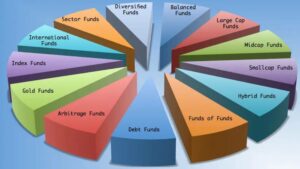

Mutual funds have wide variety of schemes that suit almost all types of individuals under various risk categories. So, if you are a conservative risk taker, then short term debt mutual funds or large-cap equity mutual funds would be more suitable for you. On the other hand, if you are an aggressive investor, then you can also look at investing in thematic or sectorial mutual funds based on your requirements and time horizon.

Asset Allocation

Asset allocation means allocating assets to a particular financial goal in such a way that it satisfies the time horizon for which it is invested and changes as per the change in the time horizon. For example, say, you wish to save money for your child’s education, which is 8 years away from now, and based on your risk profile, you need to allocate 80 per cent to equity and 20 per cent to debt. So, as you move further where your child’s education is 3 years away, you need to switch 80 per cent that is in equity to debt.

Remember, while doing so, you need to periodically rebalance the mutual fund portfolio and bring it back to the original asset allocation.

An Example: First, you need to assess your risk profile. Say, your risk profile is assessed to be aggressive. Then you need to define a financial goal or objective with a specific time horizon. Based on that, you need to identify the amount that you would require at the end of the defined time horizon. So, in our case, we will assume your financial goal is your child’s education, the time horizon is 8 years from today and the amount required at the end of 8 years is Rs 15 lakh (inflation-adjusted).

Now, based on the risk profile and the financial goal, we arrived at asset allocation, which suggests investing 80 per cent in equity and 20 per cent in debt. Based on the above information, to achieve this financial goal, you need to do SIP of Rs 5,000 or lump sum investment of Rs 8 lakh (SIP and lump sum figures are hypothetical). Therefore, the thing is pretty much clear that you need to invest Rs 4,000 in equity MFs and Rs 1,000 in debt MF via the SIP route and Rs 6.4 lakh in equity MFs and Rs 1.6 lakh in debt MFs via the lump sum route.

Hence, before committing any funds towards MF schemes, it is important to know the avenues available to you through which you can invest, and before investing, you should be clear about your risk appetite, your financial plan and asset allocation. Following these steps will help you to achieve the desired financial goals of your life.

Taxation of Mutual Funds

Non-Equity Funds

In case of Non- Equity Funds, If the holding period is short-term (i.e. holding period less than 36 months), the gains out of the same are called as Short-term capital gains (STCG) and are added to the income of the individual and taxed as per the income tax slab, in case of both Residents and NRIs.

However, a TDS @ 30% is applicable in the case of NRIs on short term capital gains. But if this is the only income that NRI has and the total amount of gain is less than the basic exemption limit i.e. Rs 2.50 lakh currently then NRI may claim the TDS Refund by filing ITR.

When the holding period is more than 3 years, gains would be treated as Long-term capital gains (LTCG) and are taxed at the rate of 20%, with indexation.

NRIs are not allowed any indexation benefit on unlisted debt Mutual funds and their capital gain tax rate is 10%. In case of Listed Mutual funds, the tax is 20% with indexation. TDS at a rate 20% is applicable for NRIs in case of LTCG.

Taxation – Dividends

The tax rules on the Dividend payments of Mutual Funds have changed recently.

From FY 2020-21, dividends paid by Mutual Funds, whether on Equity or Non-Equity funds, in short-term or long- term, would be taxable in the hands of the investor. The dividend would be added to the total income of the investor and would be taxed as per the applicable income tax slab rates.

For instance, the one falling in the 30% slab will pay tax at that rate and the one falling in the 5% slab will pay tax at that rate.

Previously, Government used to levy Dividend Distribution Tax (DDT) on mutual fund houses, which was 11.65%, including surcharge and cess, for equity funds and 29.12%, including surcharge and cess, for non-equity funds and the dividend received by the investor was net of taxes (tax-free), which is now abolished.

Mutual Fund houses also have to deduct TDS at the rate of 10% on the dividends paid in excess of Rs. 5,000 per year.