BYJU FIASCO: A Blow to Start-up Ecosystem

Byju’s, which arose as perhaps one of the most dominant start-ups after Flipkart, is on a slippery slope. Issues like defaulting on loan settlement, handing

Byju’s, which arose as perhaps one of the most dominant start-ups after Flipkart, is on a slippery slope. Issues like defaulting on loan settlement, handing

Gautam Adani’s younger brother, Rajesh Adani, was accused by the Directorate of Revenue Intelligence of playing a central role in a diamond trading import/export scheme

Another Chinese billionaire and dealmaker has gone missing, plunging one of the country’s top investment banks into turmoil. Bao Fan, the founder and executive director

Hotel sector had remained one of the worst hit sectors due to pandemic. Six quarters down the line and they are emerging with flying colours.

The U.S./ IMF just demonstrated to the entire world that it has the willingness and power to smash the ability of a world superpower to

After remaining in shambles for most of the last decade, real estate has come back with a vengeance in the last one and half years.

Finance Minister, Nirmala Sitharaman has, at last, acted upon one of her many announcements during the 2021 Budget presentation, by declaring the creation of India’s first-ever ‘Bad Bank. It will acquire all the NPAs of a bank at a price that is below its book price. It then will work to recuperate and turn around the assets by way of expert management, sale, or restructuring. How effective would be bad bank to solve the mega problem of NPAs?

Shivanand Pandit answers this big question.

In the present financial year 2021-2022, the government has increased the price of petrol 39 times and decreased once, while the diesel price was increased 36 times and decreased twice. In 2020-2021, the price of petrol was raised 76 times and reduced 10 times and that of diesel increased 73 times and decreased 24 times.

Sugar sector, for long, has always been considered cyclical in nature. Nevertheless, some structural change that is taking place now makes it a sustainable business and reduces the cyclicality.

Government Becomes a Laughing Stock! Even though the government has extended the due date for individual taxpayers to file an income tax return (ITR) till December 31, it is imposing a 1% interest for each month of delay beyond the original July 31 deadline.

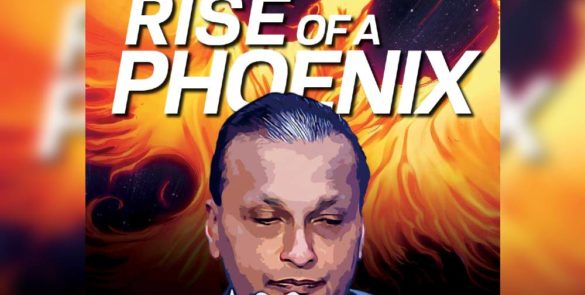

There is a fall from the grace of his group in the last twelve years, nevertheless, the position is getting better and is much better than a year ago. This is in spite of the continuous bashing by a fifth-generation politician.

There is no difference between advertising products and peddling opinions in the press because they are paid to. Media barons’ business model and the belief that society will continue to produce similar response always and ever is terribly misplaced