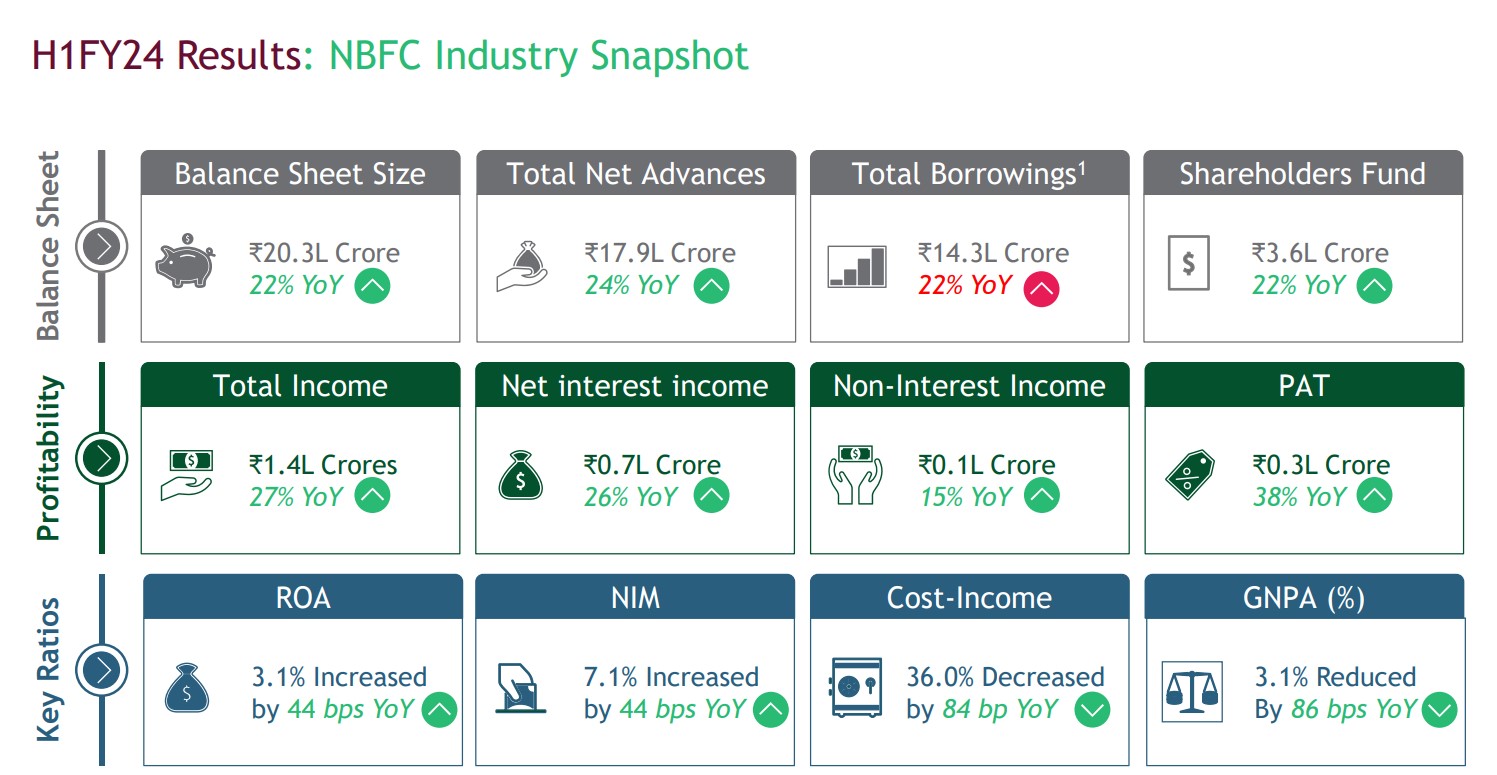

An evidence to their resilience, NBFCs have showcased a robust credit growth of 24 per cent YoY across categories. Housing Finance Companies (HFCs), although experiencing a relatively moderate growth of 10 per cent YoY, have contributed to this overall sectoral expansion. This growth has been propelled by increased disbursements, fuelled by a surge in consumption demand. The balance sheet size has also increased by 22 per cent on yearly basis to Rs 20.3 lakh crore at the end of H1FY24.

Notably, the sector witnessed a substantial 38 per cent YoY increase in absolute profits during H1FY24, propelled by improved Net Interest Margins, particularly in NBFC Microfinance Institutions (MFIs). Moreover, the sector has witnessed notable enhancements in operational efficiency, indicated by an 84 bps improvement in the Cost to Income ratio during H1 FY24. Total Income of these companies has increased by 27 per cent and stood at Rs 1.4 lakh crore at the end of six months ending September 2023.

Another positive indicator is the significant improvement in Gross NPA levels for NBFCs during H1FY24, marking an 86 bps improvement compared to H1FY23. This improvement is attributed to heightened credit demand and more efficient collection practices. Despite witnessing a fall in capitalization levels due to robust growth, most NBFCs maintain comfortable capitalization levels. Additionally, several NBFCs have initiated plans to raise further capital to support their growth aspirations.

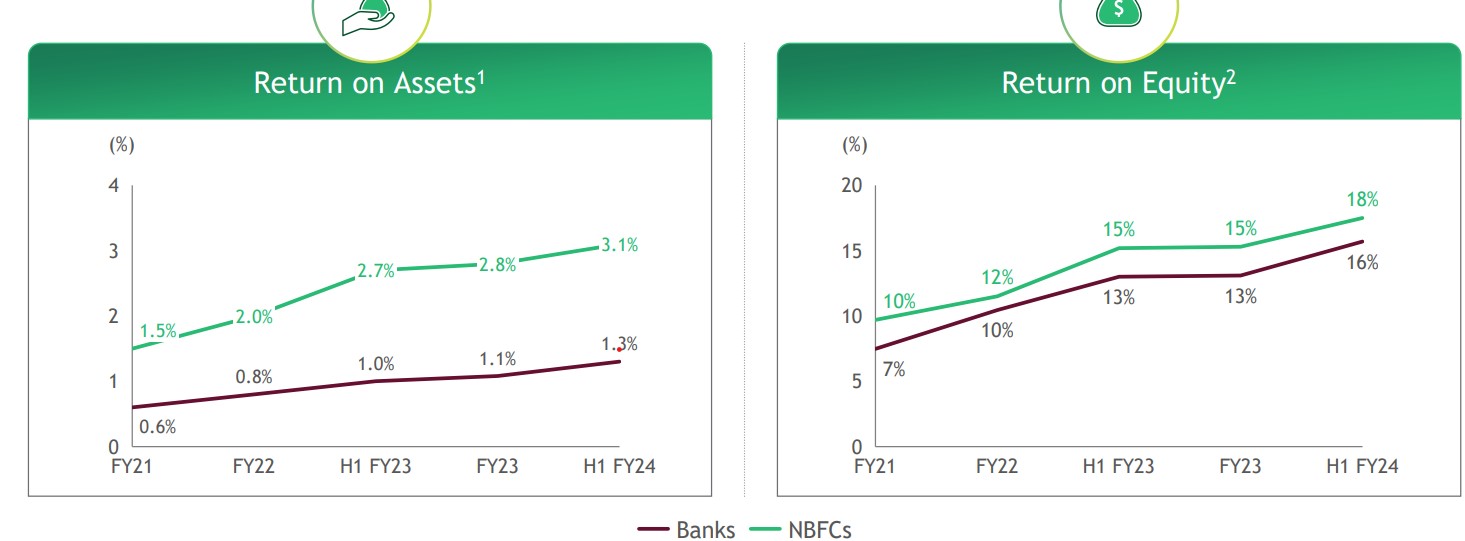

Several return ratios for NBFCs have displayed notable improvements in recent years. The Return on Assets (RoA) for NBFCs surged from 1.5 per cent in FY21 to a substantial 3.1 per cent by the end of H1FY24. Similarly, the Return on Equity (RoE) experienced a commendable uptick, escalating by nearly 8 per cent over the same period, currently standing at 18 per cent as of September 2023.

While diversified NBFCs command a premium in the market, certain housing finance companies continue to trade at a discount. Larger NBFCs are positioned favourably over banks, commanding better valuations due to expectations of amplified balance sheet growth and robust performance metrics.

Insurance Sector and Mutual Funds

While the insurers and mutual funds are not strictly lending NBFCs, they do form an important part of the financial system in terms of their AUM and the risk metrics. Let us focus on insurance first. In terms of solvency ratio for life insurance companies, LIC has consistently held the solvency ratio in the range of 180 per cent to 190 per cent while private life insurers overall have maintained solvency ratio above 220 per cent.

The threshold prescribed by IRDA is 150 per cent, so both are above the mark, although the position is a lot more comfortable in the case of the private life insurance companies. However, in the case of the non-life insurance companies, the situation is slightly different. Here, private non-life insurers have comfortable solvency ratio of above 220 per cent while it is sub-optimal (under 100) for the PSU insurance companies in India.

Overall, the situation appears to be under control as far as NBFCs are concerned. However, PSU general insurance companies have exhibited some stress in terms of solvency while debt funds are still reporting fairly high levels of stress in select categories.

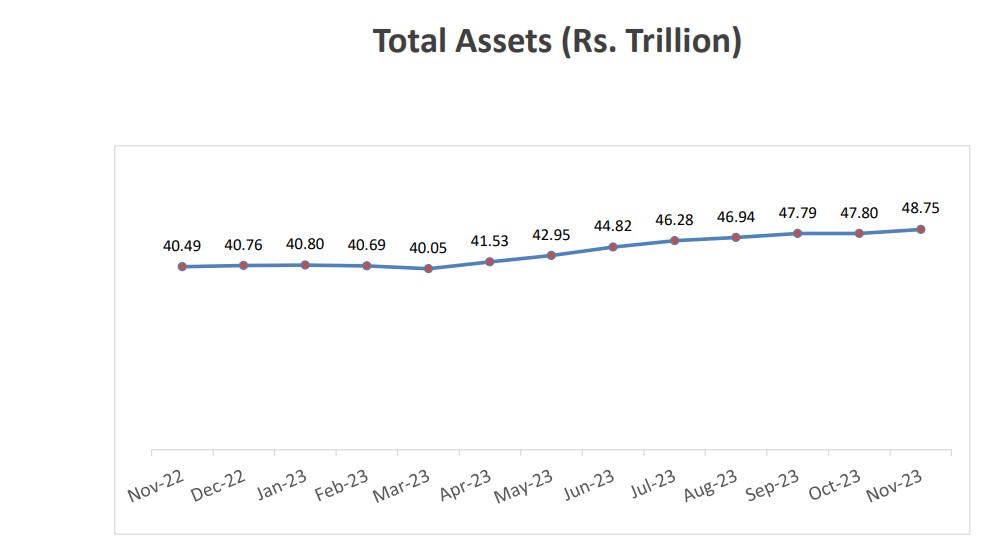

As of November 30, 2023, the Assets Under Management (AUM) within the Indian Mutual Fund Industry totalled Rs 49,04,992 crore. Remarkably, this figure reflects a significant growth from Rs 8.90 lakh crore recorded on November 30, 2013, marking a more than fivefold increase over a decade.

The industry’s AUM milestones exhibit a compelling growth trajectory. Surpassing the Rs 10 trillion mark in May 2014, the AUM swiftly doubled within about three years, exceeding Rs 20 trillion by August 2017. Subsequently, it surged past Rs 30 trillion in November 2020, showcasing the sector’s exponential expansion. May 2021 marked a significant milestone as the mutual fund industry amassed over 10 crore folios. As of November 30, 2023, the total number of folios stands at 16.18 crore. Particularly noteworthy are the 12.92 crore folios associated with Equity, Hybrid, and Solution Oriented Schemes, predominantly contributed by retail investors.

The Systematic Investment Plan (SIP), a popular investment approach offered by Mutual Funds, involves periodic fixed investments in a mutual fund scheme, akin to recurring deposits made monthly. SIP investments soared to an unprecedented high in November 2023, reaching Rs 17,073 crore. Notably, this trend wasn’t an anomaly. In the past five months, starting from July 2023, each subsequent month has surpassed the previous record of SIP inflows in mutual funds. Overall, SIP inflows in mutual funds for the first 11 months of 2023, ending November 30, totalled Rs 1,66,131 crore, marking a substantial 22.23 per cent increase compared to the corresponding period last year.

However, amidst these promising prospects, some challenges on the horizon warrant attention. The rise in risk weights for bank lending to NBFCs could potentially escalate the cost of funds for NBFCs, impacting consumer credit exposures. This scenario might particularly impact monoline companies and consumer-focused NBFCs. Despite these potential challenges, the sector has showcased remarkable resilience and adaptability.

In conclusion, Indian NBFCs stand as a proof to the nation’s economic dynamism. Their consistent growth, improving asset quality, and efficient operational strategies in tandem with India’s economic surge position them as an attractive investment avenue. While challenges persist, the sector’s resilience and adaptability augur well for investors seeking opportunities aligned with India’s ongoing economic expansion. As the Indian economy continues on its growth trajectory, NBFCs are poised to play a pivotal role in shaping India’s financial landscape and offer investors an avenue for sustained growth and returns.

In the following pages, we will take you through the leaders in the respective industry, which are not necessarily our recommendations.

The following content is available for FREE Subscription members only. If you don’t have a FREE subscription, please Register here. If you already have Free Subscription membership, please Log in to see reveal rest of the article.