Global Health, which operates and manages hospitals under the Medanta brand, has filed papers with Sebi to raise funds through an initial public offering (IPO) which consists of a fresh issue of equity shares aggregating to Rs 500 crore, and an offer for sale of up to 4.84 crore equity shares. It was founded by the renowned cardiovascular and cardiothoracic surgeon Naresh Trehan. Global Health operates a network of 4 hospitals under the Medanta brand in Gurugram, Indore, Ranchi, and Lucknow. One hospital is under construction in Patna, and another is planned for development in Noida.

As a part of the OFS, Anant Investments, an affiliate of private equity major Carlyle Group, will sell up to 4.33 crore equity shares and Global Health co-founder Sunil Sachdeva will offload up to 51 lakh equity shares. At present, Anant Investments holds a 25.67 percent stake in Global Health and Sachdeva owns a 13.43 percent stake in the company. Proceeds from the fresh issue will be used to pay debt and general corporate purposes.

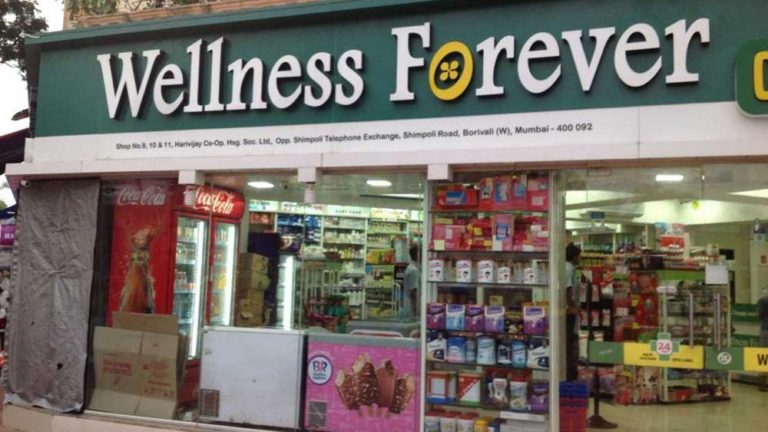

Wellness Forever

Wellness Forever Medicare expects to raise between Rs 1,500-Rs 1,600 crores through its initial public offering (IPO), per their Draft Red Herring Prospectus (DHRP) filed with regulatory authority SEBI. The company is backed by Serum Institute of India (SII) CEO Adar Poonawalla. The issue will consist of fresh equity share issues, which are worth Rs 400 crore, along with an offer for sale to the tune of Rs 1.6 crores of equity. Out of the total proceeds, while Rs 70.20 crore will be utilized for funding capital expenditure establishing new outlets, and Rs 100 crore will go towards part or full repayment of borrowings. In addition, the proceeds will also be used for funding its working capital requirements worth Rs 121.90 crore, along with other general corporate objectives.

The Mumbai-based brand, founded in 2008 by Ashraf Biran, Gulshan Bakhtiani, and Mohit Chavan is the leading wellness network in terms of the number of stores. Serving more than 6.7 million customers and employing more than 4,600 people across its presence in 23 cities and 234 stores, the chain is known for providing a self-browsing and distinctive shopping experience, providing approximately 91,500 pharmaceuticals and wellness products, with each store featuring 13,000 products spread FMCG products, nutraceuticals, medical instruments along with the standard prescription medicines.

While Biran and Bakhtiani are offering 7.20 lakh shares, Chavan is offering 1.20 lakh shares, in addition to 144.85 lakh shares offered by other shareholders.

This omnichannel retail pharmacy chain aims to strengthen its roots in tier 2 and 3 Indian markets, particularly in the pharmacy e-commerce segment, a sector expected to grow at 45 percent CAGR.