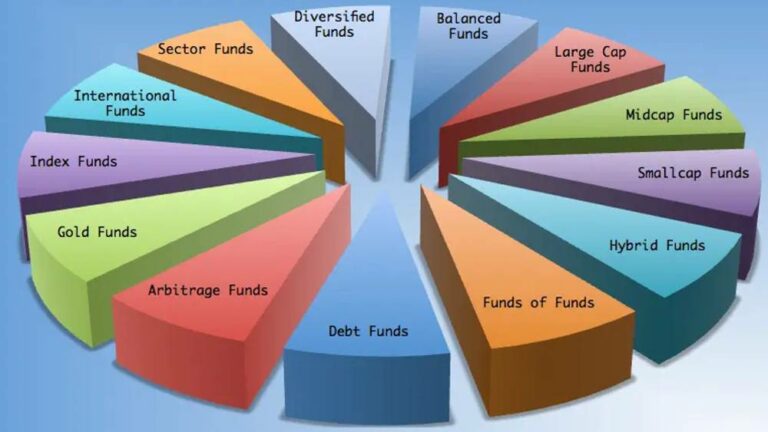

SEBI (Securities and Exchange Board of India) has categorized mutual funds into 5 main categories viz. equity schemes, debt schemes, hybrid schemes, solution oriented schemes and other schemes.

EQUITY SCHEMES

There are ten types of equity schemes –

Multi-Cap Fund

Multi-cap fund are those funds that have minimum 65 per cent of the assets invested in equity and equity related instruments. They are free to invest across market capitalization.

Large-Cap Fund

Large-cap funds are required to have minimum 80 per cent of their assets invested in equity and equity related instruments of large-cap companies. They have to invest minimum 80 per cent in 1st to 100th company in terms of full market capitalization.

Large & Mid-Cap Fund

This category of funds are required to invest minimum 35 per cent of the assets in equity and equity related instruments of large-cap companies and minimum 35 per cent of the assets in equity and equity related instruments of mid-cap companies. In case of large-cap, he has to invest minimum 35 per cent in 1st to 100th company in terms of full market capitalization and in case of mid-cap, he has to invest minimum 35 per cent in 101st to 250th company in terms of full market capitalization.

Mid-Cap Fund

Mid-cap fund are those funds that have minimum 65 per cent of assets invested in equity and equity related instruments of mid-cap companies. This means that they have to invest 65 per cent only in 101st to 250th company in terms of full market capitalization.

Small-Cap Fund

A small-cap fund need to invest minimum 65 per cent of assets in equity and equity related instruments of small-cap companies. They have to invest 65 per cent only in 251st company onwards in terms of full market capitalization.

Dividend Yield Fund

This category of funds can invest in any stocks of any market capitalisation. They have to invest minimum 65 per cent of assets predominantly in dividend yielding stocks.

Value Fund/Contra Fund

AMCs (Asset Management Companies) can choose to have only one either a value fund or a contra fund. Value fund have minimum 65 per cent of assets invested in equity and equity related instruments and he follows value investing strategy. On the other hand, contra fund also have minimum 65 per cent of assets invested in equity and equity related instruments and he follows contrarian investment strategy.

Focused Fund

Focused funds need to invest minimum 65 per cent of assets in equity and equity related instruments and can only invest in maximum of 30 stocks.

Sectoral/Thematic Fund

Sectoral fund and thematic fund needs to invest minimum 80 per cent of assets in equity and equity related instruments of a particular sector or a particular theme.

ELSS

Equity-Linked Savings Scheme or popularly known as ELSS has to invest minimum 80 per cent of their assets in equity and equity related instruments. They are free to invest across market capitalization but they come in with a lock-in period of 3 years. However, the good news is that you can avail tax deduction under section 80C up to Rs 1.5 lakhs by investing in ELSS.

Flexi Cap Fund

Flexi-cap funds are equity funds that invest a minimum of 65 percent of their assets in equity and equity-related instruments. They are free to take exposure to large-cap, mid-cap, and small-cap stocks without any restrictions as they invest across market capitalization.

DEBT SCHEMES

There are 16 sub-categories in debt schemes. So now we will walk through each of them.

Overnight Fund

Overnight fund are those that invest in overnight securities having maturity of 1 day.

Liquid Fund

Liquid fund invest in debt and money market securities with maturity of up to 91 days.

Ultra-Short Duration Fund

Ultra-short duration fund invests in debt and money market instruments such that the Macaulay duration of the portfolio is between 3 months to 6 months.

Low Duration Fund

Low duration fund invest in debt and money market instruments in such way that the Macaulay duration of the portfolio is between 6 months to 12 months.

Money market Fund

Money market funds are those funds that invest in assets that are invested in money market instruments having maturity up to 1 year.

Short Duration Fund

Short duration fund invests in debt and money market instruments such that the Macaulay duration of the portfolio is between 1 year to 3 years.

Medium Duration Fund

Medium duration fund invest in debt and money market instruments such that the Macaulay duration of the portfolio is between 3 years to 4 years.

Medium to Long Duration Fund

Medium to long duration fund are those that invest in debt and money market instruments such that the Macaulay duration of the portfolio is between 4 years to 7 years.

Long Duration Fund

Long duration fund are those that invest in debt and money market instruments such that the Macaulay duration of the portfolio is greater than 7 years.

Dynamic Bond Fund

Dynamic bond fund are the one that is not restricted by investment duration and is free to invest in the assets across duration.

Corporate Bond Fund

Hi all! I am corporate bond fund and I invest minimum 80 per cent of the total assets only in highest rated corporate bonds.

Credit Risk Fun

Credit risk fund are those that invest minimum 65 per cent of the total assets in below highest rated corporate bonds.

Banking and PSU Fund

Banking and PSU fund are the one that invest minimum 80 per cent of the total assets in debt instruments of banks, public sector undertakings and public financial institutions.

Gilt Fund

Gilt funds are those that invest minimum 80 per cent of the total assets in G-Secs (Government Securities) across maturity.

Gilt Fund with 10 year constant duration

Gilt fund with 10 year constant duration, similar to gilt fund that invest minimum 80 per cent of the total assets in G-Secs (Government Securities) such that the Macaulay duration of the portfolio is equal to 10 years.

Floater Fund

Floater funds and those that invest minimum 65 per cent of the total assets in floating rate instruments.

Note on Macaulay Duration: Now one must be wondering what does Macaulay duration as mentioned. Macaulay Duration is a concept developed by Frederick Macaulay in 1938. It measures the bond’s sensitivity to interest rate changes. Technically, it is the weighted average number of years the investor must hold a bond until the present value of the bond’s cash flows equals the amount paid for the bond.

The above details will help you in making right investment decision and to understand which fund suits you more. Remember before choosing to invest, it would be wise to assess your risk profile. This is because investment in debt funds does carry investment risk as shown in some recent cases.

HYBRID SCHEMES

There are seven types of hybrid mutual funds. So now let us walk through them.

Conservative Hybrid Fund

Conservative hybrid fund invests in both equities as well as debt. However, there are certain restrictions imposed on by SEBI. According to the SEBI guidelines these funds can invest between 10 per cent to 25 per cent of the total assets in equity and equity related instruments and 75 per cent to 90 per cent of total assets in debt instruments.

Balanced Hybrid Fund

Balanced hybrid fund are those that invest 40 per cent to 60 per cent of the total assets in equity and equity related instruments and 40 per cent to 60 per cent of the total assets in debt instruments.

Aggressive Hybrid Fund

Aggressive hybrid fund are those that invest 65 per cent to 80 per cent of the assets in equity and equity related instruments and 20 per cent to 35 per cent of the assets invested in debt instruments. AMCs (Asset Management Companies) have to choose between aggressive hybrid fund and balanced hybrid fund. They cannot have both.

Dynamic Asset Allocation or Balanced Advantage Fund

As the name suggest these funds have dynamic asset allocation. The total assets invested in equity and equity related instruments as well as in debt instruments are managed dynamically. This means that they are free to tweak investment proportions in equity and debt. They are not restricted to any specific proportions as we saw with previous hybrid funds.

Multi Asset Allocation Fund

Multi asset allocation fund is unique among hybrid fund as they have to invest corpus in at least three asset classes with a minimum allocation of 10 per cent each in all the three asset classes. However, investment in foreign securities would not be treated as a separate asset class.

Arbitrage Fund

These are the funds that follow arbitrage strategy. They invest minimum 65 per cent of the total assets invested in equity and equity related instruments.

Equity Savings Fund

Equity savings fund invests minimum of 65 per cent of the total assets in equity and equity related instruments and minimum of 10 per cent of the total assets invested in debt instruments. It is mandatory for AMCs to state minimum hedged and unhedged portion in my SID (Scheme Information Document).

SOLUTION ORIENTED SCHEMES

Retirement Fund

Retirement fund are those that are free to invest in any of the instruments then may it be debt or equity in whatever proportion the fund manager finds fit to invest. However, they come with a lock-in period of 5 years or till retirement age whichever is earlier. These funds are specifically designed to cater to people having retirement goals.

Children’s Fund

Children’s fund like retirement fund are free to invest in any of the instruments then may it be debt or equity in whatever proportion the fund manager finds fit to invest. However, they also come with a lock-in period of 5 years or till the child attains the age of majority i.e. until he/she turns 18 whichever is earlier. It is specifically designed to cater to people who wish to save for their child’s education or marriage or just savings for child.

OTHER SCHEMES

Index Fund or ETFs

Index fund and ETF also known as Exchange Traded Funds both are passively managed funds. They have quite similarities besides being managed passively, they track a particular benchmark index in its true sense. This means that they buy the exact same stocks that are present in the index with same proportions. However, they have a different structure. As per SEBI they must have minimum 95 per cent of the total assets invested in securities of a particular index that is being tracked.

Fund of Funds (Overseas/Domestic)

Fund of Funds is unique among all funds. This is because they invest only in different mutual funds. SEBI has mandated to invest minimum 95 per cent of the total assets in the underlying fund. They are free to invest domestically as well as overseas.

So this is the list of different type of funds, how they have been categorised by SEBI and what their traits are. Surely it will help readers in making right investment decision and understand which suits them more. Remember before choosing in which fund to invest, it would be wise to assess your risk profile. It is also important to know that all the funds come in two variants – one being regular plan and one being direct plan. The only difference between the regular plan and direct plan is the commissions that is paid to the MFDs (Mutual Fund Distributors) in case of regular plan whereas in case of direct plan no commission is paid and hence the expense ratio of such funds are lower and are expected to perform better than the regular plan in long run.