There is no doubt that the world is full of borrowed money. There is a nuclear bomb planted in most of every major country’s balance sheet. With the negative interest rates and inverted yield, the biggest loser will be bondholders. Given gold’s historic store of value as a currency, it’s easy to see how this could be a sought-after asset in the years ahead. In a globalized world, the appeal of alternative digital currencies may also significantly increase. The closer we get to full-blown fiat money led debt crisis, the more we will likely see the rise of cryptocurrencies!

By Rushin Shah

The world is sitting on the highest debt in history, and yet we are continuously seeing fresh record lows in bond yields. The other unusual part of this equation is that the world is having a low growth in a low inflation environment, and with populist governments increasingly looking for higher spending at negative/ultra-low rates. The multi-trillion dollar question is whether governments can successfully and consistently issue the zero-coupon perpetual bonds. If they can do that, spend the money, and central banks buy the bonds, then that is pure helicopter money. It feels like central banks have given governments the keys to the printing press in helping yields fall to current levels.

Bondholders Beware!

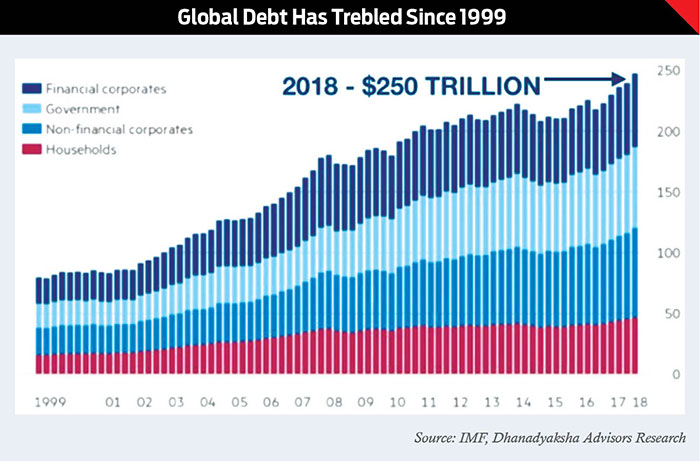

History suggests that the upper threshold for government debt/ GDP is in the range of 70-90% for developed markets (DM), 50-70% for European countries (EU), and 30-50% for the emerging markets (EM). Past these thresholds, growth slows down and unsustainable and negative debt/GDP cycle begins. Today, many countries are above these levels. Total global debt/GDP stood at 320% in Q1 2019, up from 225% in Q1 1999, an increase of 95 percentage points over two decades! Despite this rise in global debt, a near $15tn of debt now has a negative yield, which is 25% of the total debt! About 40% of government debt has a negative yield! If global debt/GDP had remained constant since 2000, we would have $70 trillion less debt in the world today.

In total the world has $250 trillion of debt, up from around $170 trillion on the eve of the global financial crisis (GFC) and only $85 trillion at the start of this century. Over the same three periods, global debt/GDP has grown from 225% (2000) to 300% (2009) and then to 320% in 2019. With average funding costs so low and poised to go lower still if current yields are maintained, central banks have effectively invited governments to experiment with more unconventional fiscal policies.

How the World will De-Lever?

The biggest and most successful global deleveraging through history occurred between 1945 and 1980 when yields were significantly below the nominal GDP (NGDP). The problem in sustainably recreating such a scenario today is that the post-WWII era saw much higher levels of GDP growth due to favorable demographics, post-war reconstruction, and high productivity growth. It will be nearly impossible to repeat such an outcome. We will only get closer to it with significant interventions by the governments and central banks. Whether such central bank money ever gets repaid or is simply written off is open to debate. Already since the global financial crisis (GFC), government debt has effectively declined in many countries if you assume quantitative easing (QE) is never repaid!

If central banks and governments can replicate some of the successes of the 1945-1980 periods, there will be one big loser – bondholders. Real wealth was destroyed in this period for those invested in government bonds. The global debt pyramid is on very shaky ground!

A World Full of Borrowed Money!

Government debt has been on an upward march since 1950 with the largest rise in overall debt levels has come in the 1980s. At a global level, the US, Japan, and China make up around half of the total government debt/GDP. Small countries have generally seen less of a debt buildup than the largest ones. This probably reflects investor tolerance as much as anything else. The larger the country, the greater its credibility and ability to borrow on the international stage. Smaller countries would likely be more limited.

For private debt, the rise in debt has been much more consistent since the 1950s as credit availability increased in many countries. Global private sector debt/GDP has stabilized since the global financial crisis, although at historically high levels. Much of the attention in this cycle has been focused on the rise in public sector debt, but the reality is that the private sector remains heavily indebted. This may have implications for the future of public sector debt in subsequent crises as governments will need to stretch their balance sheets to absorb private sector debt that is vulnerable to default.

Emerging markets (EM) public debt exploded in the 1970s through the late 80s and early 90s as widespread developed market (DM) lending occurred after the collapse of the Bretton Woods system (BWS). Capital controls were abolished which allowed massive growth in cross-border lending. Rising oil prices reinforced this by attracting lenders. EM debt boom busted in the late 1990s with the Asian debt crisis, and EM countries de-lever post-global financial crisis period. But, thereafter, reformed economic management and strong EM growth led increase in the debt/GDP with China becoming a global force – and a sizeable accumulator of debt.

Will China’s Debt Explode?

China has been a substantial borrower since the global financial crisis, especially in the private sector. China’s private debt/GDP ratio has increased from 105% in 2008 to 225% in 2019. This rapid credit growth deserves close monitoring. It’s widely appreciated that a lot of this debt went into unprofitable state-owned enterprises (SOEs) with the risks of zombie status. Though the Chinese government has control over its economy and the debt is not as exposed to the investors as other markets that have gone through debt crises. So within a relatively closed economy, it would seem that China could in theory control any private sector credit crisis.

Democracy, Debt, and Demography

is a buy side analyst at Canadian hedge fund. He can be reached at [email protected]

Before the late nineteenth century, very few countries could be considered democracies, but their number steadily increased from the mid-nineteenth century up to World War I (WWI). World War II (WWII) period saw a pause, but after the war, the trend recovered and democracy became an increasingly widespread phenomenon. This trend changed the governments’ priorities and reach with the expansion of the votes to an ever-wider cross-section of society regardless of sex or income. This increased the pressure on and incentivizing political parties to offer more spending to win votes.

Democracies kept rising post-WWII era and so does the citizens’ demands. They started demanding more and more access to education, healthcare, and subsidies for the poor and unemployed, better public services and increased provision of pensions. As the pressure built for more government spending, the biggest constraint was the same as it had been for most countries around the world – money was tied to gold. In the 1960s, the combination of factors like overly loose monetary policy, the Vietnam War and continuous pressures from the post-WWII welfare states were the tipping points for the Bretton Woods system (BWS). The US suspended its membership in the gold-based Bretton Woods system. Given that every other major global economy was linked to the U.S. dollar at the time, the world effectively moved from a global gold standard to a fiat currency regime overnight. This allowed countries to move to a world of structural deficits that persist to even this day!

So for the last 50 years, most major countries around the world have increased spending relative to the past but with tax revenues failing to keep up. Spending that is structurally higher than revenues has become a consistent theme. Democracy and later demography have proved challenging to balance budgets. The problem with taxing workers is that they vote, and the problem with taxing businesses in an era of globalization is that they can move tax jurisdiction or simply divert earnings around the world to lower-tax regimes. These are not easy problems to solve in an era of globalization.

In short, during the post-WWII period, the world experienced a wider move to improve conditions for the wider population, which led to increased spending. Since then, governments have struggled to come to terms with how to raise enough revenue to offset this. And, that’s why fiat money comes to existence and it is persisted on a wider scale!

So, What Should Investors Do?

There is no doubt that the world is full of borrowed money. There is a nuclear bomb planted in most of every major country’s balance sheet. With the negative interest rates and inverted yield, the biggest loser will be bondholders. Since China borrowed at the pick of the interest rates cycle, it will be interesting to see how China will repay that money in a negative interest rate environment.

It’s worth examining, this 1945-1980 period, in which the biggest and most successful global deleveraging in history occurred, for investment returns. Over such a long period, it would be strange if equities were not the best performer, but the real returns were slightly below their long-term average. It’s no surprise to see very poor real returns in fixed income. On the positive side, commodities – particularly oil and gold – outperformed their long-term average returns by 5% p.a. and 3% p.a. for three and a half decades, respectively. So on a relative basis, commodities will likely be the biggest winner. Given gold’s historic store of value as a currency, it’s easy to see how this could be a sought-after asset in the years ahead. In a globalized world, the appeal of alternative digital currencies may also significantly increase. The closer we get to full-blown fiat money led debt crisis, the more we will likely see the rise of cryptocurrencies!